Investing your money wisely can increase your net worth and help you live out your dream retirement lifestyle or pay college tuition for your children. Your age, income and risk tolerance all play a role in determining the best way to invest your money.

What Kind of Investing Is Right for Me?

It’s important to determine why you’re investing. Your investment goals will dictate what you invest in, how much money you invest and for how long.

Factors to consider when investing:

- Your age

- Your income

- Your financial goals

- Your risk tolerance

- Your time horizon

Most people invest with retirement in mind. Why? Simply put, retirement is expensive. You can easily spend $1 million during 20 years in retirement, according to many financial experts. Investing now is a smart and simple way to reduce your chances of running out of money after exiting the workforce.

Of course, people invest for other reasons, too. Returns on investments can help you realize major financial goals, such as buying a home, starting a business or putting your children through college.

The financial market offers numerous investment vehicles, including stocks, bonds and mutual funds. Each offers unique benefits and risks.

Risk and Return

Being a smart investor means having a good grasp on your risk tolerance. Certain financial products, such as stocks, are riskier than others, such as bonds. That’s because there is no guarantee of profit when you buy stock. If a company performs poorly or falls out of favor with investors, its stock can drop — and you can lose money.

Other investments, such as government bonds and certificates of deposit, are considered safe because they are often federally insured. However, returns from these investments are much lower as compared with stocks.

Thus, a key principle of investing is striking the right balance between risk and reward. A balanced, diversified portfolio should include a mix of both low-risk and higher risk investments.

Timing Is Everything

Patience is key for new investors. Long-term investments are more likely to yield higher gains.

That’s because your investments need time to grow. They also need time to adjust for the ups and downs of the market.

On any day, stocks can plunge. Sometimes the economy takes a downturn for months or years. If you sell stocks when the market dips, you stand to lose a substantial part of your investment.

Over time, investors who adopt a set-it-and-forget-it mindset are more likely to come out ahead of those who give in to the fear caused by market fluctuation.

Investing Early Gives You an Advantage

Compounding is another reason to leave your investments alone. Compounding interest occurs when you start earning money on the money your investments have already earned. It’s essentially a snowball effect.

Investing earlier in life gives you a compounding advantage. You are increasing your earnings just by staying invested in the market longer.

Financial expert Suze Orman, among others, strongly supports the idea of investing sooner rather than later.

“I would much rather see you invest a specific amount of money when you are young, a lesser amount of money, than waiting and have to invest five or six times (as much) when you are older,” Orman told CNBC in 2019.

Time is a safeguard against risk. The younger you are, the more time you have to recoup losses. Taking financial risks when you’re young can pay off big. And if it doesn’t, you still have years to rebuild the money you lost.

As you approach retirement, however, you should take fewer risks because it could jeopardize your nest egg.

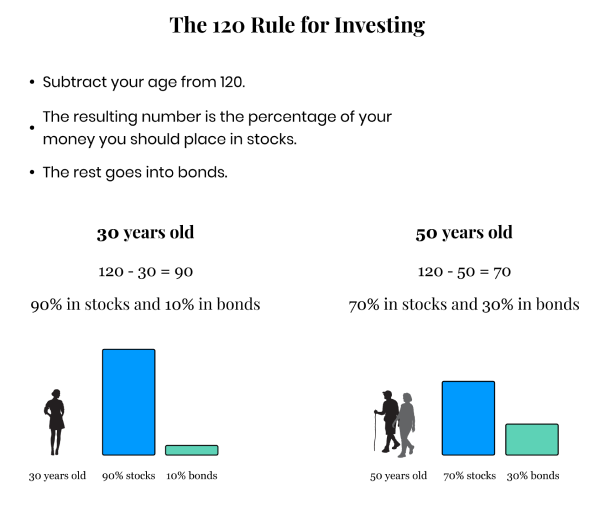

Consider the financial principle known as the 120 Rule.

The concept is simple. Subtract your age from 120. The resulting number is the percentage of your money you should place in stocks. The rest goes into bonds.

For example, a 30-year-old would invest 90 percent in stocks and 10 percent in bonds. A 50-year-old, on the other hand, should have 70 percent in stocks and 30 percent in bonds.

It’s important to note that these investments do not include your emergency savings account. Financial planners suggest allocating three to 12 months of take-home pay to savings for emergencies, such as job loss.

It’s ideal to invest when you’re young, but really, it’s never too late. Even if you’re in your 40s or 50s, you still have options, including maxing out your yearly 401(k) plan or buying an annuity.

How Much Money Do I Need to Start Investing?

