Key Takeaways

- The annuity exclusion ratio formula helps you calculate the percentage of annuity withdrawals you’ll have to pay taxes on.

- The insurance company you purchased the annuity from should also provide the exclusion ratio.

- The portion of the withdrawal attributable to earned interest is subject to tax.

If you used proceeds from an IRA, 401(k) or other tax-deferred retirement account, the exclusion rate does not apply, and your annuity payments will be fully taxable.

What Is an Exclusion Ratio?

When you purchase an annuity, you pay an initial lump-sum premium to the insurance company to fund the policy.

Once you begin receiving payouts from your annuity, a portion of each payment is not subject to income tax because it is considered a return of your principal. Since this principal was paid for with after-tax money, the IRS won’t tax you on it again.

The IRS sometimes refers to the exclusion ratio as the General Rule or exclusion percentage in tax publications.

However, this is only part of the check you receive each month, quarter or year from the insurance company. Over the years, your initial principal is earning interest, and that money is taxable. Think of it as a new earning. Likewise, gains made within a variable annuity’s investment subaccounts are also taxable. Essentially, any money that has not been taxed will have taxes deducted when it is distributed.

Your insurance company should provide you with your contract’s monthly exclusion ratio.

Example: How the Exclusion Ratio Works

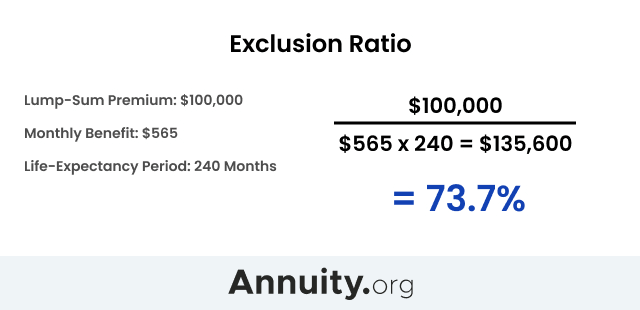

Let’s assume you purchase an immediate annuity for $100,000 when you are 65 years old.

The insurance company determines that you have a 20-year life expectancy and promises to pay you $565 a month for the rest of your life. Your initial $100,000 investment is expected to grow to $135,600 over those 20 years.

Now, the insurance company must spread your initial $100,000 principal over 20 years. This would equal about $417 a month — but your contract entitles you to $565 a month.

The IRS does not tax $417 out of your $565 monthly payment because it considers this a tax-free return of your original principal. The insurance company is basically returning portions of the after-tax money you already gave them — plus interest.

Therefore, you will be responsible for paying ordinary income tax on only $148 of your $565 monthly payout.

This means the exclusion ratio is 73.7%, because this is the percentage excluded from taxes. The remaining 26.3% is taxable.

How are annuities taxed?

Learn how an investment today can provide guaranteed income for life.

Special Considerations

There is an important detail to keep in mind in the previous example: You have a 20-year life expectancy.

But what if you live longer?

You don’t have to worry about running out of money because the annuity guarantees you a steady stream of income for life. However, you will pay higher taxes if you surpass your life expectancy.

By the time you are 85 years old, you have essentially recouped your entire original principal. From now until you die, all your payments are fully taxable. Also, the National Association of Insurance Commissioners notes that some states may levy a tax on the value of your annuity when you annuitize. This is called a premium tax, and the insurer will subtract this amount from your total contract value.

Another important consideration is that exclusion ratios apply only to nonqualified annuities.

If you use tax advantaged income, such as an IRA or 401(k) retirement account, then you will pay taxes on all the monthly payments you receive. After all, this money is tax-deferred, not tax-free.

