Key Takeaways

- Fixed annuities grow at a fixed interest rate determined by the annuity provider. They are not indexed to market performance.

- Fixed annuities are straightforward and predictable, but their fixed rate offers no protection from inflation and they are less liquid than some alternatives.

- A fixed annuity can pay immediately or you can defer payments. You can even structure the payouts to provide income for the rest of your life.

- If deciding whether a fixed annuity is right for you, consider how it works and how it compares with other types of annuities.

What Is a Fixed Annuity and How Does It Work?

A fixed annuity is, at its most basic, a financial product typically sold by an insurance provider and structured by a contract between you and the issuer. Fixed annuities act as a safe place for cash to accumulate tax-deferred interest.

Fixed annuities are the simplest and most straightforward type of annuity. They also provide the most predictable and reliable income stream, usually with the lowest fees.

You pay for a steady stream of income and, in exchange, the insurance company guarantees your principal plus a minimum interest rate. The contract, which may specify a set dollar amount, a fixed interest rate or another formula, defines how the money in the annuity grows.

Depending on your contract, you can choose to receive payments for a set number of years or the rest of your life.

Fixed annuities provide a guaranteed rate, similar to a bond or CD. They are most appropriate for the portion of your savings that you want to provide a stable rate of return without volatility.

Accumulation and Payout of Fixed Annuities

A fixed deferred annuity consists of two distinct phases: accumulation and payout.

After you decide to buy a fixed deferred annuity, the insurance company sets an agreement to pay you a minimum rate of interest when your account is growing. This is known as the accumulation phase.

During this phase, the current interest rate is applied. This annuity rate is guaranteed for that time period. The earned interest in your account grows tax-deferred during the accumulation phase.

The payout phase starts when you receive regular income from your annuity.

Various fixed annuity payout options exist. Payouts can be immediate — starting within a year of purchase — or deferred until a later date. Deferred annuities typically start paying out at retirement.

You can guarantee income payments from a fixed annuity for life, commonly referred to as a life annuity or single-life annuity. You can also receive the payments only for a set number of years by choosing what is called a period certain or term certain annuity.

You may also elect to receive annuity income benefits as a lump sum.

What Goes Into a Fixed Annuity Rate?

Unlike variable annuities and indexed annuities, fixed annuities are not linked to stock market performance. Instead, your money grows at an interest rate determined by the annuity provider.

When an insurance company receives your money, it adds it to its general account pool of incoming premiums. The company then invests that money, usually in government securities or high-quality corporate bonds.

Your fixed annuity contract will include a minimum guaranteed rate. The guarantee from the annuity company is that the interest on your fixed annuity will not dip below that rate. The company also guarantees the principal investment.

Some types of fixed annuities, such as multi-year guaranteed annuities (MYGAs), lock in the same rate for your entire contract. Others may adjust the interest rate after a certain time.

Some fixed annuity contracts provide a higher interest rate at the beginning, known as the bonus rate.

After the end of the set time period, another interest rate, known as the renewal rate, applies. You can ask your agent or broker for a renewal rate table to give you an idea of what to expect. However, even if the interest rate adjusts over time, it cannot fall below the guaranteed minimum rate specified in your contract.

How Are Fixed Annuities Treated for Tax Purposes?

One of the biggest advantages of any annuity is its tax-deferred growth potential. You won’t owe any taxes on your annuity during the accumulation period, so your interest can continue to grow throughout the contract’s term. Fixed annuities are treated the same as any other annuity for tax purposes.

“Fixed annuities grow tax-deferred,” Keith Singer, Certified Financial PlannerTM professional and president of Singer Wealth Advisors, told Annuity.org. “Withdrawal of gains are taxed as ordinary income in the year that they are withdrawn.”

If you have a qualified fixed annuity — one that’s funded from a retirement account like a 401(k) or IRA — then you’ll owe taxes on the full amount of your annuity withdrawals.

Fixed annuity owners who withdraw money from their contracts early may face a tax penalty. Withdrawals before the age of 59 ½ typically incur a 10% penalty on the taxable portion of the annuity withdrawal.

Read More: Annuity Taxation

Types of Fixed Annuities

Fixed annuities can be divided into three broad types: traditional, index and multi-year guaranteed.

Traditional Fixed

Traditional fixed annuities, also known as guarantee fixed annuities, accumulate money based on a fixed interest rate set at the beginning of your contract.

Prevailing interest rates for fixed-income investments determine the initial rate. Your contract rate may be similar or higher than certificates of deposit (CDs) or government bond rates.

