Before they turn 70, an estimated 96% of Americans will experience at least four “income shocks,” according to the National Endowment for Financial Education (NEFE).

Income shocks are major life events that cause long-term consequences for your personal financial wellness. Shocks include experiences of job loss, career change, major illness or injury, divorce or leaving the workforce as a stay-at-home parent.

On top of these major events, millions of Americans feel constant financial stress over smaller monetary pressures like covering monthly bills, building emergency savings and putting money away for retirement.

“In our most recent survey, we found that 85% of Americans said that some aspect of their personal finances is causing them stress,” Paul Golden, managing director of media and communications for NEFE, told Annuity.org.

Adding to this mounting stress is the fact that much conventional wisdom for achieving financial wellness has been turned upside down thanks to the COVID-19 pandemic and other economic upheavals in recent years.

Research suggests that major recent events, namely the rise of student loan debt and the COVID-19 pandemic — spurring the so-called Great Resignation — may have permanently changed how Americans perceive financial wellbeing.

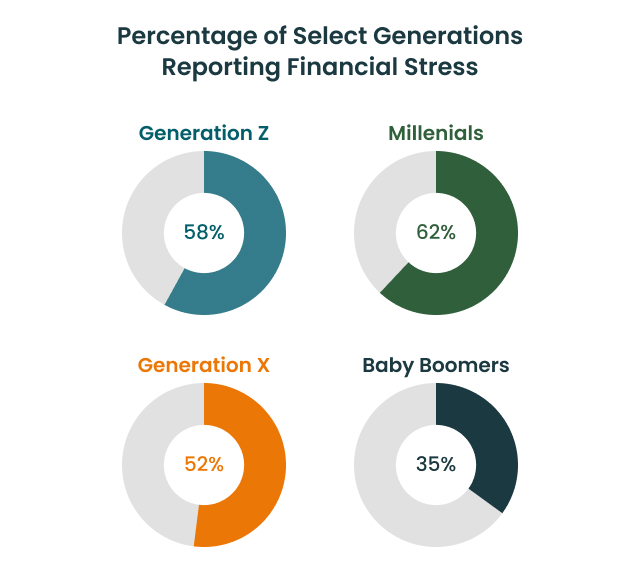

These events are major factors in shaping a financial wellness generation gap. They’re also paving the way for a new path to financial wellness for generations to come.

“We have five generations in the workforce right now, and they all have very different perceptions of their financial wellness position,” Snezana Zlatar, senior managing director and head of financial wellness advice and innovation at the Teachers Insurance and Annuity Association of America (TIAA), told Annuity.org. “That stratification comes through very loud and clear.”

While the road to financial wellbeing may have more roadblocks than it did for past generations, you shouldn’t get discouraged — you can still map your own journey toward financial wellness.

The Road Ahead: How Do You Get to Financial Wellness?

Financial wellness is distinct from financial literacy. Though it borrows from the principles of financial literacy — knowing how to budget, save, invest and reduce financial risks — financial wellness as a concept centers on alleviating personal economic stress by ensuring your ability to meet current and future financial obligations.

You achieve financial wellness when you can fully meet your current monetary commitments and feel secure in meeting your future financial goals while also being free to make the individual financial choices that allow you to enjoy life.

You may think you’re on the right road to financial wellness, but research shows that many Americans overestimate their degree of financial wellbeing.

How Do You Compare to Other Americans on the Financial Wellness Scale?

You’re not alone if you didn’t get all the answers right. Research proves that there is a disconnect between how people view their own financial wellness and just how solid their financial wellbeing actually is.

But you can use that research — and our experts’ tips — to get back on the road to financial wellness and a more secure future.

