Do you know how you’ll fund your retirement? Do you know how much you’ll need to live comfortably during your non-working years? These are tough questions that many people don’t spend enough time considering.

According to a three-part survey conducted by CNBC, over 70% of Americans received a serious financial wake-up call during the COVID-19 pandemic. Now, people all over the nation are thinking more about their long-term financial goals and paying closer to their progress in achieving them.

One popular way to refine your goals and gauge your progress is to review the average retiree income levels in the U.S., along with other key retirement statistics. Your situation may be different than that of the average person, but a benchmark can be informative, especially when you can dial into specific categories of data, such as age groups.

Average Retirement Income

According to the latest data from the United States Census Bureau, the median annual income for individuals aged 65 and older is $47,620, while the mean annual income is $75,254. A few other income data points for people of retirement age are illustrated below.

| Income Per Year | Median | Mean |

|---|---|---|

| 65+ years old | $47,620 | $75,254 |

| 65 – 74 years old | $55,747 | $84,975 |

| 75+ years old | $38,239 | $61,547 |

Understanding Median and Mean

Everybody should have a basic understanding of the median and mean statistics, especially when using them to inform a retirement plan.

Because retirees with higher incomes tend to skew the mean retirement income, the median income is a more accurate measure of the national average.

- Median

- This represents the value that exists in the exact middle of a data set. To pinpoint the median of 13 retirees’ incomes, you would organize the values from smallest to greatest. The number that falls in the 7th place is the median retirement income.

- Mean

- This is the average of all values in a data set. To compute the mean of 13 retirees’ incomes, you would aggregate the incomes and divide the sum by 13.

Basic Explanations of Median and Mean

Generally, the median is more useful than the mean for assessing average retirement income. This is because the mean is skewed by individuals with very large incomes. These outliers can easily pull the metric up into unrealistic territory for average people.

Average Retirement Savings by Age Group

Saving for retirement can begin at any age, but the most robust retirement plans are associated with aggressive savers that started early, oftentimes, in their early 20s. Unfortunately, life circumstances prevent many people from saving for retirement until their 30s, 40s or 50s.

Starting to save for retirement later in life is challenging, but you can do it successfully. It just requires careful planning and persistence. When starting at age 50 or older, it also usually calls for some sacrifices and more stringent retirement budgeting.

Vanguard conducted a study to examine how America saves. The mean and median retirement savings by age group are as follows:

Average Retirement Savings by Age Group

| Age Range | Average Balance | Median Balance |

|---|---|---|

| 0-25 | $6,264 | $1,786 |

| 25-34 | $37,211 | $14,068 |

| 35-44 | $97,020 | $36,117 |

| 45-54 | $179,200 | $61,530 |

| 55-64 | $256,244 | $89,716 |

| 65+ | $279,997 | $87,725 |

How do you fare relative to the median for your age group? If you’re lagging considerably, perhaps it’s time to meet with a financial advisor. Doing so will improve your chances of accumulating enough savings to generate an adequate amount of income in retirement.

What Is a Good Retirement Income?

If you’re wondering how much retirement income you need, you’re not alone. Most people wrestle with this question, especially those that lack financial experience, literacy or familiarity with the retirement planning process.

Generally, a good retirement income is about 75% to 85% of the pre-tax income earned in your last working year. This rule-of-thumb reflects the following assumptions: you have been saving about 15% of earnings annually, you will maintain a balanced budget and you will pay less in taxes during retirement.

That said, the target percentage may need to be revised upward or downward, depending on your life expectancy, health care costs and retirement lifestyle, which depend on your primary geographic location and travel habits. To get a more accurate idea of what a good retirement income looks like for you, start by fleshing out your future circumstances.

For an age-based benchmark, consider the data points below.

