Economic Uncertainty Boosted Demand for Annuities in 2021

- Written By Jennifer Schell

Jennifer Schell

Financial Writer

Jennifer Schell is a professional writer focused on demystifying annuities and other financial topics including banking, financial advising and insurance. She is proud to be a member of the National Association for Fixed Annuities (NAFA) as well as the National Association of Insurance and Financial Advisors (NAIFA).

Read More - Edited By

Savannah Pittle

Savannah Pittle

Senior Financial Editor

Savannah Pittle is an accomplished writer, editor and content marketer. She joined Annuity.org as a financial editor in 2021 and uses her passion for educating readers on complex topics to guide visitors toward the path of financial literacy.

Read More - Published: March 23, 2022

- 3 min read time

- This page features 6 Cited Research Articles

Financial turmoil caused by the COVID-19 pandemic has boosted interest in annuity products for working Americans. Annuity sales in the United States saw a 16% jump in 2021, according to the Secure Retirement Institute® (SRI®) U.S. Individual Annuity Sales Survey.

This growth in sales was reflected across multiple types of annuities. Variable annuity sales rose 27% in 2021, totaling $125.6 billion. Sales of fixed index annuities increased by 15%, representing the largest annual growth for the product’s sales in three years.

Prior to the pandemic, only 10% of employers provided annuities as a retirement planning option, but research by Fidelity Investments found nearly 80% of workers are interested in the products.

This year’s record-setting annuity sales marks the highest annual sales since 2008 — another notable time of financial uncertainty. Tumultuous economic climates can increase demand for annuities for a few specific reasons.

Combating Rising Inflation

Prices have risen at extraordinary rates over the past year, bringing inflation to the forefront of many Americans’ minds. As inflation continues at a rapid pace, many people worry about whether their retirement years will be financially secure.

Because annuities offer a guaranteed income stream for the lifetime of the annuitant, they help to close the so-called retirement gap — where personal savings and expected income aren’t enough to cover the entirety of a person’s retirement needs. Americans worried about the effects of inflation on their retirement savings can turn to annuities to supplement an existing savings plan, like an IRA or 401(k).

High inflation sparks interest in annuities, especially for accumulation-focused fixed index annuity products that provide principal protection combined with greater investment growth. According to Todd Giesing, assistant vice president of SRI Annuity Research, fixed-rate deferred annuities provide about three times the return of certificates of deposit (CDs) on average, making them very beneficial to investors looking for growth that can offset high rates of inflation.

Capitalizing on Stock Market Growth

Despite the financial challenges many Americans faced over the last two years, the stock market showed solid growth in 2021. Indexes that track the market’s movements all showed significant increases by the end of the year. Forbes reported that the Dow Jones Industrial Average (DJIA) gained 18.7%, the Nasdaq Composite gained 21.4% and the S&P 500 gained 26.9%.

This growth drove sales of annuities tied to market performance. The American Society of Pension Professionals and Actuaries reported that the double-digit growth in both traditional variable and index-linked annuity sales can be attributed to the stock market’s powerful performance in the fourth quarter, as well as in 2021 overall.

The stock market’s strong performance reflects another trend in annuity sales: though annual sales of fixed-rate deferred annuities in 2021 were higher than in the previous year, quarterly sales declined over the course of the year. Geising notes that this shift took place as some investors gained more confidence in the market and moved towards investment products with higher return potential.

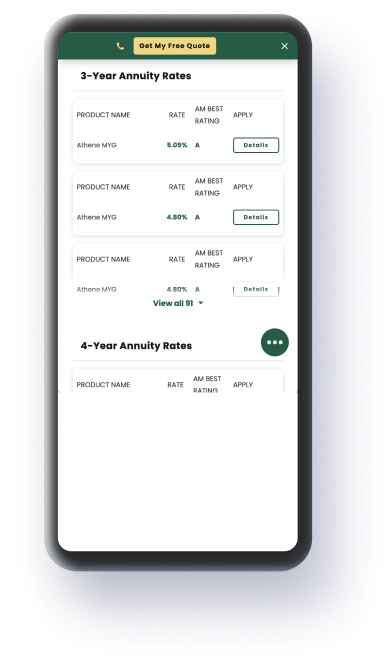

Purchase an Annuity Today

Managing Financial Risk

Times of economic uncertainty tend to make consumers more risk averse. Many people lost income during the pandemic, and those same people are likely to want to safeguard their financial wellness against future pitfalls.

Annuities are an insurance product; they mitigate financial risk by ensuring the annuitant will have a consistent source of income even if they run out of retirement savings. They can also lock in gains generated during more prosperous times to help people weather an economic downturn.

In this way, annuities are particularly valuable to older individuals who have done well in the stock market. By using their money from pure equity products like stocks or mutual funds to purchase annuities, these individuals can protect their principal as well as what they’ve gained from equity investments.