Key Takeaways

- About 50% of Americans do not have life insurance coverage as of 2022.

- Life insurance ownership rates have decreased by 2% since 2021 and about 13% over the last decade.

- 53% of American men own life insurance compared to 46% of women.

- 68% of people with life insurance feel financially secure, compared to 47% of non-owners.

- After the death of a primary wage earner, 44% of Americans would feel the financial burden within six months.

- Among those who need life insurance but don’t have coverage, 60% report that the cost of life insurance is a major reason they aren’t covered.

Life insurance can be the safety net that keeps your household financially secure amidst the loss of a primary wage earner. But while half of Americans are covered by life insurance, overall coverage has decreased by more than 10% over the last decade.

To help you understand these industry trends and which demographics are buying life insurance and why, we’ve outlined the latest life insurance statistics for 2023 below.

U.S. Life Insurance Ownership Overview

Though it’s common to own a life insurance policy, there is still a large gap between those who are covered and those who aren’t. Part of the reason is that most Americans can’t afford it. Households with a lower income are less likely to own a life insurance policy.

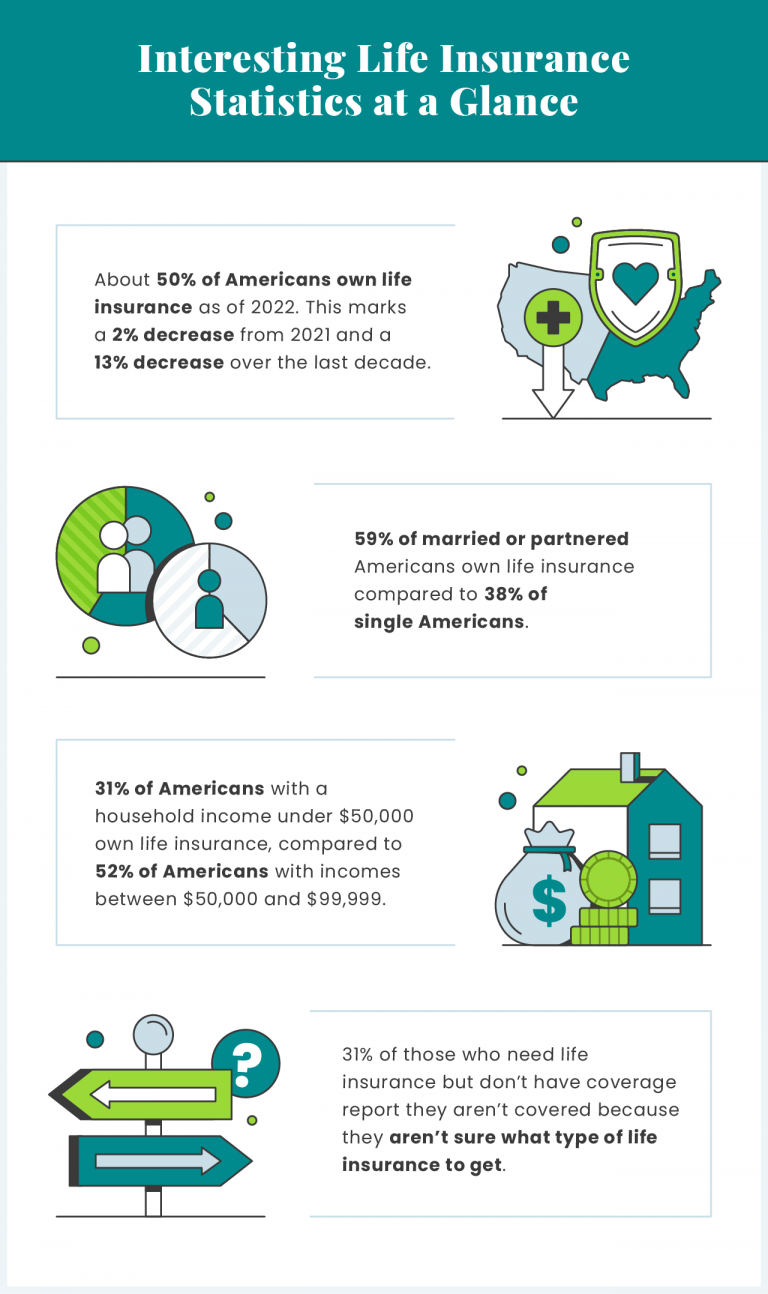

- About 50% of Americans own life insurance as of 2022. This marks a 2% decrease from 2021 and about a 13% decrease over the last decade.

