Books About Investing

Investing is a complex topic. Luckily, several experts have written books about stock market investing, real estate investing and everything in between — sharing their own experiences and mistakes in the investing world. These, and other highly rated books on investing, offer valuable insight into investing and avoiding the common mistakes investors make.

1. The Bogleheads’ Guide to Investing (Second Edition)

If you’re a beginning investor and don’t know where to start, this book can guide you through the process. With multiple authors, the book offers a rich, thorough perspective on the fundamentals of investing and making your money work for you. The authors also break down complex financial concepts in a way that is easier to understand.

2. A Random Walk Down Wall Street

“A Random Walk Down Wall Street” explores history, economics, market theory and other concepts to provide investors of all ages with solid advice. Burton G. Malkiel discusses the mathematics of investing to highlight its importance and emphasizes common mistakes investors make and how to avoid them.

Malkiel is a long-time financial investor and the Chemical Bank Chairman’s Professor of Economics at Princeton University. He’s written more than 10 books on the topic of personal finance and investing, including several editions and updates of “A Random Walk Down Wall Street.”

3. The Book on Rental Property Investing

Brandon Turner, host of the BiggerPockets podcast, takes a newer approach to investing by placing his funds in real estate — which, according to the millionaires of The Oracle, is still one of the best investments. In his book, Turner details his early days in real estate investing and how it has led to financial freedom, while offering his personal tips for success.

Turner walks readers through the steps of real estate investing, focusing on a specific concept in each chapter. If you’re looking to invest in real estate, this book should be on your reading list.

Books About Becoming Wealthy

When looking for books about building wealth, don’t be deceived. There’s no easy way to do it. These books offer advice on becoming wealthy and avoiding pitfalls, but they won’t help you get rich quick. Wealth comes from knowing how to make your money work for you and how to make it last.

4. Everyday Millionaires

Don’t be surprised if this book changes the way you view America’s wealthy. Author Chris Hogan talks with real people around the nation about their secrets to amassing a net worth of $1,000,000 or more. He shares their tips and discusses ways for people on almost any income to grow their wealth.

5. The Simple Path to Wealth: Your Road Map to Financial Independence and a Rich, Free Life

JL Collins breaks things down in his book, “The Simple Path to Wealth.” He takes readers through the process of accumulating wealth, providing them with financial data to support the concepts in the book. With roughly 4,100 five-star reviews on Amazon and more than 11,000 ratings averaging 4.5 stars on Goodreads, it’s safe to say this book steals the show with its solid, easily digestible advice.

6. Rich Dad Poor Dad

Robert Kiyosaki reveals what he learned from his own father and his friend’s father (who he saw as a father figure) in his best seller “Rich Dad Poor Dad.” With countless lessons for those who seek to build wealth, this book not only shows readers the difference between the wealthy and the nonwealthy in regard to their perception of money, but it also provides actionable steps for making your money work for you.

Books About Retirement Planning

Most of us plan on retiring at some point, but many don’t think much of it until they start closing in on 65. However, early preparation for retirement can allow you to live the retirement lifestyle you want, rather than settling for only what you can afford.

7. How Much Money Do I Need to Retire?

With rave reviews, this book is a must-read for anyone on the road to retirement. Todd Tresidder reveals five of the most important questions to ask when planning for retirement, explains how to estimate returns on your investments and explores living expenses in retirement. This comprehensive book covers retirement planning and post-employment cash flow.

Tresidder provides readers with specific data points to illustrate the failure of traditional retirement plans, and encourages them to see beyond those plans in new and creative ways. With a degree in economics and a large and successful portfolio, Tresidder — who retired at age 35 through savvy investing — is truly an expert when it comes to paving the way to a great retirement.

8. How to Make Your Money Last

A great read for anyone — whether already retired or on their way. Author Jane Bryant Quinn writes in a straightforward fashion, avoiding the fluff and giving readers the information they’re looking for. Quinn discusses common retirement topics, from how to handle home equity to managing savings through annuities and other means.

Not only does this financial genius explain the basics of finances and budgeting during retirement, but she also offers advice on continuing to earn an income and stretching your money during those post-working years.

9. AgeProof: Living Longer Without Running Out of Money or Breaking a Hip

As leading experts in the realm of wealth and health, Jean Chatzky and Michael F. Roizen examine the connection between healthy aging and healthy finances. From catching up on retirement savings for late starters to making the most of your health and retirement benefits — readers will find valuable advice in this book.

Chatzky is the CEO of HerMoney.com and hosts her own podcast. She was the financial editor of NBC Today for 25 years and has appeared on CNN, MSNBC and The Oprah Winfrey Show. Dr. Roizen is a medical professional who has penned several best sellers.

Books About Budgeting

Even if you think your budgeting methods are good enough, you can always learn more about getting the most out of your money. Whether you’re creating a retirement budget or a newlywed budget, these budgeting books can help you get started.

10. The Financial Diet

With loads of practical advice on managing your money, “The Financial Diet” won’t steer you wrong. In it, author Chelsea Fagan offers her personal financial experience and advice and that of other financial experts. In addition to learning about budgeting and investing, readers will glean insight on a range of financial topics, including mortgages and talking to your friends about money.

