A 401(k) savings account is one of the most popular retirement options for Americans. Sixty-seven percent of private industry workers have access to employer-provided retirement plans, which often offer contribution matching to maximize your investment.

The 33 percent of workers not receiving employer retirement benefits and those who are self-employed are in a position to consider 401(k) alternatives as their primary savings strategy.

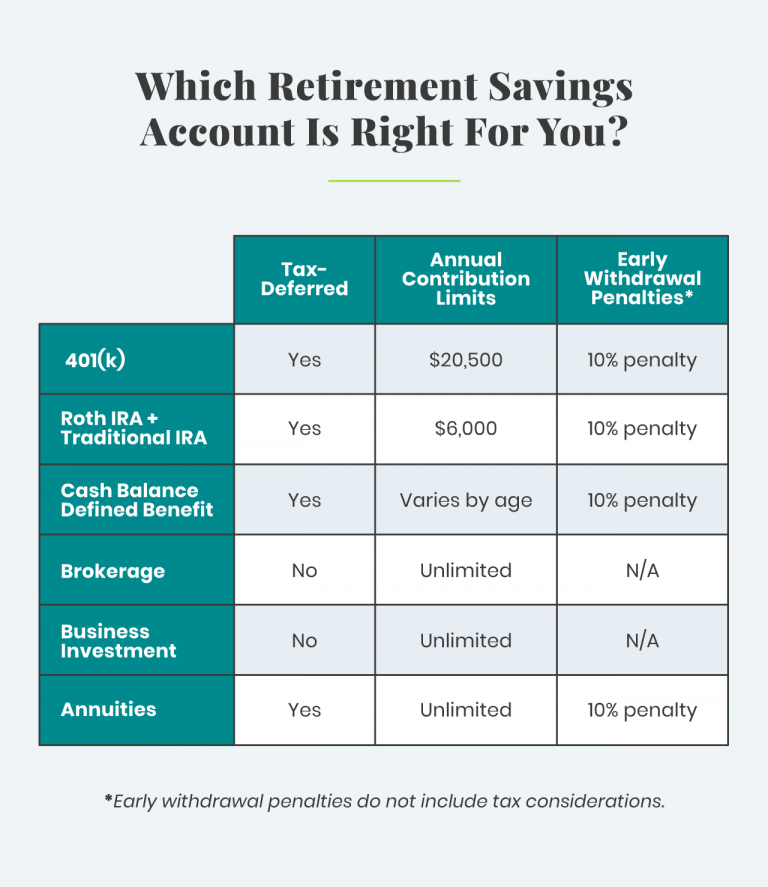

Of course, 401(k)s have limitations on how much you can contribute, and may require fees and early withdrawal penalties. So even if you’re investing in a 401(k), it’s worth exploring other opportunities.

Common 401(k) Alternatives:

- Traditional and Roth IRAs each have tax advantages and good investment options, but low contribution limits at $6,000 annually.

- Investment brokerage accounts allow you to totally control your investments, though they don’t offer tax advantages.

- Real estate and business investments may offer big payouts if you can navigate the risk.

- Annuities provide protection against outliving your retirement savings with a fixed monthly income stream.

