Key Takeaways

- Accrued interest is the interest your annuity has earned but hasn’t been paid out.

- You can calculate the accrued interest on your annuity by using a simple formula.

- Accrued interest is tax-deferred, meaning you don’t pay taxes on it until you withdraw it from your annuity.

One can gain a better understanding of accrued interest, whether on bonds or annuities, by answering four straightforward questions:

- How is accrued interest calculated?

- Is accrued interest taxable?

- What other instruments accrue interest?

- What other investments have accrual features?

Calculating Accrued Interest

Because accrued interest is most often associated with bonds, we will use examples and terminology specific to these fixed-income instruments.

Accrued interest is simple to calculate. There are just three components to it: the face value of the bond, which is also referred to as the “par” value; the “coupon rate” of the bond, which is the annual yield paid by the issuer; and the length of the accrual period.

Face value of a bond is its nominal, or par, value. This is the amount printed on the face of the certificate. To calculate an investor’s specific accrued interest, face value would be the total amount invested in the specific bond. Face value is multiplied by the bond’s stated, or coupon, rate of interest.

Here’s where the calculation gets a little tricky.

The coupon rate of interest is what the bond will earn in an entire year. And most bonds pay interest semiannually, that is, two times a year. Since the accrual period is typically measured in days, we need to compute the bond’s daily earnings.

To do this, we simply divide the coupon rate by 365, the number of days in a year, to arrive at the daily rate of interest.

The last step in the calculation is straightforward. The accrual period is simply the number of days since the bond last paid interest to the seller.

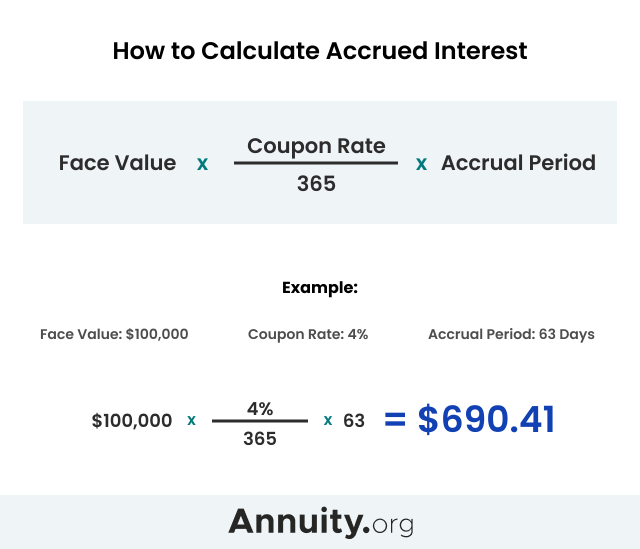

So, the formula to calculate accrued interest is:

Face Value x (Coupon Rate ÷ 365) x Accrual Period

That means an investor who sells a $100,000 bond with a 4 percent coupon 63 days after the bond’s last payment date would receive $690.41 in accrued interest from the bond’s buyer.

On the next payment date, the buyer, now the new owner, will receive the full interest payment of $2,000. This payment is 4 percent of $100,000 for 182.5 days — half a year — and includes the $690.41 of accrued interest that the buyer paid to the seller.

Accrued interest maintains an equitable balance between buyers and sellers. It’s paid to sellers because they earned it during the time they owned the bond. When the new owner receives the next full semiannual interest payment, it will include interest earned prior to the time the new owner actually owned the bond.

Taxation of Accrued Interest

Accrued interest isn’t taxable, per se. For a cash basis taxpayer interest income is taxable when it is received, not when it is earned, or accrued. Bonds accrue interest every day, but they pay interest only twice a year. When those payments are received, they become taxable — assuming the bond is a taxable bond.

So in the example above, the $690.41 of accrued interest the seller receives from the new buyer is taxable income to the seller. But when the new owner receives the first regular semiannual interest payment of $2,000, only $1,309.59 of it is taxable. The new owner gets to deduct the accrued interest paid to the seller.

This, of course, only applies to individual taxpayers. According to Entrepreneur.com, businesses that use the accrual accounting method have to report accrued interest even if they don’t sell the bond.

Other Instruments that Accrue Interest

Bonds are not the only financial instruments that accrue interest. Anyone who has ever sold a home or paid off an auto loan has encountered accrued interest. The principal is the same. Interest accrues and is due to the lender before a regular payment date.

When the transaction closes, the amount of interest paid by the borrower is calculated using the same formula. Only the terminology changes:

Loan Amount x (Interest Rate ÷ 365) x Accrual Period

Deferred Annuities & Other Investments that Accrue or Defer Interest Income

Many investors buy bonds to fund their retirement. These investors should know that there are many alternatives available to them. Among the options are zero-coupon bonds and deferred annuities.

Like regular bonds, zero-coupon bonds pay a stated rate of interest. They just don’t pay it out in regular semiannual distributions. Instead, zero-coupon bonds are sold to investors at a deep discount to their face value and pay all of the interest at maturity.

For example, a zero-coupon bond maturing in 10 years and paying 4 percent interest would sell for approximately $6,755. Over the course of the next 10 years, the remaining $3,245 would accrue gradually until the bond matured, at which time the investor would be paid the full $10,000.

But zero-coupon bonds owned in a taxable account present investors with a complexity not found in coupon bonds. The interest that accrues on zero-coupon bonds is still taxable, even though the investor receives no regular interest payments. So investors end up paying taxes even though they have received no cash from the investment.

Deferred annuities can be an effective option for investors seeking to build retirement savings using a taxable account. Using deferred annuities provides an additional benefit that zero-coupon bonds don’t have. They provide investors with tax-deferred accumulation. And studies have shown that deferred annuities can improve retirement outcomes.

While this strategy for retirement planning is different from the concept of accrued interest, it does emphasize that when it comes to saving for retirement, you have a number of options. That’s why it is prudent to seek the advice of a professional with knowledge of different investment vehicles and various retirement planning strategies.

Join Thousands of Other Personal Finance Enthusiasts

Accrued Interest FAQs

Accrued interest grows over time, increasing the value of your annuity. You only have to pay taxes on it when you receive an annuity payout. This allows you to defer taxes on your annuity while the interest builds value in the annuity.

Accrued interest on your annuity builds its value. While it may not be an asset in itself, it makes the annuity a more valuable asset.

Accrued interest in an annuity is not taxed until it is withdrawn. When you take distributions from a non-qualified annuity — one in which the money you put into it was already taxed — the accrued interest will be withdrawn first, before the principal or payments you made. Your withdrawals will be taxed until you withdraw all the interest. You will not have to pay taxes on the premium payments you put into the annuity.