Key Takeaways

- Annuities are financial contracts that can provide a consistent stream of income for life, making them a valuable part of a retirement plan.

- Annuities are highly customizable, which can allow you to achieve your financial goals in a low-risk and tax-advantaged way.

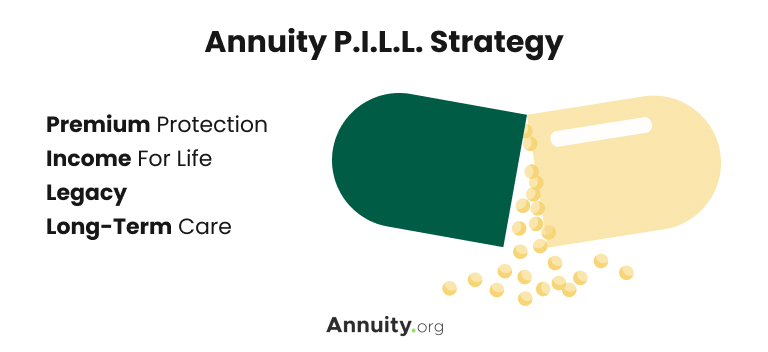

- Some of the most significant advantages of annuities include premium protection, income for life, legacy benefits and long-term care optionality.

Understanding Annuities

Annuities may seem complex, mainly because they come in so many varieties with a myriad of optional riders. Making sense of these options can take some effort. However, once you gain an appropriate perspective, the diversity of annuity offerings is clearly advantageous and can allow you to structure a vehicle that suits your unique needs and concerns.

Don’t let the facade of complexity discourage you from exploring how annuities can help you achieve your financial goals in a customizable, low-risk and tax-advantaged manner.

Consulting a fiduciary financial advisor can help make sense of things. They can break down the way these vehicles work and how their risk-return profiles compare with other investment options.

Annuities can be a great option for conservative, hands-off investors planning for retirement or individuals looking for help with long-term care costs and a means to provide for their loved ones after death. Let’s break things down using a framework we call the annuity P.I.L.L. strategy.

All annuities are not the same. Each provides different benefits and comes with their own pros and cons. Before you buy an annuity you should make sure it is the right one to fulfill the specific purpose you want it to.

Premium Protection

Premium protection refers to the ability to preserve your initial investment regardless of marketplace fluctuations. This protection guarantees you’ll never lose money on your contract.

The two types of annuities that offer premium protection are fixed annuities and fixed index annuities. The former offers a guaranteed rate of interest for a specified period, while the latter’s returns vary depending on the performance of a specified market index.

A third type of annuity, the variable annuity, is exposed to downside risk. Just like stocks, bonds and alternative investments, you can lose money with these instruments.

For many investors, particularly retirees, this risk is not acceptable. They need their savings to fund their living expenses for the rest of their lives, and they cannot tolerate market-driven losses.

Read More: First-Time Annuity Buyers

Purchase an Annuity Today

Lifetime Income

Many annuities guarantee an income stream for the annuitant’s lifetime. Some also provide income to an annuitant’s spouse for his or her lifetime via a joint and survivor option.

You can incorporate a lifetime payout feature into all types of annuities, but it is most common with fixed and fixed index annuities. If implemented in an economic fashion, this feature can be incredibly beneficial — especially for retirees worried about outliving their savings.

Owning an annuity that provides a steady stream of income and allows you to live worry-free throughout retirement can be invaluable, especially in an age where dependable pension income is scarce.

Interested in Buying an Annuity?

Legacy Benefits

Legacy refers to death benefit riders, which allow you to pass on the remaining value of an annuity to one or more named beneficiaries at death.

That said, the transfer of wealth can vary from one annuity contract to the next. For example, your contract could stipulate a lump-sum payment at death. Alternatively, it could stipulate a minimum number of payments for your beneficiaries.

The complexity increases slightly with a joint and survivor annuity. In this situation, your spouse can assume ownership of the annuity when you die under the same terms that you received your payments.

In most states, annuities move over probate-free. This means the assets go right to the beneficiary.

Regardless of the contractual terms, you can protect your heirs from having to go through probate by including a beneficiary in an annuity. Probate, the legal process of dividing a deceased person’s estate and adhering to a will, can entail unnecessary cost and time.

Join Thousands of Other Personal Finance Enthusiasts

Long-Term Care Options

Long-term care riders are options in many annuity contracts. They provide insurance to help cover the cost of long-term care, which can be extremely valuable. This is especially clear when considering that the average national cost for a semi-private room in a nursing home is about $8,000 a month ($96,000 a year), according to The Senior List.

Someone turning 65 years old has a nearly 70% chance of needing some kind of long-term care services at some point in their lifetime.

Long-term care annuity riders don’t pay the entire cost of care or provide the level of reimbursement available via traditional long-term care insurance. However, they are generally much less expensive and usually have less stringent medical underwriting than traditional long-term care policies.

If you need long-term care, a rider will usually increase your annuity payout by some multiple for a designated period. For example, your rider might pay you double your normal income stream for up to five years.

Alternatively, a rider could allow you to make large withdrawals from your annuity principal should you require long-term care. Regardless of the payout terms, a long-term care annuity rider can help you live independently, providing both financial flexibility and peace of mind.

Incidentally, their economical nature and streamlined underwriting procedures have made long-term care annuity riders increasingly popular. In fact, in 2014, the number of annuities with long-term care riders exceeded the number of long-term care insurance policies for the first time.

Currently, a long-term care policy with $165,000 level benefits purchased for a couple at age 60 costs an average of $2,550 a year.

Other Frequently Asked Questions About Annuities

An annuity involves a lump-sum purchase in exchange for a series of immediate or deferred income payouts. The variability and duration of the payouts depend on how the annuity contract is structured.

The safety of an annuity depends on the type of contract in question. Fixed annuities are extremely safe and have highly predictable, but modest, income streams. Fixed index annuities offer higher return potential and are more costly than fixed annuities, but they are still incredibly safe. Variable annuities offer higher return potential than fixed and fixed index annuities, but they can be exposed to a lot of downside risk.

A rider is an optional feature you can add to an annuity contract to ensure it meets your needs. The primary categories of annuity riders are living benefits riders and death benefits riders. The former consists of benefits payable during your life, while the latter consists of benefits payable after death.

Annuities can be a great option for conservative, hands-off investors planning for retirement. They offer high stability and can produce a steady stream of income for life. If these benefits appeal to you, explore more about buying annuities.