Key Takeaways

- Selling your structured settlement allows you to convert its periodic payments into a single lump sum of cash.

- The amount you receive will be less than the total value of the scheduled payments.

- The structured settlement buyer’s discount rate — along with its fees — will affect how much money you will receive.

- Structured settlements are thoroughly regulated through both state and federal laws and selling any structured settlement requires a judge’s approval.

Structured settlements are carefully regulated through federal and state laws, but this strict regulation should not be viewed as evidence that selling your structured settlement will negatively impact your finances. On the contrary, the ability to obtain a lump sum of cash by transferring your payment rights can help you achieve financial goals that would otherwise be out of your reach.

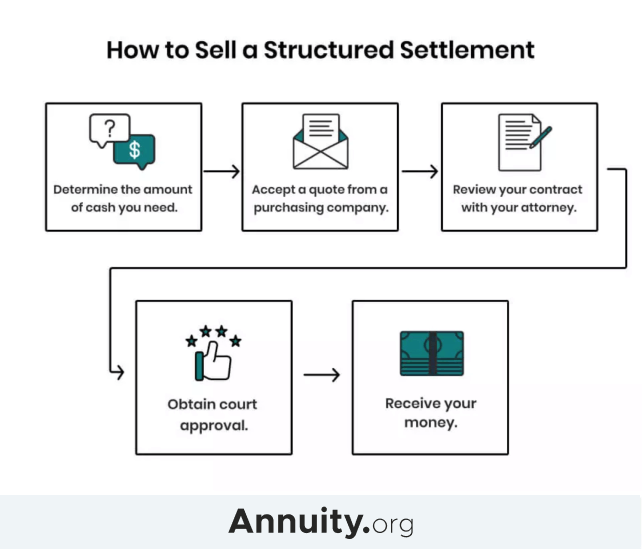

How to sell your structured settlement at a glance:

- Refer to your settlement terms and local laws to find out if your settlement can be sold.

- Consult with someone familiar with the secondary market. Consider talking to an attorney or financial advisor.

- Decide if selling makes sense for your financial goals and situation.

- Find a trustworthy company with your best interest in mind. Compare quotes, and agree to the one that appeals to you.

- Attend a court date to find out if the judge will approve your sale.

- If the sale is approved, you’ll find out within 45-60 days.

How to Sell a Structured Settlement: Key Considerations

If you are thinking about selling your structured settlement payments, we recommend you enlist the help of a trusted attorney or financial advisor with experience in the structured settlement secondary market. They will help you find a credible factoring company with a history of protecting the long-term interests of its clients.

The terms of your settlement and the laws in your state will determine whether you can sell your payments. State laws that fall under the Structured Settlement Protection Acts are intended to protect settlement recipients from unethical structured settlement buyers. Your protection is also the reason you must have your sale approved by a judge.

All structured settlement sales require a judge’s approval. The judge will consider the terms of the sale — whether you’re selling some of your payments, a portion of each payment, or your entire structured settlement — and how the sale will affect your long-term financial situation, including the likelihood that you will suffer financial hardship without the regular payments from your structured settlement.

The judge may take into account:

- Your living expenses

- Your future financial obligations, such as college tuition

- Your life expectancy

Consult your state attorney general’s office or consumer protection division to confirm that the factoring company you choose has no complaints on file.

The court-approval process takes roughly 45 to 60 days.

Although state and federal regulations are in place to protect you from entering into an agreement that may cause you undue financial hardship, you must take responsibility for your financial future. You know your goals better than the judge or the buyer’s representative. Ultimately, you have to make a decision that’s right for you and your family.

Carefully consider the implications of selling your payments. The sale could potentially affect your retirement plans, your eligibility for Social Security or other government assistance programs, and your tax obligations.

Read More: Structured Settlement Protection Acts

Stop waiting on the payments you deserve

How Much Is My Structured Settlement Worth?

Your structured settlement is technically worth the present value of your contract, but that is not the amount you will receive if you sell your payments.

The factoring company calculates the present value using a formula that takes the future value of your payments — because the company will not receive the money until some date in the future — and subtracts the growth potential the company will lose by not having the money in hand to invest immediately.