- Among Americans earning $35,000 to $99,999 annually, 45% perceive life insurance as a necessity.

- Among Americans earning $100,000 to $149,999, 33% perceive life insurance as a necessity.

- 31% of Americans with a household income under $50,000 own life insurance.

- 52% of Americans with household incomes between $50,000 and $99,999 own life insurance.

- Even among those with household incomes of $100,000 or more, 37% aren’t covered by a life insurance policy.

- Among those who need life insurance but don’t have coverage, 31% report they aren’t covered because they aren’t sure what type of life insurance to get, while 16% don’t think they’d qualify for coverage.

- 59% of married or partnered Americans own life insurance.

- 38% of single Americans own life insurance.

- 31% of Americans report that the pandemic has made them more likely to buy coverage.

Relationship status is another factor that largely contributes to life insurance ownership. Single Americans are 20% less likely to own a policy compared to married Americans.

How Many People Have Life Insurance Policies?

Although about half of American adults own a life insurance policy, age has a massive influence on who is likely to be in the “insured” category. For example, there is a 26% difference between life insurance ownership rates of 18- to 24-year-olds compared to those ages 65 and older.

- Approximately 172 million of Americans own life insurance.

- 34% of Americans ages 18 to 24 report they own life insurance policies. This marks a 6% increase in ownership over the last decade.

- 46% of Americans ages 25 to 44 own life insurance policies. This marks a 14% decrease in ownership over the last decade.

- 53% of Americans ages 45 to 64 own life insurance policies. This marks a 15% decrease in ownership over the last decade.

- 57% of Americans ages 65 and older own life insurance policies. This marks a 10% decrease in ownership over the last decade.

While older adults are more likely to own life insurance, their ownership rates have been on the decline. In fact, adults under 25 were the only age group that saw increases in life insurance ownership over the past decade.

Life Insurance Facts by Gender

Unsurprisingly gender gaps are another large determining factor in life insurance ownership. While more women report needing life insurance, 7% more men own a policy. That fact is likely a result of women having lower pay wages and lower rates of financial literacy than men.

- 53% of American men own life insurance compared to 46% of women.

- 43% of women report needing life insurance compared to 39% of men.

- 33% of women report needing life insurance but don’t own a policy.

- 29% of men report needing life insurance but don’t own a policy.

- Of women with dependents under the age of 18, 51% have life insurance coverage.

- In 2022, 31% of women reported they planned to buy coverage within the next year, compared to 42% of men.

- 35% of women report wishing they purchased life insurance earlier in life.

- 33% of women don’t feel the need for life insurance.

- While “expense” is the top reason most women don’t buy life insurance, 80% of women are overestimating policy costs.

- 53% of men and 44% of women both reported the coverage of burial and final expenses as a major reason to own life insurance.

Though men and women have different life insurance rates, their reasons for buying are similar. Both groups cited “burial” and “final expenses” as major reasons why it’s important to own life insurance.

