Budgeting for retirement is similar to budgeting at any other stage of life. The steps are the same, but the income sources and allocation of money are different.

For example, you may not be collecting a paycheck anymore, but you are probably collecting Social Security and taking distributions from your 401(k) plan, IRA, annuity or other retirement savings vehicle.

Steps for creating a budget:

- Collect all financial records.

- Identify your fixed and variable expenses.

- Categorize your expenses as essential or nonessential.

- List your nonrecurring expenses.

- Identify all sources of retirement income, including Social Security, retirement savings distributions and annuity payments.

- Calculate the ratio of essential to nonessential expenses.

- Compare these expenses to your income.

- Determine whether you need to make adjustments in your spending.

- Consider your personal goals and ideal retirement lifestyle and adjust accordingly.

What to Consider When Budgeting for Retirement

The average retirement budget is based on income sources and expense categories that differ slightly from income and expenses during earlier stages of life. For example, the Center for Retirement Research at Boston College reports that “the average household spends 30% of its income on out-of-pocket medical expenditures near the end of one spouse’s life, with lower-income households spending an average of 70%.”

Factors that Affect Retirement Income

Financial risks for retirees are exacerbated by inflation, changes to Social Security and the decline in defined benefits plans.

Planning for retirement early can make budgeting at this stage of life easier. If you started saving for retirement when you entered the workforce, or shortly thereafter, your budget won’t feel as constrained as it might otherwise.

If, however, you don’t have much in savings, you’re not alone. According to the Center for Retirement Research (CRR), “nearly a third of all households nearing retirement have no retirement savings.”

A realistic budget is indispensable for people without adequate savings.Start with a complete picture of your estimated income during retirement. It will most likely not reflect your pre-retirement income, so this step is crucial to setting up a reliable retirement budget.

Account for any factors that may affect your income, including:

- Inflation

- Rate of return on investments and savings accounts

- Annuity payments

- Pension distributions

- Retirement date

- Age at retirement

- Taxes

- Passive income sources, such as rental property or book royalties

- Earnings from part-time, consulting or contract work

- Social Security benefits

Once you have a good idea of how much money will be flowing in each month, consider your personal needs and lifestyle goals.

Ask yourself the following questions:

- What do I want to do with my retirement years?

- What parts of my current lifestyle am I unwilling to change or give up?

- How much financial support will I provide for my children and grandchildren?

- What kind of inheritance do I want to leave behind?

- Is it important to me to stay in the home I currently live in?

- How do I cope mentally and emotionally with being alone?

Retirement Expenses

According to CRR researchers, married retirees ages 53 to 64 spend 77% of their income on housing, health care, food, clothing and transportation. These basic needs account for 79% of the income of single retirees ages 53 to 64.

Aside from the basic fixed expenses, retirees must plan and budget for taxes, any intended bequests, entertainment and travel and unexpected expenses, referred to as “shocks,” that can’t be accurately estimated.

