Stock market volatility influences the values of different types of annuities to varying degrees. Certain annuities have a greater potential for gains or losses based on the stock market’s performance. When choosing an annuity, it’s important to select a product that best aligns with your level of risk tolerance at that specific point in your life.

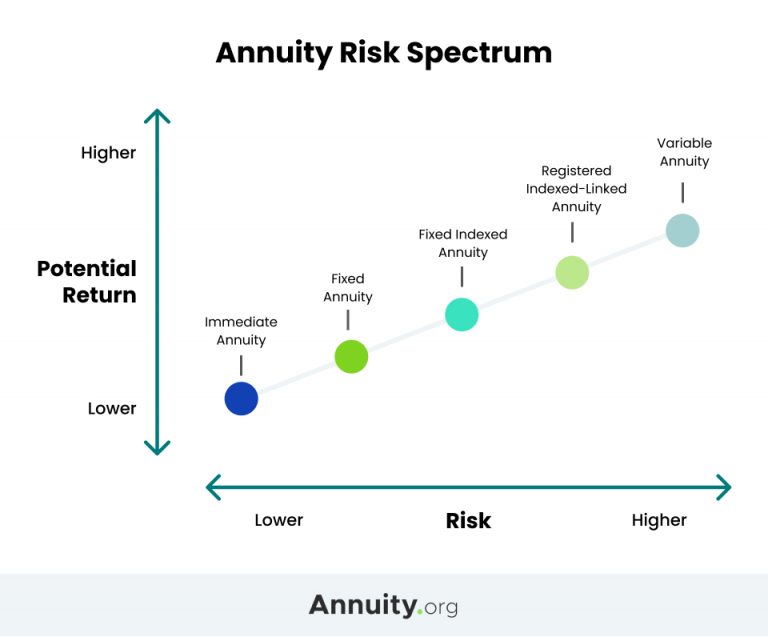

Annuities are insurance products that are best suited for people with a lower risk tolerance or those who want to balance their portfolios with a low-risk, low-return income option. But among the available annuities, buyers will find a range of features and products along the risk-tolerance spectrum.

For example, variable annuities are riskier than fixed and indexed annuities and don’t automatically offer premium protection, but they can provide a fixed income stream for a guaranteed period of time.

Therefore, variable annuities are generally better for people who have a higher risk tolerance and are seeking an income stream in retirement to supplement Social Security.

Factors That Influence Risk Tolerance

There are several factors to consider when assessing risk tolerance.

Time Horizon

According to Investor.gov, “Your time horizon is the number of months, years, or decades you need to invest to achieve your financial goal.”

Risk tolerance can depend on how soon you will need the income stream from the annuity. The younger you are, the more time you typically have to let the money grow. Thus, you can weather market fluctuations better than someone who is closer to retirement.

For example, if you are approaching retirement within the next five years, your shorter time horizon would lower your risk tolerance. If the stock market suffers a downtown, it would be more difficult to recover any substantial losses within a five-year timespan versus 25 years.

Objectives

The goal, or intention, of the investment or annuity will impact risk tolerance — and your savings strategy.

You may have capital appreciation as a goal, or perhaps you wish to balance your portfolios for effective asset allocation.

Retirement planning is likely a priority objective, as you seek to secure a guaranteed retirement income stream.

Proper management of funds could also lead to early retirement. The financial independence retire early, or FIRE, movement has gained popularity among people who aspire to secure an early retirement and financial control.

Personal Comfort Level

Wealthier people with more available capital can afford to take more risk. However, some people who can afford to take on more market risk are not psychologically prepared to do so.

Psychological factors and behavioral economics contribute to the Annuity Puzzle, or uncertainty surrounding financial decision-making. Risk is a balancing act, and some people are more prone to fear and anxiety than others.

Consider how an individual with a “cushion” of extra financial resources would approach risk; would they feel as worried about the risk compared to someone living paycheck to paycheck? The latter would likely feel more stressed about potentially enduring losses.

Levels of Risk Tolerance

Your risk tolerance can vary from year to year and circumstance to circumstance. The risk tolerance levels represent how annuity owners handle uncertain, potentially negative outcomes.

- Aggressive

- Aggressive clients have high risk tolerance. With higher risks, higher rewards are possible. This risk tolerance level is suitable for those who can “ride the wave” of the market over a longer period of time.

- Moderate

- Moderate clients tolerate risk at the medium level. Growth is possible with a relatively protected principal, or original sum of money. This is the “middle of the road” option.

- Conservative

- A low-risk tolerance level is suitable for conservative clients approaching retirement soon. They wish to protect their funds with minimum risk — and minimal growth potential.

Financial advisors assess risk profile through asking clients a series of questions. This risk tolerance questionnaire can include psychological and behavioral-related inquiries to reveal your level of risk tolerance.

Risk Tolerance Questionnaire Example

The National Endowment for Financial Education identifies risk-related questions a financial planner may ask:

- Are you more concerned about losing money or losing purchasing power?

- How much money are you willing to lose?

- How worried do you think you would be in a severe market decline?

- What kind of investments keep you up at night?

- Do you intend to track your investments daily?

- How varied do you want your portfolio to be?

According to the CFA Institute, “Best practice is to use psychometric tools (often questionnaires) that have demonstrated reliability and validity in predicting an investor’s emotional and behavioral tendencies around loss of portfolio value and investing discipline.”

Read More: How to Diversify Your Portfolio

What Is the Difference Between Risk Tolerance and Risk Capacity?

Risk tolerance and risk capacity both refer to the level of risk you must take to reach your financial goals. According to a 2022 article from ATB Financial, your available capital and financial resources impact risk capacity, compared to one’s risk tolerance — or willingness to endure losses.

Risk Tolerance = how much risk you are willing to endure

Risk Capacity = how much risk you are financially able to endure to reach a specific goal

How Does Your Risk Tolerance Influence Your Decision to Buy an Annuity?

Different types of annuities are suited for people with varying levels of risk tolerance. Principal protection and anticipated income take the stress out of the risk, and some annuity types offer higher rewards with stock market success.

All investments have a level of inherent risk, but annuities can be suitable options for individuals who wish to add stability — and a level of predictability — to their financial portfolios.