With this formula, the company calculates the “discount rate.” The discount rate is the percentage factoring companies charge to account for the inherent risk associated with money that they will receive in the future. The discount rate typically falls between 9% and 18%.

In addition to the present value of your settlement, the company takes into account the number of payments you’re selling, the dates of your payments, current market rates and economic conditions, and any service fees associated with the transaction to arrive at your discount rate.

You can get an estimate from a structured settlement calculator, but bear in mind that no calculator can account for the detailed terms of your contract. Use the estimate as a starting point and expect quotes to vary among purchasing companies.

Read More: How Does a Structured Settlement Work?

What Are the Benefits of Selling My Structured Settlement?

In a word, the benefit of selling your structured settlement is liquidity.

While structured settlements offer financial security over many years, sometimes people run into situations that demand a large sum of cash immediately. When that happens, the ability to sell your structured settlement payments can be a lifesaver — sometimes literally.

For example, you may need immediate medical care and have limited or no insurance. Or perhaps the bank is ready to foreclose on your home. The list of financial hardships is long, and sometimes people have to make the decision between their future security and their immediate needs.

If you’ve encountered a need for more money than your periodic payments can provide at once, the benefit of selling a portion of your settlement is the lump sum of cash that can not only allow you to address the expense, but also give you peace of mind.

The stress of looming debt can lead to legitimate health concerns. According to the New York Times, stress can result in numerous serious health conditions, including heart attacks. If selling your structured settlement can ease your anxiety, the benefits extend beyond the financial and into your health and well-being.

But it’s not only financial hardship that leads people to selling their structured settlements. If you received a structured settlement for a personal injury that did not result in your inability to earn an income, you may not rely on your payments the way someone who was unable to return to work would. As a competent, gainfully employed adult, you have the right to make your own financial decisions.

Why are you selling your annuity or structured settlement payment(s)?

Select all that apply

Who owns the annuity or structured settlement?

Selling a Minor’s Structured Settlement

The most carefully guarded structured settlements are those that provide for minors. If a child under of the age of 18 received a structured settlement in a personal injury case and his or her circumstances have changed profoundly since the settlement was ordered, a parent or legal guardian may sell the right to future payments, but the burden of proof is high.

Parents or guardians must demonstrate conclusively to the court that there is an immediate need for cash and that the child would be better served by selling the settlement than by receiving future payments.

Some factoring companies won’t buy structured settlement payments intended to provide for minors.

More Questions About Selling Your Structured Settlement

Now you know the basics about selling your structured settlement, but you may still have questions.

If you can’t find the answers you seek from the list of frequently asked questions below, contact a structured settlement buyer to discuss your options.

Yes, a judge must approve the sale of your structured settlement. Unlike commercially available annuities, structured settlement annuities are always subject to court approval. This does not mean that it is illegal to sell them. Selling your structured settlement is perfectly legal when a judge approves the sale. That said, there are circumstances under which a judge will not approve the sale of your settlement. This generally happens when the judge deems the sale contrary to your best interest or the best interest of your family members and dependents.

Your selling options include the sale of your entire structured settlement — meaning you will no longer retain the rights to any future payments — or the sale of only a specific number of payments or a predetermined dollar amount. Selling only a portion of your payments means you will still receive periodic payments, either resuming after the date of the last payment you sold or continuing at a reduced amount without interruption.

In most cases, no, the amount you receive from the purchasing company will not be taxed. However, some exceptions apply. According to the IRS, compensation for lost wages in cases of discrimination, emotional distress absent of physical injury or illness, and punitive damages may be taxed. The IRS also states that “interest on any settlement is generally taxable as ‘Interest Income’ and should be reported on line 2b of Form 1040.” Taxable structured settlements are rare, but before you sell your payments, review the terms of your contract with your attorney.

Factoring companies charge a discount rate on the sale of structured settlement payments. Average discount rates range from around 9% to 20% and are intended to offset the risk assumed by the purchaser in the transaction.

The length of time it will take to sell your payments depends on a number of factors. Your state statutes and the availability of the courts to review and rule on your sale are the main determinants. In addition, any errors in your documentation could delay your sale.