What Is the 50/30/20 Budgeting Rule?

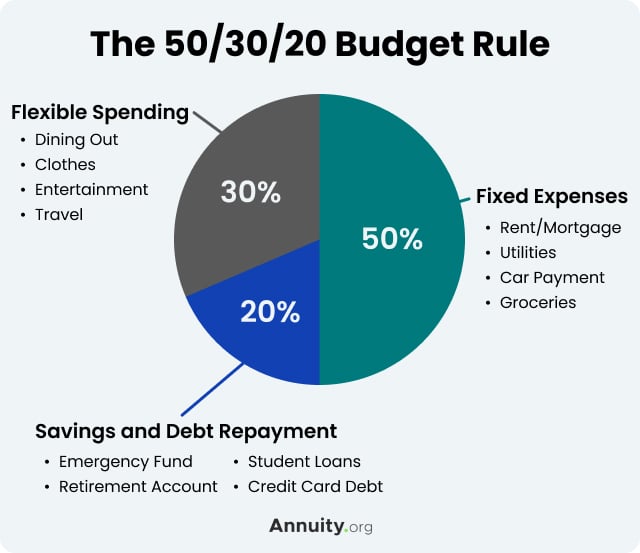

The 50/30/20 rule is a popular budgeting strategy. The numbers refer to the percentages of your monthly income that should go to fixed expenses, variable expenses, and savings and/or debt repayment.

Many personal finance professionals recommend this method for its simplicity and flexibility. The 50/30/20 rule allows you to set aside a portion of your income for flexible spending while still meeting your financial goals. Because this budgeting method leaves room for spending money on things you want even if you may not need them, it can be easier to stick to than a more strict personal finance strategy.

Saving vs. Spending

Saving money for short- and long-term goals is an important component of financial wellness. Whether it’s building an emergency fund, paying off debt or making a big purchase, such as a house, you probably have a savings goal you are trying to meet.

The 50/30/20 rule can help you meet your savings goals for the future without sacrificing the fun things you like to buy in the present. This budgeting method is all about striking a balance between saving and spending.

Financial experts recommend setting a goal of saving 20% of your income each month. Your monthly savings can be put toward one single savings goal, such as an emergency fund, or split among multiple savings goals, like a retirement account and saving for a house down payment.

If you can’t afford to save 20% of your income each month, that doesn’t mean you shouldn’t try to save at all. You should set a goal that makes the most sense for you. If that means putting away $100 per month, saving something is still better than saving nothing.

How to Budget Using the 50/30/20 Rule

The first step to any budgeting strategy is determining your net monthly income, which is what you have left after taxes and deductions.

Once you have your monthly income, the next step is to divide the amount into three portions. You can do this by multiplying your after-tax monthly income by 0.5, 0.3 and 0.2 to get each percentage. You should write down the monetary amount that makes up each percentage — 50%, 30% and 20% — so you know exactly how much you have in each category.

50% for Needs

Half of your after-tax monthly income should be put toward fixed expenses. These are the bare necessities, the things you have to pay for that cost roughly the same amount each month.

Fixed Expenses

- Rent or mortgage payment

- Car payment or public transportation

- Utilities (power, water, gas, internet)

- Phone bill

- Groceries

- Insurance

If your fixed expenses total more than 50% of your income, there are a few things you can do. You might try to find ways to save money at the grocery store, reduce your energy or water usage, or downsize to a more affordable living arrangement.

30% for Wants

Using the 50/30/20 rule, you can allocate 30% of your monthly budget toward “wants,” or flexible spending. These are things that you can technically live without but that are still a priority for you.

Flexible Spending

- Dining out

- Clothes shopping

- Vacations

- Entertainment

- Hobbies

- Gym membership

If you find that you’re spending more than 30% of your income each month on these flexible expenses, it may be time to evaluate your priorities. How many of these expenditures are important to you, and which ones could you cut back on to increase your savings?

20% for Savings

The last category is savings and debt repayment, which should make up at least 20% of your monthly budget. This last 20% should go toward helping you meet financial goals, whether it’s saving for retirement or paying off debt.

Savings and Debt Repayment

- Emergency fund

- Retirement account

- Saving to buy a house

- Paying off student loans

You should aim for 20% of your income to go toward savings goals, but you should contribute more if you are able. If you don’t spend all of the 30% of your income set aside for discretionary spending, you can move that leftover cash into your savings accounts to get you closer to reaching your goals.

You may want to alter this approach if you’re trying to pay off high-interest debts like credit card debt. High-interest debts should be paid off as soon as possible, so you might benefit from devoting a larger portion of your budget toward that.

Why Should You Use the 50/30/20 Rule?

Personal finance experts recommend following the 50/30/20 rule for a few reasons. As previously mentioned, this budgeting strategy is flexible, allowing you to spend money on things you want while also saving toward your goals.

By working to keep your essential expenses within 50% of your budget, you’re also safeguarding yourself against financial hardships. Even if your current household income drops by half, such as if one member of the home is out of work, you’ll still be able to keep a roof over your head and weather the setback.

Like all budgets, the 50/30/20 rule helps you manage your money and pay attention to where it’s going. It can give you a better idea of whether you can afford to move to a larger house or purchase that new designer bag.

The important thing about keeping a budget, even if you don’t stick to the 50/30/20 rule exactly, is that you have money rules to keep you moving in the right direction. If you’re having trouble applying the 50/30/20 rule to your personal finances but still want to use a budget, this worksheet from the Consumer Financial Protection Bureau can help you get started.