Insurance companies may increase the interest rate on your traditional fixed annuity contract after a specified period, such as two years. The new interest rate cannot fall below the minimum rate specified in your contract.

When shopping for a traditional fixed annuity, it’s important to find one that offers a competitive interest rate.

For example, some insurers may offer a renewal rate just slightly above the contractually guaranteed minimum. A relatively low interest rate may struggle to keep pace with inflation over time.

Make sure to carefully compare contract details before selecting a traditional fixed annuity.

Fixed-Index Annuity

A fixed-index annuity is linked to the performance of an underlying index, such as the S&P 500 or the Dow Jones Industrial Average. Fixed-index annuities use several measures to control your gains and losses, including return caps and participation rates.

You won’t lose any money you put into a fixed-index annuity unless you withdraw money or surrender the contract. While you won’t lose your principal if the market downturns, you’ll also miss out on major upswings.

Fixed-index annuities cap potential market highs. As a result, you won’t earn as much in strong years as you would by investing directly in the stock market.

Multi-Year Guaranteed Annuity (MYGA)

A multi-year guaranteed annuity, or MYGA, is another type of fixed annuity. MYGAs are very similar to traditional fixed annuities. The only real difference is the length of the guaranteed rate.

The interest rate for a MYGA is guaranteed for the entire contract term. There’s no risk that the insurance company will change the rate as your money grows over time.

In contrast, other fixed annuities only guarantee the initial rate for a certain portion of the contract.

Comparing Fixed Annuities

| TRADITIONAL FIXED | FIXED-INDEX | MYGA | |

|---|---|---|---|

| Rate of Return | Fixed based on the contracted rate for a set period. | Tied to index performance. | Locked in for the duration of the contract. |

| Risks | Rates can change after a specified period.Rates may not keep up with inflation over time. | Rates can change after a specified period. Potential gains are limited. | Rates may not keep up with inflation over time. |

| Tax-Deferred Growth? | Yes | Yes | Yes |

| Beneficial For | Conservative investors and those planning for retirement. | Those with moderately low risk tolerance who want a stable return. | Those looking for a safe and stable long-term income stream. |

Who Should Get a Fixed Annuity?

Chip Stapleton, Annuity.org expert contributor, finds that predictability is one of the biggest advantages of fixed annuities. Because of this, fixed annuities are most suited to risk-averse investors who are about to retire or in the first few years of retirement.

“They’re very safe products that generate a small amount of return, but it’s guaranteed,” said Stapleton, who is a FINRA Series 7 and Series 66 license holder and CFA Level II candidate. “There’s no risk involved.”

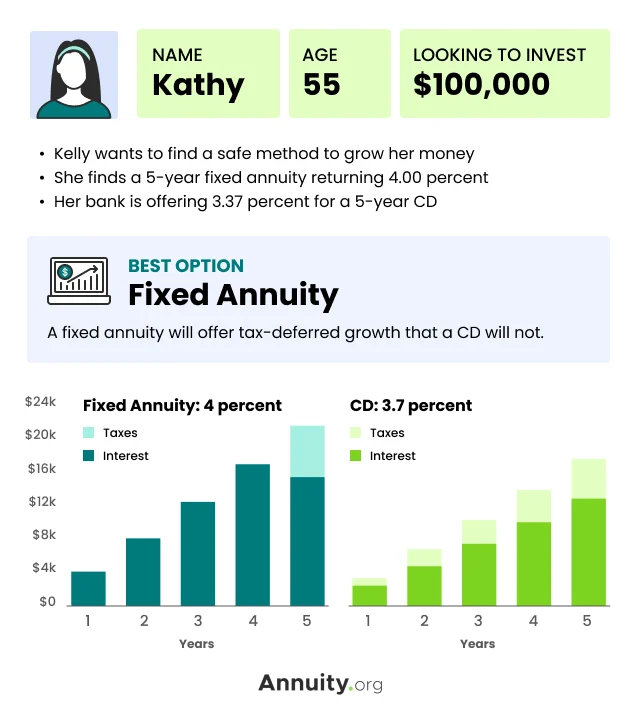

Take a look at the case study below to get an idea of how a fixed annuity might be beneficial for retirement planning.

Fixed annuities can be an attractive option for conservative investors planning for retirement like Kathy, because these products offer a predictable stream of income. Another way to supplement later life expenses can provide peace of mind to people like Kathy who value security and stability over chasing high stock market returns.

“For anybody who is concerned about the volatility of the market, any fixed investment — including fixed annuities — could be very worthwhile,” Stephen Kates, Certified Financial PlannerTM professional and Annuity.org expert contributor, told us.

