When you accepted your structured settlement, you were locked into a contractual agreement with the defendant in your personal injury lawsuit that specified a schedule of tax-exempt periodic payments. These payments, which were intended to provide long-term financial security in the event that your injuries prevented you from earning an income, have most likely been issued by a life insurance company through an annuity.

Now, though, your finances are stable and you want to sell your structured settlement. But first, you need the court’s permission.

Why Do I Need Court Approval to Sell My Settlement?

State and federal laws, known collectively as Structured Settlement Protection Acts, protect structured settlement holders from predatory practices in the secondary structured settlement market.

The secondary market refers to the purchase of existing structured settlement payment rights. Factoring companies, or structured settlement buyers, are legitimate businesses that offer a discounted lump sum in exchange for the rights to the seller’s future payments. There is nothing inherently insidious about the secondary market when all parties are informed and transparent.

The problem arises when scammers enter the picture. Unethical settlement buyers use high-pressure tactics to persuade structured settlement recipients to sell their payments, regardless of whether doing so is in their best interests.

According to a 2022 article from The National Law Review, the Consumer Financial Protection Bureau is aware of the abusive tactics used for structured settlement scams. Several tactics include pressuring recipients to sell their payments as a lump sum or even giving recipients independent advice from an attorney who was paid by the scammer’s company.

That’s also where the courts come in. The court-approval requirement keeps these corrupt dealers in check, inhibiting predatory strategies and deterring companies from using intimidation, coercion or other abusive business practices.

Structured settlement recipients may be especially vulnerable to these tactics because their contracts can be complex and the legal and financial jargon only adds to the confusing nature of structured settlement transfers.

When you add the stress and anxiety of a possible financial crisis, even a savvy consumer can make a mistake.

Read More: How Does a Structured Settlement Work?

Regulations and the Best Interest Standard

The “best interest” standard refers to the judge’s responsibility to the structured settlement seller.

The National Council of Insurance Legislators’ (NCOIL) model law for state structured settlement protection acts stipulates that transfers of structured settlement payment rights may not be approved unless the court finds that “the transfer is in the best interest of the payee, taking into account the welfare and support of the payee’s dependents.”

Additional regulation of structured settlements was enacted in 2001. The Victims of Terrorism Tax Relief Act of 2001 imposed a 40 percent excise tax on factoring companies that profited from the purchase of structured settlements.

The law had no effect on the tax treatment of the structured settlement for the recipient. According to the Periodic Payment Settlement Act of 1982, income from a structured settlement is exempt from taxation, just as the income from lump-sum settlements is exempt.

It did, however, have the undesirable effect of limiting the ability of structured settlement recipients to fully control their own finances.

Stop counting down to future payments

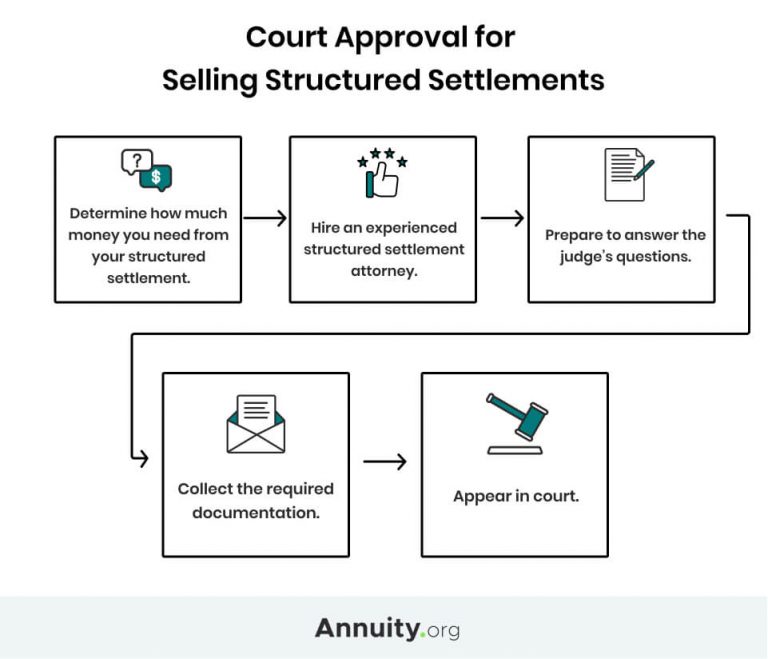

How Can I Improve My Chances of Approval?