Life Insurance Statistics by Generation

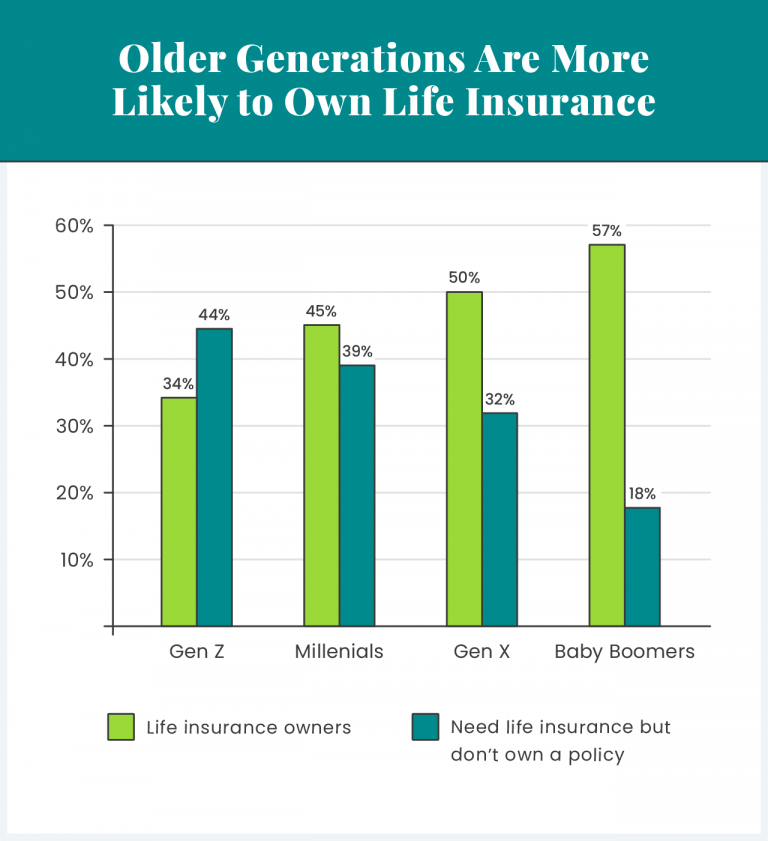

Gen Z American adults are the least likely to own life insurance while boomers are the most likely to have coverage.

- 34% of Gen Z American adults own life insurance.

- 44% of Gen Z American adults report needing life insurance but don’t own a policy.

- 45% of millennial Americans own life insurance.

- 39% of millennial Americans report needing life insurance but don’t own a policy.

- 50% of Gen X Americans own life insurance.

- 32% of Gen X Americans report needing life insurance but don’t own a policy.

- 57% of baby boomer Americans own life insurance.

- 18% of baby boomer Americans report needing life insurance but don’t own a policy.

As you might expect, this data indicates that older, more financially secure adults are more likely to own life insurance policies.

Life Insurance Ownership by Race

Compared to Hispanic, Asian and White Americans, Black Americans are the most likely to perceive a need for and own life insurance coverage

- 75% of Black Americans perceive a need for life insurance, compared to 72% of Asian Americans, 69% of Hispanic Americans and 66% of White Americans.

- 68% of Black American life insurance owners have permanent coverage compared to 66% of Hispanic Americans, 66% of White Americans and 61% of Asian Americans .

- 55% of Black Americans have life insurance coverage, compared to 42% of Hispanic Americans, 51% of White Americans and 52% of Asian Americans.

- 31% of White Americans who don’t own life insurance are likely to invest in coverage within the next year. This compares to 42% of Hispanic Americans, 40% of Asian Americans, and 60% of Black Americans.

While White Americans are the least likely to own life insurance, they’re also the least likely to perceive a need for coverage. In contrast, Hispanic Americans are most likely to perceive a need for coverage without owning a policy.

