Key Takeaways

- When choosing your annuity’s payout option, you must first decide when you’ll begin receiving payments and how long you’ll continue to receive them.

- Immediate annuities start to pay out within a year of purchase, while deferred annuities grow for several years before paying out.

- Period certain, straight life and joint and survivor annuities all carry different payout structures.

- Annuities can include a death benefit to ensure a specific payout to your beneficiaries upon your passing.

When Will My Annuity Payments Start?

When purchasing an annuity contract, you’ll first decide when you want to receive your payments. Are you hoping to receive payments right away to cover immediate needs, or are you saving for your future retirement? The answer will help you choose whether the payout structure of an immediate annuity or deferred annuity best suits your needs.

| Annuities by Payment Types | Payments Begin | Ideal For |

| Immediate Annuity (Income Annuity) | Within a year of purchase | Retirees or people expecting to retire soon who will use the payments as a supplementary income stream |

| Deferred Annuity | Retirement or another time in future | Buyers who value tax-free growth on their investment to create larger payments during their future retirement |

Immediate Annuity (Income Annuity)

As the name suggests, immediate annuities begin to pay out immediately or within a year of purchase. The most basic type of immediate annuity, the single premium immediate annuity (SPIA), converts a lump sum premium payment into a stream of income in a year or less.

Regardless of when you begin receiving payments from these products, immediate annuities are designed to create an income stream for a set period.

Deferred Annuity

Deferred annuities delay payment to the annuitant for many years after they’re purchased. Usually, the payments are deferred until retirement. In the interim, the annuity grows as interest accumulates tax-free. The longer the time between the purchase and the start of payments, the more the annuity will grow and the larger the eventual payments will be.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

How Long Will Payments Last?

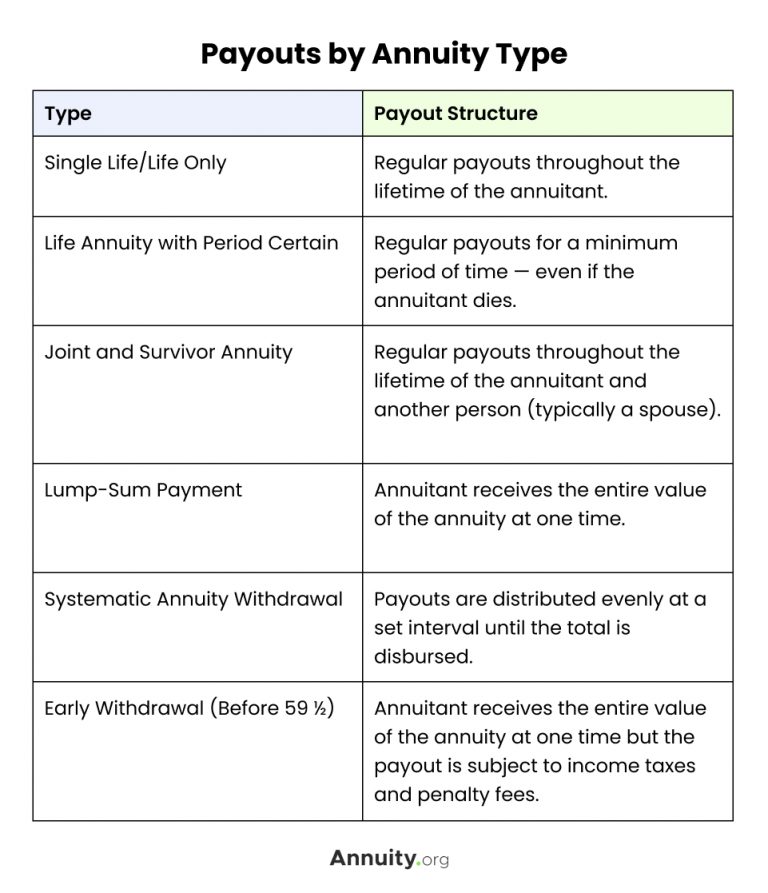

The duration of the income stream is another important consideration, with many payout options available to choose from depending on the type of annuity you choose. Again, consumers can structure the payout schedule to best meet their needs. Below are the most common options.