Financial Wellness: A Lifetime Journey

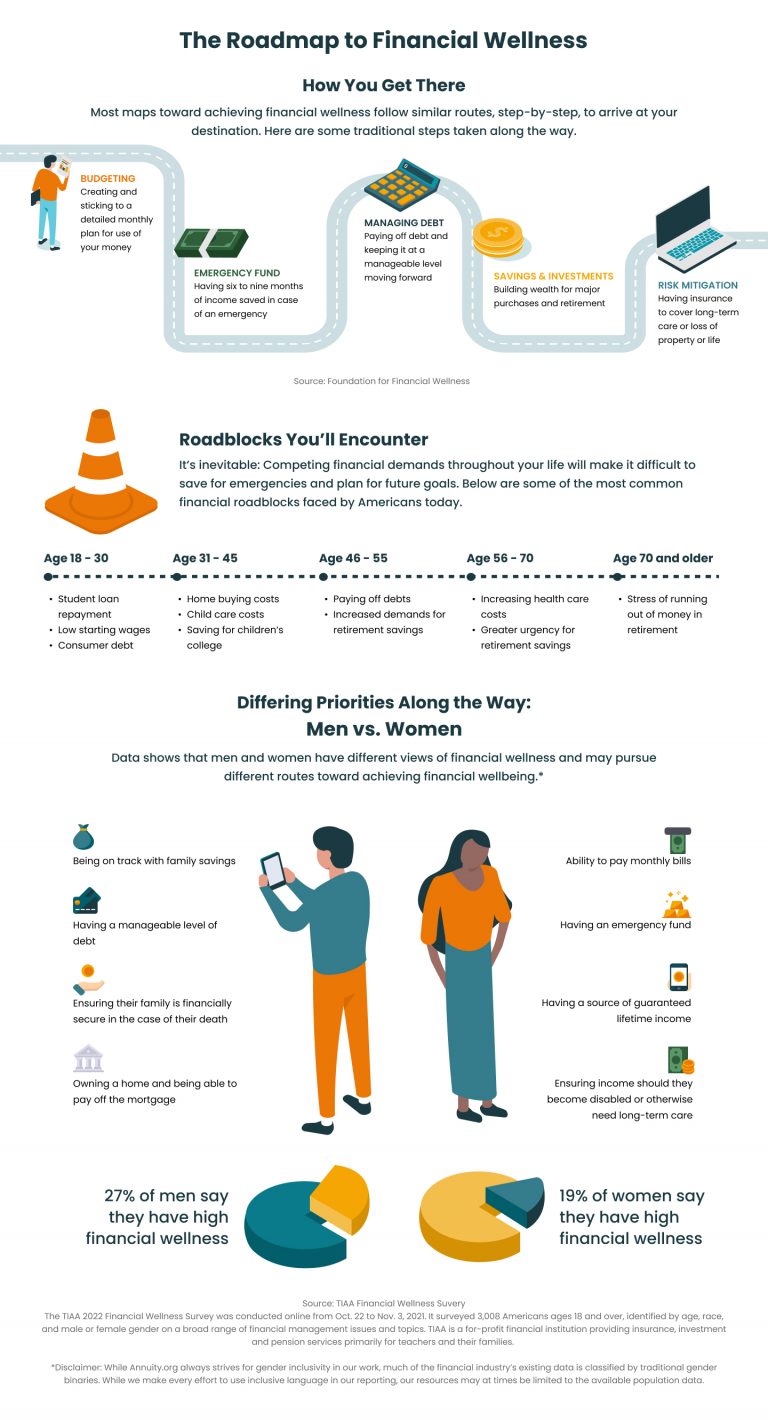

The road to financial wellness has traditionally been described in several steps, usually accomplished in a set order, allowing you to organize and manage your finances over the long term. But it’s not always a smooth road, and there is more than one route to financial stability.

“Your financial wellbeing can ebb and flow, and there can be different types of financial strain that come along as you go through life,” Golden said.

In addition to knowing the general route to financial wellness, you’ll have to be prepared for roadblocks — competing financial demands — that are typical as you age and progress throughout your life. By knowing the best roadmap for you, you can set yourself up for success before you get too far off course.

Avoiding Roadblocks

Financial roadblocks will pop up throughout your working years. Besides the income shocks that can set your financial goals back months or years, there are competing priorities for your money that shift over time.

These can prevent you from doing things like sticking to a budget, saving for the future or planning for your retirement.

In some cases, you’ll have to learn your way around financial roadblocks. In other cases, you may just have to tighten your seatbelt and plow through the roadblocks. Either way, there is a path through them — if you have a plan.

Improve Your Level of Financial Education

Financial education can pay dividends and help you better navigate tight financial times.

“Enabling people to manage their daily finances effectively — starting with budgeting, of course — and addressing and managing debt can help people focus on the long term,” Zlatar said.

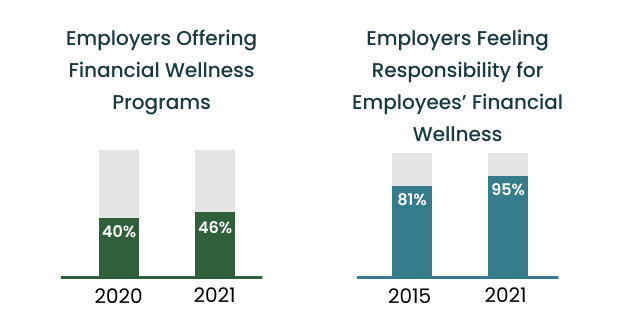

Checking with your employer’s human resources department can be an important first step on your journey. A growing number of companies offer financial wellness programs as part of their benefits package, giving today’s workforce an advantage.

