Key Takeaways

- The monthly payout of a $100,000 annuity is different for each customer, as annuity payouts are calculated based on several factors.

- The older you are when you start to receive payments, the larger those payments will be, and men’s payments will be larger than women’s because women live longer.

- The type of annuity also directly impacts how large your payout will be.

Factors Impacting How Much a $100,000 Annuity Pays Per Month

Annuity providers calculate payouts differently for every annuity contract. An annuity with a $100,000 premium can have widely varying monthly payments depending on factors including the annuitant’s age and gender, the type of annuity, the payout period and any provisions or riders that are added to the annuity.

Age and Gender

Life expectancy is used to calculate the payout of an annuity contract, so your age and gender impact how much you’ll receive from your annuity. The longer you’re expected to live and receive payments from your annuity, the less you’ll receive each month in annuity payments.

Because women tend to live longer, a woman with a $100,000 annuity will likely have a lower monthly payment than a man of the same age with the same annuity. For example, a 55-year old woman purchasing an immediate annuity might receive payments of $514 a month, while a 55-year old man would receive $535 a month under equal circumstances.

The older you are, the less time you theoretically have to receive the full value of your annuity, so your payments will be higher the longer you wait to begin receiving payments. If a 60-year-old man chooses a $100,000 income annuity to start payments when he turns 65, he could receive $799 a month. If he waits until he’s 70 to start payments, he’ll receive $1,182 a month.

Type of Annuity

The type of annuity you purchase greatly affects the payments you’ll receive when your contract annuitizes. The two main types of annuities are deferred annuities and immediate annuities.

A deferred annuity undergoes an accumulation phase before your premium is converted into a stream of payments. During the accumulation period, the annuity earns interest and increases in value.

A $100,000 deferred annuity will likely have a larger payout than a $100,000 immediate annuity. An immediate annuity is converted into payments within a year of purchasing the annuity, so it does not have an accumulation phase. The payments will be calculated based on the immediate annuity’s initial $100,000 value with no added interest.

Payout Period

When you purchase an annuity, you’ll have a few different payout options to choose from. You can choose how long you want to receive payments for, which will impact how much you’ll receive from each of those payments.

Most people purchase annuities to guarantee a stream of income they can’t outlive. This is called a single life or life only annuity because it pays out regularly for the lifetime of the annuitant. A single life annuity will give you the highest payout because the payments stop once you pass away.

Another option for annuity payouts is called a joint and survivor annuity. With this annuity, you choose a secondary annuitant, usually a spouse, to continue receiving payments after you die. These annuities have a lower monthly payment than a single life annuity, but the payments are more likely to last longer since they cover two people’s lifetimes.

You might also choose an annuity with a fixed amount payout, also known as a systematic withdrawal schedule. This type of annuity allows you to choose how much money you’ll receive each month. These payments continue until your annuity runs out of money. There’s no guarantee that you won’t outlive your annuity, but you know exactly how much you’ll get.

Additional Options

You can customize your annuity contract with a variety of additional riders and provisions, but these add-ons might affect how much your annuity pays out each month.

For example, you might choose to add a return of premium rider. This provision means that if you pass away before your annuity contract is fully paid out, your beneficiary will receive what remains of your annuity premium.

You could also choose a period certain annuity, which guarantees that you or your beneficiary will receive payments for a certain number of years. A 10-year certain annuity, for example, guarantees payments for the first 10 years of the contract. You’ll continue to receive payments if you outlive the 10 years. But if you die before then, your beneficiary will get the payouts you would have received for the rest of the 10 year period.

Both these contract provisions represent a greater level of risk to your annuity provider, so your payout amount will likely be slightly lower each month if you opt for these features.

Annuities are a popular, low-risk investment option embraced by many retirees. Others prefer the heightened upside potential offered via diversified portfolios of stocks, bonds and alternative investments. Consult with a fiduciary financial advisor to determine which approach is right for you.

More: Immediate Annuity Calculator

Case Studies

To understand how these different factors impact the approximate payout of a $100,000 annuity, let’s look at three different scenarios. The payout estimates for the first and second scenarios derive from a Charles Schwab income annuity estimator, while the estimate for the third scenario comes from an online calculator for annuity payouts.

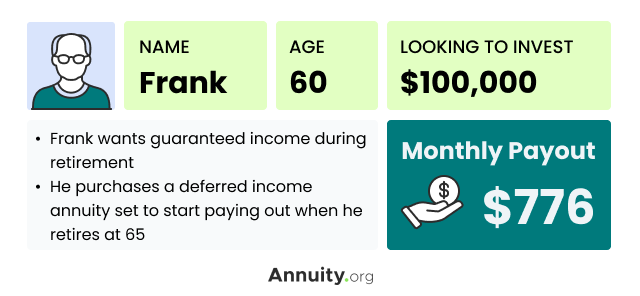

Scenario 1 – Frank

In the example above, Frank uses a deferred income annuity to set up a guaranteed income stream once he retires. A deferred income annuity doesn’t earn interest the way a fixed or variable annuity might, so it’s easier to estimate how much the annuity will pay out.

