Key Takeaways

- When purchasing an annuity, you must consider your financial objectives and decide whether an annuity can help you achieve your goals.

- People buy different types of annuities for different reasons, including for tax-deferred growth, principal protection and the ability to leave an enhanced death benefit to their heirs.

- Always research annuity providers before purchasing. Make sure the company you choose has a strong financial strength rating and a consistent rate history.

- A financial advisor, especially one licensed to offer both insurance and investment advice, can help you determine which annuity product is best for you.

Deciding If an Annuity Is Right for You

The first step to deciding whether an annuity is right for you is to understand how this product will fit into your financial plan. Annuities are insurance products where you pay a premium upfront in exchange for receiving income later.

“You need to understand what your goals and objectives are,” Russ Gaiser III, MBA, a Certified Social Security Claiming Strategist and Certified Plan Fiduciary Advisor, told Annuity.org. “If you’re thinking about an annuity, what is the purpose of the annuity in the [financial] plan?”

Most people purchase annuities for income in retirement. Assessing your current financial situation, how close you are to retirement and what your retirement income goals look like are important factors in determining whether an annuity will be beneficial to you.

What Do Your Retirement Income Goals Look Like?

To understand how much income you’ll need in retirement, you must first consider the options available to you. Many Americans receive regular payments in retirement through pension plans or Social Security.

However, the income provided by these programs is often not enough to support a retiree’s lifestyle.

“One of the questions you have to ask is, do you expect to live the same type of lifestyle in retirement?” Ralph Gale, a Certified Long-Term Care (CLTC) specialist and Certified Financial Fiduciary, told Annuity.org.

If you don’t expect your lifestyle to change, your annual expenses are likely to increase during retirement, Gale explained. “[In retirement], there’s more traveling, there’s more dining out, there’s more entertainment.”

You need to understand what your goals and objectives are. If you’re thinking about an annuity, what is the purpose of the annuity in the [financial] plan?

Russ Gaiser III, MBA, Certified Plan Fiduciary Advisor and Certified Social Security Claiming Strategist

How Does an Annuity Benefit Your Plans?

Annuities have many benefits for investors that make them a great addition to a retirement financial plan.

Increased expenses, along with the effects of inflation, might make another stream of income necessary for many retirees. If you’re worried about outliving your savings, an annuity can provide an additional income source that’s guaranteed to last the rest of your life.

“You ask yourself, ‘Do I need a guaranteed income for the rest of my life?’ If yes, then an annuity might be your answer,” Gale explained. “‘Do I need to make sure that my long-term care is taken care of and paid for?’ The answer there might be yes as well.”

For example, let’s say you are nearing retirement and have a large amount of cash assets. You could invest the funds in a brokerage account, but you run the risk of losing your money if the market takes a downturn. The closer you are to retirement, the less time your investment will have to weather the ups and downs of the stock market.

However, you can still grow your savings while keeping your money out of the market by purchasing a fixed annuity. Your money will grow at a guaranteed rate with no downside risk.

Annuities can be a great way for conservative, hands-off investors to generate income in retirement. However, they are not the only low-risk avenue to generate income. The safest alternatives include certificates of deposit, Treasury securities and highly diversified investment grade bond funds.

Important Considerations For a First-Time Annuity Buyer

You’ll have to take several considerations into account when purchasing an annuity. Be sure to take stock of your own financial situation and research different annuity products thoroughly.

How Much Money Will You Invest?

Most annuities are funded with a single lump-sum premium, although many providers offer the option of flexible premium annuities, which can be purchased through installments instead of all at once.

Because an annuity often requires a large payment upfront, it’s worth considering where that money is going to come from and how much you can afford to invest in an annuity contract.

There is no limit to how much you can invest in a nonqualified annuity — that is, one purchased with after-tax income. However, some annuity providers might have a maximum amount that they will accept from an annuity purchase. This maximum can range from $500,000 to $5 million.

That said, you probably won’t want to place all your retirement savings into an annuity. This is because annuities are very illiquid investments and you’ll face a hefty penalty if you try to withdraw your money early. It’s usually best to keep some money in a brokerage account or other more liquid vehicle for easy access if you need it.

What Type of Payout Do You Want?

All annuities exchange a premium now for income later, but that income can be paid out in a few different ways. Understanding your payout options is key when considering an annuity.

The two main payout options with an annuity are immediate or deferred. Immediate annuity contracts annuitize within one year of purchase. In contrast, deferred annuities delay annuitization for several years. The period before a deferred annuity converts to income is the accumulation phase.

Besides choosing when payments begin, you must also consider how long you want payments to last. Many annuity purchasers select a single life contract that guarantees income payments for their lifetime.