The Relationship of Financial Security and Life Insurance

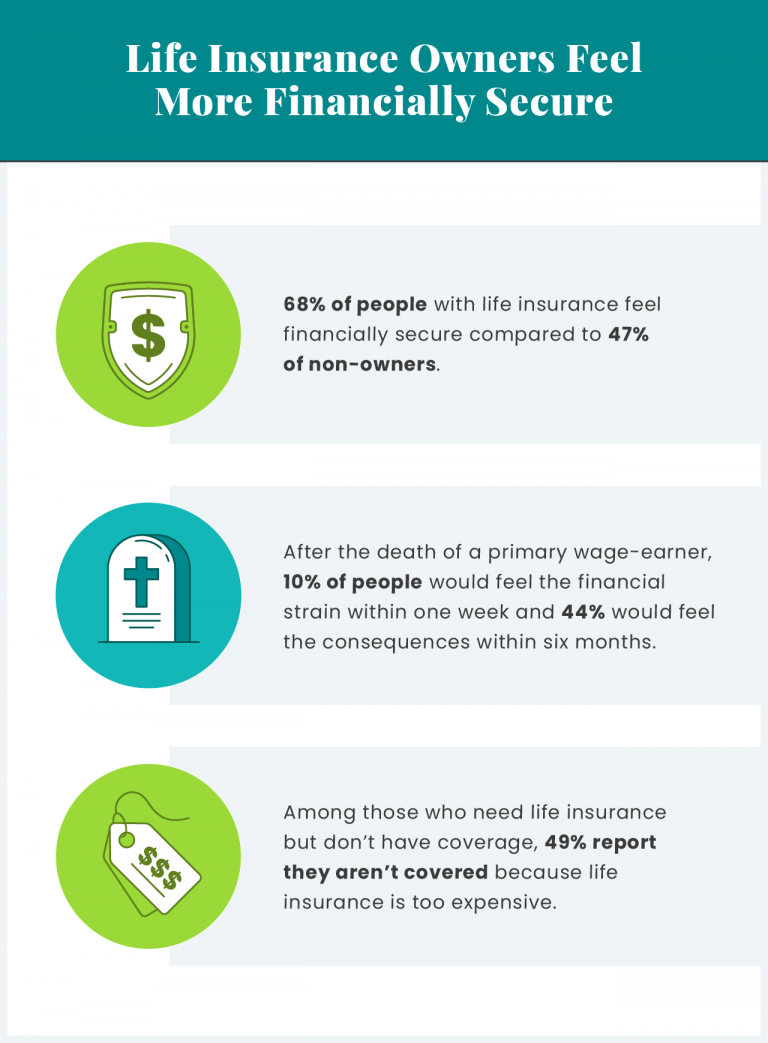

There’s a positive correlation between life insurance ownership and financial security. When comparing life insurance owners with non-owners, the former are 10% more likely to feel financially secure.

- 68% of people with life insurance feel financially secure, while only 47% of non-owners feel the same way.

- After the death of a primary wage earner, 10% of people would feel the financial strain within one week and 44% would feel the consequences within six months.

- Among those who need life insurance but don’t have coverage, 49% report they aren’t covered because life insurance is too expensive.

- 20% of people indicate they have a financial safety net of five years or more in the event of the death of their primary wage earner.

- 78% of life insurance owners with both worksite and individual coverage feel financially secure.

One of the biggest ways life insurance provides financial security is by ensuring that households are prepared for the death of a primary wage earner. As it is, a majority of Americans report they’d feel the financial strain within a week to six months of such an event.

Why Do People Buy Life Insurance?

