Research suggests that forgotten 401(k) accounts hold about $1.35 trillion worth of assets. Are you missing out on your share?

It’s common when moving jobs to not think about transferring your 401(k) funds or put it off until later. After years pass, you may even forget about the account entirely.

Here are some statistics about lost 401(k) accounts:

- There are an estimated 24.3 million forgotten accounts in the U.S.

- Every year, another 2.8 million 401(k) accounts are forgotten by employees leaving their jobs.

- These lost account owners could be losing out on over $100 billion in additional annual returns from suboptimal asset allocation.

This begs the question: How do I find my 401(k)? To learn how to find your missing funds, manage your wealth and prevent loss in the future, check out our guide below.

How To Find My 401(k) Today

Finding your forgotten 401(k) can vary in difficulty depending on how long it’s been since you worked for your old employer. If you follow the steps below, however, you should be able to find your missing funds and move toward financial wellness.

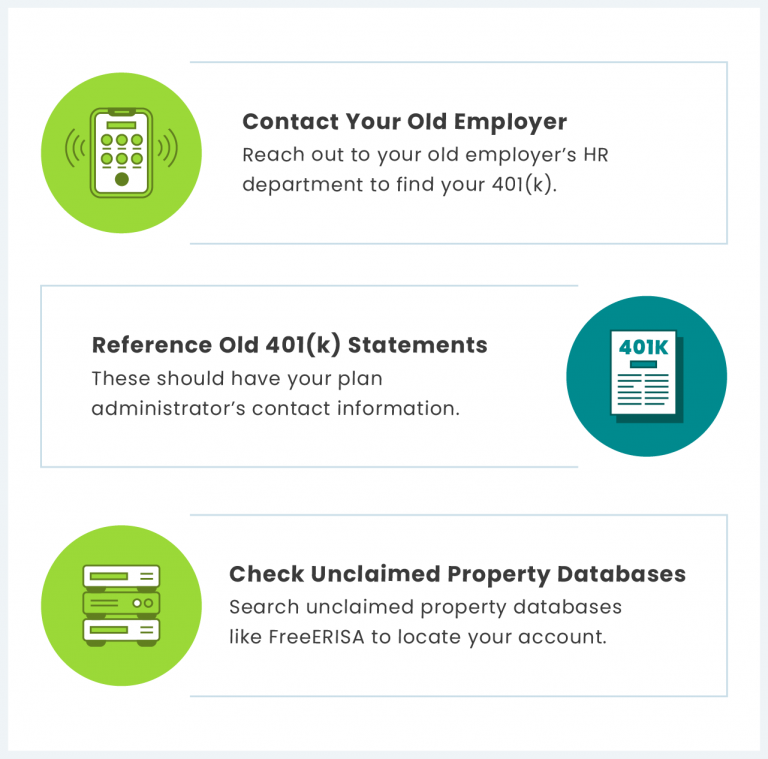

Contact Your Old Employer

When you can’t locate an old 401(k), your prior employer is the first entity you should contact. Reach out to human resources and they should be able to point you in the right direction.

Be prepared to provide the dates you worked for them, your full name and your Social Security number.

Note that if there was more than $5,000 in your 401(k), your funds are likely to still be in your old workplace’s account. If your balance was $1,000 or less, however, it’s possible that your employer sent a check for the total amount to your last known address.

Reference Old 401(k) Statements

If you’re having trouble contacting your employer or they no longer exist due to bankruptcy or an acquisition, locate your old 401(k) statements. The statement should have the contact information for your plan administrator, and you can call them directly to inquire about your funds.

Check Unclaimed Property Databases

If you’re still unable to locate your plan, try searching for it via unclaimed property databases. Keep in mind that you’ll want to have your name, Social Security number, employer name and the dates you worked for your former employer at the ready.

- FreeERISA:

- FreeERISA will let you know if your former employer rolled your old 401(k) funds into an IRA.

- The National Registry:

- The National Registry allows you to use your Social Security number to search for your unclaimed retirement accounts.

- U.S. Department of Labor:

- Search the DOL’s abandoned plan database using your employer’s name.

- Pension Benefit Guaranty Corporation:

- If you had coverage under an old pension plan, the PBGC can help you locate your unclaimed plan.

Some databases worth searching include:

Before you sift through these databases, it’s a good idea to verify that you contributed to a 401(k) at your old job in the first place. You can see any amounts contributed to your 401(k) by referring to Box 12 of your W-2 from when you worked for your former employer.

What To Do With an Old 401(k)

Once you’ve found your old 401(k), it’s important to make sure you don’t lose your funds again. If you invest your money in the right places, you could set yourself up for an early retirement.

