For many, retirement is the time to finally take a breath and enjoy the fruits of what it’s taken a lifetime of employment to create. It’s a time of freedom from daily work obligations and a time to chart the most fulfilling course.

But it’s also a time of uncertainty and limited ability to adjust when surprise crises hit. A significant financial loss or expense can be catastrophic with less time and fewer opportunities to increase resources. A medical problem can start a cascade of problems and costs that are much harder to recover from.

It’s also a time when even one of the most wished-for aspects of retirement — a long life — is actually one of its biggest risks.

Longevity Risk: Outliving Your Savings

Who doesn’t want to live a long life? How can this possibly be a negative?

For retirees who plan to live off their savings, the idea of spending it all and having nothing to pay for life’s needs can be a major negative. How can they predict how long they will live and plan to spend their money accordingly?

Spend too little and die with a pot of money in place that could have made life more comfortable. Spend too much and live your final years in poverty, surviving solely on Social Security.

While life expectancy can be predicted for large groups, it’s impossible to determine for an individual. According to the Social Security Administration, a 65-year-old man can expect to live on average until the age of 84; a 65-year-old woman’s life expectancy is 86.6 years. Social Security projections say one of every three 65-year-olds will live past age 90 and one out of seven will live to be older than 95.

If you retire at the average age of 63 and live until you’re 100, you will require income for 37 years. For many people, this is longer than an entire career of employment. But even if you live just another 20 years, that’s a long time to finance a life.

You could plan for this by being exceedingly miserly with your nest egg, but then you could die earlier and have forfeited the enjoyment of a retirement that you had worked all your life to afford. Living on Social Security alone is inadequate for most people.

For these reasons, longevity is one of the top risks for retirees. It can be mitigated or even eliminated by using a portion of your savings to buy life annuities. These insure against longevity by providing a stream of guaranteed income no matter how long you live.

Can You Retire Comfortably?

Health Care

Unexpected medical bills and high out-of-pocket costs can put a major dent in your retirement savings. A couple retiring at 65 years old in 2022 can expect to pay about $315,000 in health care costs on average — 5% higher than estimated the year before — according to CNBC News.

Few retirees receive health benefits from their former employers. The Kaiser Family Foundation found that just 18 percent of firms that employed 200 or more people and offered health benefits to their workers provided retiree coverage in 2018 — the last year KFF broke out retiree coverage specifically. More companies have been offering Medicare Advantage plans to retiring workers in a move that saves employers money, according to a 2022 report in Fortune.

And Medicare doesn’t cover everything. For example, it doesn’t cover most dental care or eye exams; it doesn’t cover routine foot care or dentures. And even when it covers something, there may be a deductible on top of the premium you pay.

Long-Term Care

The most significant health cost not covered by Medicare is long-term care in a nursing home. According to the U.S. Department of Health and Human Services, the cost for a semi-private room for a year in a nursing home exceeds $82,000, and a private room can cost more than $92,000 a year.

For many, the insurance to provide long-term care is unaffordable. The American Association for Long-Term Care Insurance reports that the average premium for a 65-year-old couple was $3,750 in 2022. A single 65-year-old man can expect to pay almost $950 on average.

Some annuity policies offer the option of purchasing long-term care riders, which could cover some of the cost if care is needed. But there may be caps on the number of payments these riders provide.

Medicaid covers the cost of long-term care provided in professional settings. But to be eligible for Medicaid, patients’ income must fall below the amount specified in their state’s Medicaid income guidelines.

The government is strict about not crediting individuals who merely give their assets away. However, eligibility differs among states, which have flexibility in setting Medicaid rules. And if you are married, it is possible to protect some of your assets and still be eligible for Medicaid with the use of a Medicaid annuity.

Mental and Cognitive Health

Depression can be a risk in retirement. Consequently, retirees have to attend to their mental and emotional needs. For example, when planning where to live, take more than just finances into account. Consider locations that will bring happiness, perhaps close to loved ones. Some retirees may want to satisfy a need for adventure or contentment.

If you have been forced to retire before you wanted to, you may be at risk for depression. This is especially true for people who defined themselves by what they did for a living. One way to avoid depression is to find something else fulfilling to do in retirement, whether part-time work or volunteering.

A study from the American Psychological Association found that people who worked after retiring were healthier and happier.

Dementia and cognitive decline can be major challenges for retirees, limiting their ability to care for themselves and handle their finances. A strong support system and communication are vital. Also there are different legal and financial strategies to help the elderly in this situation.

The Society of Actuaries suggests products and services to meet the challenges of cognitive decline, including:

- Lifetime annuities

- Managed by an insurance company and paid on a schedule for the life of the annuitant, lifetime annuities require no action from the owner and the funds may be automatically deposited.

- Long-term care insurance

- Alternatively, a long-term care rider on an annuity can cover some long-term care expenses.

- Trusts

- Setting up a trust allows a trustee to manage your finances.

- Powers of attorney

- This document lets you designate someone to legally manage your finances if you are unable to make decisions.

- Investments that don’t require regular attention

- Target-date funds are mutual funds that automatically reallocate funds to more conservative investments based on an established time horizon, relieving the investor of actively managing the portfolio.

- Money management and bill paying services

- Auto-pay programs provide assistance for people who have difficulty managing these tasks because of cognitive impairment.

Inflation

It’s difficult to predict the cost of living in the future. When you’re working, inflation can be addressed by increased salary. In retirement, your resources are often fixed.

As the U.S. Department of Labor explains in a retirement planning booklet distributed in 2014, “If your money is not earning more than the rate of inflation, you will lose part of your nest egg’s buying power.”

