Artificial Intelligence (AI) is a rapidly growing technology that is quickly revolutionizing aspects of our lives, especially in the world of finance and investing. This powerful tool can generate data and advice with speed and is said to have the potential to streamline work that financial advisors have traditionally done. A recent study by Statista found that ChatGPT, a popular AI tool, had 1 million users within the first five days of release.

However, attitudes towards this new technology have varied since many believe it cannot replace human expertise and advice. Others believe that while human judgment and expertise remain crucial, the integration of AI in investment advice can enhance decision-making processes and enable individuals to make more informed investment choices.

To look further into how Americans feel about AI and finance, we surveyed 1,042 adults on the subject. Read our study to explore Americans’ attitudes around using AI for financial advice.

Key Takeaways

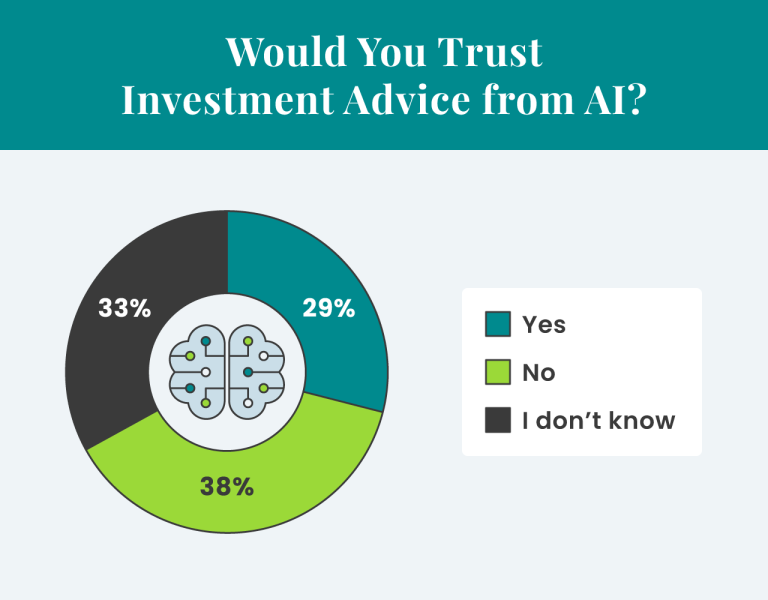

- Roughly 29% of Americans say they trust AI for financial investment advice

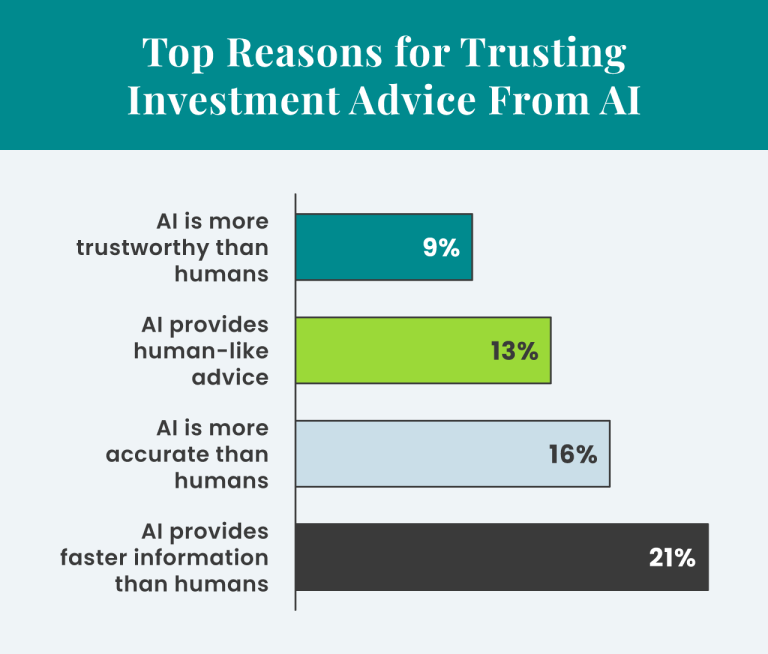

- Over 1 in 5 trust AI over humans because it provides information faster

- 1 in 4 people would use AI over humans either for stock tips or tax advice

How Is AI Being Used In Finance?

