Key Takeaways

- Typical costs associated with annuities include premiums, commissions, administrative fees and surrender costs. They vary depending on the type of annuity and the variables of the contract.

- Premiums are the money you invest in an annuity and may be made as either a series of payments or a single lump sum.

- Commissions are payments to the agent selling the annuity and vary widely. They are typically built into the cost of the annuity and not spelled out in the contract.

- An annuity may carry multiple fees, so it’s important to understand each of them and consider whether their cost makes an annuity the best choice for your needs and goals.

One of the biggest knocks on annuities is that they can be expensive. And it’s true. Commissions and fees on some annuities can really add up, especially if you don’t pay attention and ask the right questions when you buy an annuity. But, as CNN reports, not all annuities have high fees.

What Are the Most Typical Fees and Costs With an Annuity?

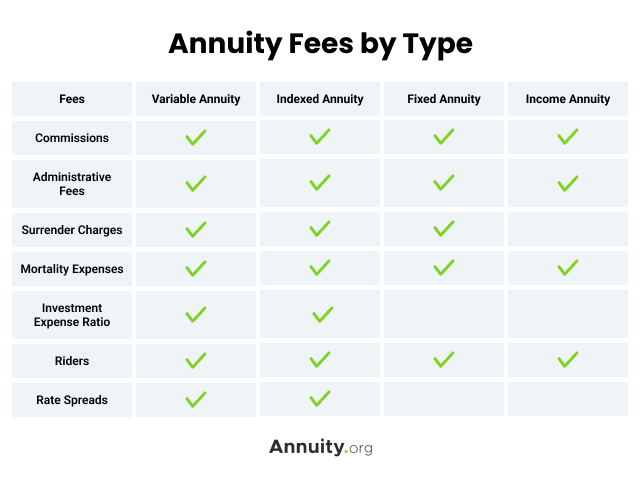

Different annuity types come with different costs. Typical costs include premiums, commissions, administrative fees and surrender charges. In general, the more complicated the annuity, the higher the costs to the consumer. Commissions and fees are generally higher for complex financial products than they are for straightforward investments.

A fixed annuity will have much lower costs than a variable annuity. That’s because fixed annuities are relatively simple. They’re not linked to investment portfolios or indexes like the S&P 500. They pay at a rate that is specified in the contract and don’t have complicated rules.

The addition of riders, which are special contract provisions used to customize an annuity, increase the cost. Riders can include death benefits, minimum payouts or long-term care insurance. The more riders you add to your contract, the more expenses you will incur. Generally, the annual charge for riders ranges from 0.25% to 1% a year.

In total, average fees on a variable annuity are 2.3% of the contract value and can be more than 3%. It’s important to know what you’re paying for. Here are some costs you may find linked to your annuity.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

Premium

The first and most expensive cost associated with an annuity is the premium. Your premium is the initial investment you make to purchase an annuity. Premiums can be paid in a single lump sum or in a series of payments, depending on the type of annuity purchased.

The more you put into an annuity premium, the more you’ll get out of it when the annuity reaches the payout phase. At minimum, you can expect to put down $25,000 for a single premium annuity. If you’re paying the premium in installments, you can start with less, ranging from $2,500 to $5,000.

Purchase an Annuity Today

Commissions

Most annuities have commissions, which are usually built into the price and not highlighted in the contract. Commissions are a portion of the annuity cost that is given to the agent that helped the issuing insurance company sell you the contract. Usually, they take the form of trailing commissions, which are paid every year.

The commissions can be anywhere from 1% to 10% of the total value of your contract, depending on the annuity type. The more complex the annuity, the higher the commission. And the simpler and more straightforward the contract, the lower the commission. In 2014, Wells Fargo announced that it would only include fixed-indexed annuities that limited commissions to 4%.