To make matters worse for retirees, the one exception to the country’s relatively low inflation rate is the rising cost of health care. According to the Labor Department, medical costs have risen more rapidly than inflation during the last two decades, and studies estimate that retirees will spend 19 percent of their income on health care by 2039.

There are various ways to address this risk, such as choosing investments that provide insurance against inflation or the potential for growth and adding a cost-of-living rider to an annuity to account for inflation.

Get Your Free Guide to Annuities

Shocks and Unexpected Costs

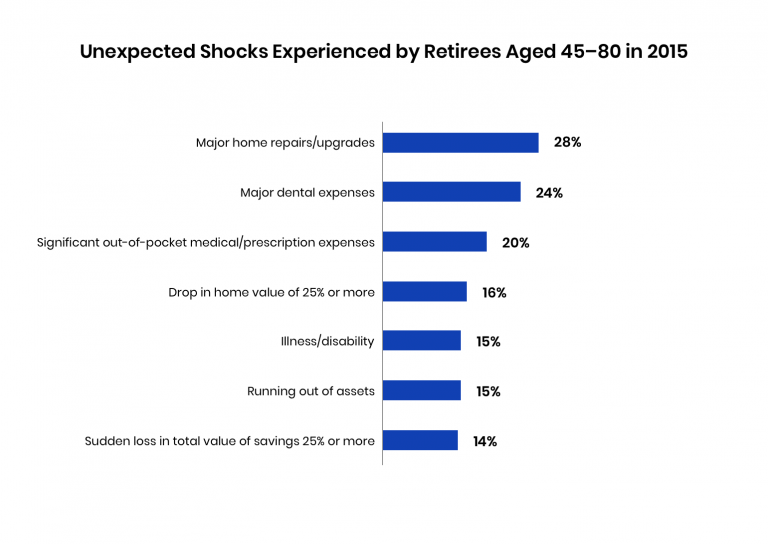

According to the Society of Actuaries, 19 percent of retirees and 24 percent of retired widows experience four or more shocks in retirement. The more shocks a household faces, the more trouble the individuals have dealing with them.

Among the findings reported by the society:

- Home repairs and dental expenses were the most common shocks reported.

- Despite the fact that half of all retirees are almost certain to face the prospect, widowhood is a shock. Depression, lost income and lingering medical bills are added risks for retired widows.

- Divorce or legal separation can severely affect retirees’ lives. Dividing marital assets can impact standards of living.

- Unexpected needs of family members, including parents, children, grandchildren and siblings could require increased personal or financial support, diminishing retirement savings.

The Society of Actuaries talked to a range of experts and individuals about ways people deal with different shocks and mitigate the effects. Adjusting spending, building an emergency fund, enrolling in dental insurance and creating a budget all stem the long-term effects of financial shocks in retirement.

Other financial risks in retirement include:

- Low interest rates on your retirement savings

- Stock market declines

- Sequence of returns

- Fraud

- Government policy

Read More: Essential Retirement Statistics for 2023

Tips for Managing Retirement Risks

Not every risk can be avoided. But most can be minimized, and many can be reduced through preparation. Again, planning is the best way to prepare for — and endure — the unexpected.

Consider a Part-Time Job

Working part-time in retirement has multiple benefits, from increasing your financial resources to keeping you engaged with the world. Many retirees find their jobs to be fulfilling ways to spend their time.

Open a Health Savings Account

If you have a high-deductible health insurance plan, you likely have the option of a health savings account (HSA). This allows you to set aside pre-tax money to cover medical costs. HSAs also roll over from year to year, so any money you don’t spend is available in later years, potentially in retirement. And unlike 401(k) money, HSA money isn’t taxed as long as it’s used on eligible medical bills.

Purchase Annuities

Guaranteeing income for life, annuities can be an effective way to insure against the risk of outliving your savings.

Take Care of Your Health

By maintaining good health, you can lower your risk of becoming sick and incurring high medical bills. Eat healthy, exercise and visit your physician regularly.

Maintain Communication

You’ll be more likely to avoid financial scams and receive support in the event that you experience any sort of cognitive impairment if you stay in close contact with family members or other trusted advisors.

Diversify Your Assets

Make sure your savings are in a variety of investments so you won’t lose everything if one of them loses value. Diversification allows you to reduce your financial risk by creating a portfolio that contains assets that respond differently to events that cause market volatility. Your financial planner can work with you to build a diverse investment portfolio.

Maximize Your Retirement Savings

While you’re still working, contribute as much as you can to your retirement accounts. Make sure you take advantage of any employer matching funds. If you want to save more than the allowable limits on 401(k)s or IRAs, you can purchase an annuity.

Long-Term Care Insurance

Long-term care insurance covers nursing homes, assisted living facilities and in-home care. More than 1.4 million people live in more than 15,500 Medicare- and Medicaid-certified nursing homes in the United States, according to a 2022 report from the U.S. Health and Human Services Inspector General.

HHS also estimated that every day, More than 10,000 Americans turn 65, and more than half of them — at some point —will need some level of long-term support.

Based on these estimates, a long-term care insurance policy may save you and your family hundreds of thousands of dollars. If the cost of a policy is too restrictive, consider the lower-priced option of adding a long-term care rider to an annuity.

Ultimately, your strategy for managing risks in retirement will depend on your lifestyle and your goals. A plan that makes sense for one person may have no benefit to someone else. It’s important to be aware of the risks, weigh the benefits of different solutions and make informed decisions with the help of a financial professional.