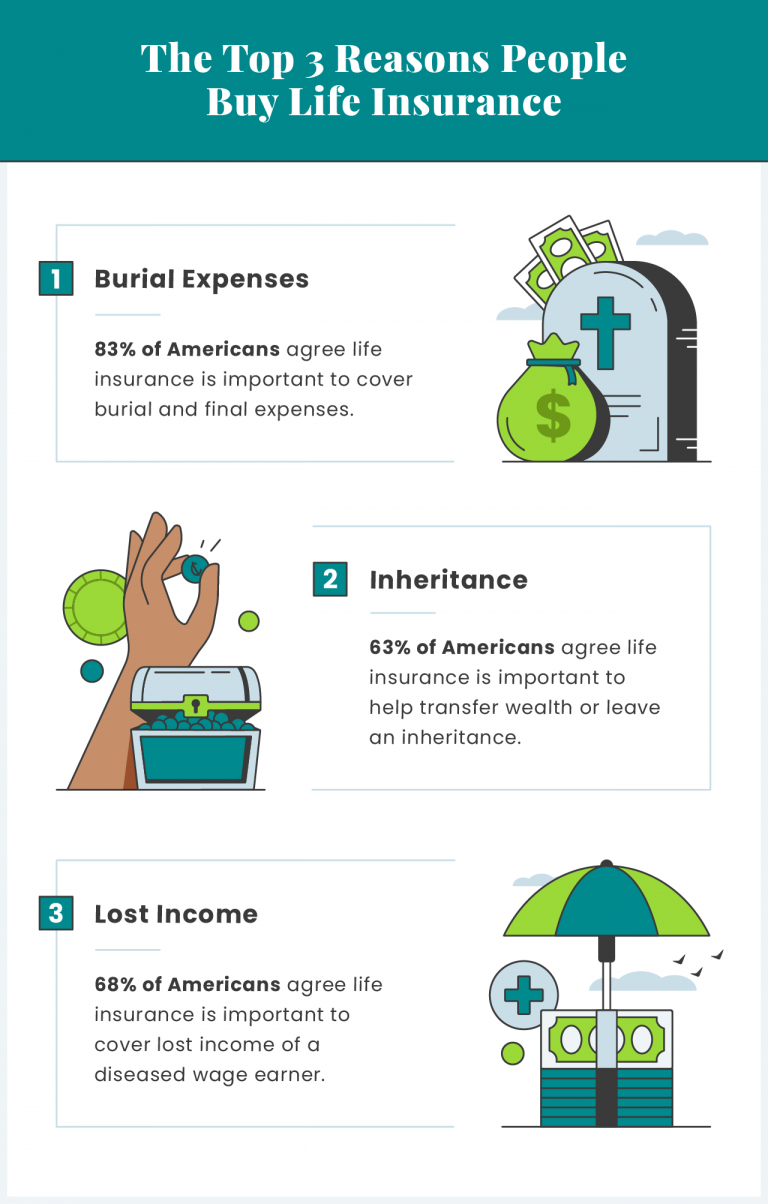

The top three reasons people buy life insurance include: covering burial expenses, compensating for the income of a diseased wage earner and transferring wealth or leaving an inheritance.

- 83% of Americans consider covering burial and final expenses an important reason to buy life insurance.

- 68% of Americans consider covering the income of a deceased wage earner an important reason to buy life insurance.

- 63% of Americans consider it important to buy life insurance to help transfer wealth or leave an inheritance.

- 60% of Americans without life insurance report the cost of life insurance as a major reason why they aren’t covered.

- 55% of Americans report their other financial priorities are a major reason why they don’t buy life insurance.

- 53% of consumers report a major reason why they don’t buy life insurance is because they are unsure what type they should get.

Some of the most common reasons people don’t buy life insurance are because of the cost, other financial priorities taking precedence or because they’re unsure of what type to get.

Life Insurance Industry Trends

Of the insurance providers that report to the National Association of Insurance Commissioners, the top 10 insurance providers are responsible for nearly half of all life insurance policies.

- The combined life insurance market share of the top 10 providers is about 46%.

- Direct life insurance premiums brought in more than $160 billion as of 2022.

- As of 2022, life insurance companies collected over $818 billion in premiums when including annuity considerations, deposit-type contract funds, and accident and health considerations.

- Northwestern Mutual Group is the life insurance provider with the largest industry market share at 7.49%.

From 2020 to 2022, life insurance premiums written have increased by $13 billion or about 9%. This indicates that the industry is on the rise.

How Much Does Life Insurance Pay Out?

Life insurance payouts are on the rise. From 2020 to 2021, life insurance claims and benefits increased by almost 6%. Since 2017, life insurance claims and benefits have increased by over $94 billion.

- Americans collected $790.8 billion from life insurance claims and benefits in 2021, up from $747.4 billion in 2020.

- Americans collected $91 billion from death benefits in 2021. That marks a $10 billion increase from 2020.

- Americans collected over $92 billion from annuities in 2021.

- Americans received almost $500,000 from matured endowments in 2021.

- Disability, accident, and health benefits paid out Americans over $146 billion in 2021. That marks a $9 billion increase from 2020.

- Americans collected over $92 billion from annuities in 2021.

Similar to general life insurance claims, annuity benefits have also been on the rise. From 2020 to 2021, annuity benefits and claims have increased by over $6 billion or about 7%.

Finding the Right Coverage for You

If your household would find it financially difficult to deal with the death of its primary wage earner, life insurance is a great safety net. Whether you invest in a traditional policy or an annuity, there are options out there to ensure that you and your family are covered, no matter what.

If you’re interested in investing in an annuity or have any questions about the process, connect with one of our financial experts today.