The sooner you begin saving for retirement, the longer your money has to appreciate and grow. However, knowing exactly how to save for retirement at a young age and at other stages of life can be overwhelming if you don’t know where to start. Look through this guide to learn what you can do during each decade of your life to prepare for your retirement years.

How To Save in Your 20s

Because of the time value of money, which is the idea that money can grow through interest, saving earlier in your life increases the amount of time your investments work for you, which can leave you with more funds to live off of when you retire.

At this stage of life, it can be tempting to focus on paying off debt, making fun purchases or spending money on inconsequential things. However, consistently setting money aside for retirement is one of the best gifts you can give yourself in the long run. Follow the tips below to get started.

Choose Your Retirement Account(s)

There are a variety of retirement accounts to choose from. This can make navigating through the benefits, returns and tax considerations difficult, particularly if you have no experience with investing.

Learning as much as you can about a few of the different accounts available to you by talking with financial professionals or reading books written by experts can help you understand which option is best for you. While there are many types of retirement accounts, you’re likely to hear about the four main ones most often:

- 401(k)

- This is an employer-sponsored retirement account, which means you’ll only have access to it through an employer. Many companies also match the amount you contribute up to a certain percentage. Depending on the type of account you have, you’ll either pay income tax when you withdraw the funds once you’re 59 ½, or you’ll pay taxes on the money before it enters your 401(k) account. You can contribute up to $22,500 to this account in 2023.

- Traditional IRA:

- Individual Retirement Accounts (or IRAs) often have greater limitations than 401(k) plans. You can only contribute $6,500 for 2023, however, IRAs are not employer-sponsored. You won’t pay taxes on Traditional IRA contributions until withdrawing the funds after you turn 59 ½.

- Roth IRA:

- Unlike a traditional IRA, contributions made to a Roth IRA are taxed before entering the account. When it’s time to begin withdrawing your funds after 59 ½, no taxes will be deducted because they have already been paid.

- SEP IRA:

- Simplified Employee Pension IRAs were created with entrepreneurs, small-business owners and self-employed individuals in mind. This is a type of traditional IRA that allows those previously mentioned and their employees a chance to save for retirement.

Save Consistently

Getting in the habit of saving isn’t the most enticing thing to do when you’re fresh out of college and earning your first real paycheck. However, the sooner you learn how to automate your savings, the easier it will be to put money away for retirement.

Build an Emergency Fund

An emergency fund acts as a safety net if you were to lose your income. Three to six months’ worth of savings is a typical recommendation; however, you can increase this as you feel necessary. These expenses include your rent or mortgage payment, cost of food, debt payment and anything else necessary for survival.

It can be helpful to dedicate a specific savings account for this money so it’s not mixed in with your monthly spending money. This will eliminate some of the temptation to spend it on non-emergency expenses like dining out or shopping.

How To Save in Your 30s

By 30, you’re likely in a chosen career path and have a sense of your financial direction. You may also have a small amount of retirement savings built up. If you’re not in this position, however, you have time to work on saving for your later years.

Savings benchmarks can help you determine if you’re on track or need to play a little catch-up. Experts recommend having anywhere from one to one-and-a-half times your salary saved by age 35. Below are a few ways you can prepare for retirement while in your 30s.

Increase Your Emergency Fund

As you age and your life changes, your emergency fund should follow suit. Having a sufficient amount of money in your emergency fund will allow you to fall back on something other than retirement savings if you lose your income.

Getting married, having children or moving to a more expensive home are all things that may require you to increase these savings. Rather than putting your retirement savings on hold to increase these emergency funds, consider picking up a side hustle or passive income opportunity to supplement your earnings and thus increase your emergency stash.

Increase Your Retirement Savings

While it may seem easier said than done, there are a few things you can start doing in order to increase your monthly retirement contributions:

- Cut down on spending

- Stick to a budget

- Stop overspending on nonessentials

- Eliminate debt

- Invest more aggressively

- Pick up a side job or side hustle

- Ask for a raise

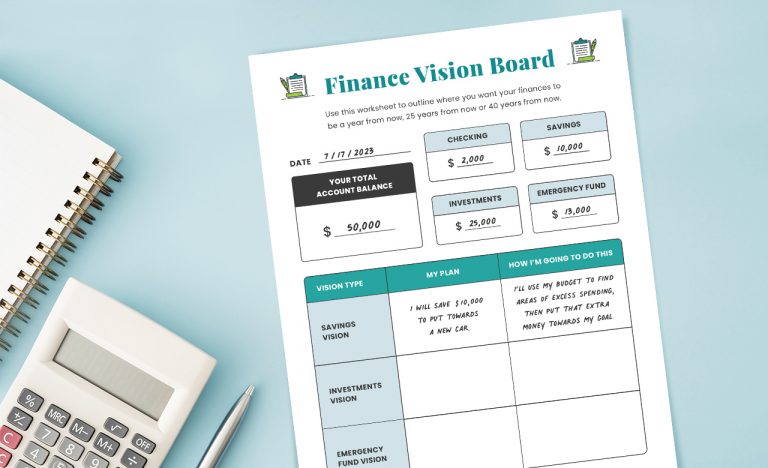

Use this side-hustle savings tracker to view your progress as you go.

