Grief can be mentally, emotionally and physically exhausting, which can make administrative tasks more challenging and affect your ability to make sound decisions. Before making any decisions about your inheritance, you should take time to mourn and care for yourself and your loved ones.

“The very first thing [the recipient of an inheritance should] do is separate the grieving process from their administrative and management process,” says Mark Shepherd, a Certified Financial Planner™ professional and Founder/CEO of Shepherd Financial Partners in Winchester, Massachusetts. “We find, unfortunately, generally too great of a mix between the two and try to give our clients the opportunity to properly grieve, then come back to look at the administration to make great decisions.”

Once you’ve had time to grieve, you’ll want to define your priorities, rank them based on your needs and wants, then go through the proper channels to reach your goals.

Define Your Priorities

“The first order of business is to do your own personal financial plan — whiteboard how you think it should look and what your goals are,” says Shepherd.

How you use your inheritance will vary depending on how much progress you’ve already made on goals like paying down debt and saving for retirement.

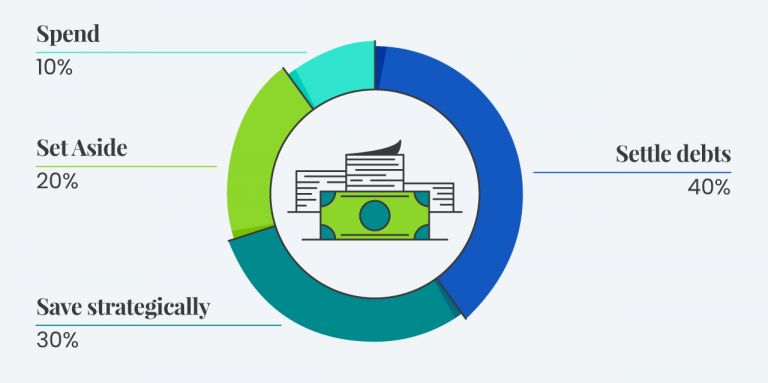

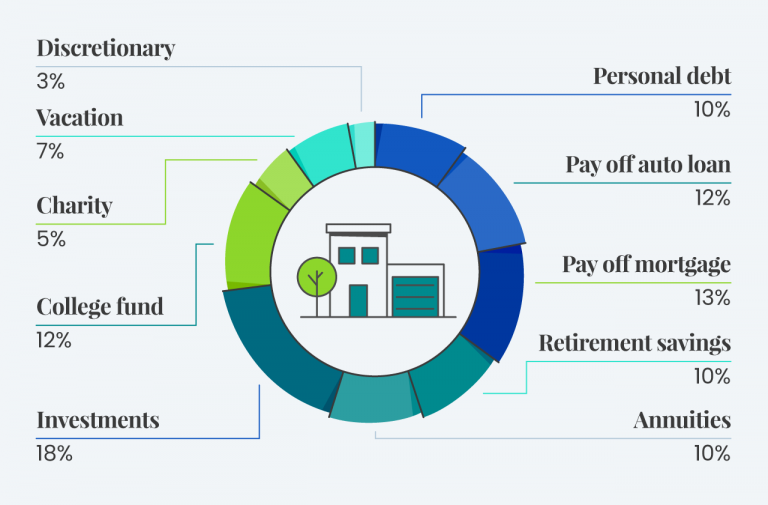

Before diving into any details, decide what percentage of your inheritance you want to dedicate to each of four major categories:

- Paying off debts

- Putting money into savings

- Setting aside funds for others

- Spending on other things

Once you’ve split your inheritance into these basic categories, making individual decisions about your assets will be a lot easier.

How much you dedicate to each category is completely up to you, but most experts agree that you should prioritize debt first, then savings and investment, followed by funds you plan to give away and, finally, spending whatever is left.