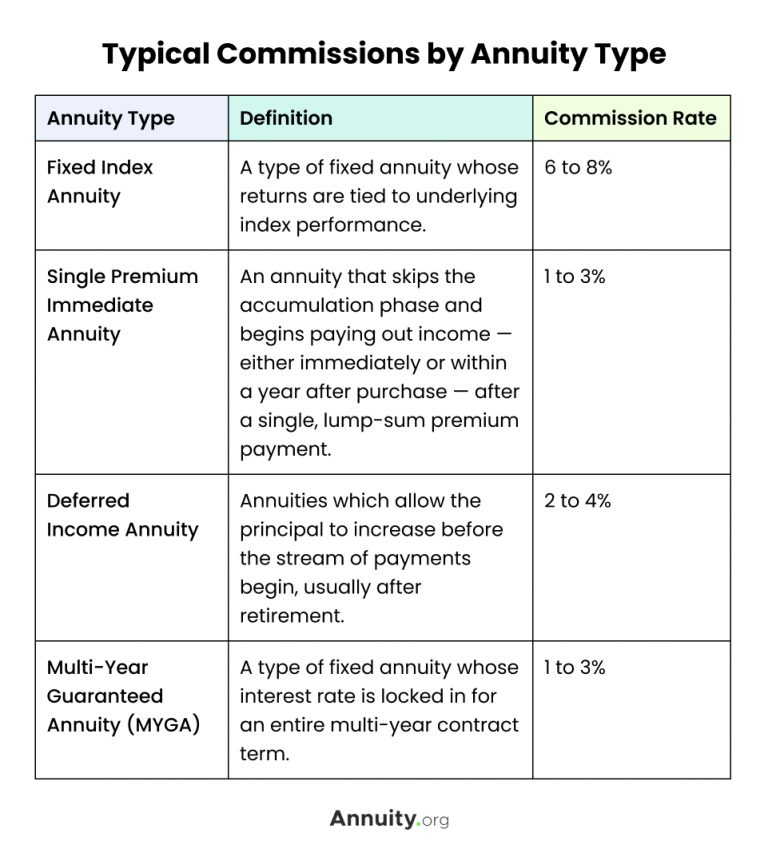

Typical Commissions on Varying Annuity Types:

- Fixed annuities are the least complex annuity type and have lower commissions than other types. Fixed index annuities can have surrender periods as low as four years, but most have 10 years with a surrender charge. The commission on a 10-year fixed index annuity ranges from 6 to 8 percent.

- Commissions on single premium immediate annuities typically range from 1 to 3 percent.

- Deferred income annuities, also known as longevity annuities, charge commissions of 2 to 4 percent.

- Multi-year guaranteed annuities (MYGAs) usually have no fees, and the surrender periods range from three to ten years. Commissions on MYGAs are usually between 1 and 3 percent.

Administrative Fees

Generally you will also have to pay an annual fee to manage and administer your annuity. This could be higher than the fees on your IRA or 401(k). Typically, it’s about 0.3% of the value of your annuity contract. This can also be a flat fee, perhaps $25 or $30 a year.

Surrender Charges

Many annuity contracts will have built-in time periods at the beginning, usually for a set number of years, known as the surrender-fee period. During this time, you are charged a surrender fee if you withdraw money in excess of the scheduled payment amounts.

If you withdraw more than permitted, you will incur a charge that varies widely from one contract to the next. Generally, it is 10% of the value of the annuity in the first year. This usually declines gradually as the surrender period expires. Incidentally, longer surrender-fee periods usually mean the agent gets higher commissions.

In addition to the surrender charge, if you withdraw money prior to age 59 1/2, you’ll most likely have to pay a 10% early-withdrawal fee levied by the Internal Revenue Service.

Mortality Expenses

Mortality expenses compensate the insurance company for the risk it takes and may be charged by the company as a commission. This fee can range from 0.5 to 1.5% of the policy value each year.