11. How to Manage Your Money When You Don’t Have Any

This book was written specifically for those who struggle with managing money, no matter their income. It’s one of few books on this list that talks explicitly about the tough challenges many Americans face when it comes to their personal finances and the economy. Author Erik Wecks provides readers with simple and actionable principles that apply to everyday life.

12. The One Week Budget: Learn To Create Your Money Management System in 7 Days or Less!

Author of “The One Week Budget,” Tiffany Aliche channels her financial wisdom toward helping women achieve financial success. However, this book’s step-by-step instructions are invaluable for men and women alike.

Having been featured on Good Morning America, TODAY, and in The New York Times, Aliche understands the fine points of finance, and she’s eager to share her knowledge. A teacher at heart, Aliche is able to simplify money-management concepts and make them accessible to those who aren’t familiar with budgeting practices.

Books for Recent Graduates

Going out into the world and earning a steady income can be satisfying for recent graduates. However, you may be tempted to use your money in ways that won’t benefit you in the long-run. You may also find that you’re not sure how to manage this new income or pay off student loan debt. The titles below can help you learn how to do all of this and more.

13. Broke Millennial

Writing specifically for millennials, Erin Lowry touches on key points this age group struggles to understand. From managing student loans to talking with a partner about debt, Lowry speaks directly to those just getting started in the world of personal financial management. Her advice is simple enough to follow but profound enough to leave an impact on your life.

14. I Will Teach You To Be Rich (Second Edition)

Finance guru Ramit Sethi dives into financial topics that teach readers how to seamlessly manage their money without stress. From how to handle car buying to paying for a wedding and automating finances, Sethi introduces 20-somethings to a world free of financial guilt.

Having studied psychology at Stanford, Sethi understands the psychology of earning, saving and investing money. For those interested in learning how to manage money and build wealth, this New York Times best seller has got you covered.

15. Get a Financial Life: Personal Finance in Your Twenties and Thirties

With the struggles 20- to 30-year-olds face, it’s no wonder Beth Kobliner has released a fourth edition of this popular personal finance book. Sharing tips on figuring out taxes, avoiding common money mistakes and eliminating debt, Kobliner understands the prominent issues in today’s economy.

16. The Next Millionaire Next Door

Similar to “Everyday Millionaires” author Chris Hogan, Thomas Stanley and Sarah Stanley Fallaw outline the traits and qualities of America’s wealthy. They discuss the foundations of building wealth and how almost anyone can do it. A great read for recent college graduates striving to build their wealth from the ground up.

17. Your Money Life: Your 20s

Full of practical money advice for those in their 20s, this book is a must-read for those figuring out how to manage their finances. Whether you’re starting from the basics or already know a thing or two about money, this book will leave you with actionable tips to better control how your money goes in and out.

18. Spend Well, Live Rich

Michelle Singletary’s “Spend Well, Live Rich” doesn’t disappoint. With seven different financial mantras and ways to manage money on any budget, this book was written mainly for people without extensive financial knowledge. Singletary provides specific tips on managing money for a life a life of financial freedom, no matter your financial situation.

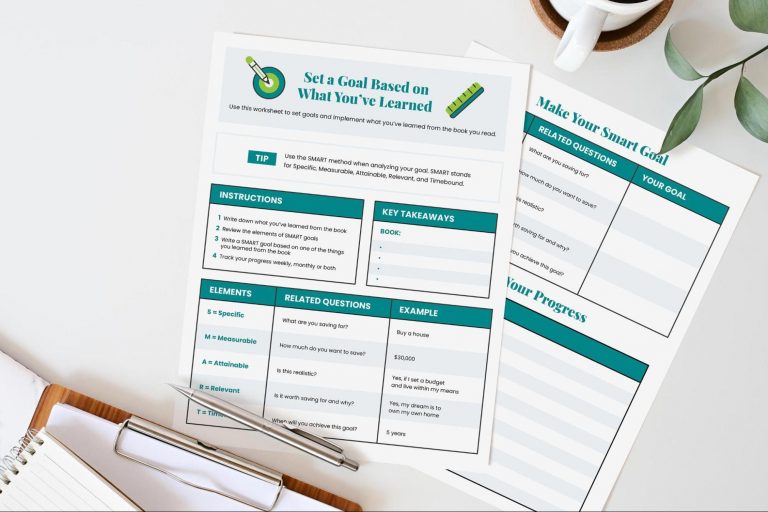

Implementing What You Learn

A book is only as good as what you take away from it, so it’s important to set goals based on what you learn and have a way to keep track of your progress. You can do this with a notebook, in the book itself if you own it, with friends who will keep you accountable or in any other way that will help you.

Because implementing what you learn and tracking your progress is so important, we’ve created a printable goal and tracking sheet below to help you get started.

By reading personal finance books, you can educate yourself on a wide range of topics, including investing, budgeting, mortgages and other loans, retirement, annuities, insurance and more. And don’t forget about resources that make learning fun and convenient, such as audiobooks, e-books, and your local library.

Join Thousands of Other Personal Finance Enthusiasts