AI is already being used in financial services and changing how investors and institutions operate. Below are some examples of ways the industry is using AI:

- Customer service: AI chatbots are being used to streamline customer service efforts from agents and can chat with customers and guide them to the right resources.

- Risk management: BlackRock’s Aladdin platform uses AI to spot risks and opportunities for its clients and give real-time investment insights through machine learning algorithms.

- Fraud detection: AI has been able to detect fraud detection by spotting abnormalities in an algorithm and can then alert banks.

- Portfolio management: An AI robot known as Wealthfront can use algorithms to help manage client investment portfolios and customize them based on certain financial positions and goals.

- Investment advice: Erica, Bank of America’s chatbot, can provide personalized investment advice based on their financial positions.

Do Americans Trust AI for Investment Advice?

When American respondents were asked if they would trust investment advice from AI, 29% of respondents reported that they would. 38% of respondents reported that they would not trust it, while 1 in 3 people don’t know if they would trust it.

21% of Americans Value AI’s Quick Information

Americans were also asked why they would trust investment advice from AI. Nearly 1 in 10 people feel that AI is more trustworthy than humans. 16% stated that they believe that AI is more accurate than humans.

Additionally, Americans said they would trust AI because of the speed that gives information — in fact, 21% of respondents stated they value that AI provides fast data.

The other reasons weren’t as popular — only 9% of respondents agreed that AI is more trustworthy than humans, and 42% stated that they wouldn’t trust AI for any of the reasons mentioned. This highlights the respondents’ concerns about AI’s trustworthiness and accuracy.

Most Americans Wouldn’t Trust AI Over Humans for Financial Advice

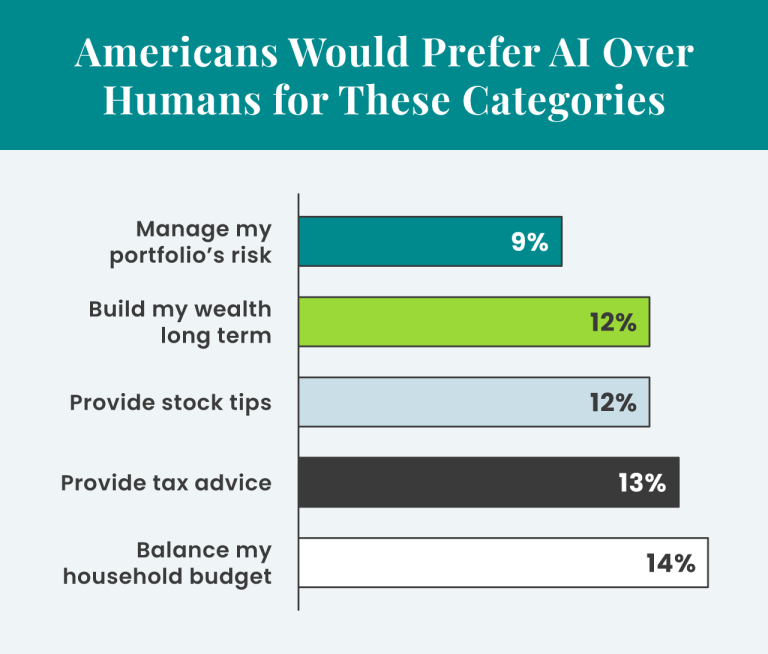

We wanted to know if people would prefer AI over humans for various financial and investment advice categories.

40% of respondents indicated that they would not prefer AI over humans to handle anything related to their personal finances. However, a surprising number of people would prefer AI to:

- Balance their household budget (14%)

- Provide tax advice (13%)

- Offer stock tips (12%)

Nearly 1 in 10 people also say they would prefer AI over humans for managing their portfolio’s risk. 1 in 4 also say they would trust AI for tax advice or stock tips.

This may suggest that Americans are more comfortable with AI providing tips for less complicated and casual matters versus more risky and personal topics such as investment portfolios and how to increase wealth.