The judge is more likely to approve the sale of your structured settlement if you can demonstrate that you have a valid reason for selling and that you understand the terms of your sale and the impact it could have on your financial well-being.

In addition to hiring a competent structured settlement attorney, come prepared to answer questions about the transfer itself, any medical expenses you may incur, and any dependents in your care.

Other questions the judge may ask include:

- Have you compared the quote from the factoring company to quotes from its competitors?

- Are you confident in the buyer’s reputation?

- Are you aware that you will receive less money by selling now than you would if you waited for the installment payments?

- Do you fully understand the transfer agreement?

- Has the agreement been reviewed by an attorney or other professional advisor who is not working for the purchasing company?

The judge may even ask what you plan to do with the money.

Don’t let this question cause you anxiety. Just remember that the judge is looking out for your best interest. You’ve thought this through, and you are confident in your decision to sell, so just relax and explain your plans to the judge. If you have any documentation that details your intent, present it to support your argument.

Bring the Required Documents

Having the required documentation on hand will not only prevent any delays with the sale, but it will also show the judge that you are competent, professional and in control of your actions.

At a minimum, you’ll need the following documents:

- Valid photo ID or driver’s license

- Settlement and release agreement

- Sale or transfer documents

- Annuity contract that funds your payments

Interested in Selling Annuity or Structured Settlement Payments?

Hiring a Structured Settlement Attorney

First and foremost, you must understand that the attorney the factoring company sends to your hearing does not represent you or your interests. This is the buyer’s lawyer, and as such, his or her loyalty is to the factoring company.

This is why the Structured Settlement Protection Act mandates that the factoring company’s disclosure statement provides “that the payee has the right to seek and receive independent professional advice regarding the proposed transfer and should consider doing so before agreeing to transfer any structured settlement payment rights.”

The “independent professional advice” should come from an attorney or licensed professional advisor who represents you exclusively.

Of course, there will be extra costs involved when you bring in your own legal counsel, but the cost of a lawyer with experience in structured settlement factoring transactions will, in most cases, be offset by the expertise and protection he or she brings to the table.

The American Bar Association suggests asking the attorney you plan to hire:

- How long have you been practicing law?

- What types of cases do you handle most often?

- Are most of your clients individuals or businesses?

- How do you charge for your services?

- What will be my total costs for representation?

- Can I pay my legal fees in installments?

- Can you provide me with a written statement that itemizes and explains all fees?

- Can I limit costs by gathering my own documentation?

Source: American Bar Association

The ABA also recommends interviewing several lawyers and contacting your state lawyer licensing agency to confirm that the attorneys you are considering are licensed in the state and have had no disciplinary action taken against them.

Frequently Asked Questions About Court Approvals

Most of the questions people have about court approval for their structured settlement payment transfers are specific to their individual situations, but you can find a bit of insight into what to expect during the process and after the court reviews your sale agreement.

The judge might deny your structured settlement sale if he or she believes the agreement is not in your best interest, is likely to result in financial hardship for you or your dependents in the future, or if the transfer agreement does not adhere to federal and state SSPAs.

If the court approves your transaction, the factoring company finalizes the transfer and sends your lump sum through your preferred delivery method. The company will likely either initiate a direct deposit to your bank or send you a check. Depending on how quickly the insurance company that issues your payments acknowledges the transfer, you could have your money within the week.

Attorneys charge hourly and flat rates, and their rates typically vary in accordance with the type of work they do for a client. There’s no standard structured settlement attorney charge.

Interested in Selling Annuity or Structured Settlement Payments?