Dozens of companies, community organizations and nonprofits also offer a wide range of personal finance and other financial literacy courses. You can even find free online courses that may suit your needs.

“Employer-sponsored financial programs make a difference for employees. We have seen, across the board, that people who participate in these programs are twice as likely to have high financial wellness ratings.”

— Snezana Zlatar, senior managing director and head of financial wellness advice and innovation, TIAA

Invest in Your Future Early

Even if you live paycheck-to-paycheck, you may still be able to set aside money for your retirement.

Marlo Richardson is a Los Angeles-based entrepreneur who has built a series of businesses over many years. She’s found success in industries ranging from restaurant and real estate investment to television and film production. She traces her monetary success to investing early — including in her 401(k) plan from her first job in law enforcement.

“When I got my first job, I started investing into its 401(k) program and it had an employer match. I was single, [with] no kids, and I invested aggressively,” Richardson told Annuity.org. “A lot of young people don’t think of investing as paying yourself first, but that’s exactly what it is. You want to pay yourself first.”

Richardson recommends for young people to directly deposit money straight out of their paycheck into their investment accounts.

“Once you get used to not having that money, living becomes so much easier and you automatically learn to live on your take-home pay,” she said.

Conquer Your Fears of Outliving Retirement Savings

Research from the U.S. Department of Labor shows a clear decline in private sector pension plan offerings. Dwindling pension plan options have led most Americans to rely on retirement savings through 401(k) plans, IRAs and similar savings vehicles. But these plans don’t guarantee lifetime income like an annuity can.

“Annuities are a vehicle that will pay you a paycheck you will not outlive. It’s like having a job you can never get fired from,” Mark Williams, president and CEO of Brokers International, told Annuity.org. “It’s conservative and won’t make you super rich, but what it does provide is peace of mind.”

A solid majority — 58% — of investors under 55 showed more interest in guaranteed lifetime income than baby boomers did, according to a 2021 study by CANNEX Financial Exchanges Limited and the nonprofit Alliance for Lifetime Income.

“If you are healthy and married when you retire at the average age of 65, you have a 50-50 chance that you or your spouse will live until your 90s. So you have to plan for 30 years of retirement,” Williams said.

The CANNEX study also found that 91% of all investors believed it was important for their retirement plan to provide a steady income stream for life.

“Annuities are a vehicle that will pay you a paycheck you will not outlive. It’s like having a job you can never get fired from. It’s conservative and won’t make you super rich, but what it does provide is peace of mind.”

— Mark Williams, president and CEO, Brokers International

The 2020 federal Setting Every Community Up for Retirement Enhancement (SECURE) Act made it easier for employer 401(k) plans to include options to invest in annuities. Williams also told Annuity.org that some companies are creating “annuity-like payouts” in their plan offerings.

By taking advantage of such plans, Americans can ease the financial stressor of outliving their retirement savings and continue smoothly on the road to financial wellness.

Interested in Buying an Annuity?

Major Detours: Student Loans, an Ongoing Pandemic and Vanishing Emergency Savings

For decades, financial wellness was largely an issue of personal finance, and people expected to deal with ups and downs on an individual basis. But two recent events have affected millions of Americans’ financial wellbeing collectively:

- Student loan debt is playing an outsized role in reducing financial wellbeing for two generations in the workforce.

- The COVID-19 pandemic has forced a reconsideration of emergency fund savings, a traditional bedrock of financial wellness.

Student Loan Debt Shakes the Workforce

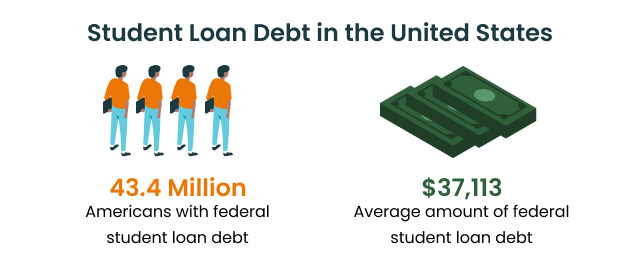

Student loan debt plays a major role in the changing face of financial wellbeing in America, according to researchers.