The predictable returns of fixed annuities make them ideal for creating a retirement budget. No matter how the stock market performs, Stapleton said, you can feel confident you’ll receive the same amount of income. This makes fixed annuities very beneficial for customers who know exactly how much money they’ll need in retirement and want a guaranteed income stream.

A fixed annuity is best suited for investors looking to preserve their principal — but who want their money to grow at a rate faster than a savings account or a CD. Stapleton said that a younger person might want a fixed annuity if they’re distrustful of the market in general and want a risk-free way to grow their money.

“But mostly, it’s going to be retirees and late retirees who are really stressing capital preservation,” said Stapleton.

Read More: What Is a Fixed-Index Annuity?

Pros and Cons of Fixed Annuities

With any investment, it’s wise to consider the pros and cons before deciding which choice is right for you.

Pros & Cons

Pros

- Guaranteed minimum interest rate

- Premium protection

- Income for life

- Simple

- Predictable

- Lowest risk

Cons

- No frills

- No inflation protection

- No capital gains tax rates

- Penalties for early withdrawals

- Surrender charges

- Lack of liquidity

For many investors, the biggest advantage of annuities is their safety. A fixed annuity is the safest of all annuity types, offering premium protection and the option to set up a stream of income you can never outlive.

Fixed annuities are also simple and predictable, making them attractive to conservative investors.

“Annuities provide guaranteed returns which leaves out the guessing and risk,” Steve Azoury, a Chartered Financial Consultant® and owner of Azoury Financial, told Annuity.org. “They also provide a guaranteed income which does not fluctuate due to stock market swings.”

No matter how the insurer’s investments perform, a fixed annuity will never earn less than its guaranteed interest rate. This means you can easily predict how much income you’ll receive from your fixed annuity.

Despite all these benefits, there remain some drawbacks to fixed annuities. The simplicity and predictability of the product come at the expense of having less growth potential than other, more complicated annuities.

Because fixed annuities grow at a guaranteed rate, they cannot adjust for inflation, so their actual value may decline over time. And the money withdrawn from any annuity is taxed as ordinary income, as it does not benefit from capital gains tax rates.

Finally, an annuity may not be the right choice for an investor who values liquidity. Money that’s tied up in an annuity cannot be withdrawn without penalties or surrender charges.

“Fixed annuities typically have bigger penalties for cashing out early than CDs and treasuries do,” Singer said.

Factors To Consider in Choosing a Fixed Annuity

When considering the various fixed annuity options from insurers, it helps to ask yourself some questions about your financial circumstances:

- How much money am I planning to invest in an annuity?

- How soon will I need annuity payments to start?

- How do I plan to pay for this annuity?

- How likely am I to need the money in my annuity contract before it matures?

You might also consider the characteristics of different fixed annuity products. Check the fine print of annuity contracts for things like fees, surrender charges and rider costs. Find out which riders are offered by the annuity provider and determine whether you would like to add any riders to your annuity.

Fixed annuities earn interest based on a guaranteed rate, so consider factors like how long that rate is guaranteed and how frequently the interest compounds.

An annuity is only as safe as the insurance company that sells it. While it is extremely unlikely an insurance company will go broke, it’s important to select an insurer with an A rating from one of the major credit rating agencies, such as Fitch or AM Best.

FINRA advises anyone shopping for annuities to contact their state insurance commissioner to ensure that their broker is registered and authorized to sell annuities in the state.

The regulatory nonprofit also suggests you research your state’s guaranty association that will protect you if your insurer becomes insolvent.

As with any investment or insurance product, working with a financial advisor can be beneficial. Your financial advisor can provide fixed annuity recommendations based on your unique goals and risk tolerance.

Is a Fixed Annuity a Good Investment in 2023?

Fixed-rate deferred (FRD) annuity sales jumped in the first quarter of 2023 to $40.9 billion, 157% higher than the first quarter of 2022, according to a recent report from the trade group LIMRA. The report also found that fixed annuities now account for 44% of total annuity sales in the country.

In the report, Todd Giesing, assistant vice president of LIMRA Annuity Research, found that “on average, FRD annuity crediting rates continue to outperform CD rates, making these products very attractive to conservative investors. LIMRA anticipates FRD products to have strong sales this year even though interest rates are expected to fall in the second half of 2023.”

The rising interest rate environment of 2023 has contributed to the increased popularity of guaranteed-rate investments like fixed annuities.

“The rates are such that you can get more than you’ve been able to get for close to 15 years,” Kates said.

