Economic turmoil comes and goes, but when growth declines into the negatives and unemployment rates rise, the economy can fall into recession. The U.S. has experienced two recessions in the last 15 years: the 2008 housing crisis and the 2020 COVID-19 recession.

While the economy has shown signs of recovery, record-high inflation has experts closely monitoring the situation. While you can’t control the market, you can learn how to prepare for a recession and protect your investments from heavy loss.

From your professional life to your portfolio, we have tips to recession-proof your finances.

Identify Your Financial Priorities

Review your personal finances first to identify your needs and financial health. This provides a foundation to plan your finances. Start by determining how much income you bring home each month and your essential spending.

Essential spending should include absolute necessities like rent and groceries. Exclude other items that you consider “needs” in your general budget, like a gym membership for your health. Knowing what your needs are now is great, while identifying essential spending shows your opportunities to trim expenses in an emergency.

When you look at your income, consider how much you actually take home from each paycheck. This doesn’t include 401(k) contributions or income that goes directly to taxes.

Then consider how you can increase your income through freelance gigs or passive income opportunities. A list of backup sources is invaluable if you lose your primary income in a recession.

Finally, determine what future financial priorities are on the horizon. Couples planning a wedding, growing families and adults preparing for retirement in the next five years should account for these additional expenses.

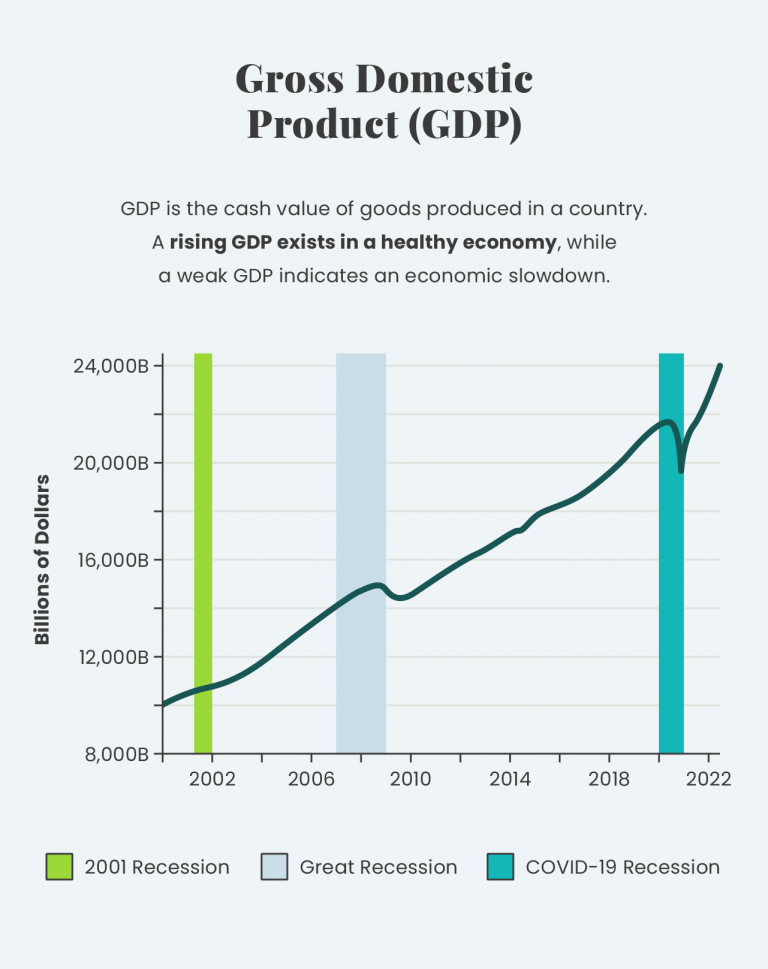

Sixty percent of Americans considered delaying their retirement following the Great Recession between 2007 and 2009. While the economy began improving in 2009, the GDP (gross domestic product) didn’t catch up to its potential until 2017 — a full decade after the recession began.

Boost Your Emergency Savings

Financial experts recommend saving six to nine months’ worth of income in case of an emergency. Keep this total accessible through a high-yield savings or money market account so you can withdraw from it immediately if needed. Compare rates between accounts, as high interest rates will maximize your investment.

