Key Takeaways

- You will pay taxes on the full withdrawal amount for qualified annuities. You will only pay income taxes on the earnings if it’s a non-qualified annuity.

- Annuity payouts for non-qualified annuities are partially taxed according to the exclusion ratio, which takes into account the annuitant’s life expectancy.

- Beneficiaries must pay taxes on their inherited annuity, but they can reduce the tax burden by stretching the payout over their lifetime or by converting a qualified annuity into a Roth IRA.

Are Annuities Taxable?

One of the biggest benefits of annuities is their ability to grow on a tax-deferred basis. This includes dividends, interest and capital gains, all of which may be fully reinvested while they remain in the annuity.

Your investment grows without being reduced by tax payments, but that doesn’t mean annuities are a way to avoid taxes completely. Annuities are subject to taxation, and how they are taxed depends on various factors.

“When you take distributions or withdraw from the annuity later in retirement, you will be taxed on the growth at your then-current tax rate,” explained annuity and retirement expert Paul Tyler.

Because of the complexity, it’s best to consult with a tax professional when purchasing an annuity and before withdrawing any funds.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

Annuities offer tax benefits through deferral. In order to take full advantage of that deferral though, it’s important to understand how and when annuities are subject to taxation.

How Are Annuities Taxed?

The tax treatment of an annuity is determined by the type of annuity, the source of funds — meaning whether it is held in a qualified or non-qualified account — and the purpose of the annuity.

Qualified vs. Non-Qualified Annuity Taxation

Annuities are classified as either qualified or non-qualified.

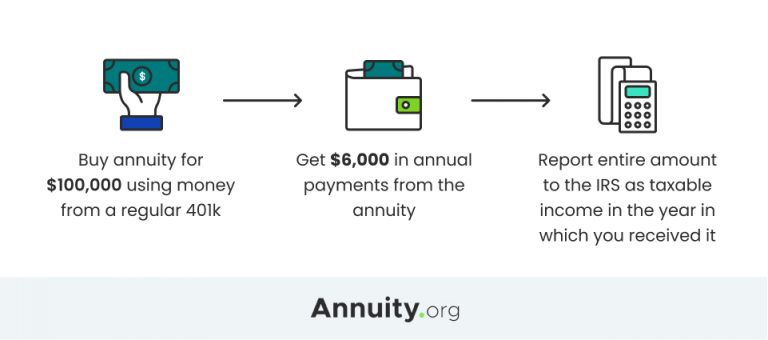

Qualified annuities are funded with pre-tax dollars, typically through an employer-sponsored retirement plan like a 401(k) or an IRA. Contributions to these annuities are tax-deferred, meaning taxes are paid when withdrawals are made.

Non-qualified annuities, on the other hand, are funded with after-tax dollars. As such, they require tax payments only on the earnings portion at withdrawal.

The exclusion ratio is used to determine what percentage of non-qualified annuity income is taxable. Essentially, this entails segregating the annuity payments into a principal component (not taxable) and an earnings component (taxable).

The exclusion ratio takes into account the principal that was used to purchase the annuity, the amount of time the annuity has been paying, the interest earnings and the annuitant’s life expectancy.

If an annuitant lives longer than his or her actuarial life expectancy, any annuity payments received after that age are fully taxable. That’s because the exclusion ratio is calculated to spread principal withdrawals over the annuitant’s life expectancy. Once all the principal has been accounted for, any remaining income payments or withdrawals are considered to be from earnings.

Exclusion Ratio Example

- Your life expectancy is 10 years at retirement.

- You have an annuity purchased for $40,000 with after-tax money.

- Annual payments of $4,000 — 10% of your original investment — is non-taxable.

- You live longer than 10 years.

- The money you receive beyond that 10-year life expectancy will be taxed as income.

Will You Be Able to Maintain Your Retirement Lifestyle?

Learn how annuities can:

✓ Help protect your savings from market volatility

✓ Guarantee income for life

✓ Safeguard your family

✓ Help you plan for long-term care

Speak with a licensed agent about top providers and how much you need to invest.

How Are Annuity Withdrawals Taxed?

How and when you withdraw funds from your annuity also affects your tax bill.

In general, if you withdraw money from your annuity before you turn 59 ½, you may owe a 10% penalty on the taxable portion of the withdrawal.

After that age, taking your withdrawal as a lump sum rather than an income stream will trigger the tax on your earnings. You’ll have to pay income taxes that year on the entire taxable portion of the funds.

Withdrawals and lump-sum distributions from annuities are taxed as ordinary income. They do not receive the benefit of being taxed as capital gains.

Regardless of how you withdraw the money, the tax status of the contract determines how much of the withdrawal will be taxed. If it’s a qualified annuity, you will pay taxes on the full withdrawal amount. If it is non-qualified, you will pay income taxes on the earnings only.

Last-In-First-Out Tax Rules

Non-qualified annuity withdrawals use last-in-first-out (LIFO) tax rules, which dictate that earnings are taxed first. Consequently, tax liability tends to be higher in the early years of annuity ownership. Once the amount withdrawn exceeds the amount of earnings, subsequent withdrawal amounts are considered a tax-exempt return on your principal.