Average Income Broken Down by Age

| Age Range | Median Household Income | Mean Household Income |

|---|---|---|

| 55-59 | $81,866 | $117,851 |

| 60-64 | $71,354 | $109,826 |

| 65-69 | $58,776 | $89,272 |

| 70-74 | $52,678 | $79,860 |

| 75+ | $38,239 | $61,547 |

As illustrated, income typically declines with age. This is largely due to how the typical retiree gradually draws down on his or her retirement portfolio, slowly diminishing its income-generating potential over time.

Unfortunately, the rate of decline can be accelerated by a myriad of retirement risks, including runaway inflation and unexpected health care withdrawals. As a result, sound investment management is important before and after you retire.

Not all individuals take the traditional path to retirement. Depending on your income level, savings rate and anticipated spending needs, you may be able to retire early. However, saving for retirement is challenging enough; early retirement calls for superb planning and a heightened level of fiscal discipline.

Where Does Retirement Income Come from?

Many people have various sources of retirement income, which can include pension plan distributions, Social Security benefits and investment account distributions. Ideally, you should have multiple, diverse streams of income to ensure you have enough to live comfortably, optimize your tax position and protect against inflation. Let’s take a closer look at the most prominent sources of retirement income.

Continued Employment

According to a recent study by Schroders, 62% of working Americans plan to continue working during retirement in some capacity. Fortunately, there does not appear to be a shortage of work. In fact, there are a wide variety of opportunities for retirees to make money and grow their skills — from keeping a blog to becoming a life coach.

How to maximize this income:

- Start a freelance consulting business using the skills you honed throughout your career.

- Get a part-time job.

- Utilize gig-economy to find something flexible that aligns with your lifestyle.

Social Security Benefits

Every time someone gets paid, a 6.2% Social Security tax is withdrawn from the gross amount. For the self-employed, this percentage doubles to 12.4%. Then, the Social Security program pays this money to qualifying retirees, including you. The amount you receive is based on how much you earn during your working years and the age you elect to start your benefit.

A study conducted by the National Institute on Retirement Security shows that 40% of Americans rely solely on Social Security benefits to fund their retirement.

According to the Social Security Administration, for 2022, the maximum Social Security benefit you can receive each month is $3,345 for those at full retirement age. The estimated monthly average Social Security income is $1,657, after a 5.9% cost-of-living adjustment.

How to maximize this income: Delay receiving your Social Security benefit until full retirement age, which is between 66 and 67, depending on when you were born. Claiming the benefit prior to full retirement age will result in a reduced monthly payment. Brian Fry, a CERTIFIED FINANCIAL PLANNER™ and founder of Safe Landing Financial, offers the following guidance:

“To receive 100% of your Social Security benefit, you must wait until full retirement age. Each year that you claim before full retirement age, you give up between 5% and 6.67% of your full benefit. Benefits increase by approximately 8% for each year that you delay claiming Social Security after full retirement age.”