Many, but not all, financial products have minimum deposit requirements. You may need less money than you realize to start investing.

While contributing to an employer-sponsored 401(k) plan is a great way to start investing, other options exist if you’re a beginner or tight on cash. Robo-advisors, such as Betterment and Ellevest, offer $0 account minimums. Likewise, investment apps, such as Acorns, require $5 or less to begin investing.

The earlier you’re able to start investing, the better — even if you start small. But before you commit large sums of money to investments, it’s important to improve your financial literacy. This includes learning to budget to substantially reduce or eliminate credit card debt and save for emergencies.

What If I Have Lots of Cash but No Investment Experience?

Just because you’re new to investing doesn’t mean you’re tight on money. Maybe you’re the lucky recipient of an unexpected inheritance or your small start-up finally made it big. Maybe you hit a casino jackpot or just won the lottery.

Investing is as crucial for maintaining wealth as it is for growing wealth.

Lots of cash sitting in your bank account loses value over time due to inflation and a concept called the time value of money. Smart investments can help you lessen your tax burden, earmark money for your heirs and safeguard yourself against economic uncertainty.

Experts strongly suggest consulting an accountant or financial advisor if you’ve recently received a large windfall but have little to no investment knowledge. A good planner can help you explore your options and discover the right solution for you and your family.

Otherwise, first-time-investor mistakes may cost you hundreds, if not thousands, of dollars.

401(k)s and Retirement Plans

One of the easiest ways to begin investing is through an employer-sponsored 401(k) plan. It’s especially beneficial if your job offers a match, which is essentially free money.

Funding a 401(k) plan is highly recommended by nearly all financial advisors because paying for retirement is expensive. Participating in a retirement savings plan gives you a head start on your long-term financial security.

When you contribute to a 401(k) plan, you can choose to invest in one or more funds. Most of the options are mutual funds, which may include index funds, foreign funds, real estate funds and bonds.

A 401(k) plan is not only an efficient way to save for retirement, but it also allows your money to compound interest tax-deferred. The earlier you begin contributing to a 401(k) plan and the more you contribute, the more money you’ll have by the time you retire.

In 2023, the maximum you can contribute to a 401(k) plan tax-deferred is $22,500. If you are 50 or older and participate in a traditional or safe harbor 401(k), you can make “catch-up” contributions up to an extra $7,500.

Experts suggest investing 10 to 15 percent of your salary in your 401(k) plan. It’s OK if you need to work your way up to this number over time. It’s good practice to increase your 401(k) contribution each time you get a raise at work.

Retirement Plan Tax Perks and Penalties

Retirement plans come with major tax perks. Employee contributions and any earnings from the investments are tax-deferred. This means you pay taxes only when you withdraw money. As long as your money stays in the plan, you won’t pay any taxes on your investment returns.

The amount you will be required to pay in taxes when you start withdrawing money depends on your income tax rate at the time of the withdrawal. You’ll face an additional penalty from the IRS if you try to take money out before you turn 59.5 years old.

If you don’t have a 401(k) plan, you can invest in an individual retirement account, such as a traditional or Roth IRA. The decision between a traditional IRA or a Roth IRA often comes down to whether you think you’re better off paying taxes now or later.

When you near retirement, you can also use a portion of your 401(K) funds to purchase an annuity, which will provide you with a steady stream of income similar to the income from a pension.

Mutual, Index and Exchange-Traded Funds

Instead of buying individual stocks and bonds, a mutual fund allows you to purchase small pieces of many different assets in a single transaction. These investment vehicles pool your money with other investors’ money. Mutual funds are typically overseen by a portfolio manager.

Index funds and exchange-traded funds, or ETFs, are types of mutual funds. When you buy an index fund or EFT, you’re essentially purchasing a share of the future profits of all major corporations.

That’s because these funds track an index, such as the S&P 500. So, if you buy an S&P 500 index fund, you effectively purchase small pieces of ownership in 500 of the largest U.S. companies.

Mutual funds are considered good investments for beginners because they’re professionally managed. This saves time. And because mutual funds and index funds are diverse in nature, they are generally less risky than individual stocks.

Even investment billionaire Warren Buffet has repeatedly touted low-cost index fund investing as “the thing that makes the most sense practically all of the time.”

The risk of investing in mutual funds is determined by the underlying performance of the stocks, bonds and other investments held within the fund. No mutual fund can guarantee its returns, and no mutual fund is risk-free.

You can purchase a mutual fund share through a broker or a mutual fund company. An initial minimum investment of $1,000 or more may be required.