After the stock market downturns that brought about rumors of a recession in 2022, many investors may be seeking ways to protect and grow their retirement savings. Fixed annuities offer guaranteed, tax-deferred growth that’s predictable and preserves the initial investment, and you can use the annuity to set up a stream of income you can’t outlive. All these factors can make fixed annuities very beneficial in 2023.

“For anybody who is concerned about the volatility of the market, any fixed investment — including fixed annuities — could be very worthwhile.”

Alternatives to Fixed Annuities

Certificates of Deposit

A certificate of deposit, or CD, is a savings security with a fixed interest rate and a specified withdrawal date, known as the maturity date.

Like a CD, a fixed annuity pays a guaranteed interest rate for a specific period, such as three to 10 years.

Fixed annuities and CDs are similar because you’re guaranteed to receive your principal investment back after a specific time — plus a certain amount of interest.

However, the two products differ in meaningful ways. CDs are generally purchased through a bank or credit union, while annuities are purchased from an insurance company.

Fixed annuities often feature interest rates similar or slightly higher than CDs. Fixed-index annuities, which are tied to the performance of underlying stock indexes, generate higher returns than CDs.

Fixed annuities can also offer more attractive tax advantages than CDs. CD interest is usually subject to federal and state income tax each year, while interest earned within a fixed annuity is tax deferred.

Bond Ladders

Like CDs and fixed annuities, bonds are a safe long-term investment that pays interest over time. Investors can “ladder” their bonds by purchasing multiple bonds with different maturity timelines, so they can receive guaranteed income each year when a “rung” on the bond ladder matures.

Both bond ladders and fixed annuities are designed to provide reliable, predictable income. However, the main difference between the two strategies is the trade-off of increased return potential or greater flexibility and liquidity.

Annuities involve investing a lump sum premium and locking that money away until you start payments. You have much less control over what you can do with that money once it’s in the annuity.

In contrast, bond ladders are easier to liquidate because you can pull your money out of one or more bonds without withdrawing all of them.

However, bonds typically generate less income than annuities purchased at the same time, and bond ladders don’t offer the same tax-deferred growth as annuities.

Dividend-Paying Stocks

Dividend-paying stocks are another strategy used by many consumers to provide growth and income in retirement. Dividends are not contractual and must be paid from earnings, making them significantly different from interest or annuity income. But a dividend-paying stock distributes its earnings regularly, making it a source of passive income.

However, as with any equity market investment, there are risks.

“We certainly saw last year how much stocks can fall, even dividend-paying stocks that have really high quality,” Kates told us.

In the past, some investors preferred dividend-paying stocks due to their higher earning potential, which consistently outperformed CDs and bonds. But Kates believes that the tide has turned and now many safer investment vehicles are offering guaranteed growth that’s greater than what most dividend-paying stocks can offer.

“It takes a lot of research and understanding of what you’re investing in,” Kates said. “Dividend-paying stocks are not necessarily for everyone.”

Variable and Indexed Annuities

The two other main types of annuities are variable and indexed annuities. Fixed, variable and indexed annuities are categorized based on how the value of the annuity contract grows.

With fixed annuities, interest rates are clearly outlined in the contract. The growth rate of variable annuities depends on the performance of an investment portfolio, while the value of indexed annuities is tied to an equity market index.

The three types of annuities exist on a spectrum of risk and return. Fixed annuities have the lowest risk and lowest return potential, while variable annuities have the highest return potential along with the most risk. Indexed annuities combine features of both fixed and variable annuities to moderate both the risk and return potential.

Join Thousands of Other Personal Finance Enthusiasts

Frequently Asked Questions About Fixed Annuities

Fixed annuity rates are set by insurance companies and take into account specific factors, including the premium amounts, current interest rates, the annuitant’s age and life expectancy and the annuitant’s sex.

Some of the highest-paying fixed annuity rates are offered by providers like Athene Holdings and Prudential.

You won’t lose money in a fixed annuity so long as you hold the contract to maturity and don’t withdraw early. Withdrawing too much money too soon from a fixed annuity can result in penalties and fees.

Many annuity contracts allow you to withdraw up to 10% of your contract’s value each year during the accumulation period without a penalty.

If the annuity contract has a beneficiary, the fixed annuity will pay out a death benefit to that individual when the annuitant dies. In the case of no beneficiary, the contract’s value is returned to the annuity provider.

Fixed annuities are the least expensive type of annuities. Carriers charge commissions and may charge administrative fees, transfer charges or underwriting fees. Be sure to read your contract carefully and ask about all fees and commissions.

The payout of a $100,000 fixed annuity can be calculated based on the annuitant’s age, gender, health status and other factors.