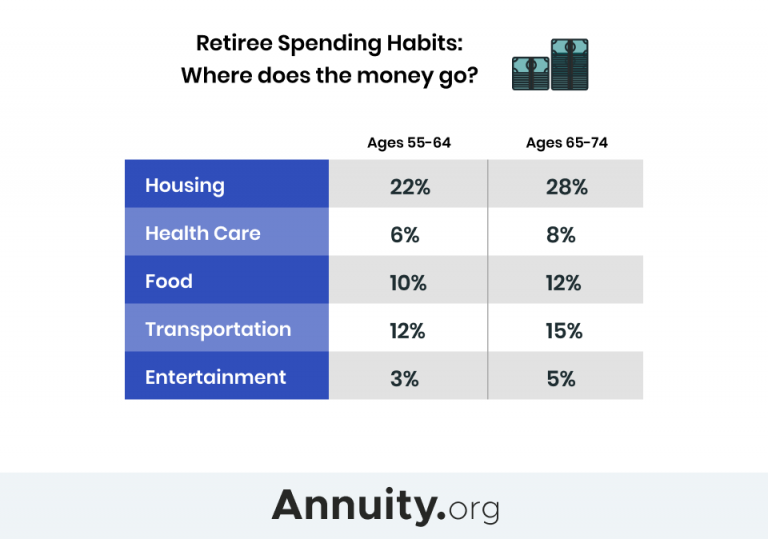

The Bureau of Labor Statistics published a breakdown of expenses in retirement across three age groups: 55–64, 65–74 and 75 and older. For all three age groups, housing was the highest expense as reported by the Consumer Expenditure Survey.

Average Annual Expenses for People Ages 55 and Older

| Expense | Ages 55 to 64 | Ages 65 to 74 | Ages 75 and older |

|---|---|---|---|

| Housing | $23,007 | $20,078 | $17,098 |

| Health Care | $6,093 | $6,966 | $7,123 |

| Food | $8,419 | $7,052 | $5,669 |

| Clothing | $1,742 | $1,157 | $737 |

| Transportation | $10,936 | $8,356 | $5,392 |

| Entertainment | $3,700 | $3,412 | $2,119 |

The analysis also indicated that health care expenses increase with age. When you combine the health problems that occur naturally as you age with the probability that your social network will inevitably shrink over time, the need to budget for entertainment becomes more obvious than ever.

The National Institute on Aging has found that social isolation and loneliness are linked to an increased risk of high blood pressure, heart disease, obesity, weakened immune systems, anxiety, depression, cognitive decline and Alzheimer’s disease.

Taxes & RMDs

Retirees pay taxes on Social Security benefits and withdrawals from 401(k) plans and IRAs. Annuity distributions are also taxed, although the portion that is taxed depends upon whether the annuity is considered qualified or nonqualified.

When you are creating your retirement budget, make sure you take into account the state and federal income taxes you will be required to pay.

And if you plan to relocate to another state when you retire, consider the state income and property taxes, as well as sales tax and estate taxes.

Only seven states fully tax military retirement pay.

Required minimum distributions are another factor that can be overlooked when creating a budget for retirement. You will have to pay taxes on these IRS-mandated distributions, and failing to take them will result in a penalty.

Can You Retire Comfortably?

Shocks and Other Considerations

In addition to added financial strain, shocks in retirement take a toll on a person’s mental and emotional state. It can be difficult to make decisions when faced with a shock such as the death of a spouse, divorce, a disability or unavoidable home repairs, so having money set aside for such an occurrence can have an impact not only on your financial well-being, but your emotional well-being, too.

Budgeting for shocks is essentially the same thing as having an emergency fund, which most financial experts advise should equate to three months’ salary for working individuals.

According to researchers from the Urban Institute, “more than two-thirds of adults age 70 and older experience at least one negative shock over a nine-year period.”

Common shocks among retirees include:

- Home repairs and maintenance

- Major dental expenses

- Extraordinary medical expenses

- Widowhood

- Divorce

- Investment losses

Source: Society of Actuaries

Higher Health Care Costs

Health care is one of the most significant spending adjustments retirees have to make. Representing 16 percent of spending by Americans ages 65 to 74, health care is the second highest cost for retirees. Thus, the spike in medical expenses during retirement is considered a shock.

Very few employers offer insurance coverage for retirees, which means the cost of health insurance is passed on to the employee upon retirement. According to Medicare.gov, even if your former employer offers health benefits to retirees, it’s not required and they can change or cancel your coverage at any time.

Furthermore, Medicare doesn’t cover all health services. For example, the program doesn’t cover most dental care.

A 2022 brief published by the Center for Retirement Research at Boston College examined how much money older Americans spend on uncertain health costs. The author concluded that “lifetime health care spending by retirees above and beyond predictable premiums is high and uncertain.”

Long-Term Care

Long-term care is not covered by Medicare, and long-term care insurance can be costly.

