With the variety of types, riders, payout options, interest-crediting methods and tax treatment, it’s no wonder people’s eyes begin to glaze over at the mention of annuities.

It is true that annuities can get complicated as a result of their flexibility. It is also true that annuities are technically contracts — which means they’re filled with legalese. And when insurance companies combine this specialized “lawyer’s language” with complex actuarial formulas and contract-specific clauses, it can be daunting to the general public.

But this shouldn’t prevent you from accessing all the information you need to make informed decisions about your finances and retirement.

All annuities are tax-deferred. You will not pay taxes on principal or interest until the money is disbursed or withdrawn.

How do I know which annuity is best for me?

Our financial experts can help you choose the best annuity to fit your goals.

Compare Annuity Benefits, Not Annuity Features

When we talk about all the different types of annuities, we’re referring to the available features. You’ll be presented with options regarding premiums, payout schedules, investment types, add-on features and death benefits. But the first choice you must make — and a good financial advisor will lead with this — is your objective.

Every financial instrument and investment vehicle you include in your portfolio should serve your individual long- and short-term goals. Just as a restaurant can’t satisfy every diner with one dish, an insurance company can’t serve every client with one annuity product.

If you’re allergic to gluten, you’re not going to order the lobster ravioli — unless the waiter assures you that the pasta is gluten-free. This is good news for you, but not as helpful to your date, who’s allergic to shellfish.

In other words, if you know what you want and you’re realistic about your limits, you can, with the help of a knowledgeable expert, narrow down your options and make a decision that’s right for you.

The Most Common Annuity Objectives

Stan Haithcock discusses the PILL strategy in great detail on his own website and in interviews and publications across the financial and insurance field.

PILL stands for:

- Premium protection

- Lifetime income

- Legacy (or bequests)

- Long-term care

These objectives are common among retirees and people nearing retirement, and annuities are uniquely suited to solve for them.

PILL represents the origin of annuities as insurance products intended exclusively to provide lifetime income for retirees.

The annuity industry has grown to accommodate clients with other objectives, offering various riders and strategies that solve for a range of goals, including minimizing taxes, managing required minimum distributions, extending death benefits and growing capital.

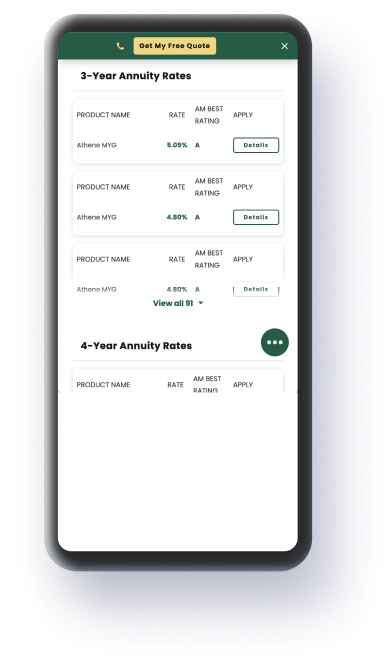

Purchase an Annuity Today

Annuity Classification

Annuities can be classified by several characteristics. And they are often classified by more than one, which can lead to confusion.

For example, annuities are classified by their underlying investments, with fixed annuities based on bonds and other fixed-income products and variable annuities based on subaccounts that may include mutual funds, money market funds and other investments. A third investment type, indexed, functions as a hybrid with income payments determined by a stock index. Indexed annuities offer upside potential with protection against market risk. This is your gluten-free lobster ravioli.

Fixed annuities are the least complicated and least expensive type of annuity. They’re intended to provide a guaranteed income stream with fixed payment amounts. They are reliable and predictable, which makes them a great fit for those seeking the benefit of income security without regard for capital appreciation.

Conversely, variable annuities offer the potential for growth tied to the market but lack the reliability and security of fixed annuities. Variable annuities are more suitable for people who are willing to trade the predictability of a guaranteed income stream for the possibility of capital appreciation.

In this case, the gluten allergy from our restaurant analogy is the equivalent of your risk tolerance. If you know your goal is income security in retirement, then your risk tolerance — the degree of volatility you’re willing to bear from the annuity — is naturally going to be low. This is your limit, and it should dictate your decision to purchase a fixed annuity.

But the investment type isn’t the only characteristic that determines how a specific annuity works.

Annuities are classified by one of more of the following contract provisions:

| Investment Type | Fixed | Variable | Indexed | |

| When Income Benefits (Payments) Begin | Immediate (within 1 year of contract start) | Deferred (at a future date) | ||

| When Annuitization (Conversion of Premium to Income Stream) Begins | Immediate (at the time the premium is paid) | At a future date | ||

| Primary Purpose | Income generation | Tax-defered growth | ||

| Payout Commitment | Fixed Period | Fixed amount | Lifetime | Joint lifetimes |

| Tax Status | Qualified | Non-qualified | ||

| Premiums | Single | Flexible (multiple) |

The periodic payments, which are referred to by insurance companies as “income benefits,” may begin within a year of the contract purchase date — immediate — or at or at a date set in the future — deferred. Be aware that the terms “deferred” and “immediate” may also refer to annuitization.

For example, a deferred income annuity is technically an immediate annuity with a deferred payout schedule.

In an excerpt from his book “Safety-First Retirement Planning: An Integrated Approach for a Worry-Free Retirement (The Retirement Researcher Guide Series),” annuity expert Dr. Wade Pfau recognizes the ambiguity, stating that “[the label ‘deferred immediate annuity’] is not really a contradiction because the immediate part of the name refers to immediate annuitization, and the deferred part of the name refers to the delay in starting the annuitized payments.”

Income annuities are immediately annuitized regardless of when payments begin, which means the premium is converted to a stream of periodic payments at the time the premium is paid.

Some people choose not to annuitize their contracts at all. For them, the purpose of the annuity is safety and growth, as opposed to guaranteed income. These people prefer to have control over the funds and are willing to sacrifice the security of a payment stream they can’t outlive.

For those who choose to annuitize their annuities, there are the decisions of when to begin the payout phase and how long the payments should last. Insurance companies offer the options of lifetime payouts and period certain payouts. Lifetime payouts may be categorized even more precisely as single-life or joint-life payout options.

As always, never make a financial decision without examining it through the lens of a holistic plan, and when in doubt, talk to a trusted, reputable financial advisor about your long-term goals and your reasons for considering buying an annuity. Ask your advisor to break down any complicated concepts to ensure that you understand not only the product, but also how it enhances your portfolio and your life.