Settle Your Debts

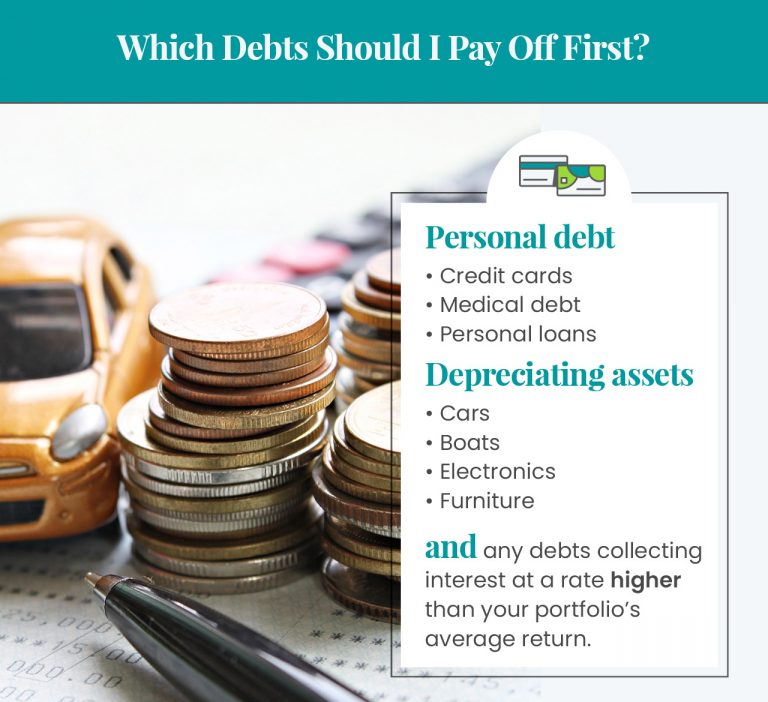

Your first priority in distributing your inheritance should be eliminating any significant debts. This doesn’t mean you should automatically sink your entire endowment into paying off outstanding balances, but if you have any that accrue interest at a rate faster than your interest-bearing accounts and investments, your money will be best spent on closing those accounts.

How to Do It

To figure out which debts you want to settle with your inheritance, take a look at all of your outstanding balances and evaluate whether they’re considered high- or low-priority.

Common high-priority debts:

- Auto loans

- Credit card debt

- Personal loans taken for nonessential purchases

- Unsubsidized student loans

- Medical debt

- Payday loans

These debts often have high APR, and are therefore usually the most expensive debts to carry.

On the other hand, there are categories of “good” debt that you should keep open. These debts usually have lower APR or help balance your credit mix, which helps maintain your credit score.

Common low-priority debts:

- Subsidized student loans

- Mortgage loans

- Zero-interest loans

- Small business loans

If a debt has an interest rate that’s lower than your investment portfolio’s average return, it makes more sense to keep the debt and put your money toward saving strategically instead. Similarly, mortgage debt is usually low priority because real estate often appreciates, so your rising home value may offset the cost of interest.

Save Strategically

Once you’ve settled high-priority debts, your next objective should be to find ways for your money to earn you more by accruing interest, appreciating in value or qualifying you for tax advantages.

How to Do It

Just like you prioritized your debts by most to least expensive, you’ll want to prioritize your savings in the same way.

The most important savings accounts to have are an emergency fund and your retirement savings. If you’re low on emergency funds, use this opportunity to replenish them. If you got a late start on saving for retirement, your inheritance can allow you a chance to catch up.

Prioritize tax-advantaged accounts like your 401(k) and traditional and Roth IRAs. Once you’ve maxed out these accounts, consider expanding your retirement savings with low-risk financial tools like bonds or fixed annuities.

Start with Low-Risk Options

After shoring up your immediate savings, you’ll want to augment a solid foundation by selecting financial products that offer the highest returns at the lowest risk.

Examples include:

- Mutual funds

- Money market accounts

- Fixed annuities

- ETFs

- High-yield savings accounts

- Certificates of Deposit (CDs)

- Bonds

Spreading out your assets helps mitigate risk and protect your savings against economic downturns.

Pepper in Higher Risk Investments

Once you’ve established a foundation of low-risk investments, you can afford to take some chances in hopes of scoring a higher return.

Examples include:

- Variable annuities

- Commodities

- Real estate

- Individual stocks

- Options

- Cryptocurrencies

- Small business investing

- Peer lending

View our glossary of key financial terms

Set Aside Funds for Others

Choosing to donate or bequeath your assets to others is a personal choice that will rely heavily on factors such as whether you have dependents, your relationships with your loved ones and your personal connections to charities and religious organizations.

Some people choose not to leave anything behind. But if you are planning to set aside funds, it’s important to know how best to go about it.

How to Do It

You’ll want to establish different types of funds depending on who will be the beneficiary. Two common vehicles for amassing funds for heirs are trusts and annuities.