For example, if you invested $100,000 in an annuity that grew to $150,000, your gains would be $50,000. If you then began making withdrawals from that annuity after age 59 ½, all withdrawn funds up to $50,000 would be subject to income tax.

Since it would be considered a return on your principal, you wouldn’t have to pay taxes on any amount withdrawn after that $50,000.

How Are Annuity Payouts Taxed?

According to the General Rule for Pensions and Annuities by the IRS, each annuity income payment from a non-qualified plan is made up of two parts. The tax-free part is considered the return of your net cost for purchasing the annuity. The rest is the taxable balance or the earnings.

When you receive income payments from your annuity as opposed to withdrawals, the idea is to divide the principal amount — and its tax exclusions — evenly out over the expected number of payments. The rest of the amount in each payment is considered earnings subject to income taxes.

Taxation of Inherited Annuities

If you are the beneficiary and inherit an annuity, the rules for taxation can vary depending on what type of annuity you inherit, according to CPA Paul Miller, managing partner at Miller & Co., LLP.

Miller told Annuity.org that qualified annuities follow essentially the same tax rules whether they’re purchased or inherited. “Withdrawals from the inherited annuity are subject to ordinary income tax. The tax treatment depends on whether the original annuity owner had begun taking required minimum distributions (RMDs) before passing away,” Miller said.

Inherited non-qualified annuities can be a bit more complicated; the tax consequences depend on how the beneficiary chooses to receive their payout.

“If you choose to take a lump sum, the earnings portion is subject to income tax,” said Miller. “If you opt for periodic withdrawals, the taxable portion is subject to income tax at the time of withdrawal.”

Peace of Mind Comes From Knowing Your Money Is Protected

Lowering Taxes for Beneficiaries

Beneficiaries who want to reduce the tax liability of their inherited annuity have a few options. Miller proposed two potential strategies: one that can work for any annuity and one that works best for qualified annuities.

Those who inherit qualified or non-qualified annuities can utilize the stretch provision to lessen the tax burden of an inherited annuity. With the stretch provision, the beneficiary can choose to receive periodic payments of the annuity’s value over their lifetime or life expectancy.

“This allows the remaining funds to continue growing tax-deferred while reducing the annual taxable income,” said Miller.

An inherited qualified annuity can also be converted to a Roth IRA. A Roth IRA is typically funded with after-tax dollars, so the beneficiary would have to pay income tax upfront when they make the conversion.

However, “While this conversion incurs immediate income tax, future withdrawals from the Roth IRA will be tax-free, providing potential tax savings in the long run,” Miller said.

Miller suggested that a Roth conversion may be most useful for beneficiaries who are in lower tax brackets.

How Do I Report Annuity Income on My Taxes?

Once you begin receiving annuity payments, you’ll need to report that income on your tax return. You can do so using a 1099-R form.

Taxpayers use 1099-R forms to report distributions from retirement savings products including annuities, retirement plans and pensions. If you’ve received a distribution of $10 or more from any of the retirement income sources, also known as payers, you must file a 1099-R form when you file your taxes.

You should receive a 1099-R form on or before Jan. 31 of each year for distributions received during the previous calendar year. Taxpayers who receive distributions from multiple payers will receive multiple forms.

What Is Publication 575?

Every year, the IRS updates Publication 575 to offer guidance on the taxation of distributions from pensions and annuities. The detailed document also explains how to report that income on your tax return.

Other topics covered by Publication 575 include information on rolling over certain distributions from one retirement plan to another, how to report disability payments, how to report railroad retirement benefits, and how to determine which part of an annuity payment is tax-free.

You can find Publication 575 on the IRS website.

Join Thousands of Other Personal Finance Enthusiasts

Frequently Asked Questions About Annuity Taxation

Annuities are taxed when you withdraw money or receive payments. If the annuity was purchased with pre-tax funds, the entire amount of withdrawal is taxed as ordinary income. You are only taxed on the annuity’s earnings if you purchased it with after-tax money.

All annuities feature tax-deferred growth, but none are completely tax-free.

Inherited annuity earnings are subject to taxation. The taxed amount depends on the payout structure and the beneficiary’s relationship with the annuity owner, as a surviving spouse or otherwise.

Taxes are deferred until you begin receiving your distributions from the annuity. Then, the payments are taxable based on whether the annuity was purchased with qualified (pre-tax) or non-qualified (post-tax) funds. Your withholding strategy should depend on your overall income and tax bracket at that time.

While it’s impossible to avoid paying taxes on an annuity completely, you can reduce the tax burden of your annuity by converting a deferred annuity into an income annuity. The income annuity’s payments will be made of both taxable interest and tax-free return of premium, lowering your tax liability for each income payment.

The amount of tax you’ll owe on an annuity withdrawal depends on the type of annuity you have. A withdrawal from a qualified annuity will be taxed as normal income at your current tax rate, while non-qualified annuity withdrawals are only partially taxable.

If you cash out your annuity early, you’ll have to pay taxes on the full value of the annuity if it’s a qualified annuity. When cashing out a non-qualified annuity, you’ll only owe taxes on the interest the annuity has earned.

Roth IRA annuities are funded with after-tax dollars, so the withdrawals are not usually subject to income tax.