“When 401(k) plans were first instituted, concepts like student loan debt weren’t what they are today,” Kristen Carlisle, general manager of Betterment for Business, told Annuity.org. “Things like trying to save for a child’s education through vehicles like 529 plans weren’t really as prevalent.”

The result was that families had to rely on student loans, which became the norm for two generations of students going to college.

Today, student loan debt in the United States totals $1.75 trillion and is growing six times faster than the American economy, according to the Education Data Initiative. Total student loan debt has increased more than a staggering 430% since 2003.

“The youngest generations of workers — millennials and Generation Z — are feeling financial stress the most,” Carlisle said. “Millennials and Gen Z are also the two largest generations dealing with student loans.”

The CARES Act was signed in 2020 to provide emergency relief to federal student loan borrowers feeling the economic effects of the pandemic. But, with the student loan repayment moratorium slated to expire in May, student loan debt is likely to add to financial stress for millions more young Americans in the very near future.

COVID-19 Forces a Rethinking of the Emergency Fund

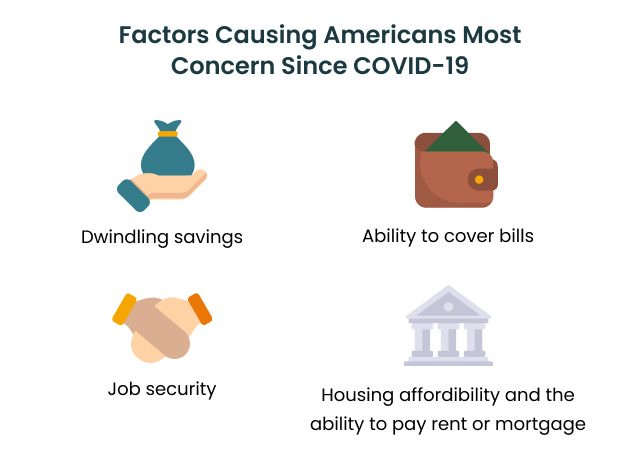

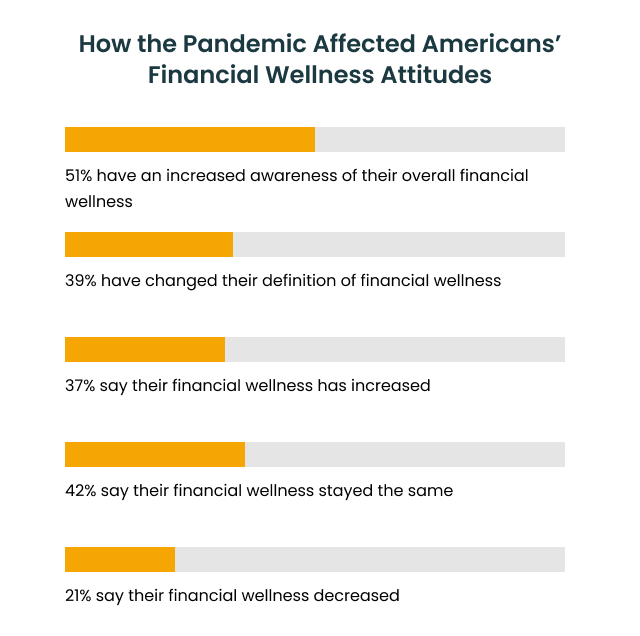

The pandemic and the economic upheaval that it spurred has dramatically affected Americans’ ideas about financial wellness.

“We know that there is concern out there — a lot of it is pandemic-driven, a lot of it is how well people are prepared to weather these disruptions. And, quite honestly, there are very few households that can withstand financial setbacks that have endured this long,” Golden said.

A key aspect of financial wellness has long been the idea of an emergency savings fund, a type of disaster preparedness for your finances.

NEFE research found that, while people are saving more, they are also drawing on retirement savings and dipping into emergency funds when they need money.

“The typical advice was that you needed to have three to six months of income set aside in an emergency savings account,” Golden said. “But what we’ve seen with this pandemic is that — even with that much — it still may not have been enough. You can’t ignore how unrealistic those guidelines are for many, many households in this country.”

COVID-19 has forced reflections on how difficult it is for most people to put away that much money and how serious and long-term an emergency the pandemic has been for so many workers.

