Key Takeaways

- Annuities are highly customizable and come in many forms.

- They can be particularly beneficial for certain groups, including women, retirees, U.S. expats, small business owners and high net worth individuals.

- Annuities lack federal insurance, so choosing a financially stable provider company is important.

- Consult with a trustworthy financial planner to find the annuity that best meets your long-term financial objectives.

How To Buy an Annuity

After you’ve chosen your annuity provider and decided on the terms of the contract, you’re ready to buy. But what’s the process for buying an annuity?

“I think the process is twofold,” says Certified Financial Planner™ professional Marguerita M. Cheng. “Are you purchasing an annuity with retirement funds, such as an IRA? If that’s the case, it would be a custodial transfer and a non-taxable event. With non-retirement money, if it’s cash in your checking account, you can write a check. If it’s cash in your brokerage account, you could initiate a transfer.”

Typically, you purchase annuities through an insurance company. You can also buy them from brokerage firms, mutual fund companies and banks.

“If you have investments you need to sell to fund the account, please consult with your tax advisor regarding the tax implications,” Cheng told Annuity.org. “You don’t want to invest all the proceeds.”

You should also know of state premium taxes that may affect you.

Buying an annuity should be about how it fits into your plan. Once you’ve decided an annuity purchase is right for you, be sure to conduct due diligence on the issuer.

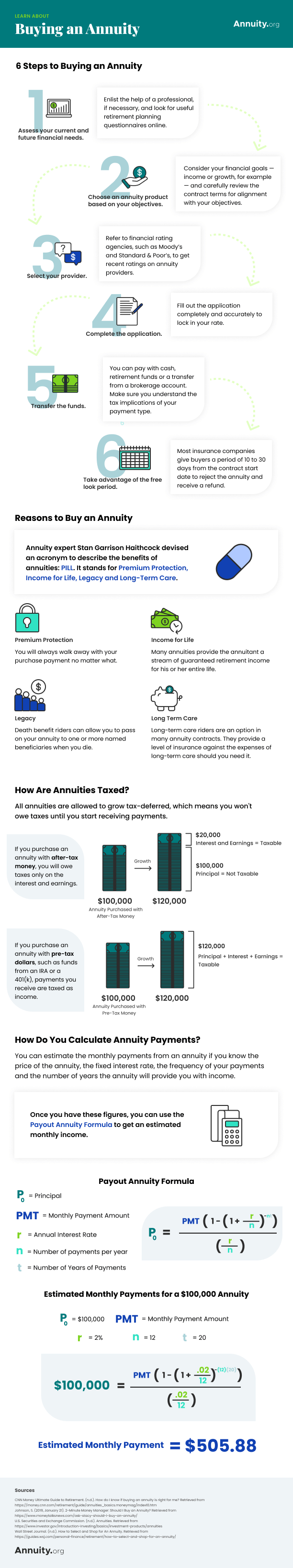

Steps To Buying an Annuity

Unlike stocks and mutual funds, annuities are insurance contracts, which means they are purchased differently. However, by following the outlined steps, you’ll be well-equipped to find an annuity that perfectly suits your goals with ease.

How To Buy an Annuity in 5 Steps:

- Assess your financial situation and establish goals. Consult with an advisor to establish objectives.

- Choose an annuity product that meets your needs, considering the goals you created.

- Research annuity providers and select one with a strong credit rating.

- Apply for the annuity and sign the contract. Compare and customize the contract until it is tailored to your needs.

- Fund your annuity with the premium payment. Consider the tax consequences of each payment type before you fund the annuity.

The first step to buying an annuity is to assess both your present and future financial situation. What are the goals you want to achieve, and can an annuity get you to those goals? Consulting with a financial advisor can help you answer these questions.

Once you’ve clarified your objectives, you can choose an annuity product based on what you need. Annuities are highly customizable products you can design to provide income, growth, a death benefit and more. Consider also how much you want to invest in your annuity and where the funds will come from.

Along with choosing an annuity product, you’ll also need to select an annuity provider. Do some research to find companies that specialize in the type of annuity you want and have strong credit ratings from financial rating agencies.

Because the federal government does not back annuities, it’s important that you choose a reputable, stable carrier. One way to research annuity providers is to refer to financial rating agencies like Moody’s and S&P Global for recent ratings.

The next step is working with the annuity provider — and, ideally, your financial advisor — to apply for and sign an annuity contract. Comparing contracts for similar products from a few different companies can help you make the best decision for you.

After signing the contract, you’ll transfer the money for the annuity premium payment. You can purchase an annuity with cash, retirement funds or by transferring money from a brokerage account. Each payment type has tax consequences that are worth considering before you pay the premium.

The annuity’s free-look period begins once the annuity contract is issued. This period typically lasts 10 to 30 days, during which you can cancel the annuity contract and receive a refund. Take advantage of this time to review the annuity contract and make sure it meets all the objectives you have for this product.

Take your time. Make sure you understand all provisions of your annuity contract, including fees and commissions.

Read More: The Cost of Waiting for Interest Rates to Rise

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

When Should I Purchase an Annuity?

The best time to purchase an annuity depends on the type of annuity you want to purchase, your age, gender and interest rate environments. These elements factor into whether you’ll get the most out of your annuity.

Deferred annuities accumulate growth over time before they convert to income payments, while income annuities immediately convert the premium into a payment stream. You’ll want to purchase a deferred annuity sooner than you would purchase an income or immediate annuity.