Fixed Income Annuities vs. Variable Annuities

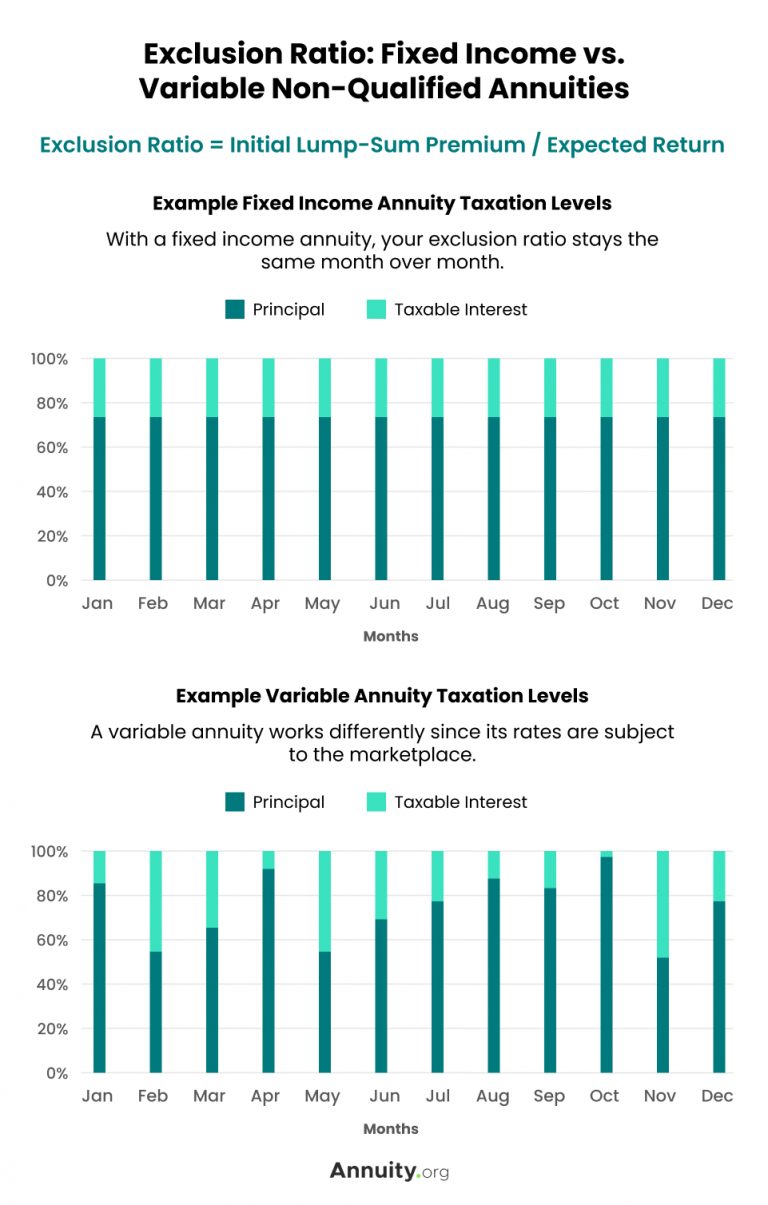

Calculating the exclusion ratio of a fixed income annuity is easy because the insurance company pays you the same amount of money with each distribution, according to your contract.

Therefore, the exclusion ratio should never change.

While variable annuities follow the same basic exclusion ratio formula, a couple additional rules apply.

These financial products include subaccounts invested in the marketplace. As the name implies, variable annuity payouts vary based on market conditions.

The taxable portion of your variable annuity is calculated in the same manner as a fixed income annuity, by multiplying the number of total monthly payments by the dollar amount of each monthly payment, then dividing that figure by your initial lump-sum premium.

However, if your payouts increase because stocks are performing well, you won’t get a bigger tax break.

Let’s consider to our earlier example. You pay a $100,000 premium and have a 20-year life expectancy. About $417 a month is tax-free.

Unlike our earlier example though, a variable annuity does not offer you the same $565 static monthly payment as the fixed annuity did. Some months you may receive $1,000. Other months it may be $750.

Regardless, no matter how large your variable annuity payments become, only $417 a month is tax-free because this amount is still the return of your initial principal over 20 years.

However, if the amount you receive from a variable annuity is less than the tax-free amount, you can apply the leftover tax-free amount to future payments.

For example, one month the market performs poorly, and your variable annuity earns only $300. But up to $417 a month is tax-free. This means you can roll over the tax savings on the extra $117 by refiguring the tax-free amount.

Be aware that the IRS has a procedure for refiguring your tax-free amount. You must file a statement with your tax return that includes the annuity start date, your age on that date, your original premium amount, and the total amount of tax-free money you have received.

Join Thousands of Other Personal Finance Enthusiasts

Annuity Exclusion Ratio FAQs

To calculate a fixed annuity’s exclusion ratio, multiply the monthly benefit by the number of months left in your life expectancy. Then divide your lump sum premium by the number you just calculated. This will give you your exclusion ratio (the percentage of your withdrawal you do not have to pay taxes on). Subtract that percentage from 100 and it will tell you what the taxable percentage is.

Variable annuity taxation rates may be affected by market conditions. If your variable annuity performs below the exclusion ratio, you can roll over the amount and declare it a loss on your taxes.

You can face steep tax penalties for an early annuity payout. An early withdrawal could throw out the exclusion ratio altogether, resulting in you having to pay taxes on all withdrawals until the annuity is drawn down to the amount of the original principal you paid into it.