When you are considering retirement savings options or a new employer’s benefits package, it is important to understand how a 401(k) plan may fit into your financial portfolio.

401(k) plans provide tax advantages for retirement savings. Contributing directly from your paycheck reduces your income tax from a traditional 401(k), as the funds are deducted from your taxable earnings. We discuss the Roth 401(k) later on.

401(k) plans also offer growth potential as the money can be invested in a selection of index funds, mutual funds or exchange traded funds. The earnings on the underlying investments are also tax-deferred and reinvested, so they can grow with compounding interest. You do not pay income tax on your contributions or earnings until you start withdrawing money.

It is also possible to rollover 401(k) funds into another qualifying account or financial product, such as an annuity, for potentially higher earnings or guaranteed lifetime income.

When you reach retirement age, or 59 ½, you may begin receiving distributions directly without penalty.

What Is a 401(k) Plan?

A 401(k) plan is an employer-sponsored qualified retirement plan that is intended to help employees grow their retirement savings.

A 401(k) is a defined contribution plan, as opposed to a defined benefit plan, such as a pension. This means that the participant contributes a percentage of their earnings in the form of payroll deductions to the retirement plan, rather than the employer being the sole contributor.

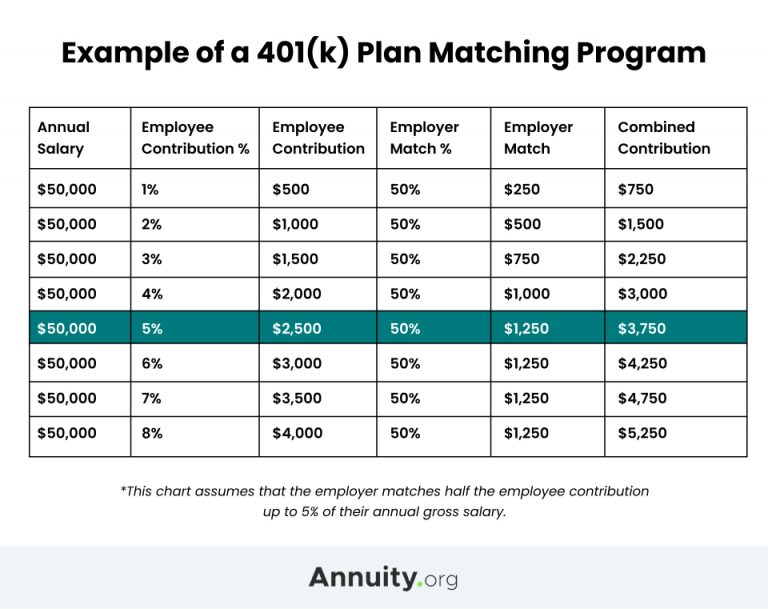

You can contribute a percentage of your annual income to your 401(k), so long as your contribution amount does not exceed the IRS limit for the tax year. For example, if you earn $50,000 annually and you wish to have 5 percent of your total wages allocated to the plan, the amount — $2,500 — would be divided among the number of paychecks you receive each year.

In addition to the employee’s contribution, many company’s offer an employer match to 401(k) plans.

How Does a 401(k) Plan Work?

Once the plan is established, a 401(k) goes through a period of tax-deferred growth before the employee reaches retirement. A 401(k) plan’s lifespan can be summed up in four steps:

- Step 1

- Your employer offers you a 401(k) plan in your benefits package. You enroll in the plan and select your underlying investment for growth, depending on your time horizon and risk tolerance. Self-employed workers also have the option to establish an independent, or solo 401(k) plan.

- Step 2

- You contribute pre-tax money from your paycheck directly to the 401(k) plan. Your employer may also match your contribution or pay an additional percentage. (More employers are now offering Roth 401(k) plans, which you contribute to on an after-tax basis.)

- Step 3

- Those funds are invested in your underlying portfolio, and earnings may ebb and flow with the investment’s performance over time. The qualified retirement plan’s contributions and earnings grow on a tax-deferred basis until the time of withdrawal.

- Step 4

- After reaching 59 ½ years old, you may begin withdrawing funds from the plan to use as retirement income. You may pay income taxes on your withdrawals at that time. Depending on the year you were born, you must begin taking required minimum distributions at either age 73 or 72.

Phases of a 401(k) Plan

RMDs: The Retirement Advantage You Can’t Afford to Miss

Types of 401(k) Plans

The Internal Revenue Service provides a comparison chart that shows the differences in plan contributions, income limits and distributions. Employers generally offer two main categories of 401(k) plans for their employees: traditional and Roth.

Traditional 401(k) Plans

Traditional 401(k) plans allow employees to contribute pre-tax dollars their paychecks to employee-elected funds. There is no income limit on traditional 401(k) plans, but the IRS enforces an aggregate employee-elected contribution limit.

Withdrawals from traditional 401(k) plan are taxable as income. Unless the participant is still working, the IRS requires that distributions begin no later than age 73, or 72 if the participant turned 72 before January 1, 2023.

Roth 401(k) Plans

Roth 401(k) plans, also called designated Roth accounts, receive after-tax contributions. Similar to a traditional 401(k) plan, there is no income limit for participation.