Deferred annuity owners tend to purchase their annuities between the ages of 45 to 59. This allows ample time for the annuity to accumulate value before they collect payments at retirement.

Financial advisors recommend purchasing an immediate annuity between the ages of 70 and 75. This age range strikes a balance of maximizing the annuity payout while providing income during retirement years.

Your age and gender also impact your annuity payouts and can factor into your decision of when to buy an annuity. The longer you’re expected to live, the lower your payments will be. So, the older you are when your contract annuitizes, the more you’ll receive in each payout. Women typically have lower payouts than men of the same age because they tend to live longer than men do.

In some cases, waiting to purchase an annuity might make sense. If you’re in good health and have the funds to cover expenses for a few years in retirement without an income stream, delaying an annuity purchase can boost your eventual payouts.

However, waiting to buy an annuity doesn’t always pay off because of the impact of interest rates. Purchasing an annuity when interest rates are high can lead to a higher payout, but it’s hard to predict how interest rates will fluctuate over time. You could wait to purchase your annuity only to find that new rates are lower than they would have been if you hadn’t waited.

Is an annuity a good investment?

Learn how an investment today can provide guaranteed income for life.

How Will Purchasing an Annuity Affect My Retirement Plan?

As employer-provided pensions become less common, retirees often rely on Social Security and personal savings. However, Social Security only replaces a fraction of pre-retirement income. Balancing comfortable spending in retirement without completely exhausting savings due to uncertain life expectancy can be challenging.

This is where annuities step in, acting as longevity insurance to protect against outliving your savings. Annuities offer a guaranteed income stream, providing retirees with the assurance of future income. You even have the option to buy a joint annuity with your spouse, ensuring lifelong payments for both of you.

A life annuity will provide periodic payments — a steady income stream — for your entire life, no matter how long you live, even if you’ve used up your initial principal and earnings.

An annuity can also serve a strategic role in your retirement portfolio. For example, you can purchase a qualified longevity annuity contract (QLAC) inside a qualified retirement account. The funds used to buy a QLAC, up to certain limits, are exempt from your required minimum distribution (RMD).

How Do I Choose the Best Annuity for Me?

“The decision to purchase an annuity is very personal,” Cheng told us. “Every investor’s financial situation is unique.”

That’s why it’s best to determine your needs and goals and evaluate your comfort level with risk.

Questions To Ask Yourself When Choosing an Annuity

- Are you looking for guaranteed income or long-term growth?

- How close are you to retirement?

- What other income streams do you have in place?

- Are you prepared for lifestyle changes that come with retirement and the loss of a steady income?

- Does your family have a history of longevity and are you in good health?

For example, if you want a reliable income for life with little risk and low costs, you might consider a fixed annuity. If you’re comfortable taking some risks in exchange for the possibility of higher returns, a variable annuity might suit you.

Given the complexity of annuities and finances as a whole, it’s important to talk to a professional who can help you evaluate your retirement portfolio and explain your financial options.

Read More: First-Time Annuity Buyers

Annuities Tailored to Specific Lifestyles

Certain groups may find annuities particularly beneficial.

- High Net Worth Individuals

- Annuities can grow existing wealth or convert it into guaranteed income, making them an attractive addition to a high net worth individual’s portfolio.

- Retirees

- The ability to guarantee income for life is very attractive to retirees, helping ensure they will never have to worry about outliving their savings.

- Small Business Owners

- Those who are self-employed or own small businesses may lack traditional savings options. Annuities can help guarantee their financial security over other savings strategies.

- U.S. Expats

- Living or working overseas can limit access to many savings options. But annuities can grow or guarantee income for those living in other countries.

- Women

- Women are less represented in the workforce and can leverage annuities as an innovative way to grow wealth and help bridge that financial gap.

- People with Children

- Annuities can guarantee income for your beneficiaries. Purchasing an annuity for your child can extend their inheritance over many years.

Types of People Who Can Benefit from Annuities

These groups are just a few examples of who can benefit from annuities. Their adaptability makes them attractive for many types of people.

Read More: Are Multiple Annuities a Good Idea?

Will You Be Able to Maintain Your Retirement Lifestyle?

Learn how annuities can:

✓ Help protect your savings from market volatility

✓ Guarantee income for life

✓ Safeguard your family

✓ Help you plan for long-term care

Speak with a licensed agent about top providers and how much you need to invest.

Where Can I Buy an Annuity?

You can buy an annuity from various legitimate companies and providers. Many insurance companies offer annuities, and you can contact them to learn more about their options and customize an annuity that makes the most sense for your needs.

Banks, known for strong financial security, also sell annuities. However, remember that the same legal protections and assurances banks offer for your other assets may not apply to their annuities.

Investment firms sell annuities as well, offering you another way to construct an annuity that suits you.

Some annuities, especially less complex options, are available from these institutions entirely online.

What questions will I be asked when I call Annuity.org?

Learn how an investment today can provide guaranteed income for life.

Frequently Asked Questions About Buying Annuities

If your long-term financial plan includes securing income for retirement and diversifying your portfolio, annuities can be a suitable option. Annuities offer tax advantages, death benefit provisions, protection against market downturns and guaranteed income for life.

Annuities are popular options for those who wish to secure a guaranteed lifetime income stream. They address the risk of potentially outliving your savings in retirement while providing tax benefits along the way.

The earlier you purchase an annuity, the more your money can grow. Due to tax-deferred compound interest that can build exponentially over time, waiting to purchase may come with a cost.

The best type of annuity for you depends on your circumstance. Consider factors like your time horizon, financial goals and risk tolerance.