Although some regulations are relatively uniform across the states, it is important to understand the nuances of an annuity purchase in your state.

For example, if you purchase an annuity in Connecticut, that annuity may not mirror a product with the same name in Ohio. The annuity may not have the same benefits nor matching rates.

Even if this annuity is offered by the same annuity provider who is licensed in multiple states, each state regulates and taxes annuities differently. Therefore, the state in which you buy your annuity matters.

Typically, you can only buy annuities from insurance companies licensed to operate in your home state. Though, if you own residences in more than one state, you may be able to weigh your options.

State Annuity Regulations

Because annuities are insurance products, they are subject to state insurance commission regulations. These annuity regulations are designed to protect consumers and provide oversight over the companies and their finances.

While state insurance commissions regulate the sale of annuities, variable annuities have an added layer of surveillance: the federal Securities and Exchange Commission and the Financial Industry Regulatory Authority.

To continue holding their licenses, annuity providers must also follow suitability standards outlined by states and the National Association of Insurance Commissioners, or NAIC. These best practices are meant to protect the consumers and ensure they purchase products that align with their goals — not the insurance company’s goals.

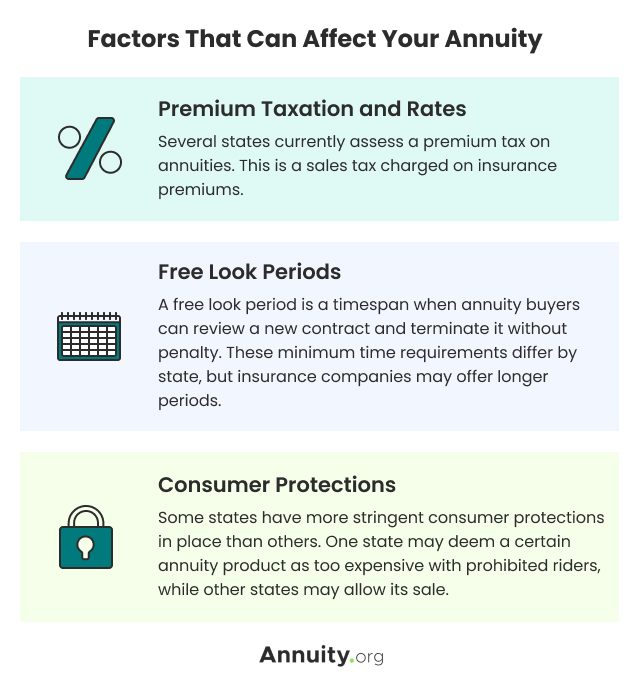

Individual state provisions impact annuity rates and benefits. Three key factors can vary state-by-state: premium taxation, free look periods and consumer protections.

Purchase an Annuity Today

Premium Taxation and Rates

Several states currently assess a state premium tax on annuities. This is a sales tax charged on insurance premiums. Premium tax varies by state, and some states do not assess premium tax.

The taxes may also vary by the type of product. The annuity type you select determines how the annuity will earn interest and the rate at which it will grow. Annuity rates can vary across state lines.

Free Look Periods

A free look period is a timespan when annuity buyers can review a new contract and terminate it without penalty. These minimum time requirements differ by state, but insurance companies may offer longer periods. For example, if a state requires a minimum of 10 days, the insurance company may designate 30 days — meeting or exceeding the state regulation.

Consumer Protections

Some states have more stringent consumer protections in place than others. One state may deem a certain annuity product as too expensive with prohibited riders, while other states may allow its sale.

New York, for example, has provisions that may limit annuity options. These may seem like restrictions, but the regulations are in place to protect the consumer. Other states may allow more growth potential, with the possibility of more risk to the buyer.

States also provide coverage for consumers in the unlikely event that your annuity company is unable to cover your payments.

State Guaranty Associations

State guaranty associations exist to provide a layer of protection for consumers if an insurance company defaults. Instead of the annuity owner losing the entire annuity’s value, the state guaranty association can cover some, if not all, of the annuity’s worth.

State guaranty association coverage varies by state. The amount you are entitled to recover is based on the present value of your annuity.

Your state’s guaranty association will be in your state of residence. Each state’s association may have rule variations. For example, some guarantee the coverage of multiple contracts, while others guarantee up to a combined dollar amount.

Examples of Annuity Considerations By State

California

California assesses a 2.35% premium tax on annuities. The state guaranty association provides present-value annuity coverage up to $250,000. California mandates a free look period of 10 days for annuity buyers, and 30 days for seniors.

Learn More About Annuities in California →

Florida

Florida’s annuity premium tax is 1%, and consumers have benefits coverage of $250,000 from the Florida Life & Health Insurance Guaranty Association. Florida requires a minimum of 21 days for the annuity free look period.

Learn More About Annuities in Florida →

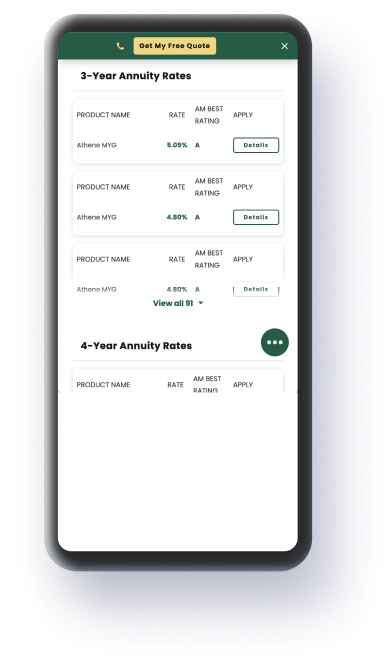

What Annuity Products Are Available In My State?

Annuity companies may offer a specific product with certain features in some states, but not in others. Providers must also meet specific requirements to be licensed in your particular state.

As you consider which annuity provider is best for you, it’s important to do your research and review credit ratings to help determine financial strength.

An experienced financial advisor can discuss available options with you — and answer questions about your home state’s rules and benefits.