Investment Expense Ratio

The cost of managing investments in a variable annuity is covered by the investment expense ratio. Variable annuities have investment and management fees. These fees can be referred to as expense ratios, 12b-1 fees or service fees. They can range from 0.6 percent to more than 3 percent each year.

Riders

Riders are extra provisions that can be added onto an annuity contract for an extra charge. Some of the most common riders include the death benefit rider, which pays out the annuity’s remaining value to a beneficiary after the annuitant’s death, and the guaranteed minimum withdrawal benefit, which allows the annuitant to withdraw a certain amount of funds from the annuity each year without penalty.

Depending on which annuity and which riders you choose, rider fees could range from 0.25% to 1.15% of the annuity’s value per year.

Fees vs. Spreads

Indexed annuity contracts may also feature “spreads.” Dave Bochichio, a Certified Educator in Personal Finance (CEPF®), and Founder of Clean Cut Finance, told Annuity.org, “a spread is a percentage of gains that the insurance company takes each year before distributing interest into the annuity’s account.”

Insurance companies administer spreads by subtracting a percentage from the interest rate the annuity earns. For example, a provider might impose a 2% spread on indexed annuities. This means that if your indexed annuity earns 8% interest in a year, the actual interest credited to your account will be 6% after the company deducts the 2% spread.

If an annuity earns no interest due to poor market performance, the spread will not be subtracted from the account’s value. This is what sets annuity spreads apart from annuity fees, which are still charged no matter how the annuity performs. “A spread typically doesn’t cost anything in a negative environment,” Bochichio said, “whereas fees cost money in positive and negative environments.”

Other charges may include transfer charges, distribution charges, third-party transfer charges, contract fees, underwriting fees and redemption fees.

Which Annuities Have the Lowest Fees?

The amount you’ll pay in fees can vary based on what type of annuity you purchase. Generally, more complex annuities have more fees associated with them than simple annuities. This means that a variable or indexed annuity, while it has a greater potential for growth, is likely to cost more in fees than a fixed or income annuity would.

Are There Annuities With No Fees?

Regardless of which type of annuity you choose, you will likely have to pay at least administrative and mortality expense fees. Much like there’s “no such thing as a free lunch,” there’s no such thing as an annuity that won’t charge any fees at all.

Some annuity providers offer annuities with no surrender charge or commission fees. These products are known as direct-sold annuities, because they’re sold by the insurance company directly rather than through a licensed annuity agent.

Is an Annuity Still Worth It?

Whether or not purchasing an annuity is worth the costs and fees comes down to your individual financial circumstances. For some, the fees associated with investment-based annuities make them too expensive compared to simply investing directly in the market. Others prefer to be able to access their savings without a surrender penalty.

But, paying the fees to purchase an annuity might be worth it if you’re looking for a way to supplement your retirement income. Many retirees are at risk of running out of money in their later years, and an annuity is specifically designed to hedge this risk by providing a stream of income you can’t outlive.

If you’re looking for a safe way to grow your savings and have guaranteed income in retirement but are concerned about annuity fees, consider a fixed annuity. These products are among the simplest annuities and typically have the lowest fees.

Join Thousands of Other Personal Finance Enthusiasts

Frequently Asked Questions About Annuity Fees and Commissions

In addition to the premium you pay to fund your annuity, you will also have to pay fees to manage it. Depending on how your annuity works, you may either pay a flat annual fee or an annual percentage of the value of your annuity. The cost is typically more than fees you pay for an individual retirement account (IRA) or 401(k).

An annuity rider is an option — such as a death benefit — that you can add to your annuity contract. You typically pay extra for each enhancement through a rider fee. Rider fees can add up over time and should be considered carefully when deciding on an annuity rider.

Annuity agents tend to be paid a commission based on how much you deposit into your annuity. Annuities that are more complex tend to have higher commission rates for the agent.

Annuities grow on a tax-deferred basis, so you don’t pay taxes until you begin receiving payments. You’ll only be taxed on the interest the annuity earned, not on the premium you invested.