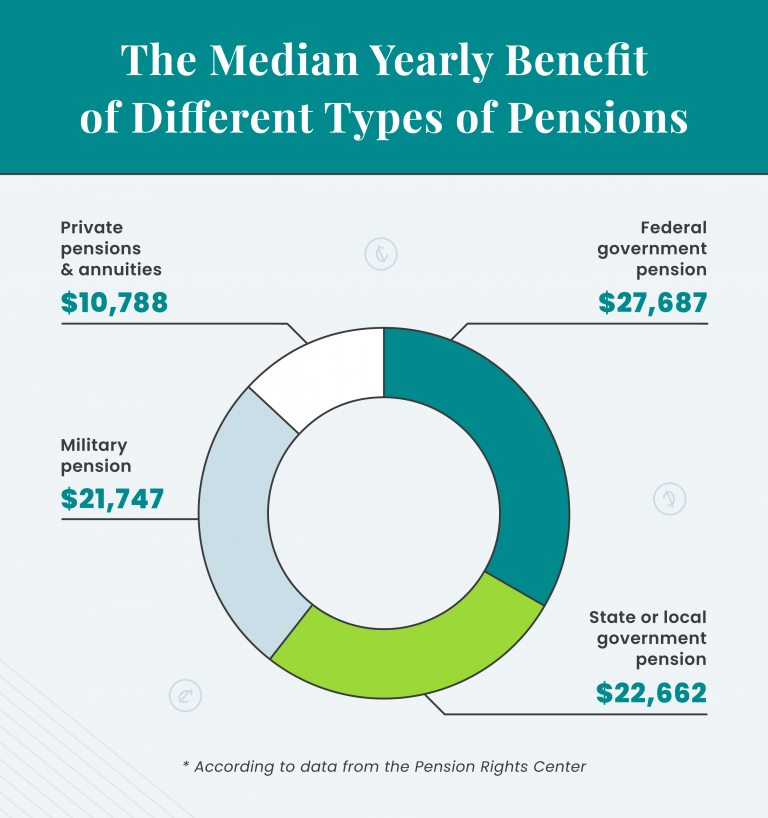

Pensions

According to the Pension Rights Center, only about one-third of American retirees receive income from defined benefit retirement plans, which reflects the steady decline in pension plans. According to the United States Department of Labor, there were 113,062 pension plans in 1990, but only 46,869 in 2018.

The median private pension in the United States pays out $10,606 per beneficiary annually, according to the latest data from the Pensions Rights Center. On average, other types of pensions, including government and military pensions, pay out higher benefits.

How to maximize this income: Generally, by working as long as possible for a pension plan sponsor, you can increase your benefit. Usually, the benefit will also increase as you earn more money.

Personal Financial Assets

According to the Transamerica Center for Retirement Studies, 48% of American workers expect their main form of retirement income to be from personal financial assets, some of which, are tax-advantaged.

Most investors hold some combination of the following assets:

- Annuities

- IRA accounts

- 401(k) accounts

- Taxable brokerage accounts

- Real estate

Depending on how they’re structured, the first three vehicles offer the potential for either tax-deferred or tax-exempt growth. The latter two asset types do not receive favorable tax treatment.

Regardless of the personal financial assets you own, strive to maintain a holistic perspective. The success of your retirement plan is dependent on how the various assets complement each other and your other sources of income, not on standalone performance. Along those lines, be sure to strive to maintain an appropriate degree of diversification. This can help to improve the risk-adjusted performance of your retirement portfolio and extend the longevity of your savings.

How to maximize this income:

- Invest the maximum amount into your retirement accounts each year.

- Look into buying an annuity to protect your savings and grow your money on a tax-deferred basis. In doing so, be sure to shop around for reputable annuity providers.

- Invest your money in passive, income-producing investment funds that hold bonds, dividend-focused stocks and commercial real estate.

Ready to Secure Your Financial Future?

4 Withdrawal Strategies for Retirement Income

Building adequate sources of income is one aspect of the retirement journey. Being strategic about the way you withdraw funds during retirement is the other. Without a solid plan, you may spend too much too fast and not have enough money to support your lifestyle. Fortunately, the strategies outlined below can help you extend the longevity of your savings.

- Annuities: An annuity is a tax-deferred financial product issued by an insurance company. To buy an annuity, you pay the issuer a lump-sum of money in exchange for a guaranteed stream of income.

- The 4 percent rule: This rule suggests you should withdraw 4% of your retirement portfolio in the first year of retirement and adjust for inflation in subsequent years. Doing so can mitigate longevity risk.

- Fixed-percentage or fixed-dollar withdrawals: With this approach, you determine a specific percentage or amount to withdraw periodically. Projections are necessary to home in on an appropriate withdrawal.

- The Bucket Method: With this system, you divide your money into distinct buckets that serve specific purposes. Some of your funds will remain in a liquid bank account to cover day-to-day expenses. Other funds may be invested in relatively stable, fixed-income assets to generate income to replenish your bank account. Other funds may be invested in growth-oriented assets to bolster the value of your retirement portfolio.

Don’t underestimate the importance of maintaining a strategic distribution plan. It can make the difference between having a stressful, uncertain retirement and living comfortably and confidently. If you’d like to explore these approaches in more detail, consult with a fiduciary financial advisor.