Key Takeaways

- Annuities are insurance contracts that provide you with a guaranteed source of income during retirement. The way annuities work is by converting your premium payments into regular payments that can last for a specified period or your entire life.

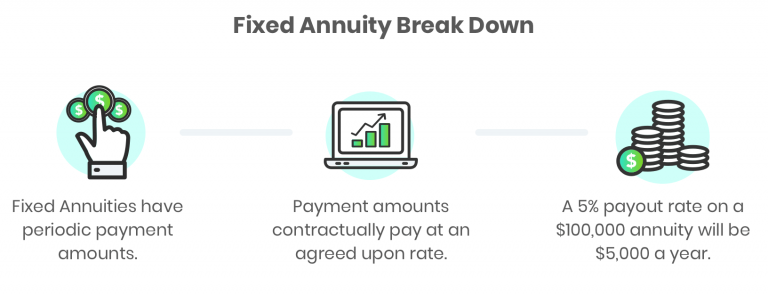

- Fixed annuities offer a predictable source of income with periodic payments agreed upon in the contract.

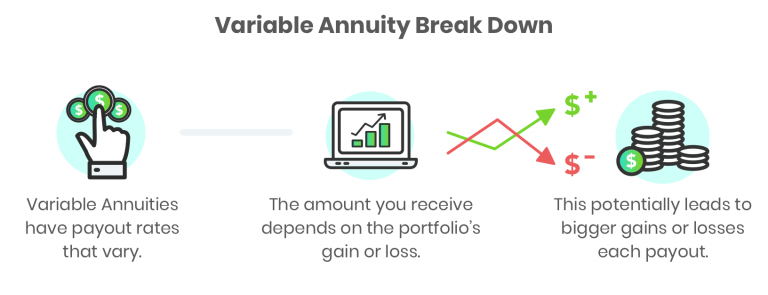

- The number of periodic payments from variable annuities varies depending on the annuity’s underlying investment portfolio’s performance.

Annuities are insurance products that provide a reliable, steady stream of payments to support your financial needs for the rest of your life or for a pre-determined number of years.

Because they are contracts, annuities can also be adapted to meet your specific needs and fit your comfort with different levels of risk.

You can get a fixed annuity in which the payments are spelled out exactly ahead of time in the contract. Or you can get a variable annuity with the potential for higher – or lower – payments, depending on the performance of a traditional investment portfolio.

Annuities are not for everyone. But if you’re nearing retirement and need to ensure you can pay your living expenses after you’ve stopped working, you should consider if an annuity is right for you.

Annuities Explained

Discover how annuities work in this informative list where we explore the key aspects of annuities and how they provide guaranteed monthly income payments through a process called annuitization.

How Do Annuities Work?

- Annuities are long-term investments that offer guaranteed monthly income payments throughout the contract’s duration.

- The process of annuitization involves converting converts a lump-sum investment into a reliable and guaranteed income stream.

- The income payments are received regularly, usually on a monthly basis.

- Annuities provide financial security by ensuring a steady source of income over the contract’s lifespan.

How Do Fixed Annuities Work?

Annuities come in various forms, offering reliable and steady income streams tailored to individual needs. An example of an annuity is a fixed annuity, which guarantees regular payments based on the terms of the contract. For instance, with a $100,000 fixed annuity and a 5% payout rate, you can expect to receive $5,000 annually. This example demonstrates how annuities provide financial stability and consistent income over time.

How Does a Variable Annuity Work?

Variable annuities have payout rates that vary, depending on the performance of an investment portfolio. The amount you receive in payments depends on how much money the portfolio gains or loses. This is riskier, but also has the potential of paying you more.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

Are Annuities a Good Idea?

Whether annuities are a good idea depends on your circumstances, your needs and whether the particular annuity type is a good fit.

If you already have a healthy pension or another source of income sufficient to support your everyday needs in retirement, you may not need an annuity.

If you don’t have a guaranteed stream of retirement income, you should consider buying an annuity. An annuity is a good source of lifetime income.

Who Should Consider Annuities?

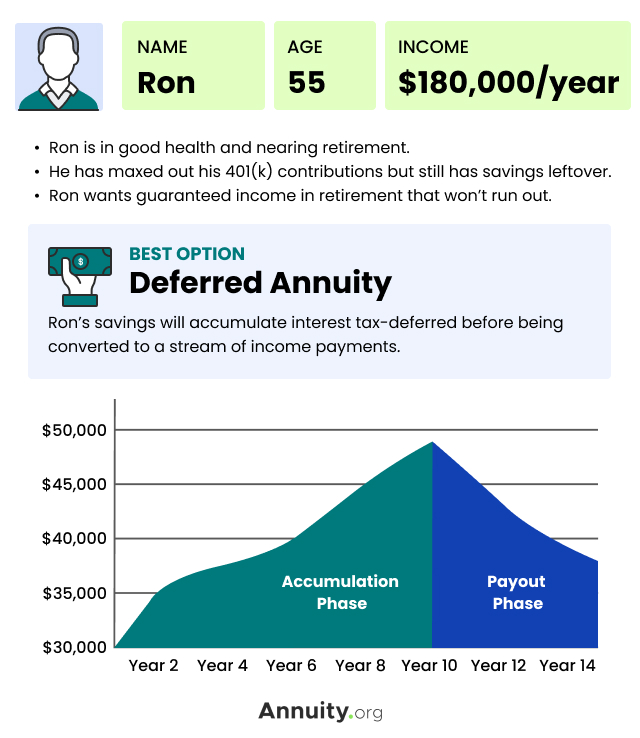

To give you an idea of who an annuity might be most suitable for, let’s look at a case study example.

