Functioning as a potent and easily accessible savings instrument, a 401(k) aids in retirement preparation. In fact, the Investment Company Institute reports that Americans held $6.3 trillion in 401(k) savings as of September 2022.

But are you contributing enough to your 401(k)? According to the Federal Reserve, only 40% of Americans believe their retirement savings are on track. Our median and average 401(k) balance by age timeline will help you strategize and see how your 401(k) savings stack up against others.

Median and average savings data at various ages and savings as a multiple of salary are useful metrics to evaluate retirement savings progress. Seeing how you stack up against others can provide motivation to save.

The more retirement savings you can accumulate throughout your working years, the more financially secure you will likely be in later life.

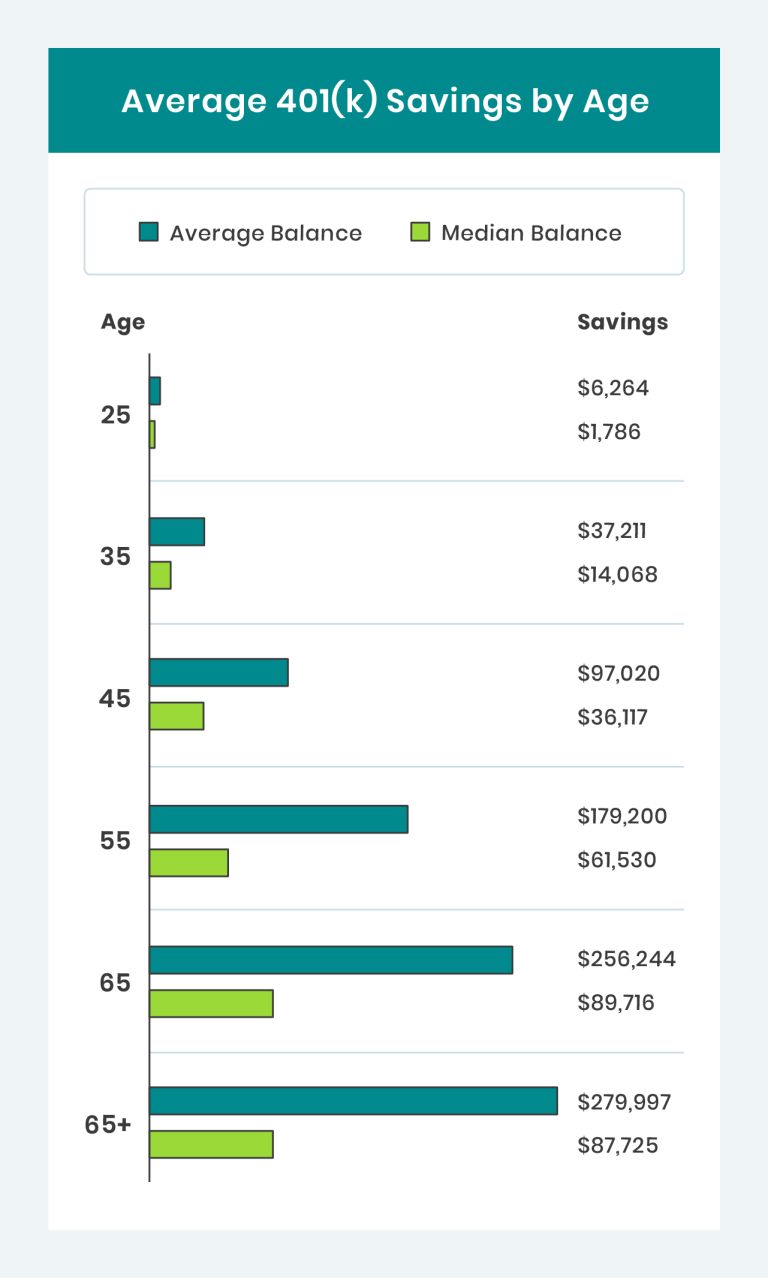

Average 401(k) Savings by Age

Knowing the median and average 401(k) balances in the U.S. can guide your retirement planning. According to a 2022 study from The Transamerica Center For Retirement Studies, most Americans began saving in their late 20s and early 30s. However, Gen Z recognizes the value of saving early and has started saving at a median age of 19.

Check out the 401(k) retirement savings chart below to see how your account balance compares.

