How are Viatical Settlements and Life Settlements Similar?

There are several ways that viatical settlements and life settlements overlap, both in what their purpose is and how they function. In fact, the life settlement industry was born out of the viatical settlement business.

Much of how a settlement functions, and who is involved, is the same for both life and viatical settlements.

A viatical settlement involves someone who is terminally ill selling their life insurance policy in exchange for immediate cash. A life settlement is a very similar process, but the seller of the policy is not terminally ill, though still usually old.

Lump Sum of Income

One key similarity between both types of settlements is the end result and motivation for selling the policy: a lump sum payment.

Life insurance policies typically work by paying out a death benefit to your beneficiaries or family members after you die. But viatical and life settlements involve selling your policy to someone else in exchange for money now.

Remember that the lump sum you are offered will never equal or be particularly close to the death benefit that would have been paid out if you kept the policy.

The goal of the buyer is to make a profit by receiving the death benefit when you die, which exceeds the lump sum they paid you and any premiums they paid on the policy while you were still alive.

Can be Processed by Third Party

Another key similarity between viatical and life settlement is that both involve the selling of a life insurance policy to a company or provider.

This means that the policy is sold to a third party. This is not the same thing as surrendering a policy to the insurance company you received it from.

Instead, a new entity, such as a viatical settlement company, buys the policy from you. The company essentially becomes the new beneficiary of the policy and receives its death benefit when you die while you get a lump sum of cash up front for selling the policy.

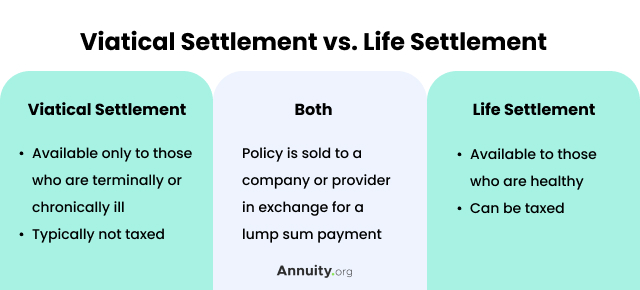

What are the Differences Between a Viatical Settlement and Life Settlement?

While viatical settlements and life settlements have much in common in how they operate, there are key differences as well. Viatical settlements cater specifically to those who are terminally ill, with the seller of the policy selling it to a company or provider in exchange for a lump sum.

Life settlements also involve selling a policy for immediate cash, but the seller is not terminally ill or nearing death.

How They are Taxed

Taxation of the settlement is a major difference between the two types of settlements. Viatical settlements typically are not taxed. This means that your lump sum payout that you receive for selling your policy is not considered a form of income, and you will not have to pay taxes on it.

Laws and regulations can vary, so there may be some situations where this is not the case.

If you are selling your policy in a life settlement, however, there are situations where you may have to pay taxes on the payout that you receive. It’s important to consider the differences in tax implications when looking into potential settlements.

Medical Requirements

Medical requirements play a major role in the difference between viatical and life settlements as well. In the case of viatical settlements, the seller of the policy must be terminally or chronically ill.

This usually means that their life expectancy is less than two years. If the seller is not terminally ill, then they are unlikely to be eligible for a viatical settlement. The idea behind viatical settlements is that, since the seller is expected to die soon, the company buying the policy can expect a high return on investment.

According to the State of Connecticut Insurance Department, terminal illness is not a requirement for life settlements. The seller can be healthy but do tend to be old.

How to Decide Between a Viatical and Life Settlement

When deciding between a viatical or life settlement, your personal circumstances will more or less decide for you.

Each settlement caters to different scenarios and situations. If you are terminally ill, then you would opt for a viatical settlement. If you are healthy but wish to sell your life insurance policy, then you would opt for a life settlement.

Remember to consider the consequences before choosing either. If you do opt for a settlement, your death benefit will go to the company or provider that bought it. This means your family or beneficiary will not receive anything when you die. And the lump sum payment will likely be significantly less than the death benefit.

Many people opt for one of these settlements because they need money immediately due to serious expenses or can no longer afford to pay their premiums.

It makes sense for you to go over all of your options (such as if your life insurance policy has a terminal illness rider) before opting to sell your policy to get the money you need.

Frequently Asked Questions

A viatical settlement involves someone who is terminally ill selling their life insurance policy to a third-party company or provider. The seller receives a lump sum payout that is typically somewhere between the value of the policy’s surrender value and death benefit, while the buyer receives the death benefit when the seller dies.

A life settlement is when someone with life insurance who is typically older sells their policy to a company in exchange for a lump sum payout. The seller can be healthy, unlike in a viatical settlement.

People pursue a viatical or life settlement often when they have immediate expenses and no other way to pay them. A viatical settlement, for example, could be used by the seller to pay for their medical care, treatment, or even their policy premiums.