“Annuities are wonderful because they guarantee payments for a long period of time and can be longevity insurance in a lot of ways,” said Stephen Kates, Annuity.org expert contributor and Certified Financial Planner™ professional. If you’re healthy and likely to live a long life, an annuity can be good insurance against outliving your savings.

Many people nearing retirement experience something called “the retirement gap,” where they have less saved for retirement than they should and risk not having enough money to continue the lifestyle they enjoyed before leaving the workforce. Annuities offer a solution to bridge the gap by providing an additional savings vehicle that grows tax deferred.

The tax deferment feature of annuities makes them ideal for high-net-worth individuals, like Ron in the example above. Ron’s annuity can earn interest while he’s still working, and he won’t be taxed for that income while he’s still in a higher tax bracket. When the contract annuitizes after Ron retires, he’ll likely be receiving less income and, therefore, could be in a lower tax bracket. As a result, he’ll end up paying less tax on his annuity earnings than he would on something like a CD, which is taxed each year as interest accumulates.

Most financial experts recommend annuities to people who are retired or about to retire and have maxed out other savings accounts such as a 401(k) or IRA. “A deferred annuity is basically like an uncapped IRA,” said Kates. An annuity allows you to contribute as much money as you want, and you won’t be taxed on the interest your money earns until you withdraw it.

While annuities can be a crucial part of retirement income strategies for many consumers, they’re not for everyone. If you’re unhealthy, annuities might not work for you. This is especially true if you don’t expect to live long and are unlikely to outlive your savings. You also may need access to your savings to pay medical bills.

If you’re younger, you’re likely able to invest in stocks and other offerings that are more risky because you have time to recover losses in the long run. If you’re older, the safety and predictability of annuities are likely to be more suited for your needs.

The good thing about considering annuities is that many of them offer a free-look period that gives you time to consider the contract and make sure it is the right choice for your life.

Are Annuities Safe?

By and large, annuities are a safe investment. However, it’s important with annuities to purchase them from highly rated, well-established insurance and financial services companies with good reputations.

That’s partly because, unlike certificates of deposit, annuities are not insured by the Federal Deposit Insurance Corporation.

All states have guaranty associations that insure at least partially against the failure of annuity providers.

The amount of protection varies from state to state. States also regulate insurance companies, requiring them to meet financial standards intended to keep them solvent.

All insurers that sell annuities must belong to the guaranty associations in the states where they operate. For information about your state’s guaranty association, you can find links to all state associations on the website of the National Organization of Life & Health Insurance Guaranty Associations.

Ways Annuity Investments Are Safer

In two states — Florida and Texas — your money in an annuity is protected from creditors and frivolous lawsuits. Most other states provide limited protections. And likewise, in federal bankruptcy cases, the law provides a small amount of protection of annuity assets from creditors.

Investing in a fixed annuity, as opposed to the stock market, protects your money from the overall economic threats that can diminish your nest egg in the short term, said Wenliang Hou, quantative analyst at Fidelity Investments.

This is especially important for older people depending on their savings who cannot afford to ride out a down market.

Annuity vs. 401(k)

Annuities and 401(k) plans are retirement accounts with some significant differences.

- Availability

- 401(k) plans are available only to individuals whose employers offer them. Annuities are not employer-sponsored and can be purchased by anyone.

- Contribution limits

- There are contribution limits for 401(k) accounts, but none for annuities. As of 2023, the annual 401(k) contribution limit is $22,550 or $30,000 if you’re 50 or older.

- Tax deferrals

- Both annuities and 401(k) accounts provide the ability to defer paying taxes on earnings until the money is withdrawn. However, contributions to 401(k) accounts may be deducted from your taxes in the years in which they are made. Contributions to annuities may not be tax deducted.

- Taxes on withdrawals

- Because of that 401(k) deduction, withdrawals from those accounts are taxable in their entirety. Only the portions of annuity withdrawals that represent earnings are taxable.

Here are some of those differences:

Some people chose to roll all or part of their 401(k) savings into annuities as a means of providing a stream of income to fund retirement.

The Setting Every Community Up For Retirement Enhancement (SECURE) Act, which was passed into law in December 2019, gives employers greater leeway to include annuities in their workplace-sponsored retirement plans.

Join Thousands of Other Personal Finance Enthusiasts

How Much Do You Need to Start an Annuity?

Each annuity has different fees and restrictions. Different companies set different investing requirements.

But in deciding whether you have enough money to invest in an annuity, it may be best to consider what kind of return your annuity purchase might bring.

Let’s take a fixed, immediate annuity with a 5% payout rate as an example. That means, each year, you will receive payments totaling an amount equivalent to 5% of your investment.

| Fixed Annuity Purchase at 5% | Yearly Payment | Monthly Payment |

|---|---|---|

| $1,000 | $50 | $4.71 |

| $5,000 | $250 | $20.83 |

| $10,000 | $500 | $41.66 |

| $25,000 | $1,250 | $41.66 |

| $50,000 | $2,500 | $208.33 |

| $100,000 | $5,000 | $416.67 |

| $500,000 | $25,000 | $2,083.33 |

You should decide if the money you can spend on an annuity will bring you enough income to make having the annuity worthwhile.

Read More: What If Your Annuity Provider Changes?

Frequently Asked Questions Surrounding Annuities

The type of annuity you purchase and the terms of your contract dictate exactly how you’ll be paid from your annuity. You typically receive the principal back from an annuity in the form of periodic annuity payouts.

An annuity is a financial product structured by a long-term contract between you and an insurance company. Annuities are part of a retirement strategy designed to provide you with a steady stream of guaranteed income in retirement.

Market fluctuations have different effects on different types of annuities. Fixed annuities, for example, guarantee your returns. Others, like indexed annuities, are tied to indices and can carry more risk in down markets.