Interest Rates Make Annuities Attractive for People Near Retirement

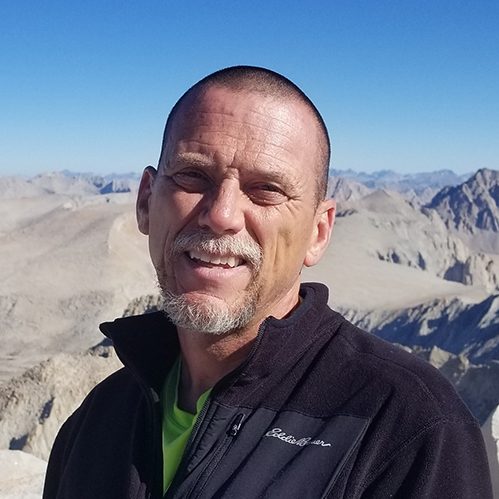

James Philpot is director of the Financial Planning Program and an associate professor in the finance and risk management department at Missouri State University in Springfield.

In the first part of our conversation, Philpot, who holds a doctorate in Finance, discusses how rising inflation rates and interest rates affect annuities as part of a retirement savings plan.

He explains how fixed annuities may be an attractive option for people nearing retirement.

In this episode, you’ll learn:

- Rising inflation is causing uncertainty for people nearing retirement.

- Annuities may be an attractive option for retirement planning as interest rates rise.

- Fixed annuity owners can benefit from the current state of interest rates.

James Philpot

James Philpot