If you don’t have much money to invest, remember that many 401(k) plans offer a selection of mutual or index funds with no minimum investment. In addition, index funds tend to be cheaper than mutual funds. Fidelity and Charles Schwab are two brokers that offer index funds with a $0 minimum.

Bonds and CDs

Bonds and certificates of deposit, or CDs, are considered safe investments. Both offer only modest returns but carry little or no risk of principal loss.

Bonds are a way for companies and governments to borrow money. Think of them as an IOU.

When you buy a bond, you’re lending money to the company or government that issued it. The bond issuer promises to pay you back for that amount, plus interest, at a specific time in the future.

Bond prices and interest rates share an inverse relationship, meaning that when interest rates fall, bond prices tend to rise.

There are three main bond types:

- Corporate

- Municipal

- U.S. Treasuries

You can purchase federal bonds online through a program on the Treasury Direct website. This helps you avoid paying a fee to a broker or other money manager.

Most interest earned through bonds issued by U.S. state governments and municipalities is exempt from federal income tax. Some escape taxation at the state level, too. For example, U.S. Treasury securities are exempt from state income taxes. Also, most states don’t tax interest on in-state municipal bonds.

Like a bond, CDs hold a fixed amount of money for a certain amount of time, such as six months, one year, or 10 years. When you cash in or redeem your CD, you receive your initial investment plus any interest.

By placing funds into a CD, you promise to keep your money in there for a certain period of time. You’ll usually face penalties for early withdrawals.

Unlike bonds, which are purchased from a company or government, most CDs are purchased through a bank or credit union. A CD bought through a federally insured bank is insured up to $250,000. The only real risk with CDs is the possibility that inflation will grow faster than your money, thus diminishing your returns over time.

Bonds and CDs help round out diverse portfolios. But if you’re young and far from retirement, it makes more sense to put a bulk of your investments into more growth-oriented assets, such as stocks and mutual funds.

Read More: What Is a Certificate of Deposit?

Stocks

Stocks have provided the highest average rate of return among investment types for decades, according to the U.S. Security and Exchange Commission.

But if you’re an investment beginner, stocks can be intimidating. The stock market is complex and constantly changing. It takes time and research to make money and manage risk.

When you buy a stock, you are purchasing a small percentage of a company that should grow in value. But that growth is not guaranteed.

You can take a hands-on approach to stock trading or you can invest your money with a robo-advisor. Virtually all major brokerage firms offer this service, which invests your money for you. We’ll discuss robo-advisors and micro-investment apps in more detail later.

If you choose the hands-on approach, the first step is opening an investment account with a brokerage firm.

Examples of popular online brokers include TD Ameritrade, Merrill Edge and E-Trade. While these sites offer tools and resources, it’s important to remember that online brokers are best for experienced hands-on investors who prefer to manage their own portfolios.

You can also choose to buy individual stocks of a particular company. However, hand-picking stocks takes a great deal of time, effort and money. The cost of individual stocks depends on the share price, which can range from a few dollars to a few thousand dollars per share.

Many financial experts agree that most people should invest in individual stocks only if they believe in the company’s potential for long-term growth. Never invest in anything you don’t understand, especially individual stocks.

Read More: What Is a Dividend?

Stocks and Taxes

Some taxes are due only when you sell investments — stocks, for example — at a profit. Other taxes are due when your investments pay you a distribution, also known as a dividend.

Investment tax is complex, but understanding the basics can get you started.

Capital Gains Tax

You don’t pay taxes when your stock price goes up. Taxes are owed only when you sell those investments for a profit. This applies not only to stocks, but to most other investments, too, including profits from the sale of bonds, mutual funds and ETFs.

Buying an investment at one price and selling it later at a higher price is known as capital gains.

For tax purposes, the IRS splits capital gains into two categories: long-term and short-term. Long-term capital gains receive more favorable tax treatment from the federal government than short-term gains made in a year or less.

Keep in mind that you might have to pay capital gains tax to your state as well.

Read More: Federal Tax Brackets

Capital Loses

A capital loss is when you sell an investment for less than you paid for it.

This is beneficial for tax purposes because capital losses can be used to reduce your capital gains tax. In other words, if you sell one stock at a $3,000 profit but sell another stock at a $2,000 loss, you’ll be taxed only on the $1,000 difference.

Dividend Taxes

Dividends are payments made by a company to owners of the company’s stock.

For tax purposes, dividends fall into two groups: qualified and nonqualified. Nonqualified dividends are sometimes called ordinary because they are taxed as ordinary income. Qualified dividends are usually taxed at a lower rate.

In both cases, people in higher tax brackets pay more taxes on dividends.

