California is the fourth-largest insurance market in the world and the largest in the United States. To regulate annuity sales in the state, California has important provisions in place and governs key features of annuities – such as premium tax, consumer protections and free-look periods.

“California has been at the forefront of providing legislation designed to protect consumers interested in utilizing annuities,” Retirement Income Certified Professional, George F. Shave III, told Annuity.org.

When you’re ready to purchase an annuity in California, your insurance company and agent must follow the state provisions and best practices.

Key Takeaways

- Californians enjoy significant consumer protections when they purchase annuities, including suitability regulations, advertising restrictions and an extended 30-day free-look period for seniors.

- Annuity providers that operate in multiple states often offer different rates and limitations on their California annuity products.

- California taxes annuity premiums at 2.35%, or 0.5%, if the annuity is a qualified deferred or income annuity. The state also charges a 2.5% tax penalty on early distributions from annuities.

- An annuity owner can protect up to $15,650 of an unmatured annuity’s value from creditors in California.

Buying an Annuity in California

Buying annuities in California is different from buying them in other states. That’s because California has more annuity regulations than most states.

For instance, say you have an aunt that lives in Nevada, and she purchased a fixed annuity from a well-known provider.

She says, “You should purchase the same annuity from the same company — it’s a great product!” You call your financial advisor, and you learn that the product with the same name has different rates and available riders in your state. How could this be?

First, the provider would need to be licensed in both Nevada and California to sell annuities to you and your aunt. Then, the annuity company and its products are subject to California’s more stringent regulations.

Annuities can be excellent products for helping Californians plan for retirement and live during their non-working years.

During the purchase, it’s important to ask questions and thoroughly examine your contract.

“I would advise clients to be sure they understand the terms of the annuity contract they are buying,” Shave said.

Before your purchase is finalized, you will have a free-look period, which allows you to review your contract and cancel, if necessary. The free-look period is 30 days for senior residents in California.

Annuity Providers in California

Companies must be licensed in California to sell annuities in the state. Even if a company is licensed in multiple states and it sells an annuity product elsewhere, that product will likely have different rates, benefits and limitations in California.

Because of the vast range of annuity products available in California, speak with a financial professional and ask questions to determine which annuity product best meets your needs.

| Company | Product Name | Interest Rate |

| American Equity | GuaranteeShield 3 | 1.45% |

| North American | Guarantee Choice 100k+ 5 | 1.90% |

| American National | Palladium MYG 250k+ | 4.45% |

| Global Atlantic | SecureFore 3 100k+ | 4.95% |

| Fidelity and Guaranty | FG Guarantee-Platinum 5 | 5.20% |

Annuity & Other Retirement Taxes in California

California levies a 2.35% state premium tax on annuities. Qualified deferred and income annuities are taxed at 0.5%.

Early retirement plan withdrawals are subject to a 10% federal penalty. California assesses an additional 2.5% penalty on early distributions.

California residents also have a state income tax to deal with. It ranges from 1% to 12.3%, depending on filing status and taxable income. However, the state doesn’t Social Security benefits, estates or inheritances.

Annuity Regulations in California

The California Department of Insurance (CDI) governs all annuity providers licensed in the state; its core mission is consumer protection.

Any annuity sales in California must align with the standards of the Annuity Suitability Reform Bill. It mandates that insurers evaluate the consumer’s age, income, financial objectives and other factors. The insurer also must verify that the annuity purchase is appropriate for the consumer.

Senate Bill 620, authored by former Senator Jack Scott, put in place a code of conduct for financial advisors.

Senate Bill 620 affects the sale of annuities in California in the following ways:

- Restrictions on advertising practices

- Restrictions and disclosures when making presentations in clients’ homes

- Better replacement standards

- Guidelines to regulate the sale of annuities specific to Medi-Cal eligibility

- Restrictions on how variable annuity funds are invested during the free-look period

- Restrictions on commission payouts to active members of the State Bar of California

- Continuing education requirements

“California was the first state in the nation to mandate annuity training for advisors,” Shave said. “It started with an initial eight-hour training requirement and continues each license renewal with four hours of ongoing training. The goal here, to assure that we are putting better advisors in front of consumers.”

A new bill proposed by California State Senator Bill Dodd is designed to strengthen existing regulations by requiring insurance agents to act within the consumer’s best interest when recommending or selling annuity products. The proposed bill, which could become effective in January 2025, also requires agents to supply a buyer’s guide to anyone who purchases an annuity in California.

Are Annuities Protected from Creditors in California?

California has asset protection laws in place to benefit residents. For unmatured life policies, including annuities, the exempt amount is $15,650 for an individual. However, courts can levy a financial judgment beyond these dollar amounts.

Benefits from matured annuity policies are exempt to the extent they’re reasonably necessary to support the debtor and their spouse and dependents. If you buy an annuity in California while you’re a resident of the state, the agreement is governed by California law — even if you later move to another state with different asset protection rules.

What Is the California Life & Health Insurance Guarantee Association?

The California Life & Health Insurance Guarantee Association exists to protect annuity owners. In the unlikely event an issuing annuity company becomes insolvent, the state guaranty association works to ensure annuitants continue to receive their benefits.

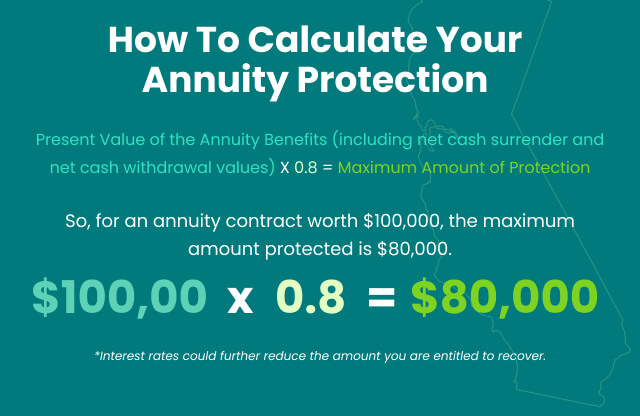

In California, the Guarantee Association protects 80% of the present value of the annuity benefits up to $250,000. If you bought multiple annuities from a single insurer, the maximum amount the Guarantee Association will provide is $250,000. However, if you and your spouse each have an annuity contract, the limit applies to each of you, separately.

Additional Resources for California Annuity Buyers

As you consider your annuity options in California, review the company’s ratings to gauge the financial stability of the provider. A financial advisor or annuity expert can answer your questions and guide you in the right direction as you pursue your financial goals.

To learn more about California annuities, visit:

- California Department of Insurance

- California Annuities Guide for Seniors

- California Life Insurance and Annuities Guide

- California Life and Health Insurance Guarantee Association

FAQs About Annuities in California

Yes. California levies a 2.35% tax on the premiums paid for private annuities and a 0.5% tax on the premiums paid for qualified deferred and income annuities. Additionally, state income tax may be levied on your annuity benefits, depending on the circumstances

Annuities enjoy some protection from creditors in California. If you’re single and the annuity is unmatured, $15,650 of its value is exempt. Benefits from matured annuities may also be protected, if you and your loved ones rely on those benefits for support.

According to the Annuity Suitability Reform Bill, annuities sold in California must be determined to be suitable for the consumer based on his or her age, income, retirement goals and other factors. The state is currently working to make the regulations more stringent in order to better serve consumers.

Editor Malori Malone contributed to this article.