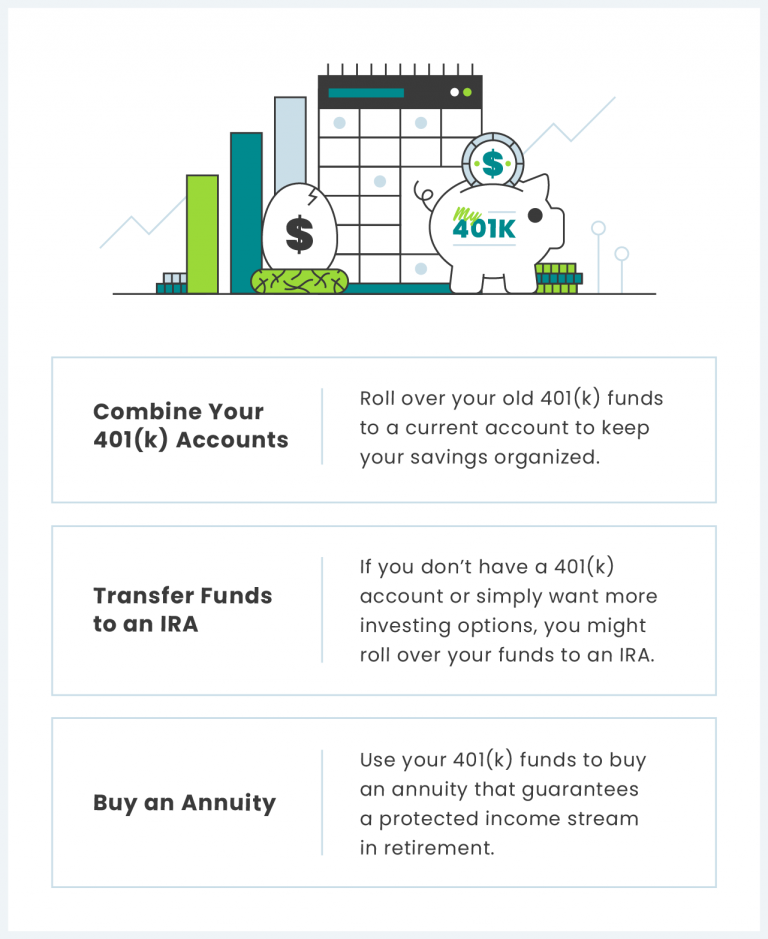

Combine Your 401(k) Accounts

Having multiple 401(k) accounts across multiple employers can make it difficult to keep track of your retirement savings. If possible, you may want to take the funds from your old account and combine them with the 401(k) you have at your current employer.

To see if this is an option for you, contact your HR department. If your plan allows for it, then you can choose to transfer your funds with a direct or indirect rollover.

For direct rollovers, you’ll fill out a form and your former plan administrator will transfer the funds for you. If you decide to do an indirect rollover, your plan administrator will send you a check for your old 401(k) account funds and you’ll place the money in your new account.

Transfer Funds to an IRA

Another way to protect your retirement funds is to transfer them into an individual retirement account (IRA). Like the process above, you can transfer funds from your 401(k) to an IRA via direct or indirect rollovers. If you don’t already have an IRA, you can open one online or through the brokerage of your choice.

While 401(k)s often offer higher permitted contributions and employer-matched contributions, IRAs typically offer more investment options.

Before opening a new account, check out our IRA guide to find out which type is best for you.

Invest in an Annuity

If you’re looking for long-term financial security and tax-deferred growth, you may want to invest your 401(k) funds into an annuity. Annuities are a great way to create a consistent stream of protected income for retirement. Like the two options above, you can typically roll over funds to an annuity.

Different types of annuities might be right for you depending on your timeline for retirement. Before you invest, make sure to research all of your options.

Tips To Prevent Future Loss

Once you have an idea of where all your retirement funds are, it’s important to keep tabs on your account.

- Be Proactive:

- When you change jobs, move funds as you go instead of waiting.

- Monitor Your Funds:

- Schedule a time at least twice a year to check on your 401(k) account balance and make sure that it’s on track with your retirement goals.

- Organize:

- Save your 401(k) statements and be sure to record any important account information in a secure place.

Here are some helpful tips to keep track of your 401(k):

As you invest in your retirement, remember to evaluate your risk tolerance and regularly check in on your accounts to make sure you’re on track to retire.

The last thing you want is to lose previously invested money that’s sitting in your old 401(k) account. To find your 401(k), contact your former employer or search through unclaimed property databases. Once you’ve secured your old funds, keep tabs on its location so you don’t lose your money again.

You may even want to use your funds to buy an annuity so that you have a guaranteed stream of income down the road.

For more information on saving and investing for retirement, check out our infographic below.