Key Takeaways

- Basis points are financial units of measure commonly used to precisely calculate changes in the value or rate of a financial instrument, such as interest rates, bond yields and investment returns.

- One basis point is equivalent to one-hundredth of 1% or 0.01%.

- Annuity providers use basis points to show changes in annuity rates.

- Investors use basis points to show the cost of mutual funds, treasury or corporate bonds, stocks, mortgage loans and other financial instruments.

Banking, accounting and other financial sectors use basis points to express interest rate changes and rate spreads. These industries often refer to basis points as “bps” or “bips.”

Basis points are useful when discussing interest rates and other percentages, such as the cost of annuity riders or administrative fees, of less than 1%.

Why Use Basis Points Instead of Percentages?

Basis points offer clarity when discussing percentages. Instead of using percentages, you can use basis points to express changes precisely.

For instance, a 100 basis point increase equals 1%. This avoids confusion, as 1 basis point always means 0.01%. Unlike percentages, basis points provide an absolute, unambiguous figure, ensuring clear communication.

Conversely, if the rate increases by 100 basis points, the result is constant. The rate updates to 6%. Likewise, an increase of one basis point would only increase the rate to 5.01%.

Price Value of a Basis Point (PVPB)

One basis point equals 0.01% or 0.0001.

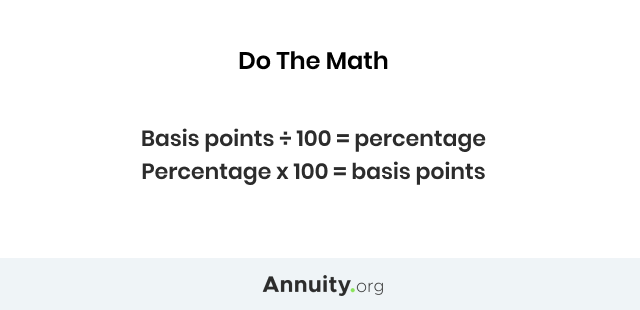

You can use a calculator or simple arithmetic to convert basis points to a percentage and, likewise, percentages to basis points.

How Do Annuity Providers Use Basis Points?

Annuity providers use basis points to denote incremental annuity rate changes. They also use basis points to express the difference between two interest rates. When calculating the interest that should be credited to an indexed annuity with a rate spread, annuity issuers use basis points to determine the change in the index and subtract the spread.

Basis points also reflect annuity fees, and they serve as an important consideration when comparing annuity products. Charges such as agent commissions, administrative fees, surrender charges and mortality expenses are often listed in basis points in initial contracts. Understanding basis points can help consumers quantify or calculate the financial impacts of these fees.

How Do Investors Use Basis Points?

Investors use basis points to convey the costs of mutual funds and other exchange traded funds.

Basis points impact a myriad of financial instruments, including treasury bonds, corporate bonds, common stocks and mortgage loans.

Investors also apply basis points as a consistent means to compare expenses and certain funds’ fees. Basis points can express an asset’s change in value. Prevailing interest rate adjustments, even by one mere basis point, can have a significant impact on bonds and other investments.

These basis points, although they represent only one one-hundredth of a percentage point, can have big dollar implications for institutions and individuals.

Frequently Asked Questions About Basis Points

The price value of a basis point is a measurement of the change in the price value of a bond for a one basis point change in yield. It is used to measure price volatility and interest rate risk.

Dollar duration is a measurement of the price change to a bond’s value, in dollar terms, following a market interest rate change. Dollar duration measures the price of a bond for every 100 basis points of change in interest rates and helps determine how sensitive a bond or bond portfolio is to interest rate changes.

Basis points help investors, traders and analysts describe movements in interest rates and other amounts lower than a percent. They also commonly use basis points to help compare rates between different securities.

Join Thousands of Other Personal Finance Enthusiasts