How To Save in Your 40s

A standard benchmark for your retirement savings at 40 is to have three times your annual income saved. This is a time when promotions and salary increases are often present, so don’t be afraid to increase your saving goals as well.

Reevaluate Your Goals

Reevaluating goals in your 40s can help you identify areas of improvement while you still have time to make adjustments. By this time of your life, you should have a clear idea of your financial trajectory and if you’re likely to reach retirement when you plan to.

If you’re not sure where you stand, talk with your financial advisor. They should be able to pinpoint weak spots in your financial plan, what goals you’re close to accomplishing and how you can utilize your money most effectively before you retire.

Take Risks With Your Investments

If you’re planning to retire closer to 60 or 65, you still have around 20 years to recover if your investments perform negatively. Having a diversified portfolio — or a mix of investments split between different risk levels — can also help mitigate the risk of losing all your funds if one or two areas of your financial plan perform badly.

Likewise, if your investments in more aggressive or higher risk accounts perform positively, you’ll be more prepared for retirement. Don’t get too conservative with your investments in your 40s. You may be getting somewhat closer to retirement, but you’re still many years away.

How To Save in Your 50s

By this point in your life, you should have at least six times your annual salary saved for retirement, if not more. This is also a good time to evaluate your health and how you anticipate it will be in the coming years. By considering this factor now, you’ll be better prepared for the years ahead.

Take Advantage of Catch-Up Contributions

Catch-up contributions are a way for those with limited retirement funds to invest additional money into retirement accounts each year. Limitations set on accounts vary, with the 401(k) limit normally at $19,500 per year and the IRA limit at $6,000. If you are 50 or older and behind on retirement savings, you are legally allowed to contribute an additional:

- $6,500 to a 401(k) and

- $1,000 to an IRA

This means that each year you can contribute a total of:

- $26,000 to a 401(k) and

- $7,000 to an IRA

By maxing out these contributions, you’ll have more money collecting interest in the years before you retire, as well as more income to live off of when it’s time to withdraw your funds.

Prepare for Future Medical Costs

Consider your current health and how it may be 10 or 15 years from now. Understanding the funds you’ll potentially need for health care costs down the road can give you a more accurate depiction of your expenses during those retirement years.

You’ll also want to take into consideration the cost of living if you anticipate that you’ll someday need additional help with everyday activities. According to the Genworth Cost of Care Survey, the median cost of in-home care services and assisted living facilities amounts to roughly $4,500 a month, while the median cost of a nursing home reaches upwards of $8,000 a month. Make sure you’ll have enough retirement savings to afford these services if the need arises.

How To Save in Your 60s

When you hit age 60, it’s recommended to have eight times your salary saved. However, some financial advisors recommend having up to 11 times your annual salary saved. This amount greatly depends on how aggressively you invested your money in the previous decades and how early you began saving.

Prepare for Your Retirement Budget

Now that retirement is on the horizon, it’s time to prepare for what’s ahead. This includes creating a practical retirement budget for when you stop working. This budget should outline your estimated monthly expenses like food and living space, as well as your “fun money” that is used for non-essential expenses.

If you feel your retirement lifestyle will be less comfortable than your current circumstances, consider living off of your projected retirement budget now. This will help you adjust and be prepared for the realities of your post-work life.

Likewise, if you find that your retirement lifestyle doesn’t meet your expectations, don’t be afraid to work longer or pick up a part-time job after you retire to supplement your retirement income.

Delay Social Security Payouts

To receive the full amount of Social Security benefits, you need to wait until full retirement age, or age 67. While you can begin receiving benefits as early as 62, doing so reduces your benefit each month by about 30 percent of the amount you would receive if you deferred your payments until full retirement age. On the other hand, benefits increase by as much as 8 percent each year you delay receiving the benefits after age 67.

Plan Your Retirement Fund Distribution Strategically

Pulling money out of retirement accounts strategically can increase your savings and prevent you from losing hard-earned money. There are a few ways to do this but one of the most common ways is by purchasing an annuity.

An annuity is a contract between you and an insurance company. You pay the company a lump sum, and in turn, they send you periodic payments of a certain amount. This can help eliminate overspending and potentially increase earnings from your saved money.

Conclusion:

Knowing how to save for retirement is important in each phase of your life. There are actions you can take in your 20s, 40s and even 60s as you prepare for your later years. Utilizing retirement accounts when you’re young can give your money time to appreciate. Likewise, taking advantage of catch-up contribution options in your 50s will help you get on track if you’re behind.

Understanding how to plan for retirement at every stage of life will help ensure you have the retirement lifestyle you want when you’re done working. If you’re unsure how to best act on any of the topics mentioned above, talk with a financial advisor who can answer your questions and help you set up an ongoing retirement plan that shifts as you age.

Not sure how to keep track of your progress? Use the worksheet below to track your wins and losses each month of the year.