IRAs can help you pay less in taxes while you are saving for retirement. Your earnings are not taxed while they are in the account, which can help your investments generate additional earnings over time.

IRA funds can grow by accumulating compounding interest, which means the earned interest is reinvested within the IRA’s underlying investments.

For example, if you have $1,000 in an IRA with a 4 percent annual interest rate, you will have $1,040 at the end of the year. Then, interest builds on top of that interest, so you would earn 4 percent on $1,040 the following year, and so on. After 10 years with no additional contributions, your balance would reach $1,480.24.

Depending on your income and employment category, you can set up different types of IRAs. Each type offers different tax benefits, but also comes with its own set of rules and limits.

The important thing is to start saving for retirement as early as possible, regardless of the type of account. The earlier you start saving, the faster your money will grow and the less money you will need to set aside to reach your retirement savings goal.

What Is an IRA and How Does It Work?

The IRS refers to IRAs as “individual retirement arrangements.” Like other retirement savings vehicles, IRAs hold and invest contributions while the owner enjoys tax benefits.

IRAs are not investments in and of themselves. But mutual funds, exchange traded funds, stocks and bonds are types of investments sometimes held in IRAs that can grow over time.

Generally, you are eligible to open an IRA if you earn income. You can set up an IRA with a bank, trust company or other financial institution.

The IRS approves these providers, referred to as custodians, to ensure they follow safekeeping practices and government regulations. In most cases, you can direct how you wish to have your IRA money invested by the custodian.

Types of IRAs

There used to be only traditional IRAs available, but IRAs have evolved to accommodate people beginning their careers, self-employed workers and small business owners.

Traditional

If you receive taxable compensation, you can open and contribute pre-tax funds to a traditional IRA. Individuals over the age of 70 ½ were not permitted to contribute to a traditional IRA in the past, but the IRS repealed the rule for tax years following Dec. 31, 2019.

You can deduct traditional IRA contributions from your annual income, though the amount is based on earnings and participation in employer-sponsored retirement plans.

Individuals over the age of 73 (0r 72 if you reached 72 before Jan. 1, 2023) must take required minimum distributions, or RMDs, or they may face tax penalties.

One way traditional IRA account holders can delay RMDs is if they purchase a qualified longevity annuity contract (QLAC). This type of annuity is available for qualified retirement plans, such as a traditional IRA, and allows you to defer RMDs until 85 years old.

Roth

You can contribute to a Roth IRA with post-tax funds, or income that has already been taxed.

Contributions are not deductible on your federal income tax return, nor do you have to pay income taxes on qualified withdrawals after retirement.

Roth IRAs and traditional IRAs have the same contribution limits. However, an income ceiling applies to Roth IRA contributions, so you cannot contribute if you earn more than the IRS-established amount.

Roth IRAs do not have RMDs, so you do not have to withdraw funds when you reach 73 years old.

Self-Directed

Self-directed individual retirement accounts, or SDIRAs, allow a broader range of investment options.

In a 2018 bulletin, the U.S. Securities and Exchange Commission warned that “investors should be mindful that investments in self-directed IRAs raise risks including fraudulent schemes, high fees, and volatile performance.”

SEP

A Simplified Employee Pension, or SEP IRA, is an affordable and flexible option for small-business owners, self-employed workers and entrepreneurs. These plans are similar to traditional IRAs, but they allow for significantly higher annual contributions and employer-to-employee contributions.

If a small business owner contributes to employees’ SEP IRAs, the contributions are typically tax-deductible. Minimum distribution rules apply to SEP IRA owners.

SIMPLE

Savings Incentive Match Plans for Employees of Small Employers, or SIMPLE IRAs, are retirement savings plans for individuals who employed 100 or fewer employees within the calendar year. Employees, including those self-employed, can participate in a SIMPLE IRA plan if they have earned at least $5,000 in compensation during any two years before the current calendar year and expect to receive at least $5,000 during the current calendar year. Like traditional and SEP IRAs, minimum distribution rules apply.

Learn More: The Best Rollover IRAs of 2023

Tax Treatment of IRAs

IRAs and other retirement savings options are subject to different taxation rules. IRS-imposed taxes for IRAs impact three categories: tax deductions, earnings and withdrawals.