You can opt to continue payments over your and your spouse’s lifetime with a joint and survivor annuity. An annuity with period certain guarantees that, if you pass away before the payout period elapses, your beneficiary will receive the remaining payments. Finally, you can also select a lump-sum payout on most annuity contracts.

Fees and Penalties

One of the most important considerations when shopping for annuities is the fees and penalties associated with the contract. All fees and penalties should be clearly stated in the annuity contract. Take a close look at the products you’re considering and compare the costs and fees.

Nearly all deferred annuities come with a surrender charge. This is a penalty imposed on annuity owners who withdraw money from their annuity too soon after purchase.

Surrender charges typically represent a percentage of the annuity’s value, and the charge becomes less expensive each year until the surrender period is over.

Aside from the surrender charge, your annuity may have other fees depending on the type of annuity you purchase. The more complex an annuity is, the more fees it typically carries. Variable annuities have the most fees, while fixed annuities tend to have very few.

All annuities have a free look period, during which you can cancel your contract and get a full refund. You can use this free look period to review the annuity and make sure it meets your needs.

Tax Implications

Finally, you should understand the tax implications of purchasing an annuity. Many financial advisors recommend annuities for their tax-deferred growth potential, but this doesn’t mean you won’t owe taxes on your annuity.

Annuities grow on a tax-deferred basis, so you won’t be taxed on the interest your annuity accumulates until you receive payments. The portion of your annuity payments that are taxable depends on whether your annuity is qualified or nonqualified.

A qualified annuity is purchased with pre-tax funds. If you use funds from a qualified retirement plan to purchase your annuity, you are purchasing a qualified annuity. The entire value of your income payments is taxable when you annuitize a qualified contract.

An annuity purchased with after-tax funds is nonqualified. This includes annuities purchased with cash. When you receive income from a nonqualified annuity, only the portion of the payout that represents the interest earned counts as taxable income.

Read More: Are Multiple Annuities a Good Idea?

Purchase an Annuity Today

Which Type of Annuity Works Best for You?

