What Is Workers’ Comp?

When employees suffer injuries or illnesses due to their job, they may be entitled to benefits through a special type of insurance from their employer. This state-mandated insurance program is known as workers’ compensation, sometimes also called “workmans’ comp.”

More than 90 percent of all U.S. workers are covered by workers’ compensation laws. Each state has different regulations for which employers must have coverage and which types of workers are excluded from the requirement.

- Location

- The illness or injury may arise at the workplace, while traveling for business, while running a work-related errand, or even while attending a mandatory social event with co-workers or clients.

- Cause

- A job-related injury might be from a single accident, such as slipping and falling down a flight of stairs, or it might be a repetitive stress injury that takes years to develop, as with carpal tunnel syndrome or chronic back problems. A job-related illness could be caused by exposure to toxic substances, or it could be a dangerous health condition caused by constant mental and emotional stress.

- Fault

- The harm may be accidental, or it may be the fault of the employee, the employer or some other third party like a co-worker or a customer.

Workers’ compensation structured settlement cases include a wide range of scenarios:

Though workers’ compensation insurance covers many potential situations, keep in mind that coverage may be denied if an employee suffers an injury specifically because they were intoxicated, breaking the law or otherwise violating company policy at the time.

Common instances involving a structured settlement include:

- Brain injuries

- Amputations

- Severe burns

- Vision loss

- Spinal cord injuries

- Any other injury resulting in permanent disability or a disability affecting employment

In order to receive workers’ compensation benefits, an injured employee must waive the right to sue their employer. However, if the harm was caused by the negligence of an employer or a third party, the employee does have the option to bypass the workers’ compensation system and file a personal injury lawsuit.

Workers’ compensation covers medical bills, lost wages and the cost of retraining and rehabilitation.

Family members of workers killed on the job may be eligible for benefits as well. Claims can be resolved through lump sum cash payouts, trust funds or structured settlements.

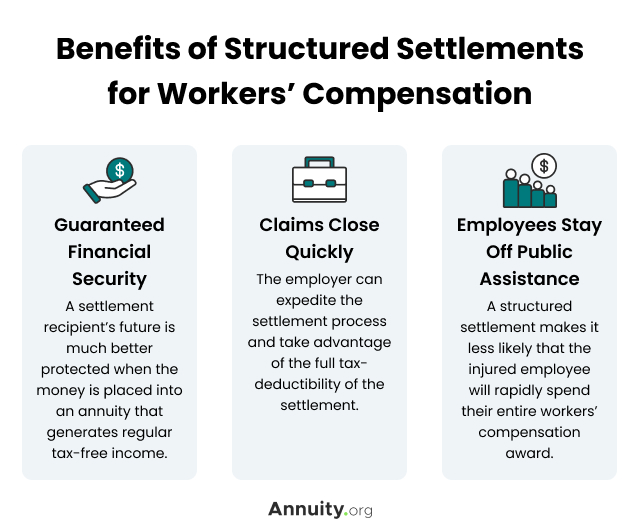

Benefits of Structured Settlements for Workers’ Compensation

In cases where an employee is permanently disabled to the point that they cannot return to meaningful employment, the workers’ compensation claim is often resolved through a structured settlement. A structured settlement annuity guarantees the disabled employee a long-term stream of tax-free, inflation-protected income.

When an annuity is chosen as a settlement, a structured settlement broker helps analyze the employee’s needs to determine how the periodic payments should be made. Around one-third of injured persons choose this option over a cash lump sum, according to the National Structured Settlements Trade Association. The federal government has encouraged the use of structured settlements through legislation since 1983, because such arrangements usually work to the advantage of everyone involved.

Unlock Your Money Today

Guaranteed Financial Security

A seriously injured employee may face costs for ongoing medical treatment, future surgeries and the replacement of durable medical equipment for the rest of their life. On top of that, they may never be able to earn an income from working again.

Given these challenges, even a multimillion-dollar lump sum payout can run out quickly if it is not managed and invested with great care. A settlement recipient’s future is much better protected when the money is placed into an annuity that generates regular tax-free income. The only downside is that the settlement money cannot be accessed ahead of schedule unless the rights to future payments are sold on the secondary annuity market.

Read More: How Does a Structured Settlement Work?

Claims Close Quickly

By paying the annuity provider up front to handle the long-term payments, the employer can expedite the settlement process and take advantage of the full tax-deductibility of the settlement amount as if it were a lump sum.

Employees Stay Off Public Assistance

The state benefits because a structured settlement makes it less likely that the injured employee will rapidly spend their entire workers’ compensation award and run out of money. Without the settlement funds, the injured employee would have to turn to Medicare, Medicaid or other public aid to cover health-care and living expenses.

Medicare and Workers’ Compensation Structured Settlements

A structured settlement can also be used to fund a Workers’ Compensation Medicare Set-Aside (MSA) account, where the employer is responsible for the cost of the primary medical treatment for the claimant, and Medicare is the secondary payer.

Some ideal cases taking the MSA approach include instances where:

- Compensability and liability have been determined

- Disbursement is still active at least 10 years in the future

- A level of disability has been determined for the plaintiff

An MSA can reduce the employer’s settlement cost.

If you are a medicare beneficiary and you are considering a structured settlement, you should have the Centers for Medicare and Medicaid Services (CMMS) review the settlement before your case is closed. A CMMS review will ensure your settlement accounts for Medicare-covered expenses. This is typically achieved by opening a MSA account.

A CMMS review will make your settlement compliant with Medicare laws, and it will also ensure Medicare will cover your expenses if your medical condition changes unexpectedly and you no longer have enough funds in your MSA.