Key Takeaways

- A market value adjustment (MVA) is a contract clause associated with fixed deferred annuities.

- Insurance companies use market value adjustments to reduce their risk of loss should the annuitant take too many early withdrawals or cancel the contract during the accumulation phase.

- A market value adjustment can also positively impact the contract value of your annuity in falling interest rate environments.

What Is a Market Value Adjustment?

A market value adjustment is a contractual stipulation associated with fixed deferred annuities. An annuity can be structured in a variety of ways, but fundamentally, it entails an upfront premium payment in exchange for a guaranteed income stream, which begins at a future date and lasts for a specified period.

The period between the purchase of an annuity and the beginning of its income stream is known as the accumulation period. During this period, the money in the annuity grows on a tax-deferred basis. While the annuity owner (annuitant) may be able to decide when to begin the income stream, to avoid a penalty, they must typically wait a specified amount of time. This period is known as the surrender period.

Now that we’ve touched on the foundational aspects of a fixed deferred annuity, let’s turn our attention back to the market value adjustment (MVA). Essentially, an MVA is a monetary adjustment that can be applied to an annuity contract if the annuitant makes withdrawals beyond allowed limits during the surrender period.

MVA terms and computations vary widely, but they inevitably reflect an inverse relationship with interest rates. If you withdraw more than permitted when interest rates are rising, you will most certainly experience an unfavorable MVA. If you withdraw more than permitted when interest rates are falling you could experience a favorable MVA.

An MVA can never reduce the cash surrender value of an annuity below the minimum guaranteed in the contract. Furthermore, an MVA will not apply to amounts withdrawn under a penalty-free provision or amounts withdrawn following the surrender period.

How Does an MVA Work?

To avoid a penalty, a fixed deferred annuitant must typically wait until the surrender period ends to begin withdrawing funds. That said, most products allow for penalty-free withdrawals each year, up to a certain percentage of the annuity’s value.

For example, a common annual allowance is 10% of the annuity value. A gradual year-over-year reduction in the surrender penalty is also common. For a 10-year surrender period, this could mean a penalty amount that declines by 1% each year (as illustrated below).

| Year | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| Surrender Penalty | 10% | 9% | 8% | 7% | 6% | 5% | 4% | 3% | 2% | 1% |

Let’s look at how an MVA is actually applied. For illustrative purposes, assume the following:

- You own a fixed deferred annuity with a cash surrender value of $250,000 and a 10-year surrender period.

- The contract allows for penalty-free withdrawals of 10% annually during the surrender period.

- Withdrawals in excess of the penalty-free allowance are subject to a gradually declining penalty that aligns with the 10-year penalty scheme shown in the table above. You are near the end of the third year of the surrender period, which stipulates a penalty of 8% on withdrawals that exceed the penalty-free allowance.

- Since the purchase of the annuity, the relevant interest rate (contractually defined as the yield on the 10-year U.S. Treasury bond) has risen by 2%, from 1% to 3%.

- You process a withdrawal of $50,000.

Given the complexity, the outcome of the withdrawal can be fairly difficult to determine, but the explanation outlined below should provide some clarity.

- Given a penalty-free withdrawal of 10% annually, $25,000 can be withdrawn without any concern ($250,000 X .10 = $25,000).

- The remaining $25,000 of the $50,000 withdrawal is subject to a surrender penalty of 8% (the three-year penalty) and an MVA, which is explained below.

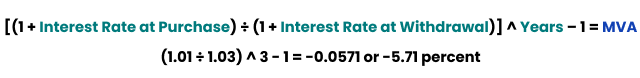

- While each annuity contract will have a specific formula for calculating the MVA, a reasonable adjustment is outlined below.

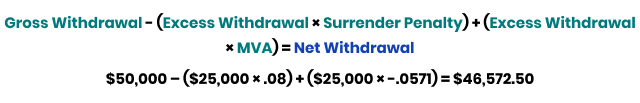

- In combining the components above, we are left with the following net withdrawal:

As you can see, the early withdrawal resulted in the loss of $3,427.50 ($50,000 – $46,572.50 = $3,427.50), which includes an MVA of $1,427.50 ($25,000 × .0571 = $1,427.50).

Why Do MVAs Exist?

An MVA is designed to provide the issuer of an annuity protection against investment losses that occur when an annuitant withdraws funds or cancels a contract in the early stages of the accumulation period.

When you purchase a fixed deferred annuity, the issuer takes your money and invests it in fixed-rate assets, like bonds. The issuer does this with the goal of growing your money to a level that will cover issuance expenses, provide you the promised stream of cash payouts and generate a worthwhile profit.

However, given their fixed-rate nature, the values of these investments are highly sensitive to changes in interest rates. They tend to do poorly when rates are rising, and they tend to do better than expected when rates are falling.

Given this interest rate sensitivity, the investing time horizon is critical to the issuer. The annuity issuer needs the full accumulation period to generate adequate funds. If the annuitant pulls money sooner than anticipated, especially when interest rates are rising, the issuer will undoubtedly incur losses when it tries to sell the investments.

The MVA is the tool the issuer uses to protect against these potential losses. Fundamentally, this shifts risk to you, the owner of the annuity. From the annuitant’s perspective, this appears unfavorable, but an MVA clause is not all bad. It actually allows an issuer to offer higher interest crediting rates than otherwise feasible. Moreover, in a falling interest rate environment, an MVA can result in more money for the annuitant.

Other Considerations

Given the punitive nature of an early withdrawal or a complete surrender, it is important to think carefully before acting. This is especially important for early withdrawals made prior to the age of 59½. In this situation, in addition to the previously mentioned penalties, an annuitant could be liable for a 10% early withdrawal tax penalty and ordinary income tax.

All things considered, an early withdrawal can be quite expensive — and highly detrimental to the preservation/accumulation of wealth.

Incidentally, if you are thinking about canceling your fixed deferred annuity because you do not like the contract terms, you may have a better option. Depending on your circumstances, you may be able to execute a 1035 exchange, which effectively allows you to swap one annuity contract for another. While it sounds simple, this maneuver can expose you to unique tax implications. So, before proceeding, be sure to consult with a CPA or financial advisor.

Closing Thoughts

A market value adjustment is a tool used by an annuity issuer to reduce its exposure to interest rate risk. Essentially, it is a monetary adjustment that can be applied to an annuity contract in the event of early withdrawals that violate contract terms.

An MVA, coupled with other early withdrawal penalties, can be costly. As a result, it is important that you think carefully about whether you will need access to your money before entering into a fixed deferred annuity. Make sure you have a high comfort level with the surrender period and the deferred nature of the income stream.

Market Value Adjustment (MVA) FAQs

Insurance companies can apply a market value adjustment to your annuity contract to protect themselves against loss by changing the value of your annuity in certain situations as defined by your contract. For example, an MVA may be triggered if you surrender all or part of your annuity before the accumulation phase ends. Not all contracts come with an MVA.

Every insurer has its own formula for calculating a market value adjustment. An insurer may calculate the change in interest rates since you first bought the annuity and adjust the amount of its loss or gain based on current rates or the interest rate when you made your withdrawal.

A market value adjustment can be positive or negative for the annuity owner. If interest rates have gone up since you bought the annuity, the insurance company will suffer a loss which they may pass on as an MVA. But if interest rates have gone down, it can work as a positive for the owner by increasing the surrender value of the annuity.

Join Thousands of Other Personal Finance Enthusiasts