There are dozens of different types of trusts, but the basic structure involves a trustor (the person bequeathing the funds), a trustee (the person responsible for dispersing the funds) and a benefactor (the person receiving the funds). The drawback of a trust is that it requires a person to be responsible for fund disbursements, which may draw them into interpersonal conflicts with the account’s beneficiaries and their family members.

Alternatively, you could pass funds onto your heirs by purchasing an annuity. Like a trust, an annuity disburses payments to beneficiaries in increments, but annuities are held by insurance companies instead of individuals and therefore eliminate the potential for interpersonal conflict.

Save for College

If you decide you want to set aside some of your inheritance for a loved one’s future college tuition, you should open an account designed specifically to save for educational expenses. These accounts are tax-advantaged — some allow you to avoid paying taxes on earned interest, while others are tax-exempt altogether.

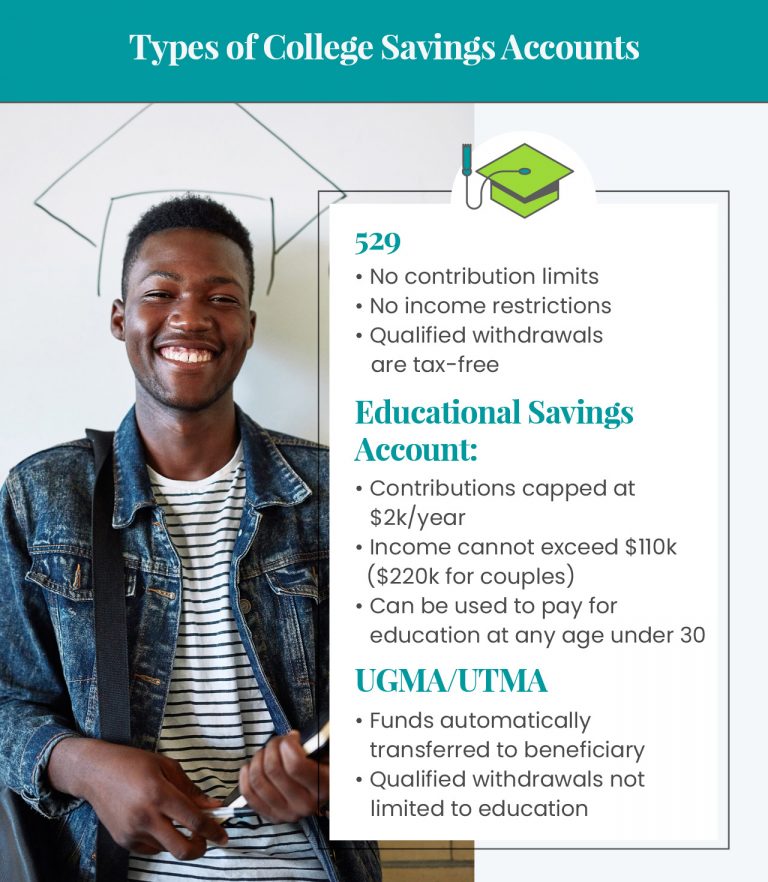

The four most common college savings accounts are 529s, Coverdell Educational Savings Accounts, UGMA accounts and UTMA accounts.

529 Pros & Cons

Pros

- No set contribution limits

- No income restrictions

- No age limit on withdrawals

- Earnings are tax-free

- Withdrawals are tax-free as long as they’re made for qualified purchases

- Can be transferred between beneficiaries

Cons

- Restrictions on how funds can be invested

- Withdrawals must be made for college expenses to avoid penalty

Coverdell Educational Savings Accounts Pros & Cons

Pros

- Can be used to pay for education at any age, not just college

- Earnings are tax-free

- More freedom on how funds can be invested

Cons

- Contributions are capped at $2,000 per year

- Contributors’ adjusted gross income cannot exceed $110,000 ($220,000 for joint married couples)

- Withdrawals must be made before beneficiary turns 30

UGMAs and UTMAs Pros & Cons

Pros

- Withdrawals can be made for any purchase benefiting the beneficiary, not just education

- Benefits from a variety of tax advantages

Cons

- Some contributors may be uncomfortable with increased freedom afforded to beneficiary

- Can’t be transferred between beneficiaries

- Weaker tax benefits than other college savings accounts

To Donate to a Nonprofit

If you want to donate part of your inheritance to charity, you can do it directly or you can open a donor-advised fund. When you open a donor-advised fund, you allow a financial institution to serve as custodian of your account, though you can recommend how you think the funds should be invested. Your contributions and their earnings are tax-free, and you can make donations to charities from the funds in the account.

