Portfolio diversification is achieved by mixing different types of investments together in order to reduce risk. Yet an investor can increase expected rate of return and still reduce risk by adding high-risk assets to a portfolio of low-risk assets. The relative proportion of this mix can create the optimal portfolio for any investor — regardless of their objective.

How to Build a Diversified Portfolio

The first step in the process is to determine the optimal asset mix using traditional asset classes:

- Stocks

- Bonds

- Cash

Each of these asset classes has historically earned investors different rates of return. They have also come with varying levels of risk. Over the long haul, stock returns have outperformed those of bonds. Bonds have had higher returns than cash. On the other side of the coin, stocks have been riskier than bonds and bonds have been riskier than cash.

So the first step in the portfolio diversification process requires investors to determine the right mix of stocks, bonds, and cash they should own. In other words, what proportion of the portfolio should be in stocks? What percentage should be in bonds? And how much should stay in cash or a money market fund? This is called asset allocation.

Asset allocation is the most important step in the portfolio diversification process. The reason for this is that more than 90 percent of a portfolio’s expected return is dependent upon its asset mix. Likewise, the portfolio’s risk level — or volatility — also depends on its asset mix.

This gives investors a couple of ways to approach the asset allocation question:

- Based on risk tolerance

- Based on consumption goals

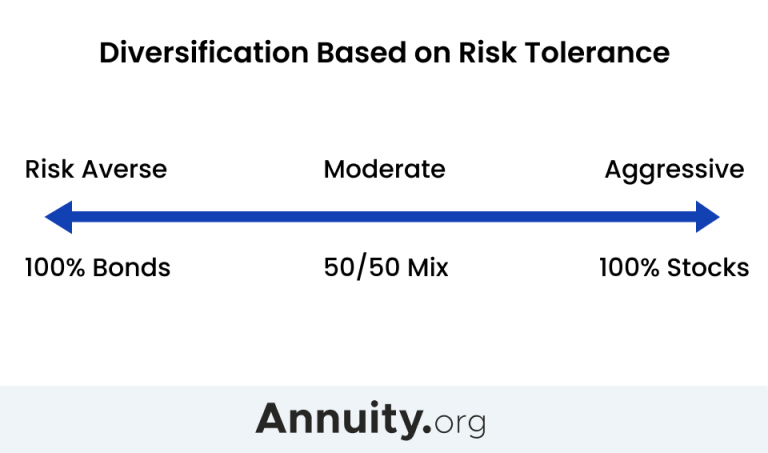

An investor looking to completely avoid risk could own only bonds. Someone with a high tolerance for risk might invest in nothing but common stocks. Every other investor on the continuum between the risk-averse person on one end and the aggressive person on the other would have a mix of stocks, bonds, and cash somewhere between the two.

While the risk-averse investor’s expected rate of return will be considerably lower than the aggressive investor’s likely return, he or she would certainly achieve the goal of avoiding stock market risk.

Risk Tolerance vs. Consumption Goals

The only problem with developing an asset allocation based on risk tolerance is that the ultimate portfolio may not earn a return sufficient to finance the investor’s long-term consumption goals. If this happens, they risk running out of money before they die.

A more prudent way to approach asset allocation is to determine how much money will be required to get to — and through — retirement. To do this, one needs to consider both their income and expenses over that period of time. From there, the investor needs to calculate how much money will be required today to finance everything in the future.

If the expected rate of return on the current portfolio is sufficient, then the investor doesn’t have to do any more work. If it isn’t, then the allocation needs to be adjusted to make sure that the portfolio earns enough money to finance all of the investor’s desired consumption goals. If that doesn’t work, then the investor must rein in his or her consumption goals.

How to Diversify Common Stocks in a Portfolio

The next step in the diversification process is to determine which securities to own. Investors looking for capital appreciation will typically look to the stock market for that growth. And, again, that growth comes with risk. In fact, there are two types of risk that come with owning stocks.