Vanguard 401(k) Balances by Age

| Age | Average Balance | Median Balance |

|---|---|---|

| <25 | $6,264 | $1,786 |

| 25-34 | $37,211 | $14,068 |

| 35-44 | $97,020 | $36,117 |

| 45-54 | $179,200 | $61,530 |

| 55-64 | $256,244 | $89,716 |

| 65+ | $279,997 | $87,725 |

While we highlight average defined contribution 401(k) balances, it’s important to note that these numbers don’t include other retirement investments, like IRAs.

To help you inform your retirement savings plan, we’ve used information from Vanguard to outline the average balance of 401(k)s along with recommended savings goals for each generation below.

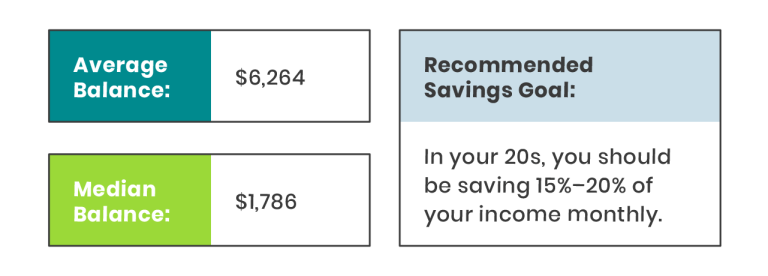

Average 401(k) Balance in Your Early 20s (<25)

According to the Federal Reserve, most young adults (62%) have begun saving for retirement by their 20s, though only 28% of this group believe their savings are on track.

Saving early offers significant benefits to your retirement planning. Even small contributions in your 20s can pay off, as compound interest helps your balance grow over a longer period.

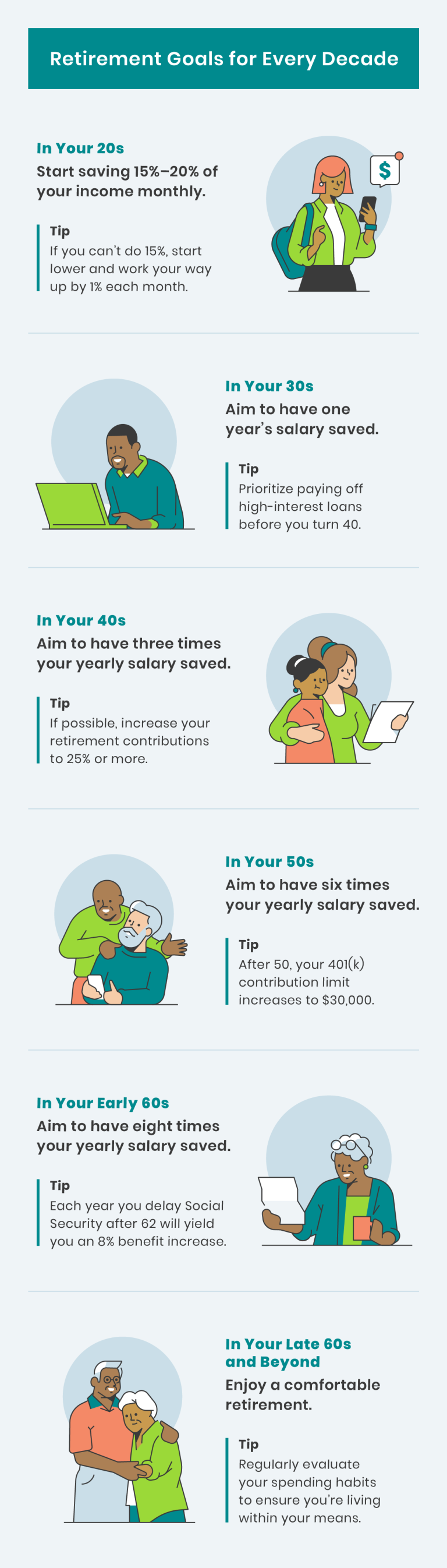

Some experts recommend investing 15%–20% of your income as soon as it’s feasible for your budget. If that’s not doable, try increasing your current contributions by as little as 1% each year to support your retirement.