Single Life/Life Only

Also called a straight life or life-only annuity, a single life annuity lets you receive payments throughout your life. Unlike other options that include beneficiaries or spouses, a single life annuity limits payments to the annuitant’s lifetime without a survivor benefit. If you pass away before receiving your full premium, the insurance company keeps the balance. To decrease the chances of this happening, consider buying a life annuity with a period certain.

Life Annuity with Period Certain (Fixed Period/Guaranteed Term)

Period certain annuities resemble straight life annuities but have a minimum set payment duration, often 10 or 20 years, even if the annuitant passes away. If the annuity holder dies before this period ends, a beneficiary or the annuitant’s estate receives the remaining payments. Adding the period certain reduces the amount of your monthly payments to cover the extended time guarantee.

Joint and Survivor Annuity

Joint and survivor annuities ensure payments will continue for the lifetimes of both the annuitant and another person, usually a spouse. This option results in smaller individual payments than you would receive with a straight life annuity or a life annuity with period certain of the same amount.

You may choose to add a period certain and designate a beneficiary who would receive the death benefit if both annuitants die before the period ends.

Lump-Sum Payment

This option allows the annuitant to receive the entire value of the annuity at one time. This choice can lead to a significant tax burden since the IRS mandates income tax payments be made in the distribution year.

Systematic Annuity Withdrawal

A systematic annuity withdrawal lets you decide the dollar amount and frequency of payments without considering the income stream’s duration. Thus, there is no guarantee that the funds will last through the remainder of your life; how long payments last depends entirely on the cash value of your contract.

Early Withdrawal

Electing to withdraw money from your annuity before you reach the age of 59 ½ results in a 10% government penalty plus any applicable taxes. If that withdrawal is within five to seven years of purchasing the annuity, you may also owe the annuity provider a surrender charge of up to 20%, depending on how much time has passed since the purchase.

Read More: First-Time Annuity Buyers

How Are Payouts Calculated?

Besides the type of annuity and payment duration, other factors influence how insurers calculate annuity payouts.

Your age and sex stand out as the two most significant variables not yet discussed. Generally, the longer you’re expected to receive payments, the lower each payment’s amount will be. This means that the older you are when payments begin, the greater your payout for each period will be. And, because women tend to live longer than men, a woman’s annuity payments will likely be lower than a man’s of the same age.

Purchase an Annuity Today

Death Benefit

Your annuity contract may include a provision for a death benefit. Usually, the designated beneficiary receives either the contract value or the amount of the total paid premiums.

Beneficiaries of qualified annuities must withdraw the full annuity contract value within 10 years of the annuitant’s death.

Beneficiaries typically have a few options for receiving a death benefit from a nonqualified annuity. As Lisamarie Monaco, an independent life insurance agent, explained to Annuity.org, a beneficiary may have the option to either take a lump sum or stretch the payments throughout their life. “If there is no named beneficiary, the annuity may be paid out to the annuitant’s estate.”

If a beneficiary opts for a lump sum, the IRS mandates the distribution of the annuity’s entire cash value to the beneficiary within five years following the annuitant’s death. This is known as the “five-year rule.” Alternatively, beneficiaries can base distributions on their own life expectancy, which is used to calculate the minimum yearly withdrawal the beneficiary must make.

Frequently Asked Questions About Annuity Payouts

There are many types of annuity payout options, each with its own pros and cons. The best is the option that suits your needs. Choosing a life annuitization option is popular because it provides a lifetime income stream, reduces your risk of outliving your retirement savings and typically results in the highest payout.

What happens at the end of an annuity depends on the type of annuity you have and how your contract is structured. With a Multi-Year Guaranteed Annuity, for example, your contract may auto-renew if you take no action at the end of the term.

In general, you cannot change your payout option once you begin receiving payments from your annuity.