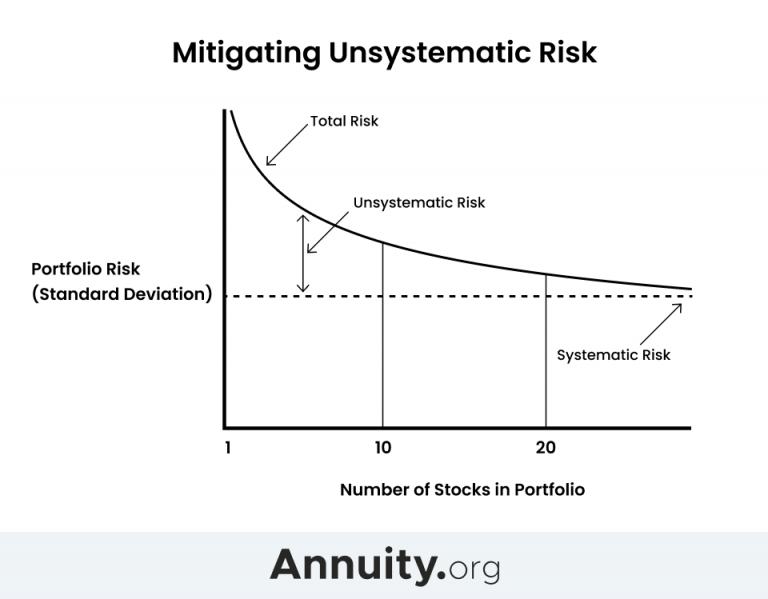

The first is market risk, also called “systematic” risk. This is the risk that when the market declines, most stocks will follow it. Sadly, there’s not much an investor can do to avoid systematic risk.

The second type of risk is unsystematic risk. This is the risk that something unforeseen can cause a specific stock to decline on any given day. While investors can’t eliminate unsystematic risk, they can mitigate it. The way to do that is to diversify. That means adding more stocks from different industries to the portfolio.

The Effect of Diversification on Risk

| Number of Stocks | Standard Deviation June 1960 to May 1965 |

Standard Deviation June 1960 to May 1970 |

|---|---|---|

| 1 | 6.50 | 7.00 |

| 2 | 4.70 | 5.00 |

| 3 | 5.00 | 4.80 |

| 4 | 4.50 | 4.60 |

| 5 | 4.30 | 4.60 |

| 10 | 4.00 | 4.20 |

| 15 | 3.80 | 4.00 |

| 20 | 3.80 | 3.90 |

Studies, such as the Wagner and Lau study published in the Financial Analysts Journal, have shown that each additional stock added to an equity portfolio decreases its total volatility. Those same studies show that the optimal number of holdings is between 20 and 25 stocks. Any more than that won’t significantly decrease the portfolio’s volatility. So here too, diversification helps maximize return and minimize risk.

Investors can also diversify a portfolio by owning mutual funds, EFTs, or variable annuities.

Depending upon the investor’s objectives and personal preferences, greater diversification can be achieved by mixing size and style investment themes. This means the portfolio includes large-cap, small-cap and mid-cap equities, i.e., shares of companies of various sizes, and owning both value stocks and growth stocks.

Even further diversification can be achieved through global exposure. International stocks can be further diversified in terms of size and style by including both developed and emerging markets. Emerging markets are those that are growing quickly in developing nations.

Diversified Structures to Generate Income

Investors looking for income have many choices to diversify portfolios regardless of whether they invest in equities. They can add corporate, government, or municipal bonds to the mix. They can buy certificates of deposit. Or they can own fixed annuities.

Bond and annuity investors can diversify portfolios by laddering. This strategy invests equal amounts in successive maturities over a set period of time. For example, someone with $100,000 might invest $10,000 each into bonds that mature every year for the next 10 years. Laddering with annuities can be achieved a couple of different ways. An annuity expert can help you determine an effective laddering approach.

Income can also be generated using alternative investments.

Alternative Investments Diversify Correlation Risk

Alternative investments are by definition any asset class that isn’t a stock, bond, or cash — the asset classes that comprise “traditional” investments. Investments in commercial and income-producing real estate or real estate investment trusts (REITs) are technically alternative investments.

Funds that invest in private companies, private equity or venture capital, for example, are common alternatives. Investment vehicles that use exotic or unusual trading strategies, use options or other derivatives, or take both long and short positions in stocks are all alternative investments. You can even include annuities in the “alternatives” basket.

The key diversification benefit that alternatives offer is that they are not correlated to traditional investments. That means they can provide positive returns even when traditional stock and bond markets are in distress.

But most alternative investments are only available to big institutions or accredited high-net-worth investors. Nevertheless, individual investors looking to diversify traditional stock and bond portfolios using alternatives can still look to annuities to fill that role.

Diversification is all about reducing risk. But avoiding all risk can create a situation where an investor might outlive his or her money. This is why it’s important for investors, especially beginning investors to weigh all the options and seek professional advice before attempting to construct a well-diversified portfolio.