The type of annuity you purchase determines the level of risk and the earning potential you can expect from the product. The draw of annuities for many people is the accrual of compounding interest for a number of years.

This interest rate is unchanging and guaranteed in fixed annuity and multi-year guaranteed annuity contracts, whereas rates for variable annuities rely on the performance of an investment portfolio.

Fixed index annuities, on the other hand, are unique in that there are two interest-earning strategies possible: a declared-rate strategy and an indexed strategy. Declared-rate interest crediting occurs daily, and indexed crediting occurs at the end of the term. Terms are typically one year.

Funds in an FIA that use an indexed strategy earn interest based on the performance of a major index, such as the S&P 500. The returns they offer are calculated by tracking this index.

The benefit of an FIA is that you get principal protection that’s not available with a variable annuity and a greater potential for gains than you’d get from a fixed annuity. In return for the protection from risk, the insurance company establishes limits on the amount of interest it will ultimately credit to a fixed index annuity.

How Does Interest Crediting Work

Interest crediting works differently for indexed annuities than for fixed annuities. FIAs have the greatest interest crediting variations and limitations on earnings because without them, the insurer would not be able to provide the principal protection and investors would face the risk of losing money on these products.

The limits on the amount of interest the insurance company will credit you when using the indexed strategy occur in the form of pricing levers called caps, spreads and participation rates.

- Caps

- A cap is the maximum interest rate you can earn, regardless of the change in the index.

- Participation Rates

- A participation rate is multiplied by the percent change in the index to determine the amount of interest credited.

- Spreads

- A spread is a percentage that is subtracted from the index change to determine the interest that will be credited to you.

Pricing Levers

Consider your annuity strategy when reviewing these options to ensure you find the appropriate crediting method.

Crediting Methods for FIAs

In addition to setting pricing levers, insurance companies can customize the way in which interest is credited to the contract.

The most common methods use a simple formula for the percent of index value change, which can be either positive or negative: (A-B)/B

The Three Most Common Interest Crediting Methods

- Annual point-to-point

- Monthly averaging

- Monthly point-to-point

Annual Point-to-Point

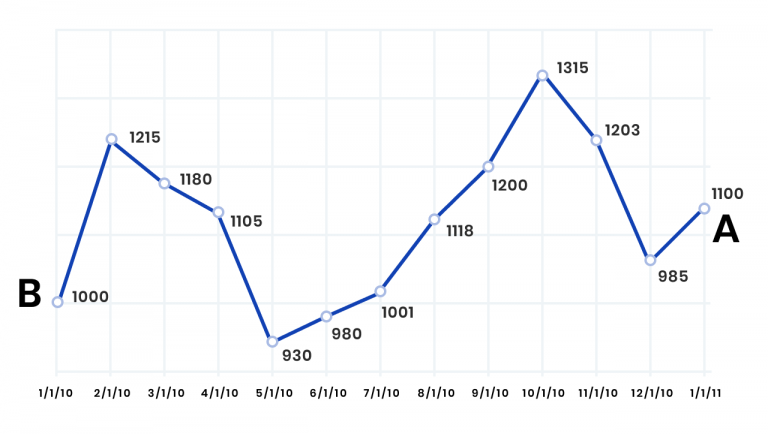

The annual point-to-point method is the least complex interest crediting method. It is calculated by tracking the index at point A, which is the anniversary date of the contract, and comparing it with the index at point B, the beginning of the contract year.

Monthly Averaging

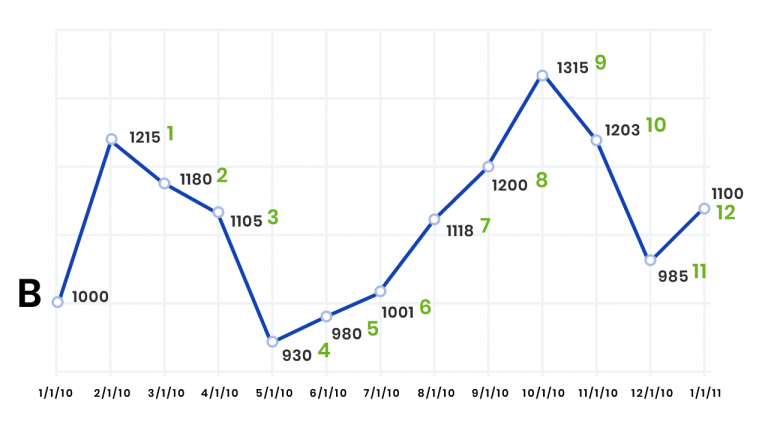

Monthly averaging is similar to point-to-point crediting, but instead of point A representing the index value on the contract anniversary, the index is tracked each month for 12 months, and the average is used for the point A value. Point B is still the index value at the beginning of the contract year.

Monthly Point-to-Point

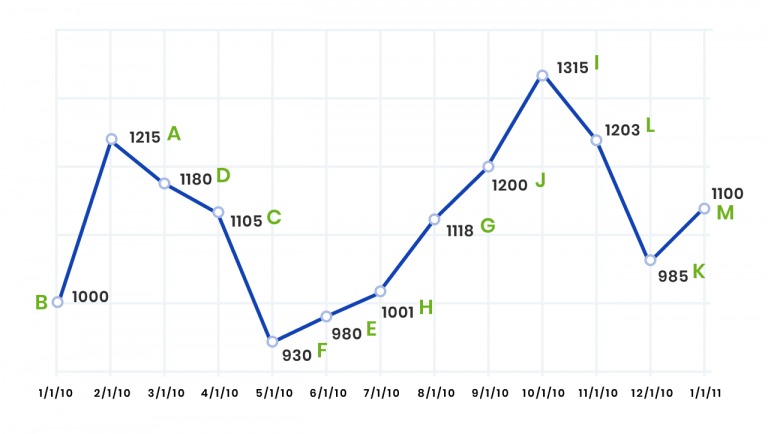

Interest crediting using the monthly point-to-point method requires a few more steps. Using the (A-B)/B formula, the insurance company tracks the index from month to month, applying the cap for gains. The sum of the gains for the months in the term is the amount credited. If the sum is negative, zero interest is credited to you.

Crediting Methods for Fixed Annuities

According to the Institute of Business & Finance, there are four crediting methods for fixed annuities:

- Portfolio

- All contracts are credited the same interest rate for the same period.

- New Money

- Also referred to as the “pocket of money method,” the crediting rate depends upon when the insurance company receives the premiums.

- Tiered Interest Rate – Type One

- Interest is credited based on the contract’s cash value.

- Tiered Interest Rate – Type Two

- Interest is credited at one rate if you annuitize the contract and a lower rate if you surrender the contract.

While the calculations and terminology may be intimidating, it’s important to understand the way interest crediting works — especially for fixed index annuities — because the method used can have a substantial impact on your returns.