Traditional IRA

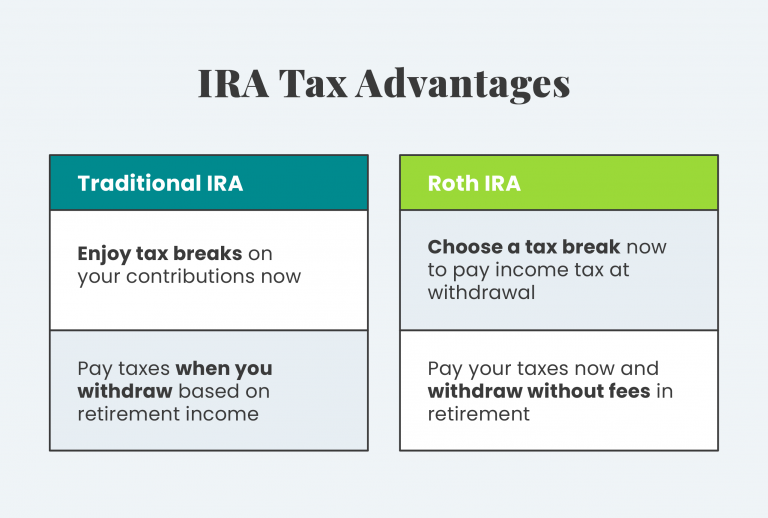

Traditional IRAs (individual retirement accounts) offer additional flexibility and tax benefits than 401(k) accounts, making them one of the most popular 401(k) alternatives. Individuals can contribute up to $6,000 a year, and defer tax payments until the money is withdrawn in retirement.

IRAs offer a variety of investment opportunities, including stocks, mutual funds, real estate and even cryptocurrency. You can have a traditional IRA in addition to your 401(k) and other retirement accounts.

| Benefits: |

|

| Considerations: |

|

| Annual contribution limit: | $6,000 |

Roth IRA

Roth IRAs are similar to traditional IRAs with a few key benefits. With a Roth IRA, individuals can choose to forgo their tax break on contributions in exchange for withdrawing their money tax-free at retirement.

If you’re expecting your income to steadily increase throughout your working years, this is a good opportunity to save on future taxes. If you’re currently a high earner and expect to make less by retirement, then taking the tax break now could be a better option.

Roth IRAs also allow you to include your account in your inheritance so you can build generational wealth. These accounts still have an annual contribution limit of $6,000, however, so you can’t invest a huge amount.

| Benefits: |

|

| Considerations: |

|

| Annual contribution limit: | $6,000 |

SEP IRA

SEP stands for “simplified employee pension,” and SEP IRAs are available for the self-employed. You’re eligible with freelancing income of any kind, even if you’re currently employed somewhere else.

You have the opportunity to contribute much more with SEP IRAs than other IRAs allow. Instead of a dollar amount, you’re limited to 25 percent of your business earnings. If this is more than $6,000 a year, you have the opportunity to capitalize on the compound interest on a significant sum of money.

SEP IRAs provide the same contribution to all employees of an individual business. If you have other employees working for you, consider contributions to employee SEP IRAs in your budget.

| Benefits: |

|

| Considerations: |

|

| Annual contribution limit: | 25 percent of business earnings up to $61,000 |

Cash Balance Defined Benefit Plan

A cash balance pension plan is an opportunity for self-employed individuals to catch up on retirement savings. Participants can contribute a defined percentage of their annual earnings plus interest, and contribution limits increase with age.

Otherwise, these investments work similarly to 401(k)s, and may be a good addition to your retirement portfolio. Individuals can choose a fixed or variable annual interest rate in the form of a credit. Participants have the option of withdrawing their money as an annuity or lump sum at retirement.

| Benefits: |

|

| Considerations: |

|

| Annual contribution limit: | Varies by age and income |

Investment Brokerage Accounts

Few accounts are as flexible as a brokerage account, which gives you freedom to invest and withdrawal from a variety of investments. There are no age restrictions, and you can shop for the opportunity with the highest yield for your investment.

The downside of opting out of formal retirement accounts is that you lose the tax benefits 401(k)s and IRAs can provide. You’ll be taxed for any profit once you withdraw from your account.

You’re also responsible for managing the account, though you can consult with a financial advisor to help you make the most of your investments. Still, there are additional risks to managing your own investments, and brokerage accounts don’t offer a guaranteed payout.

| Benefits: |

|

| Considerations: |

|

| Annual contribution limit: | None |

Business Investment

Individuals with business savvy and disposable income can invest in a startup business in exchange for partial ownership or profit shares. There’s no guarantee that a business investment will succeed, however, so this option comes with some risks. Do your due diligence to study the business, industry and market before investing.