The financial ramifications for needing long-term support can be devastating. A study cited in a brief from the Office of the Assistant Secretary for Planning and Evaluation revealed that wealth drops drastically for people who require nursing home care.

According to the brief, “over a nine-year period median household wealth grew 20% for married people ages 70 and older who did not receive nursing home care, but fell 21% for their counterparts who received nursing home care; for single people who received nursing home care, median household wealth fell 74%.”

Ideally, Americans should consider the likelihood of needing long-term care before they retire because a shock of this magnitude is extremely difficult to overcome. An annuity with a long-term care rider can provide some security at an affordable price.

But regardless of whether you have savings to cover long-term care, you’ll want to incorporate this into the emergency savings category of your retirement budget.

Providing Financial Support for Adult Children or Other Family Members

In April 2022, a Savings.com survey found that half of all parents with adult children are still providing some form of financial support, and these parents are giving their children an average of $1000 a month.

Expenses Parents Cover for Their Adult Children

- Cell phone

- Rent

- Groceries

- Student loans

- Medical bills

- Car payment

- Wedding

- Dining out

- Mortgage

The Atlantic published an article in 2019 that cited statistics from AARP, which revealed that grandparents in the United States provide financial support for their grandchildren’s education, living expenses and medical care.

In the United States, 53% of grandparents pay for their grandchildren’s education.

And while you may be more than happy to provide whatever financial help you can to your children and grandchildren, financial experts warn that dipping into retirement savings to do so puts you at risk of depleting funds for your own living expenses. This, in turn, puts you at risk of becoming a financial burden to them in the future.

You can mitigate some of this risk by budgeting for these potential expenses. Be realistic about what you can afford to give.

Economist Teresa Ghilarducci told The Atlantic that grandparents often think they have the means to provide for their children and grandchildren but, in reality, they aren’t prepared for increased medical bills and long-term care. And they don’t anticipate that “costs for house cleaning and personal services are likely to go up as they become more fragile.”

The Nuts & Bolts of Creating a Retirement Budget

Budgeting programs and retirement budget worksheets can streamline the process of planning and tracking expenses. Some personal budgeting software applications now allow you to link to your bank accounts, automatically synching your transactions. And many offer financial and budgeting advice.

But number crunching and data entry are only part of the budgeting process. These tools are only as good as the information the user feeds them.

This means you’ll have to do some critical thinking — and possibly some soul searching — before you put these tools to work.

Identify All Fixed and Variable Expenses

These expenses generally recur monthly, annually or quarterly. Some — for example, groceries — may even occur on a weekly basis.

To get a holistic picture of your finances from which you can create your budget, collect all financial statements — paper and electronic. You may find it helpful to get a copy of your credit report to ensure that you aren’t forgetting any open accounts. This way, you can see all your outstanding debt in one place, which you will need to include in your budget.

Calculate the average of the last 6 to 12 months for variable expenses. Variable expenses are those that fluctuate in amount but are necessary, or essential, expenses. For example, your electric bill is a recurring essential expense that fluctuates in amount based on your power use.

Categorize Each of Your Expenses as Essential or Nonessential

Essential expenses include categories such as food, clothing, housing, utilities, transportation, health care, taxes, insurance premiums and auto registration.

Nonessential expenses, also referred to as discretionary expenses, may be fixed — as is the case with cable, streaming services, memberships and subscriptions — or variable.

Convert essential expenses that occur on a non-monthly schedule to monthly amounts. For example, if your homeowners insurance premium is billed quarterly and your payments are $300, budget $100 per month for that expense.

Anticipate One-Time Expenses

Nonrecurring expenses include vacations, weddings and certain gifts or charitable giving. You’ll need to estimate these expenditures and include them in your budget.

Calculate the Ratio of Essential to Nonessential Expenses

The percentage of your income that goes toward your essential expenses will, of course, be higher than the percentage that goes toward discretionary spending. The question is: How much higher is it?

