As you plan for your retirement in New York, an annuity can be a great addition to your financial portfolio.

While New York is not generally considered tax-friendly, it provides greater protection for annuity buyers compared to most states. This impacts the products that can be sold, their benefits to consumers and the companies that sell them.

If you live in New York, or you plan to move to the state soon, it’s important to consider the state-specific rules that can impact your annuity.

Key Takeaways

- New York’s regulations and protections for annuity products issued in the state are more favorable to consumers than many other states.

- Annuity buyers in New York should buy products approved for sale in the state to avoid potential scams.

- New York doesn’t charge a state premium tax on annuities, unlike some other states.

- Annuity owners in the state of New York are protected up to $500,000 by the Life Insurance Company Guaranty Corporation of New York (LICGC), if an insurance company becomes insolvent.

Buying an Annuity in New York

If you buy an annuity in the state of New York, you buy one that is approved for sale by the state. That approval brings specific financial protections for buyers.

“Annuity products approved for sale in New York generally provide greater consumer protections than products sold elsewhere. The minimum account values are higher, charges are lower, and annuitization and death benefits are more favorable.”

If an annuity broker suggests you buy an annuity from another state or sign an application outside of New York, be careful — as you will not be subject to the same protections and benefits.

In New York, insurance companies offer four types of accumulation annuities. Each type differs in how the contract credits investment income.

- Excess Interest Annuity

- As the most common type of accumulation annuity, an excess interest annuity has a fixed minimum interest rate for the life of the contract, usually ranging from 1% to 3%. Providers can also allow discretionary excess interest, or adjusted rates, based on market earnings.

- Modified Guaranteed Annuity (MGA)

- A modified guaranteed annuity (MGA) has a guaranteed principal amount with a fixed interest rate for a specific time period. An MGA buyer can choose a guarantee period offered by the insurance company, often ranging between three to 10 years.

- Fixed Equity Indexed Annuity (EIA)

- An equity-indexed annuity (EIA) has a minimum interest rate floor, and it allows for potentially higher gains. This annuity type can credit additional interest if there are gains in its associated market index, such as the S&P 500.

- Variable Annuity

- Unlike the first three types, the accumulation of financial gains on a variable annuity depends on the performance of underlying investments. While variable annuities may generate higher returns, the annuity owner assumes the risk of market volatility.

Types of Accumulation Annuities in New York

Annuity Providers in New York

Annuity companies must be licensed in New York to issue products in the state. By approving annuity sellers, the licensing body, the New York State Department of Financial Services, deems them capable and trustworthy.

To confirm that your company is licensed in good standing in New York, use the New York State Department of Financial Services Company Search. You can also review the company’s credit rating to assess its financial strength and its ability to pay claims.

Retirement Income Taxes in New York

As you pursue your financial goals, consider taxation rules that impact your state — and your funds. New York state income tax ranged from 4% to 10.9% in 2022. But residents of New York City and Yonkers have their own income tax rates.

New York state doesn’t impose state tax for certain types of retirement income, including:

- Social Security benefits

- Federal and New York government pensions

- Military retirement plans

- Railroad retirement benefits

In addition, taxpayers over the age of 59 ½ can exclude up to $20,000 of qualified pensions and annuity income. Any income over $20,000 from a private retirement plan or an out-of-state government plan is subject to New York taxes.

New York doesn’t impose a state premium tax on annuities, unlike some states.

Annuity Regulations in New York

Compared to other states, New York has heightened protections and enhanced benefits for people who buy state-approved annuities.

For instance, New York mandates a minimum “free look” period of 10 days, and a maximum of 30 days. This allows annuity buyers the chance to review their contracts thoroughly and cancel without penalty if needed.

The state also has the Suitability and Best Interests in Life Insurance and Annuity Transactions Regulation, which requires brokers, agents and insurers to act in the best interest of the consumer when recommending annuity or life insurance transactions. By law, they must consider the buyer’s needs, objectives, risk tolerance, financial situation and other relevant factors. They also must disclose any conflicts of interest or compensation arrangements. The regulation imposes suitability, disclosure, training and recordkeeping requirements on agents and insurers.

Once you buy a New York-approved annuity, it is subject to rules to help maximize your benefits. For example, annuities that grow in value over time must maintain a certain account value, and New York has standards to calculate this value. They include maximum charges and minimum interest rates that benefit the annuity owner.

Also, the distribution of death benefits in New York isn’t considered a surrender. That makes the money not subject to surrender charges.

Are Annuities Protected from Creditors in New York?

According to N.Y. Ins. Law § 3212(d), annuities are generally protected from creditors in New York, provided the contract aligns with the terms of the related New York statute. The New York State Insurance Department regulates these protections.

What Is the Life Insurance Company Guaranty Corporation of New York?

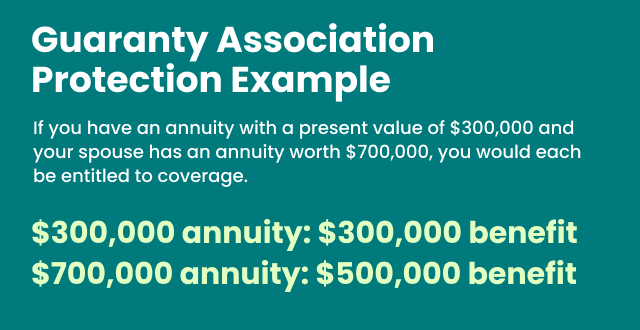

The Life Insurance Company Guaranty Corporation of New York serves as a safety net for annuity buyers in the state. In the unlikely event an annuity provider defaults on payments, state guaranty associations can cover claims up to the state-determined limits.

According to the New York State Department of Financial Services, “Generally, immediate and deferred annuity contracts issued to a New York resident by a licensed life insurance company that provide fixed benefit guarantees are covered by the Life Insurance Company Guaranty Corporation of New York for up to $500,000.”

This means that the guaranty corporation could cover up to $500,000 of the present value of your annuity if your New York-licensed annuity insurer turns insolvent. This applies to individual contracts for annuities bought in New York, if you were a resident when you bought it. If you move out of the state, you may be eligible for protection in your new state in coordination with New York’s limits.

The protection limit increases to $1 million for a group annuity that doesn’t guarantee benefits to a specific individual in the contract.

Other Resources for New York Annuity Buyers

New York annuity regulations can be complicated, but you get help navigating them through certain groups that can help answer your questions.

- Life Insurance Company Guaranty Corporation of New York

- The Guaranty Corporation website shares the details of New York consumer coverage and protections.

- New York State Department of Financial Services

- The New York State Department of Financial Services provides annuity product-specific information and a company search portal, which you can use to confirm that a company is licensed in New York. The site also provides an outline of policyholder protections and a glossary of terms.

- New York State Department of Taxation and Finance

- The New York State Department of Taxation and Finance website has tax filing links for New Yorkers and helpful tax information for retirees.

Resources

FAQs about Annuities in New York

Yes, most annuities are taxed in New York — but not all. Untaxed annuity income includes any pension income from New York state, local governments, the federal government and certain public authorities. In addition, New York residents older than 59 ½ can shield up to $20,000 of their taxable annuity income from state income tax.

Annuities are typically protected from creditors in New York if the annuity contract type aligns with the terms of the New York Insurance Law § 3212(d)(1) statute.

New York has a number of annuity regulations designed to protect consumers. They cover a variety of areas, including annuity sales, disclosures, suitability and complaints. The New York State Department of Financial Services (NYDFS) is charged with enforcing the regulations.

Editor Malori Malone contributed to this article.