Spend What’s Left

It’s not essential to keep a portion of your inheritance to enjoy, but it can certainly be beneficial. When you arrive at this point in your inheritance planning, you’ll have spent a lot of time and energy on managing your estate, and you may also be experiencing many of the mentally and emotionally draining symptoms of grief. Allowing yourself the space to spend on something you enjoy can be a healthy way to recuperate.

How to Do It

Unlike the first three strategies on our list, there’s no better authority on how to spend your discretionary inheritance than you. However, here are a few ideas that might provide you some inspiration.

Honor Your Loved One’s Legacy

There are many ways you can honor your loved one with a long-lasting token of their memory. You can organize a private dedication or you can opt to set aside some funds to sponsor or donate to a cause or organization they cared about.

Here are some options you can consider when deciding how to memorialize your benefactor:

- Adopt a bench in your loved one’s favorite park.

- Name a star after your loved one.

- Work with your community to commission a mural.

- Sponsor a guide dog.

- Dedicate a pew in your loved one’s church.

- Adopt a room in your local Ronald McDonald house.

- Fund a room at your local homeless shelter.

- Sponsor a child in need.

- Put together an online memorial page.

Whatever way you decide to memorialize your loved one, be sure to check the legitimacy of any charitable causes before making a donation.

Share an Experience with Family

When you use part of your inheritance for family activities, you give your loved one the chance to provide one final gift to those they left behind. Finding opportunities to create new happy memories lets your family move toward closure in a way that’s positive and peaceful.

- Take a family trip to your loved one’s birthplace.

- Host a family reunion.

- Plan a day of service for your family to participate in a cause your loved one cared about.

- Try out one of your loved one’s favorite hobbies together.

Anything that brings your family together in memory of a loved one is a wonderful way to honor their legacy.

Relax and Recover

End-of-life care, events and rituals are exhausting. After weeks or even months of bereavement ceremonies and customs, you could probably benefit from an opportunity to recuperate.

- Sleep hygiene is incredibly important for coping with grief, so upgrade your bedroom to help ensure your mind and body can rest.

- Enroll in a yoga class — science shows that yoga practice helps individuals process loss and foster a closer relationship with loved ones who have passed.

- Take a grief retreat to connect with others experiencing similar loss or to practice coping mechanisms like mindfulness, meditation and exercise.

- Grief affects our cognitive function, making basic tasks more challenging. Consider hiring additional help for a few weeks or months — extend the babysitter’s hours, splurge on a home meal delivery service, have the house professionally cleaned — to lighten your load while you recoup.

- Adopt a pet! Pets are so effective in helping humans cope with grief that funeral homes have begun keeping trained therapy dogs onsite.

Self-care is complicated, especially in grief, so it’s a great idea to set aside some of your budget for things that alleviate your emotional challenges and help you nurture yourself.

What About Taxes?

If your inherited funds were kept in anything other than a basic savings account, you’ll need to handle them correctly in order to maximize potential tax benefits and avoid withdrawal penalties.

- IRAs and Roth IRAs have specific requirements for beneficiaries that vary depending on the relationship to the original owner and the age of the original owner when they passed.

- Bonds may or may not be taxable depending on whether your loved one already paid taxes on the bonds’ earned interest.

- Stocks are not subject to taxes unless the beneficiary chooses to sell, at which point the profits are subject to capital gains taxes

Besides income taxes, there are also a number of inheritance-specific taxes that may or may not apply to your endowment.

- Estate tax: 40% tax that applies only to inheritances of over $12.06 million; individual states also have estate tax thresholds and rates that may be different

- Inheritance tax: separate state-level tax that applies only in Iowa, Kentucky, Maryland, Nebraska, New Jersey and Pennsylvania

- Capital gains tax: applies to the profit on any inherited capital assets sold for more than their market value on the owner’s date of death

Doing the research and hard work necessary to manage your inheritance can be a challenge, but the peace of mind that comes from having a well-balanced portfolio of assets is worth it. With some smart decision-making, you can set up not only yourself, but also your loved ones for lifelong financial wellness.