If your essential expenses are so high that you have no money left at the end of the month to enjoy your life, it may be time to consider downsizing.

Identify All Sources of Retirement Income

A large portion of your income in retirement will come from Social Security, pensions, 401(k) plans and IRAs.

In addition to these income streams, you may have annuity payments, earnings from part-time work or passive income streams, such as real estate or investment dividends.

Include it all in your budget.

Compare Expenses to Income

This is where the rubber meets the road. If your spending exceeds your income, you’ll have to make adjustments. If you have the ability to generate more income, perhaps by taking on part-time or consulting work, you can offset some of your costs. Otherwise, it’s time to assess your expenses and start cutting.

Align Adjustments with Your Personal Retirement Goals

Where you choose to adjust your spending is a personal decision. Only you know what’s truly important to you, and only you should decide what to sacrifice and what you’re willing to sacrifice for.

If you need guidance, enlist the help of a trusted financial expert. If he or she doesn’t listen when you describe your goals and your ideal retirement lifestyle, find a professional who does.

How & Where to Adjust Spending

Before you can create a plan for adjusting your expenses in retirement, you need to know where your money goes now. Once you have a starting point, you can review the essential categories where you predict an increase in spending, such as health care, and balance them against the costs that will naturally decrease, such as transportation and dry cleaning — or any other work-related expenses.

Then examine your nonessential categories. What are you willing to sacrifice? Do you have memberships or subscriptions you rarely use? Are you paying for services you can get for free? Is there a storage unit full of items that should have been donated or tossed a long time ago draining hundreds of dollars a year from your bank account? These small recurring expenses can add up to a significant chunk of change.

Do a little research to discover senior discounts and entertainment offerings from your public library. You may be able to cancel that Audible subscription and never miss it.

Mortgages and Car Payments

If downsizing is an option for you, seriously consider the benefits of moving to a lower-cost home. Because housing is the largest expense in retirement, your budget would gain a significant boost if you could lower or eliminate your mortgage payment.

If you start planning for it early, you can leverage a biweekly mortgage-payment strategy to lower the interest on your loan. Ultimately, according to experts, “paying your mortgage every two weeks adds one full payment each year (13 payments — based on 26 bi-weekly payments each year, versus 12 monthly payments).”

Car payments are another viable opportunity for cutting costs in retirement. While you may still need a reliable vehicle in retirement, you certainly don’t need to buy new.

Behavioral Economics and Your Retirement Budget

And here is where the soul searching comes in. Why haven’t you cleared out that storage unit yet?

Behavioral economics is the study of how psychology and emotions affect people’s decision-making in regard to their finances.

A study from the Yale School of Medicine noted that hoarders had an increased activity in the regions of the brain associated with conflict and pain. Even if you’re not a hoarder, you may experience some level of discomfort when parting with your possessions.

Experts suggest practicing mindfulness — a state of being actively engaged in the present moment — to identify our reasons for holding on to things that no longer serve us.

The impact of mindful living on your finances in retirement can make it much easier to stick to your budget and cut unnecessary expenses. And as a bonus, it will reduce your stress and anxiety, which may be high as you transition to this new stage of your life.

Using a Retirement Budget Worksheet to Adjust Spending

A retirement budget worksheet can be as high- or low-tech as you’d like. You can create a worksheet using a pen and paper, an Excel spreadsheet or a Google Sheet with the appropriate categories.

You can also use one of the hundreds of interactive retirement budget worksheets offered through banks and investment firms. Your financial advisor may also offer worksheet templates and guidance for completing the worksheet accurately.

The Financial Literacy and Education Commission’s MyMoney.gov offers worksheets and other financial-literacy related resources intended to “strengthen financial capability and increase access to financial services for all Americans.”

If you’d prefer the convenience of automated synchronization for tracking your spending and adjusting your budget as you go, try a personal budgeting software such as YNAB or Mint.