Individuals with less disposable income may be interested in sites like Wefunder and SeedInvest. These platforms vet businesses to reduce the risk (although no investment is fully risk-free), and work as a crowdfunding platform so you can invest with a lower dollar amount.

| Benefits: |

|

| Considerations: |

|

| Annual contribution limit: | None |

Health Savings Account (HSA)

Health savings accounts are designed to help individuals with high-deductible insurance plans cover health care costs, but there are additional investment benefits. Individuals can contribute $3,600 to a solo plan, or $7,200 to a family plan each year. Employers may also contribute.

Earnings on HSA contributions are tax-free, and you’ll receive tax breaks for contributing to your account each year. Your account balance is available for you to use on qualified medical expenses, and you can withdraw money for nonmedical use with a 20 percent fee.

Once you hit retirement age at 65, you can withdraw the money tax-free and without penalty fees to use as you’d like. There are no minimum contribution limits, so it’s a highly flexible account with significant tax benefits.

| Benefits: |

|

| Considerations: |

|

| Annual contribution limit: | $3,600 for individuals; $7,200 for families |

Annuities

Buying annuities allows you to contribute a lump sum or make a series of contributions to become a future income stream. There are several types of annuities available based on your investment needs.

Deferred annuities are often used for retirement planning to protect retirees if they outlive their savings. The annuity begins paying participants at an age of their choosing.

On the other hand, immediate annuities begin paying as soon as a lump sum investment is made. These are beneficial for individuals with sudden wealth, like lottery winners.

Investors can also choose between fixed and variable annuities. Fixed annuities have a set payment amount on a given schedule, while variable annuities may fluctuate depending on the investment’s success.

| Benefits: |

|

| Considerations: |

|

| Annual contribution limit: | None |

Real Estate

Property investments are a popular choice for a variety of savings goals, but they come with risk. Anyone who owns property has the opportunity to sell the real estate for a profit.

Owners can choose to sell a home they’ve owned and built equity in, or purchase and sell a property they’ve improved. Owners can also choose to maintain and rent the property for additional income, while also building equity to sell at a later date.

Homeownership continues to be a popular investment for Americans as home prices and sales continue to increase, while low mortgage rates and down payment assistance increase accessibility.

| Benefits: |

|

| Considerations: |

|

| Annual contribution limit: | None |

Is a 401(k) Worth It Anymore?

A 401(k) account provided by an employer is a convenient retirement package for many Americans. The option for employers to match contributions and the professionally managed portfolio help make it a popular option.

401(k) accounts aren’t without their drawbacks. There aren’t as many investment opportunities available as other retirement plans offer. There are also fees and restrictions on when participants can access their funds.

If your employer offers 401(k) matching as a benefit, it’s worth taking advantage of those contributions. It’s also wise to explore other retirement options that can better serve your savings goals with increased investment opportunities, higher returns and unlimited contributions.

Is a Roth IRA Better Than a 401(k)?

Each account has its advantages, and ideally you’re able to invest in multiple accounts, including a Roth IRA and 401(k).

Roth IRAs have fewer fees than 401(k)s, while offering more investment opportunities and increased access to your funds. Both accounts are tax-deferred, and you have the option to enjoy tax-free withdrawals if you don’t take tax breaks from your contributions.

A 401(k) account that includes employer-matching contributions can be a significant benefit to your savings goals. You’re able to collect free money and 401(k) accounts have higher contribution limits than IRAs. Taxes are deferred and you can enjoy tax breaks for your contributions, but 401(k) plans tend to have more fees than a Roth IRA account.

A 401(k) account is accessible and comes with great employer-sponsored benefits if you work a traditional nine-to-five. Freelancers, business owners and anyone looking to maximize their retirement planning can benefit from 401(k) alternatives. IRAs, individual investment accounts and even real estate can allow you to invest more money for greater returns and flexibility.