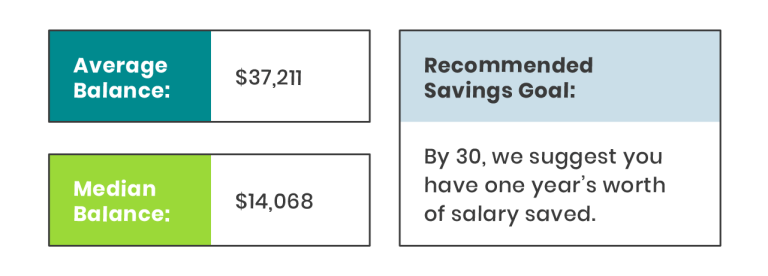

Average 401(k) Balance for Ages 25–34

According to the Federal Reserve, most young adults (62%) have begun saving for retirement by their 20s, though only 28% of this group believe their savings are on track.

Income increases with age, which means Americans are better suited to invest significant portions of their income toward retirement.

We recommend you save the equivalent of your annual income by age 30. So if you make $60,000 a year, plan to save that dollar amount before your 30th birthday.

25% of Americans ages 30-44 had no retirement savings in 2021.

Source: Federal Reserve

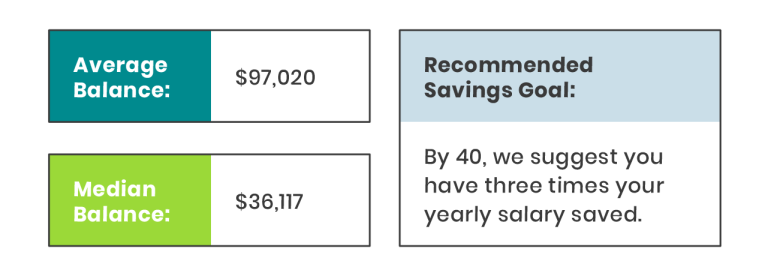

Average 401(k) Balance for Ages 35–44

By age 44, 75% of Americans have a retirement account, though only 39% believe they’re on track to reach their retirement goals.

Considering that $62,244 is the median income for this age group, many Americans fall short of having one year of their salary saved. Just 46% of their annual income is represented in a defined contribution plan. We recommend that you have three times your yearly salary saved for retirement by this age.

Average 401(k) Balance for Ages 45–54

By age 62, seniors are eligible to receive permanently reduced Social Security benefits, while full retirement benefits kick in at age 67 for most pre-retired Americans.

The median 401(k) balance begins to decline after age 65 — likely a result of retired individuals beginning to withdraw from their savings. Average retirement balances see a slight increase from the previous age range as many adults continue to work throughout retirement and collect interest on existing investments.

Workers who choose to stay in the workforce through age 70 without collecting Social Security can enjoy increased benefits. This payout can increase by 8% each year you delay collecting benefits.

How To Set Retirement Savings Goals

The U.S. Department of Labor recommends individuals save between 70% and 90% of their preretirement income for each year of retirement. With inflation, a goal of 80% is a good place to start.

Since the average life expectancy in the U.S. is around 76 as of 2021, you should plan for longer than that to ensure your savings won’t run out. For a savings milestone for each decade, check out our timeline below.

Having eight times your monthly income by 60 might seem like a lot, but this should give you more than enough funds to enjoy the rest of your life in comfort.

If you find yourself falling behind on your savings goals, it’s a good idea to reevaluate your budget and cut back on unnecessary spending. For additional guidance, seek out a financial advisor to help you along the way.

How Much Should You Contribute to Your 401(k)?

According to Tommy Gallagher, ex-investment banker and founder of Top Mobile Banks, “Your overall goal should be to contribute at least 15-20% of your gross income each year to 401(k)s, with a goal to increase your contributions as you age and your salary increases.

“Ideally, individuals should try to increase their 401(k) contributions with salary increases to fully utilize the employer match and build a solid retirement account. Investing more now can be more beneficial in the long run since compound interest will have time to kick in.”

That said, what you can afford depends on your pay and lifestyle. And regardless of your income, the most you can contribute annually to a 401(k) in 2023 is $22,500 or $30,000 if you’re over the age of 50.