Distributions from Roth 401(k) plans are not taxed so long as they meet the criteria for qualified distributions. To be considered qualified, the account must be held for at least five years, and the participant must be at least 59 ½ years old. Distributions resulting from disability or death also meet the criteria. Roth 401(k) plans are also subject to the same required distribution rules as traditional 401(k) plans.

Read More: Best Solo 401(k) Providers

Pros and Cons of 401(k) Plans

401(k) plans have a myriad of benefits and potential disadvantages within the retirement savings realm. As you prepare for retirement, understanding pros and cons of available plans can help with your financial decision-making.

- Federal protection under ERISA:

- The Employee Retirement Income Security Act of 1974 is a federal law that protects retirement plan money through standards set for employers. According to the U.S. Department of Labor, “The law also establishes detailed funding rules that require plan sponsors to provide adequate funding for your plan.”

- Employer matching:

- Employers can match your contribution to the plan, essentially adding free money. For example, if you contribute 6 percent of your income, they may match the full 6 percent. Some employers may contribute up to a certain percentage, or they may not offer matching at all. Employers may also delay the matching until the employee is vested in the company, remaining with the organization for a determined amount of time.

- High contribution limits:

- The 401(k) plan contribution limit for 2021 is $20,500 with an additional $6,500 for employees aged 50 and over. The higher your contributions, the lower your federal income tax for the tax year.

Pros of 401(k) Plans

Although their benefits almost always outweigh any drawbacks, 401(k) plans may pose some challenges for some investors.

- Rules comprehension:

- People may not understand the rules associated with 401(k) plans and how they differ from other retirement savings options. Building your financial literacy is the best way to ensure you can maximize the benefits of your plan and avoid penalties.

- Limited investment options:

- 401(k) plans typically offer limited investment options as compared with other financial instruments. Investors who prefer to have a wide range of choices may consider this to be a drawback.

- Penalties:

- If you need to withdraw money from your plan before reaching the age of 59 ½, you will pay a 10 percent penalty. The IRS assesses a 6 percent penalty for excessive contributions above the annual limit, as well. These penalties are easily avoidable, and they do not occur unless you break the established rules of 401(k) plans.

- Account fees:

- Some of the underlying investments have associated maintenance fees, and some are higher than others. For example, low-cost index funds or exchange-traded funds (ETFs) generally assess lower fees.

Cons of 401(k) Plans

As you weigh the pros and cons, it is important to receive guidance from a financial advisor who is familiar with your individual circumstance. Diversifying your financial portfolio and employing multiple retirement income options — including annuities, which work by insuring against longevity risk — can help you maximize your savings.

More: Roth IRA vs. 401(k)

401(k) Plans and Annuities

Although 401(k) plans are qualified retirement accounts and annuities are insurance products, both are designed to provide financial security in retirement and can work hand-in-hand to help you reach your financial goals.

Because 401(k) plans are subject to annual contribution limits, you may benefit from putting any extra funds you’d like to contribute to your retirement savings toward purchasing an annuity. This will allow you to realize additional tax advantages once you’ve maxed out your 401(k) plan contributions for the year.

If you are nearing retirement and are concerned about outliving your savings, a qualified longevity annuity contract (QLAC) may make sense for you. This option allows those with a 401(k) to fund their annuity from their retirement account savings to guarantee financial security through retirement and sidestep required minimum distributions.

In 2019, the Secure Act retirement legislation introduced a provision for employers to offer annuity options alongside their 401(k) plans. This measure shifted the financial liability from the employer to the group insurance company, thereby widening the options for employees.

Rolling over 401(k) funds to an annuity product is possible without penalty if you follow the IRS rules. Also, if you leave your job, you could make a qualified withdrawal or an eligible retirement plan rollover within a 60-day window.

In a proposal to include deferred lifetime income annuities (DIAs) as a default option in employer-sponsored 401(k) plans, researchers at the Brookings Institute concluded that “automatically enrolling retirees using only a small portion of their 401(k) assets can substantively enhance retirement security and improve welfare.”

Tax Treatment of 401(k) Plans

Money in a 401(k) plan grows tax-deferred with compounding interest. For example, if you contribute $100 from each paycheck to your plan, you do not pay income taxes on that money or the interest it earns during the tax year. Instead, the interest is reinvested — essentially allowing your interest to earn interest. This is what we refer to when we talk about compounding interest, and it has a significant impact on your retirement savings.

If you can, you should max out your contributions and aim to reach the annual limit — which is $20,500 in 2021. When you turn 50 years old, your annual limit increases. If you cannot afford to contribute the maximum amount, you should contribute the amount that would maximize your employer’s matching contributions.

When you begin receiving payments from your plan, you must report all distributions as income on your federal income tax return — unless they are rolled over into another qualifying account.

The amount of income tax you owe will depend on the type of plan you have. Traditional 401(k) plan withdrawals are subject to income tax, while qualified distributions from Roth 401(k)s plans are not taxed when you receive then because you paid taxes on the money before contributing to the plan.

The IRS mandates that 401(k) plan participants take required minimum distributions based on their age and account balance. These payments are also considered taxable income.