“Our data — and data from a lot of other organizations — consistently shows that about half of our population is living paycheck to paycheck. If your household budget is so tightly allocated for the things you need to pay for, it’s really hard to come up with that money to save,” Golden said. “There has to be a recognition in the financial wellness field that you can’t just tell people to save up three to six months or six to nine months of income.”

Figuring out exactly how much someone should save — and realistically can save — each payday may be easier in theory than in practice.

“Our data — and data from a lot of other organizations — consistently shows that about half of our population is living paycheck to paycheck. If your household budget is so tightly allocated for the things you need to pay for, it’s really hard to come up with that money to save.”

— Paul Golden, managing director of media and communications, National Endowment for Financial Education

Golden said the idea of such a substantial emergency fund can be unrealistic to a lot of Americans who see the suggested goal as “an astronomical amount.”

Carlisle also expressed that the amount can be overwhelming for many Americans, emphasizing that it ”feels very inaccessible” to so many.

Both experts suggested people save what they can, when they can — still striving for that six- to nine-month goal, but not being discouraged by or beholden to the number traditionally tied to it.

Mapping a New Route Toward Financial Wellness

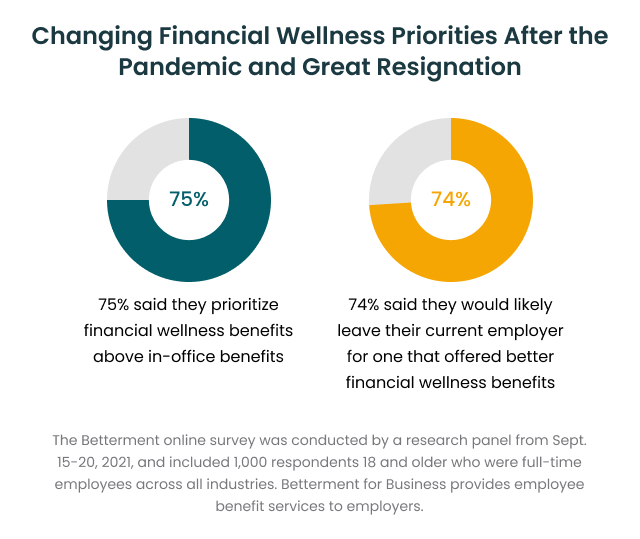

The Great Resignation — the phenomenon beginning in April 2021 which saw U.S. employees leave their jobs in unprecedented numbers — directly resulted from Americans rethinking their financial wellbeing as the pandemic began to ease. It’s also spurred workers to prioritize financial wellness among workplace benefits and has accelerated employers’ focus on increased financial wellness benefit offerings.

“A lot of people — 54% of workers — are more stressed about their finances than they were before the pandemic,” Carlisle said.

Meanwhile, a Betterment survey found massive shifts in workers’ priorities because of the pandemic, with a particular emphasis on employer financial wellness programs.

“The tide was starting to shift before the pandemic in terms of people just really needing more from their financial benefits. When the pandemic hit, it fast-tracked everything,” Carlisle said.

Research shows younger workers — millennials and Gen Z — are especially looking for benefits that meet “wider needs,” Carlisle said. This is likely to push employers to consider offering financial help with student loan debt as part of their benefits packages.

Employers are looking beyond traditional retirement and health care benefits to recruit and retain workers in an increasingly competitive labor market. A growing number are offering financial wellness programs and believe they have a responsibility for their employees’ financial wellness.

“This is a trend that is not going away. It’s only going to increase — particularly as you see this demand coming from new generations of the workforce,” Carlisle said. “The events of the last two years only accelerated this conversation in a meaningful way.”

The programs are also beneficial to employers who see financial wellness programs as a means to reduce worker stress, ultimately increasing productivity on the job. At the same time, workers report improved wellbeing from the programs.

“Employer-sponsored financial programs make a difference for employees,” Zlatar said. “We have seen that, across the board, people who take part in employer-sponsored financial wellness programs are twice as likely to have high financial wellness ratings.”

Despite the massive roadblocks that the pandemic, Great Resignation and student loan debt have brought to financial wellness approaches of millions of Americans, the aim remains the same as it has for past generations: Reduce your financial stress by taking control of your financial needs and goals. And, if we’ve learned anything from the past few years of economic upheaval, it’s that the course toward financial wellness continues to evolve.

“One size does not fit all. We have to be much more targeted when we think about ongoing financial wellness education. Ideally, it involves starting early but maintaining it,” Zlatar said. “Because the goal will always be to meet your long-term goals, achieve a lifetime income and prioritize these competing priorities — it’s a journey.”