How To Improve Your Retirement Savings Strategy

Before you start saving for retirement, it’s best to have a plan of action. Here are some simple tips to help you save for your golden years:

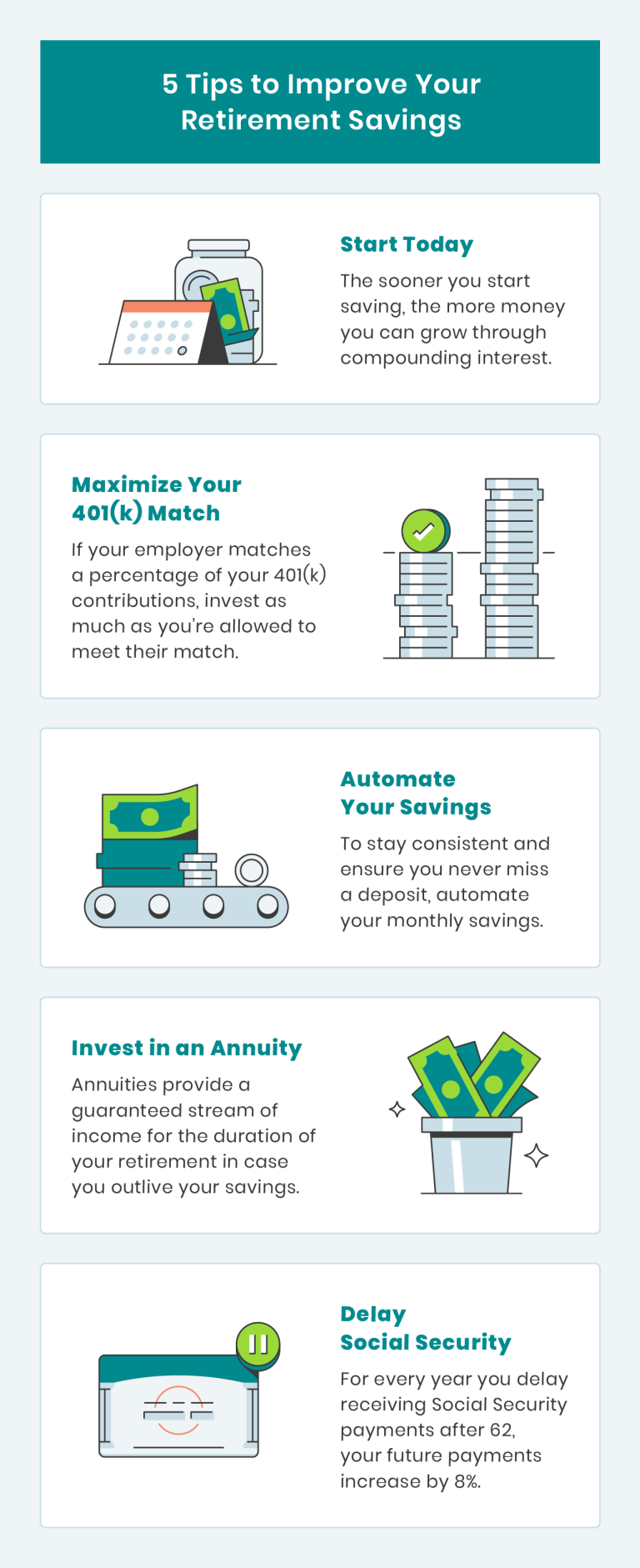

- Start today: Generally, risk tolerance decreases with age. The sooner you start saving and exploring high-return investments, the more money you can save through compounding interest.

- Make the most of your 401(k): If your employer matches a percentage of your 401(k) contributions, you should contribute as much as possible to make the most of the match.

- Automate your savings: It’s easy to overlook savings when life gets busy. Most banking apps allow you to automate savings, ensuring you never miss a deposit.

- Invest in an annuity: Annuities provide a guaranteed income stream for the duration of your retirement in case you outlive your savings. You can also name beneficiaries to receive your inheritance when you pass.

- Delay Social Security: For every year you delay receiving Social Security payments after 62, your future payments increase by 8%.

Estimated retirement needs can evolve over time, but a robust savings strategy early on provides a foundation for your investments to grow and allows you to retire on time.

Next Steps

As you prepare for retirement, it’s important to have savings goals outlined to help you stay on track. Understanding the average 401(k) balances of others your age helps you see whether you’re ahead of the fold or need to revisit your savings strategy.

Our free tool can help you find a financial advisor to fulfill your savings needs. Once you’ve been matched, consult with them for free with no obligation.

For more information on creating a retirement savings strategy, check out our infographic below.