While filing taxes can be time-consuming, a tax refund can feel like bonus income for many Americans. The average tax refund in 2022 (for the 2021 tax-filing year) was $3,252, up by 15.5% from the previous year.

That said, the IRS has informed taxpayers about changes to the 2022 tax filing year, where one can anticipate lower tax refunds in 2023 than the previous year. While these changes may impact your tax liability, many other factors determine how much you’ll receive.

In this guide, we’ll further explore those factors to best estimate your tax return and go over smart ways to invest and maximize it.

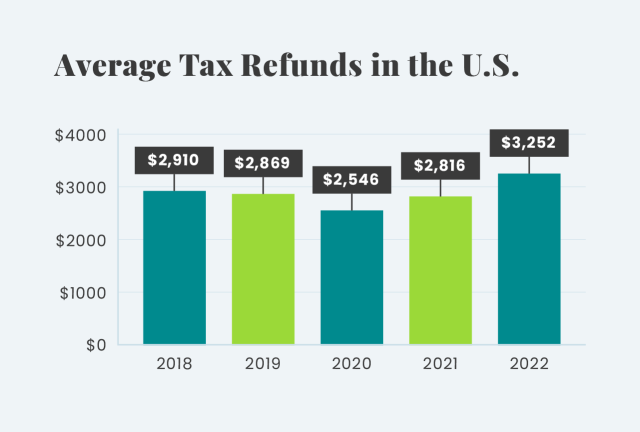

Average Tax Refunds by Year

Tax returns fluctuate slightly every year due to tax law changes, unemployment rates, and other factors. Below is a snapshot of the average tax refunds over the past five years.

How To Estimate Your Tax Return

What you pay in taxes and receive back depend on many factors, including your income, the amount withheld each year, and if you qualify for any tax breaks.

Remember that you only receive a tax refund when you pay more taxes to your state or federal government than you have to. In this case, the refund is a check from the government for the amount you overpaid.

With a few pieces of information and calculations, you can estimate your tax refund for the year.

Once you know your taxable income — your gross income minus all possible deductions — and tax bracket, you can make the best estimate of your return.

Depending on what tax deductions and credits you can qualify for, you can maximize your tax refund. Let’s take a deeper look at the two.

Deductions

Tax deductions allow you to subtract certain expenses from your income before filing taxes. You may be able to deduct contributions to retirement plans or interest payments on your mortgage.

Tax Credits

Not to confuse with deductions, tax credits are subtracted from the amount you owe in taxes and reduce your total tax liability. Unlike deductions, tax credits are the same for everyone eligible — deductions depend on your marginal tax rate.

Below are a few common tax credits most taxpayers can claim:

- Child Tax Credit (CTC):

- for taxpayers who claim children under 18 years of age as a dependent

- Earned Income Tax Credit (EITC):

- low-income individuals or families who meet certain requirements

- Education Credits:

- for qualifying educational expenses such as tuition

What To Expect from Your 2023 Tax Refund

Several tax rules for credits and deductions have changed from the previous tax filing season. Unlike in 2020 and 2021, there weren’t any stimulus payments or special tax credits in 2022 for economic impact. With these changes, the average taxpayer can expect a higher federal income tax obligation (and thus a smaller refund).

Below is a summary of changes to the 2022 tax-filing year:

Tax Credit Reversions

If you took advantage of any childcare-related tax breaks the previous year, the same credits may not be applicable for the 2022 tax return. The Child and Dependent Care Credit, originally up to an $8,000 credit for two or more qualifying individuals for the 2021 tax year, falls to $6,000 for the 2022 tax year.

Likewise, the Earned Income Tax Credit (EITC) reverted to its pre-pandemic amount, which is lower than the previous year. Qualifying individuals who could claim up to a $1,502 tax credit without children for the 2021 tax year can now only claim up to $560 for the 2022 tax year.

Stimulus Payments

The last and final economic stimulus checks were issued in 2021, which many taxpayers could claim in their 2021 tax filings and receive larger refunds. However, these claims aren’t available for the 2022 tax year.

Charitable Deductions

Through the Coronavirus Aid, Relief, and Economic Security (CARES) Act, taxpayers filing individual returns could claim deductions of up to $300 for cash contributions in 2021 ($600 for married individuals filing jointly).

For the 2022 tax year, however, this provision through the CARES Act isn’t available. Individuals who can take a standard deduction may not take the same deduction for their charitable donations.

7 Smart Ways To Invest Your Tax Refund

While a tax refund can provide extra income for the month, there are several strategic ways to make the most of it. Discover clever ways to maximize your return using the methods listed below.

Pay off Debt

Consider using your tax refund money to eliminate debt, such as credit cards, personal and student loans. Tackling debt, especially those with high-interest rates, will help you save money in the long run.

Boost Your Emergency Fund

Having an emergency fund can help you manage unexpected expenses. A good rule of thumb is to set aside at least three to six months of living expenses in case of financial difficulties. If it has been challenging to reach that amount, the extra money on hand from your tax return can help boost it.

Contribute to Your Retirement Accounts

Another effective way to use the extra money is to increase your retirement contributions, such as IRAs and 401(k) plans. Many employer-sponsored 401(k)s offer to match your contributions up to a certain percentage, which is essentially “free money.”

Increase a Home Down Payment

If you’re saving up for a home, consider using your tax refund to increase the down payment. This can help reduce the overall mortgage loan and help avoid private mortgage insurance.

Purchase an Annuity

In addition to retirement accounts, annuities can provide reliable income streams during retirement. Since they’re insurance products, annuities carry less risk than investing in stocks and bonds, which are never guaranteed.

Start a College Fund

To save for your child’s college education, you can invest your tax return in a 529 plan. Also referred to as qualified tuition plans, 529s are financial accounts sponsored by your state that allow for tax-exempt growth of savings, specifically for future educational expenses.

Make a Charitable Donation

Lastly, consider using your tax return money to donate to charity. Not only are charitable contributions a way to support a worthy cause but they also help reduce your tax bill.

FAQs

Will investing affect my tax return?

You generally have to pay taxes on any investment income, such as selling stock shares, which will most likely reduce your tax return. Fortunately, you may be able to qualify for tax exemptions and deductions. Tax-sheltered investments, such as retirement accounts and health savings accounts, typically provide these tax deductions and exemptions.

When should I hire a tax professional?

If you’re unsure if you qualify for certain tax credits and deductions, it may be in your best interest to hire a CPA or tax professional. They can provide expert and personal tax advice for your unique situation

What if my refund is lower than expected?

While a sizable tax refund is nice, it could mean you’re paying more in taxes each year than needed. On the contrary, owing the IRS taxes during filing most likely means not enough is withheld from your income.

A tax refund can help with your financial goals, but remember that receiving one means you’ve paid more than you need to in taxes. This mistake prevents you from making the most of your income throughout the year. If you’re unsure how much taxes you should pay during filing season, a trusted financial advisor can help.