Terry Turner, senior writer and financial wellness expert for Annuity, advises that six to nine months of savings is enough to find a new job, even in a recession. “An emergency fund lets you pay your bills and day-to-day expenses without using credit cards or damaging your credit rating,” he says.

If you don’t already have emergency savings, start saving as much as you can without compromising your retirement goals. An emergency account can keep you afloat if you lose a job, and it can also cover surprise expenses like car repairs.

The U.S. unemployment rate reached an all-time recorded high of 14.7% in 2020 as a result of the pandemic. The average unemployed person was jobless for 16.5 weeks, highlighting the importance of robust emergency savings.

Let’s Talk About Your Financial Goals.

Reduce Your Debt

Your debt total breaks down into monthly payments covering part of your principal and interest. Debt may make something more affordable through bite-sized payments, but you’re ultimately paying over the suggested retail price (MSRP).

When times are good, taking on debt for a new car or a furniture set is fine. But those monthly payments add up, and in times of economic stress, you’ll want as few essential expenses as possible. Reducing your debt can save you hundreds a month.

A lower debt-to-income ratio also expands your credit opportunities in case of an emergency. Relying on credit to get by is never ideal, but it’s a good backup you’ll want available if you lose your job or need to make a large purchase you otherwise can’t afford.

Firm debt increased over 5 percent following GDP losses, indicating the Great Recession. Lenders can be slow to correct, increasing long-term debt and credit spreads that worsen the recession and delay recovery.

Diversify Investments

A diverse portfolio is always recommended to protect your investments from economic downturns and losses. A mix of secured bonds, stock investments and hard assets helps you achieve long-term growth based on your risk tolerance and financial goals.

Each investment type offers different returns and risks. Generally, you’re offered higher returns with higher risk, while low-risk investments tend to pay out less. Diversification uses low-risk assets to secure your portfolio while maximizing returns with high-risk, high-reward investments.

- Health Care

- Health care spending increased 9.7% to account for 19.7% of GDP in 2020.

Examples: Pfizer | UnitedHealth Group | Johnson & Johnson - Consumer Staples

- Demand for food and household goods remains stable or even increases during recessions as consumers reduce spending.

Examples: Procter & Gamble | General Mills | Kroger - Utilities

- Utility stocks are heavily regulated and traditionally perform well during declines.

Examples: American Water Works | AES Corporation | NextEra Energy - Budget Retailers

- Walmart shares increased 12% during the Great Recession and 10% in the first half of 2020 as demand for affordable staples increased.

Examples: Walmart | Costco | Dollar General

Historically Recession-proof Investments

“It’s actually a good idea to talk to your financial advisor before a recession,” recommends Turner. “If you’re worried about the economy, a licensed professional can help you understand what’s going on and counsel you on your particular financial options.”

Learn how to diversify your portfolio before the risk of recession hits and protect your family’s peace of mind.

Buckle Down Your Budget

Reduced spending ahead of a recession allows you to increase your investments and emergency fund contributions to create your own safety net. Continuing a tight budget during a recession also helps you cover your monthly costs and reduce debt without sacrificing your quality of life.

You don’t have to count pennies forever, but having a disciplined budget you can fall back on in hard times reduces the stress of managing your finances and trying to make ends meet.

You’ve already calculated your monthly income and essential expenses. Use this information to create a backup budget, including alternative income sources, liquid assets and potential spending cuts.

Researchers analyzing global recessions between the Great Depression and the Great Recession found that industrialized countries like the U.S. take nine years to return GDP potential to pre-downturn trends.

Plan for the Long Term

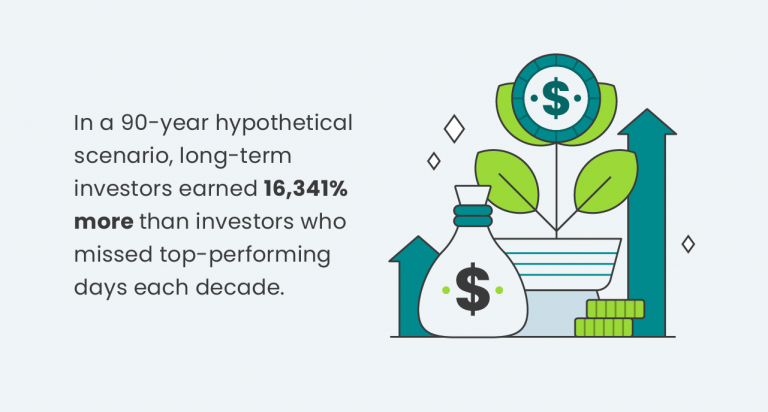

Generally, your investments are most profitable left untouched. This is especially true during recessions, when panic selling your stocks can result in loss while staying invested gives the market time to rebound.