To be considered qualified, a dividend must meet two main requirements:

- It is paid by a U.S. corporation or qualifying foreign entity.

- You own the stock or other security for a certain amount of time.

New investors can lighten their tax burden by holding foreign stocks and taxable bond mutual funds in a tax-deferred retirement account like an IRA or 401(k) plan.

Dividend taxes are complex and include many exceptions, unusual scenarios and special rules. See IRS Publication 550 for more detail, and consult a tax professional with further questions.

Join Thousands of Other Personal Finance Enthusiasts

Annuities

In times of market uncertainty, more people are turning to annuities for added security in their retirement planning portfolio.

Annuities technically aren’t investment products. They’re a type of policy issued by an insurance company that’s designed to grow your money for retirement.

Annuities are highly customizable. Common types of annuities include fixed annuities, which provide a stable payout, or variable annuities, which fluctuate based on market changes.

Fixed-indexed annuities are designed to offer better returns than a bank CD.

All annuities can be purchased with a single premium or multiple premiums. Insurance companies issuing annuities guarantee their payouts, much like a life insurance policy. You can get a contract that sets up distributions to pay out immediately, in several months or many years from now.

An annuity’s principal investment grows over time, and like a 401(k) plan, taxes on annuities are deferred until the payments commence. Instead of taxing the value of the entire annuity contract, the IRS taxes consumers only on the annual distribution.

Anyone can buy an annuity, and there are many to choose from. However, these financial products often require a significant premium, which means that although annuities can be bulletproof retirement investments, they may not be ideal for beginning investors.

If, however, you’ve recently inherited or won a large sum of money, annuities can offer attractive tax advantages. It is also smart to consider this option as you near retirement.

View our glossary of key annuity terms

Investment Help

There’s a lot to learn when you begin investing, and no one starts out an expert. Even the savviest investors started with limited knowledge.

Luckily, you have options.

Consulting a financial planner or advisor is always a smart decision. Financial fiduciaries are paid through flat hourly rates instead of commission and are required to put your best interests first.

If you’ve inherited or won a large sum of money, professional investment advice is critical, especially if you are new to investing. While financial planning services cost a little extra money, sound advice and peace of mind is priceless.

Marguerita M. Cheng, Chief Executive Officer of Blue Ocean Global Wealth, believes there is great value in working with a financial advisor if you are new to investing.

“For our clients, we address both short-term savings for any emergencies or opportunities that arise and a long-term investing plan for their life financial goals,” says Cheng.

“This gives them peace of mind and allows them to avoid making emotional decisions with their investments.”

If you’re starting small with minimum capital, consider using tools like robo-advisors or micro-investing apps to familiarize yourself with the market.

What Is a Robo-Advisor?

A robo-advisor is an investment management service that uses algorithms to build and look after your financial portfolio.

Betterment, Wealthfront and Ellevest are popular examples. These companies use computer models to determine the best portfolio mix for your unique needs based on your age, income and goals.

When you open a robo-managed account, you usually supply basic information about your investment goals through an online questionnaire. Robo-advisors build their portfolios largely out of low-cost ETFs and index funds, which are baskets of investments that often reflect the behavior of the S&P 500 or another index.

Using a robo-advisor can be a good move for beginner investors. They allow you to quickly manage your investments without consulting a financial advisor.

Most robo-advisors have account minimums of $500 or less and offer low management fees of 0.25 percent. Some programs can even sell certain assets at a loss to offset gains in other assets — a process called tax-loss harvesting — that can help reduce your tax bill.

However, you’ll pay the fees charged by index funds and ETFs, called expense ratios, in addition to that management fee.

Micro-Investment Apps

Micro-investing apps, such as Acorns or Stash, are types of robo-advisors. These apps allow you to save and invest money in small amounts.

By linking a credit or debit card, these apps round up purchases to the nearest dollar. When you reach $5 in spare change, the app invests that money for you into a diversified portfolio.

You can also opt to have a specific amount of money, $20 for example, transferred from your bank account to the micro-investing app each week.

Like robo-advisors, these apps invest your money into a portfolio of ETFs. Your investments are then diversified across thousands of stocks and bonds.

These apps let you begin investing with just $5 or less. Acorns also lets you choose a portfolio based on your risk tolerance.

While micro-investment apps are easy to use, returns are minimal. That’s why some experts suggest spending your spare change elsewhere.

“You can round up your Starbucks purchase by a nickel for the rest of your life, and then you’ll have a handful of nickels,” financial expert Chris Hogan wrote in a 2020 blog post. “Micro investing produces micro results.”