What Is an Annuity Statement?

An annuity statement gives the annuity owner an update of the cash value and, in the case of variable and indexed annuities, the investment value of their annuity.

Annuity statements also confirm any activity that has occurred related to the annuity, such as index values or rate cap details. When you purchase an annuity, you’ll receive these statements at regular intervals — usually once per year for fixed annuities or once per quarter for variable annuities.

How To Read an Annuity Statement

To help give you an idea of what your annuity statement might look like, consider an example:

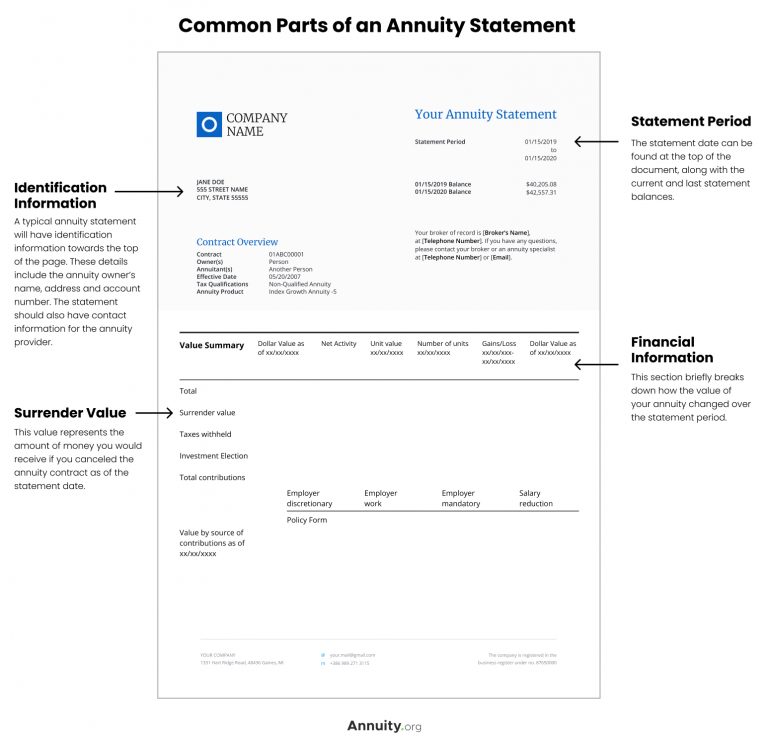

- Identification Information

- A typical annuity statement will have identification information towards the top of the page. These details include the annuity owner’s name, address and account number. The statement should also have contact information for the annuity provider.

- Overview of Contract

- The statement will have an overview of the contract terms, like the names of the annuity owner and annuitant, if not the same person. This section also contains specific details of the annuity contract, including the product type, tax qualification status and effective date.

- Financial Information

- An overview of the financial information available for the statement period will also be provided. This section briefly breaks down how the value of your annuity changed over the statement period. If you have an indexed annuity, the financial activity overview will include details on index values and rate caps.

If you own a traditional fixed annuity, there won’t be much to report in this section. The statement will tell you how much interest your annuity earned in the previous statement period and what the interest rate will be for the next period.

- Transaction History

- A statement for a variable annuity might have an additional section for transaction history. This section will tell you about any purchases or sales of mutual fund units and any dividends you may have earned from those mutual funds.

- Surrender Value

- No matter which type of annuity you have, your statement should include the surrender value of your annuity. This value represents the amount of money you would receive if you canceled the annuity contract as of the statement date.

Because annuities work by letting a lump-sum premium grow over time to be converted into a stream of income years later, the surrender value will always be less than what you would earn from receiving payments from a mature annuity in its distribution stage.

Common Parts of an Annuity Statement

Purchase an Annuity Today

Annuity Statement Tax Implications

One advantage of annuities is that they allow for tax-free growth on your investments — you don’t pay taxes on the annuity until you withdraw funds or begin receiving payments. If you have a fixed annuity, there won’t be any tax implications to look out for when you review your statement.

If you have a variable annuity, it’s important to note how much of your annuity’s value is your original contribution and how much is the gains generated from the annuity’s investments. This information should be available in the financial details of your statement.

Because of the tax laws surrounding withdrawing funds from an annuity, your original contribution to fund the annuity is not taxable should you choose to withdraw it. However, any gains your variable annuity earned are taxable. Understanding the composition of your annuity’s value can help you anticipate the tax implications of withdrawing funds.