Annuity Popularity: Wink Releases 2021 Statistics

- Written By Sheena Zimmermann, M.Ed.

Sheena Zimmermann, M.Ed.

Financial Writer

As a professional who values lifelong learning, Sheena Zimmermann joined the Annuity.org team with a deep commitment to connecting readers with resources designed to improve their financial literacy and strengthen their financial health.

Read More - Edited By

Emily Miller

Emily Miller

Managing Editor

Managing editor Emily Miller is an award-winning journalist with more than 10 years of experience as a researcher, writer and editor. Throughout her professional career, Emily has covered education, government, health care, crime and breaking news for media organizations in Florida, Washington, D.C. and Texas. She joined the Annuity.org team in 2016.

Read More - Published: July 9, 2021

- 3 min read time

Competitive intelligence firm Wink Intel this month published the 94th and 95th editions of its Sales & Market Report. The report shares comprehensive data for deferred annuity sales for the fourth quarter of 2020 and the first quarter of 2021.

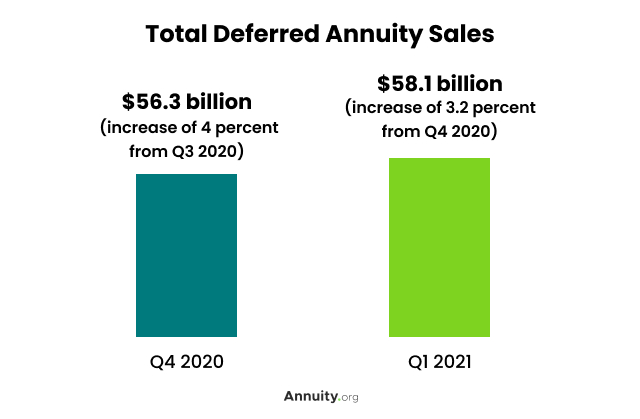

Deferred annuity sales in 2020 totaled $209.1 billion. The fourth quarter accounted for $56.3 billion, or roughly 27 percent, of the 2020 total.

So far, in the first quarter of 2021, deferred annuity sales have reached $58.1 billion — approximately 28 percent of the previous year’s total sales.

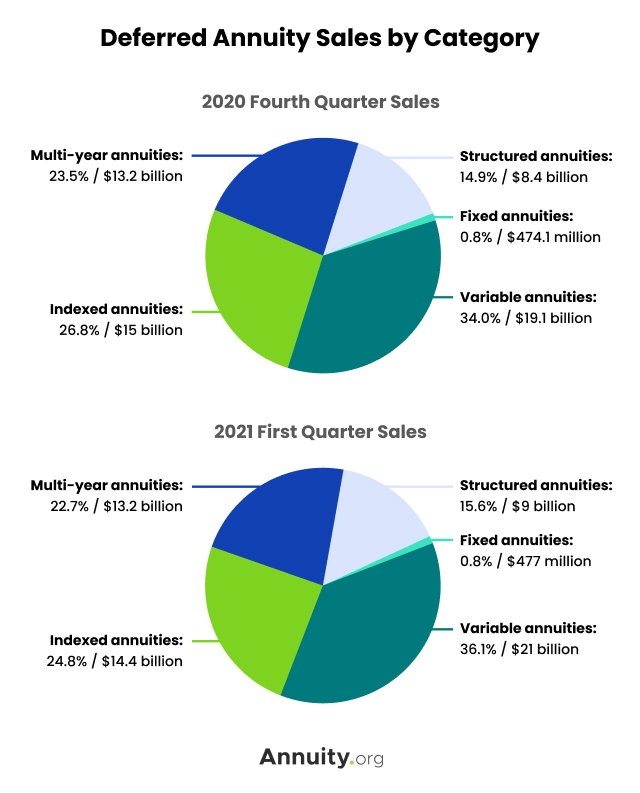

Out of the annuity types included in the report, variable annuities were the most popular products, with indexed annuities ranking second. Fixed annuities had the smallest percentage of sales, although sales increased by almost $3 million from the previous quarter.

Background

Wink’s Sales & Market Report, launched in 1997, is a quarterly analysis of annuities and insurance products available to consumers.

The report showcases a breakdown of sales by annuity companies and product types. The high participation rate, at an estimated 99 percent of providers, results in a reliable and accurate representation of industry sales.

Participants by Annuity Types Offered

- 61 indexed annuity providers

- 45 fixed annuity providers (46 in 2021)

- 69 multi-year guaranteed annuity providers (66 in 2021)

- 14 structured annuity providers

- 46 variable annuity providers (43 in 2021)

Report Highlights

In addition to presenting the sales figures for five specific annuity products, the report offered an analysis of variable versus non-variable annuity categories. The variable product lines in the 2021 report, structured and variable annuities, boasted a 17.6 percent increase in sales compared with the same period in 2020. The sale of these products grew by 9.4 percent from the fourth quarter of 2020.

In contrast, non-variable products were collectively down by 2.8 percent from the previous quarter, and up 5.8 percent from the previous year. Deferred indexed annuities, traditional fixed annuities and multi-year guaranteed annuities (MYGAs) are the non-variable products included in this report.

As of the first quarter of 2021, Athene USA ranked No. 1 in indexed annuity sales, with claiming the second spot.

New York Life is the No. 1 carrier of MYGAs with 19 percent of the market share. Companies followed in second place.

Source: Wink Intel

Source: Wink Intel

Witnessing the sales trends of specific annuity types can inform future projections.

“I project that structured annuity sales will soon gain enough momentum to surpass where their indexed brethren were just over a decade after development,” said Moore Market Intelligence and Wink CEO Sheryl J. Moore. “My latest forecasts show structured annuity sales eclipsing indexed annuities’ before 2022 closes.”

Why Is This Important for Annuity Buyers?

If you are interested in purchasing an annuity, it can be advantageous to explore the various types — and the potential benefits and risks involved.

This snapshot of annuity sales can offer insight into the broader market trends and economic shifts that may be leading consumers toward one type of annuity or another, but it’s always wise to speak with a financial advisor about your personal circumstance and goals.

Absent from the Wink report were data on sales of all annuity product lines. For example, the report did not share statistics on single premium immediate annuity sales, but Moore expects reporting to expand in the future.