Florida is one of only nine states with a substantial, valuable perk for annuity buyers – no state income tax. While saving on taxes may not be every buyer’s top priority when purchasing an annuity, it’s a significant factor that varies by state.

As you plan for your retirement in Florida’s sunshine, consider the annuity rules and options specific to the state.

Key Takeaways

- Annuities are regulated by the Florida Department of Financial Services (DFS).

- Annuity sellers in Florida are subject to regulations that include suitability and disclosure requirements.

- Annuities in Florida are protected from creditors.

Buying an Annuity in Florida

Annuities are insurance products that are regulated at the state level. When you buy an annuity in Florida, the contract is subject to the state’s standards for charges, benefits and protections.

Florida has traditionally placed fewer restrictions on annuities, which may translate to less protection for consumers. This is especially true when comparing its protections to states like New York and California, which heavily regulate the products. However, in May 2023, the Florida House of Representatives and Senate passed House Bill 1185, which introduces a wave of new regulations designed to provide additional consumer protections.

Annuity companies must be licensed in Florida to sell an annuity in the state. The Florida Department of Financial Services keeps a record of all insurance companies licensed to do business in the state. You can search for your annuity company on the Florida Office of Insurance Regulation website.

Florida requires insurers that sell annuities to allow a 21-day free-look period for fixed annuities and variable annuities. This gives buyers time to review and consider the terms of their investment. Buyers can cancel their investment without penalty during the free-look period.

Annuity Providers in Florida

As you shop the annuities offered by Florida’s licensed providers, be sure to evaluate each insurer’s financial strength. The most effective way to do this is via the provider ratings offered by credit rating agencies.

Annuity Products Available in Florida

| Company | Product Name | Interest Rate | AM Best Credit Rating |

| American Equity | Guarantee Shield5 | 4.80% | A- |

| Americo | Platinum Assure 7 | 5.40% | A |

| Fidelity & Guaranty | Guarantee Platinum 7 | 4.90% | A- |

Annuity & Other Retirement Taxes in Florida

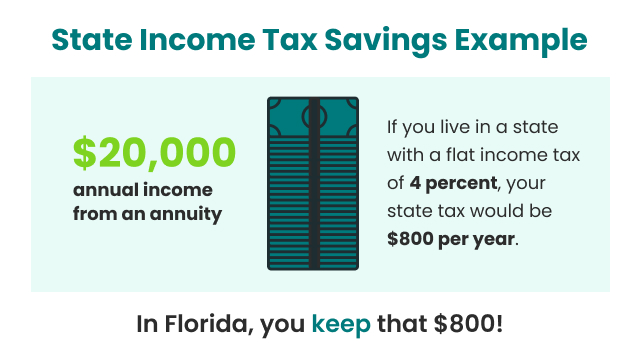

Florida doesn’t have a state income tax, which is a major perk for annuity owners and retirees. When you receive payments from your annuity, you may be subject to federal taxation on the portion deemed income, but you won’t owe state taxes on it. The same is true for social security benefits received.

Another tax advantage associated with Florida pertains to estates. Florida levies no tax on estates or inheritances.

Annuity Regulations in Florida

Like other states, Florida has regulations and suitability standards governing annuity sales.

According to Florida law, an insurer or agent must “have reasonable grounds for believing the recommendation is suitable for the consumer, based on the consumer’s suitability information.”

In addition, the National Association of Insurance Commissioners, or NAIC, further updated its Suitability in Annuity Transactions Model in 2020 to promote consistency among the states. Florida recently adopted the NAIC Annuity Transactions Model in May 2023. Now, the state will require annuity sellers to document that they understand the customer’s needs; have considered a wide range of solutions and have recommended the best one. It replaces the Florida customer information questionnaire with a national standardized one.

The new regulation pertains to any sale or recommendation of an annuity. Moreover, any agent who sells annuities must complete certain training requirements – including courses about the types, uses and taxes of annuities. Agents must also behave ethically and are prohibited from dissuading consumers from providing honest information or filing a complaint.

Are Annuities Protected from Creditors in Florida?

Florida law mandates that proceeds and cash surrender values for annuities and life insurance policies are exempt from creditors. The specific protection falls under Title XV Homestead and Exemption, Chapter 222 Method of Setting Apart Homestead and Exemptions.

What Is the Florida Life & Health Insurance Guaranty Association?

The Florida Life and Health Insurance Guaranty Association protects Florida residents in the event an insurance company fails to cover claims. The state guaranty association covers eligible annuity contracts up to $250,000 per owner. For annuitized contracts, the maximum guarantee is $300,000. To be eligible for coverage, you must be a valid Florida resident on the date the insurer is declared insolvent.

Consider the following example:

If you own two annuities with the same company — one worth $200,000 and one worth $150,000 — the state guaranty association may cover up to the $250,000 limit. You could then submit a claim for the remaining $100,000 against the estate of the insolvent company.

Incidentally, if you own a variable annuity, the Florida Life and Health Insurance Guaranty Association covers only the portion of the annuity guaranteed by the insurer or the fixed interest accounts. The guaranty association won’t cover underlying investment portfolio options that aren’t guaranteed by the insurer.

Other Resources for Florida Annuity Buyers

Florida has regulatory authorities that provide support for state residents. Here is a list of resources that provide direction and assistance with financial products, service companies, financial institutions and collection agencies.

- Florida Department of Financial Services – Division of Consumer Services

- The department has a consumer helpline: 1-877-693-5236 (or 850-413-3089 for out-of-state callers). Florida buyers can file complaints by telephone, online or email. In Florida, insurance companies must respond within 20 days to the financial services department after a complaint has been filed.

- Florida Life & Health Insurance Guaranty Association

- The state’s guaranty association website details the annuity consumer protections for Florida residents.

- Florida Office of Insurance Regulation

- The Florida Office of Insurance Regulation “serves Floridians through its responsibilities for regulation, compliance and enforcement of statutes related to the business of insurance.” The site also provides a company search function and other consumer resources.

Resources

FAQs about Annuities in Florida

Yes. Although Florida doesn’t have a state income tax, you may be subject to federal taxes when you get payments from your annuity. Before buying an annuity, consult with a qualified financial professional to understand the tax implications.

Yes. Annuities are protected from creditors. Florida Statute 222.14 provides that proceeds from an annuity contract issued to a Florida resident are not subject to attachment, garnishment or legal process to benefit any creditor of the annuity beneficiary.

Florida has many annuity regulations in place to protect consumers. They were most recently updated in 2023. The state’s annuity regulations specify suitability requirements, disclosure requirements, a free-look period and the protections afforded by the state’s annuity guaranty association.

Editor Malori Malone contributed to this article.