Most Americans Stick to Financial Advisors for Investment Advice

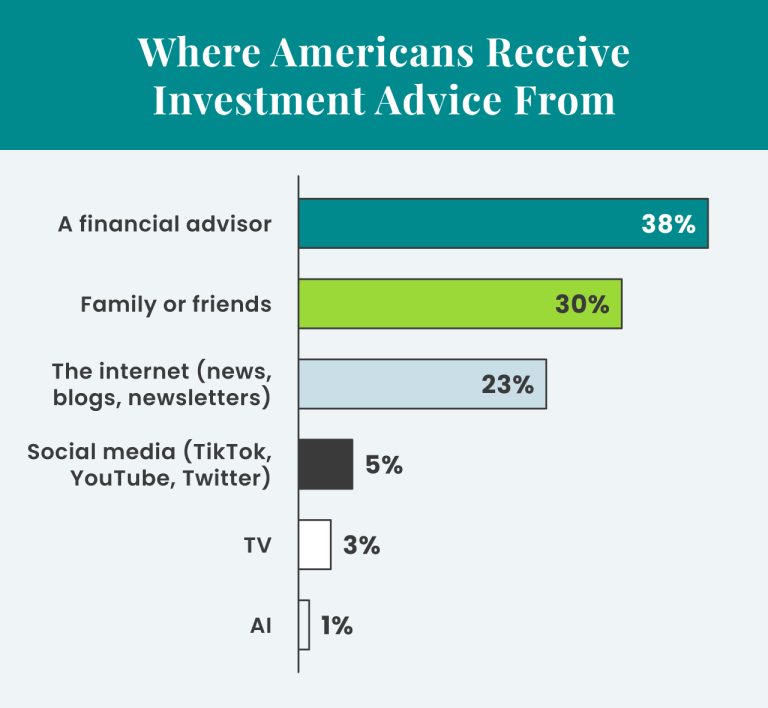

We also asked American respondents where they prefer to receive investment advice.

Despite the emergence of AI tools, 38% of respondents stated that they still receive investment advice from financial advisors. Respondents also chose methods, such as from family and friends (30%) and the internet (23%).

Right now, only 1.2% of respondents receive investment advice from AI — after social media (5%) and TV (3%).

Benefits of AI in Finance

Although many Americans don’t trust AI, the AI market size is projected to reach $1,354 billion by 2031. That said, some benefits can be useful to those looking for additional and supplementary information about investing and finances:

- Automation: AI can provide automated services that make getting advice and tips about finance and investing quicker and more accessible.

- Streamlined tasks: Since AI is a robot, it can perform many tasks at once that humans may not be able to do as quickly or efficiently.

- Enhanced data analysis: AI algorithms can extract insights from vast amounts of financial data, helping financial institutions identify trends, patterns and correlations. These insights enable better forecasting, risk management and strategic decision-making.

- Fraud security and detection: AI algorithms can analyze large volumes of data and identify patterns or anomalies that may indicate fraudulent activities. This helps detect and prevent fraud more effectively, enhancing security in financial transactions and systems.

Challenges of AI in Finance

There are some challenges that AI in finance faces, such as:

- Data quality and availability: AI algorithms require high-quality data to operate at maximum potential. Ensuring data accuracy, completeness and consistency could be challenging, especially when dealing with diverse and complex financial data sets.

- Skills and talent gap: Implementing and managing AI systems requires specialized skills and expertise. Since it’s a newer technology, there’s a shortage of professionals with a deep understanding of AI technologies and their application in finance. This could also affect data quality.

- Ethical considerations: The use of AI raises ethical concerns, particularly in finance. Bias in AI algorithms can lead to unfair practices in areas such as credit scoring and loan approvals.

- Ability to adapt: AI models work off historical data, so in an industry such as finance, when there’s potential for unexpected events, AI may not be able to adapt quickly enough to new information.

Is AI the Future of Finance?

Many Americans are wary of receiving financial advice from AI, but there are many predictions that AI will help fill future gaps in the financial industry. Many predict that AI will make it easier for advisors to facilitate their relationship management.

While AI holds significant promise for the future of finance, it’s important to note that human expertise and oversight are still essential. AI can support and augment human capabilities. If you’re looking for simple advice about financial and investment opportunities, then AI could be a helpful tool you can use alongside advice from a financial advisor.

Get a Trusted Financial Advice Today

Getting the right financial and investment advice can help you down the road when you begin to near retirement. Our free tool can help you find a financial advisor to help you with your savings or retirement goals. Once you’ve been matched, consult with them for free with no obligation.

Methodology

The survey of 1,042 adults aged 18+ was conducted via SurveyMonkey Audience for Annuity on June 29, 2023. Data is unweighted and the margin of error is approximately +/-3% for the overall sample with a 95% confidence level.