Accounting for factors like his age and when the annuity will start paying out, we can estimate that Frank’s annuity will pay out $776 each month. This estimation is for a single life policy, which means there’s no death benefit associated with the policy and none of the premium will be returned to Frank’s beneficiaries if he passes away before he receives the full return of his annuity premium.

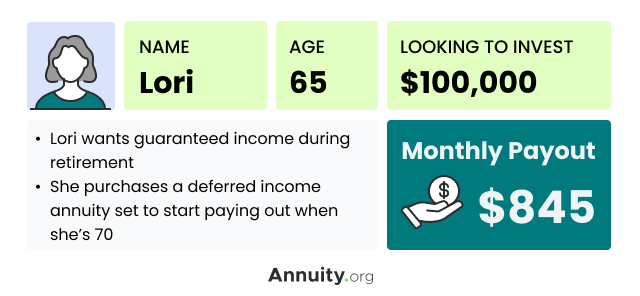

Scenario 2 – Lori

Lori’s circumstances are similar to the last case study. She’s a retiree who wants to set up a guaranteed income stream she can’t outlive. Lori purchases the same type of annuity and pays the same premium amount.

In this case, Lori’s payout is estimated to be $845. The biggest reason that Lori’s payout is higher than Frank’s is her age. By starting payments at 70 instead of 65, Lori will receive a larger payment each month. That said, her payment is slightly reduced because she is female. A 65-year old man purchasing a 5-year deferred income annuity would receive a payout of approximately $902.

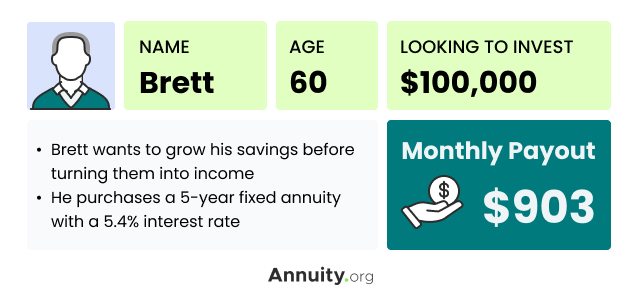

Scenario 3 – Brett

When Brett’s fixed annuity matures, he’ll receive a payout of roughly $903 a month. Brett’s payout is the highest of these three examples because of the type of annuity he purchased.

Brett purchased a type of fixed annuity called a multi-year guaranteed annuity or MYGA. This type of annuity earns interest at a guaranteed rate for a certain number of years. In this example, Brett’s MYGA earned 5.4% interest for 5 years before converting to income payments.

By purchasing an annuity with a guaranteed interest rate, Brett was able to grow his $100,000 annuity before he converted it to income. As a result, he can expect a larger payout than if he purchased an income annuity.

Alternatives to a $100,000 Annuity

If you want to invest your money in a low-risk, income-oriented product to safeguard your retirement, annuities are a great choice, but they’re not the only choice. Alternatives to a $100,000 annuity might be placing that money in certificates of deposit (CDs) or purchasing bonds or dividend-paying stocks.

CDs are bank products that allow you to deposit a sum of money into an account and leave it there for a required amount of time. When the CD matures, you’ll receive your principal deposit and the interest it earned. CDs are very safe places to put money and might be preferable to an annuity if you’re looking for a short-term investment.

When you purchase a bond, you’re essentially loaning money to a corporation or the government in exchange for receiving interest when the bond matures and the money you lent is returned to you. Another very safe savings vehicle, bonds tend to underperform in terms of growth when compared to annuities.

Finally, you could invest your $100,000 in dividend-paying stocks. These are stocks from well-established companies that tend to fare well during market downturns but are less likely to experience extreme growth. Dividend-paying stocks are considered relatively stable, but as with any stock, returns are not guaranteed.

Frequently Asked Questions

Annuities can protect you from outliving your savings and offer tax-advantaged growth, but they can have costly fees and may not keep pace with inflation.

The two main types of annuities are deferred annuities, which accumulate interest before converting to payments, and immediate annuities, which immediately convert the premium amount into a stream of payments.

Annuities usually pay out each month for the rest of your life. You can also choose a joint life annuity to cover you and a second annuitant.

In most cases, you will not be able to change your payout option once you’ve started receiving annuity payments.

What happens to the rest of the annuity after the annuitant dies depends on the type of annuity. A single life annuity will stop payments, while a joint annuity or annuity with period certain may continue making payments to a secondary annuitant or beneficiary.