Tax Deductions

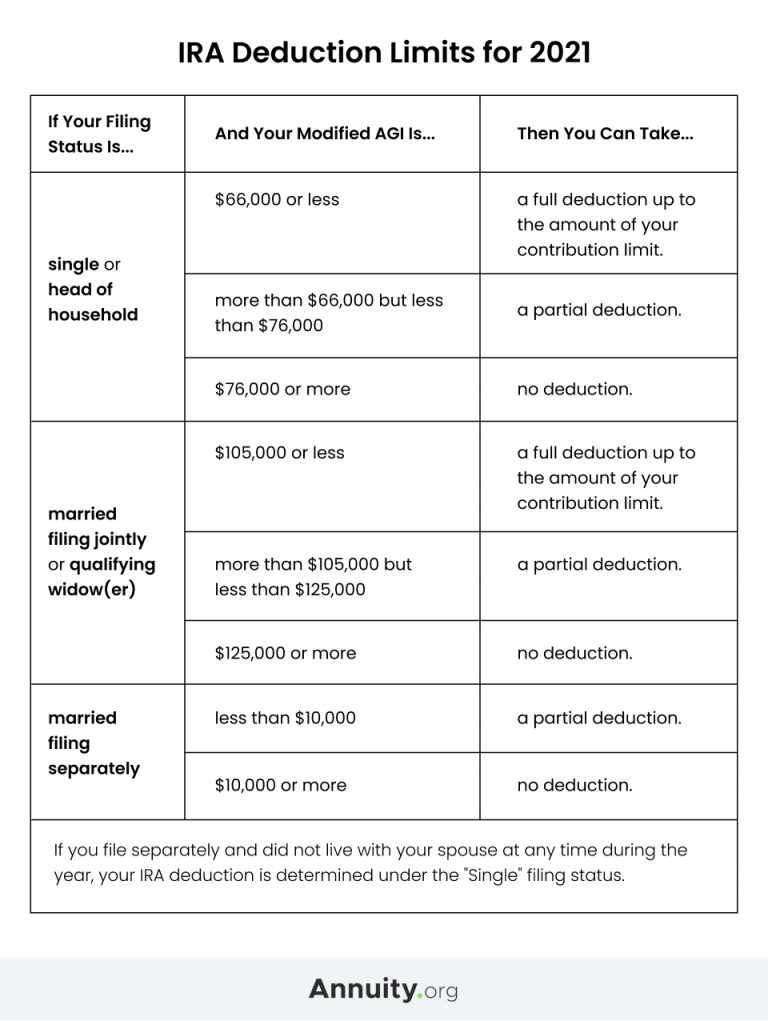

Deductions refer to money you can subtract from your annual income when you file your federal tax return.

Contributions to a traditional IRA may be tax-deductible, depending on your income and whether or not you have a retirement plan through your employer.

You can contribute to a traditional IRA regardless of your participation in an employer-sponsored plan. However, you may not be able to deduct all of your contributions if you are covered by a retirement plan at work and your income exceeds certain levels.

If you do not have an employer-sponsored plan, you are allowed to deduct contributions to your traditional IRA in full.

Roth IRA contributions are not deductible, so you do not receive an income tax break by paying into your account.

Earnings

Your money can earn interest as long as it remains in the account. Traditional IRA earnings grow tax-deferred, so you do not pay taxes on the gains until you make a withdrawal.

Roth IRA earnings grow tax-free, so you owe no tax on the investment earnings — so long as you follow the IRS rules for withdrawals.

Withdrawals

If you own a traditional IRA, you are required to start taking withdrawals when you reach age 73. When you make a withdrawal from a traditional IRA, the initial investment and the earnings can be taxed as income if your IRA contributions were tax-deductible when you made them.

Roth IRAs do not require withdrawals until after the account owner dies. You can withdraw contributions and earnings with no tax or penalty if the account has been open at least five years and you are at least 59 ½ years old.

Early Withdrawals and Exemptions

An IRA is designed to provide retirement income, so the IRS assesses a 10 percent penalty if you withdraw IRA funds before reaching the age of 59 ½ . However, if an IRS exception applies, the owner can be exempt from the early distribution penalty.

For example, some withdrawals for higher education, medical expenses or the purchase of a first home might not be penalized in certain circumstances. In addition, under the Secure Act, you can take an early distribution without penalty when you welcome a new child — either by birth or adoption.

Contribution Limits and Eligibility Rules

Money you pay into your IRA is called a contribution. In 2023, your total contribution to your traditional and Roth IRAs cannot exceed $6,500 if you are under the age of 50. If you are 50 or older, you can contribute up to $7,500.

You can have a traditional IRA and a Roth IRA at the same time, but you cannot exceed the annual contribution limit. For example, if you pay $4,000 into a traditional IRA, you can only contribute up to $2,000 into your Roth IRA.

Participating in an employer-sponsored retirement plan may limit your IRA deductions. If you are covered by a retirement plan at work, your modified adjusted gross income (MAGI) must be below the IRS income range for you to be able to deduct contributions to a traditional IRA and/or contribute to a Roth IRA.

IRAs and Annuities

Depending on your long-term financial goals, holding an annuity within an IRA may be an advantageous option for you. Annuities are insurance contracts that can offer tax benefits and guaranteed lifetime income, and they can supplement IRAs — or other retirement savings tools — to maximize your income in retirement.

You can also consider allocating IRA assets to an annuity through a rollover, or a direct funds transfer. The IRS also permits funds to be withdrawn from one eligible retirement plan and deposited into another within a 60-day window.

Using traditional IRA funds to purchase a qualified annuity provides tax advantages that can help increase your savings. It is important to understand the applicable taxes — and when they come into play — for any new plans or transfers.