As you enter a recession, Turner reminds you to stay calm and consult an expert.

“Before you start moving your investments around, talk to your financial advisor,” he says. “Different investments — stocks, bonds, mutual funds — can behave differently in a recession. A professional advisor can guide you through the best steps to take for your particular situation.”

The greatest days for stock investors often follow the worst, and pulling your investments during downturns could have huge implications for your return potential. Investors who missed the 10 best days of the decade saw a 91 percent return on average, compared to those who maintained their long-term investments and saw a 14,962 percent increase.

Invest In Yourself

Building your career and reputation is another way to build job security that can protect you from lost income during a recession. Whether you love your career field or are interested in a change, here are some ways you can invest in your success to limit the negative effects of economic downturns:

- Go back to school to advance your current career prospects.

- Study to enter a recession-proof field like health care.

- Build your personal brand and expertise.

- Expand your skills and income streams through freelance work.

- Learn more about the economy and personal finance to make confident money decisions.

People of color and individuals with less education tend to be the most significantly affected by income loss during recessions since the 1980s. These groups also have fewer savings and investments to fall back on in hard times.

What Is A Recession?

A recession is a sustained period of weak or negative GDP growth that marks a sharp decline in economic activity across sectors. Recession identification considers several economic factors, including:

- GDP

- Personal income

- Employment levels

- Industrial production

Economic declines including any of these factors for several months in a row may be considered a recession. Typically, recessions are accompanied by high unemployment rates.

Recessions can be difficult to weather, but they’re not uncommon and should be considered in your regular financial planning. In fact, the U.S. has experienced 13 recessions in the last 100 years since the Great Depression.

How To Prepare for Economic Collapse

The worst-case scenario of planning for economic crises is having emergency finances that you never use — a much better scenario than never preparing for the next recession.

Below we outline specific tips on preparing for a recession considering your lifestyle.

How To Prepare for a recession if You’re Retired

It’s always wise to consult a financial advisor before adjusting your portfolio. This is especially important if you’re approaching retirement age and can’t afford to slow your growth or lose large sums of money.

Even then, your retirement savings are likely safe, according to Turner.

“A lot of people freak out when the value of their investments start dropping. But if you’ve invested for your retirement, you’re very likely to be in it for the long run,” he says. “And in the long run, the markets may earn back all your losses before you need them.”

If you’re concerned about lost investments, consider moving some of your equities into fixed-rate annuities. These promise guaranteed returns regardless of the economic situation and provide assurance in case your retirement savings dry up.

It’s important to understand your retirement needs when making financial decisions. Determine your retirement income goals, current expected income and essential retirement expenses to build a retirement budget.

A retirement age calculator can help you identify your expected retirement age and income to start planning.

How To Prepare for a Recession With No Money

Those living paycheck to paycheck are often most vulnerable to economic downturns. Not only do these low-paying jobs experience high unemployment rates, but they’re less likely to have an emergency fund to fall back on.

If your finances don’t allow you to save, try to identify opportunities to increase your income. Consider:

- Negotiating a raise

- Creating passive income

- Developing a new skill

- Freelancing

You should also find ways to reduce your spending so you can afford to build some emergency savings. Even $5 a week grows to $260 in a year, which you can then reinvest and grow further.

A tight budget doesn’t have to permanently disrupt your lifestyle. If you focus on saving one month, loosen up and follow your standard budget the next month and continue the cycle until you have a comfortable savings.

What Jobs Survive a Recession?

Recession-proof jobs typically experience less volatility, and may even see growth, during economic turbulence. These are society staples that consumers will always buy into, including:

- Health care

- Public safety

- Education

- Utilities

- Funeral services

- Financial services

- Social work

- Legal work

Jobs in luxury industries like hospitality, real estate and automotive can see the largest losses as people buckle down and reduce their spending.

Economic fluctuations are a natural part of our economy, and it’s important to know how to prepare for a recession. Downturns often cause increased unemployment rates and stocks to fall, so protecting your investments and career should be a top priority.