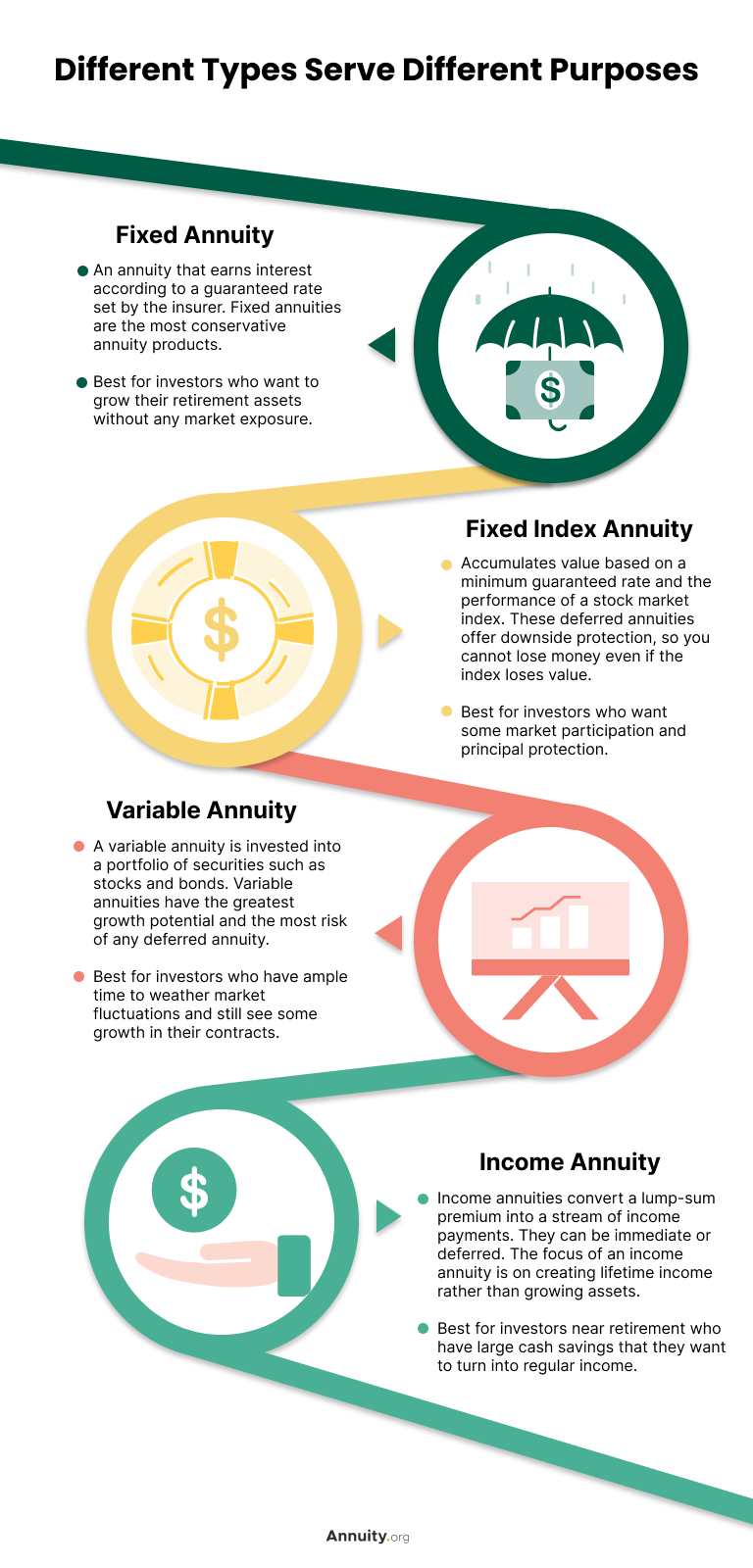

There are many types of annuities, and you can customize each to fit different income strategies.

People purchase annuities for different reasons, Gaiser said, namely for principal protection, guaranteed income or tax-deferred growth. Which annuity is best for you ultimately depends on your goals for owning the annuity.

The four most common types of annuities are fixed annuities, fixed index annuities, variable annuities and income annuities. Each of these products can serve a purpose in your retirement plan, but not all annuities will work for all investors.

Read More: Reasons To Buy An Annuity

Customizing Your Annuity

A key feature of any annuity contract is the ability to customize your annuity to meet your personal financial needs. Depending on your provider and the type of annuity you purchase, you’ll have a variety of options for additional riders and provisions to augment your contract.

Annuity riders fall into two categories: living benefits and death benefits. Living benefits affect the income received by the annuitant, while death benefits relate to what is left to the annuity’s beneficiaries after the annuitant’s death.

Variable and fixed index annuities are commonly sold with living benefits because the income from these products isn’t as predictable as a fixed annuity. Living benefits offset the inherent risks of variable and fixed index annuities by placing some form of guarantee on the accumulation or payout.

Read More: Living Benefits

Many annuities also provide the option of a death benefit rider. Some annuities may come with a standard death benefit; here, the beneficiary might receive only the original amount the owner contributed less any withdrawals made. A rider can enhance this benefit so the beneficiary receives more of the annuity’s actual value.

Your financial goals and circumstances will determine how you should customize your annuity. Working with a financial advisor can help you understand the terms of an annuity contract and how best to adjust the contract to suit your specific needs.

Gale suggested working with a professional who’s licensed in both insurance and investment advising, as annuities are only one part of a financial plan. “You want [someone] in the middle that understands both sides,” he explained.

Gale also recommended seeking advice from a fiduciary. Fiduciaries are required by law to act in the client’s best interests, so you can feel secure that you aren’t being sold products that don’t benefit you.

Finding the Right Company

To find the best annuity provider for you, it’s important to conduct your own research and consider multiple options.

One of the most significant things to look for in an annuity provider is their financial strength rating. Annuities are not backed by the federal government like CDs or savings accounts, so the security of your annuity’s value depends on the insurance company itself.

Credit rating agencies like AM Best, Moody’s and Fitch issue financial strength ratings for annuity providers. The grade a provider receives represents how likely it is to fulfill its financial obligations. A rating of B or better usually shows a sufficient level of financial stability for an annuity provider, Gale said.

While a provider’s financial strength is an important consideration, it’s far from the only factor to account for when choosing where to purchase an annuity.

“As an advisor, I’m looking at how consistent their rates are,” said Gale. “A lot of companies start out with really high rates and then go right to the minimum the next year. So it looks good up front, but then it doesn’t produce the way it should.”

In addition to investigating rate history, research the specific products the company offers. You may want a provider that specializes in your preferred type of annuity, or one that offers an attractive living benefit or similar feature.

Tips for Avoiding Fraudulent Companies

Unfortunately, unscrupulous insurance companies can take advantage of the inherent complexity of annuities and make fraudulent or misleading claims to consumers.

Here are some indicators that an annuity provider is legitimate:

- Strong financial strength ratings

- Positive independent reviews

- Clearly stated fees on annuity products

- Transparent brokers or advisors

- Brokers or advisors have relevant designations or licenses

On the other side, there are a few red flags to watch out for when speaking with an annuity broker. If the broker uses high-pressure tactics or tries to create urgency with a “today-only” offer or signing bonus, this could indicate a bad actor. A good advisor or broker will give you time to look over an annuity contract before signing.

You’ll want to work with a trusted financial advisor and speak to representatives from the providers you’re considering before making any decisions.

Read More: How To Tell If an Annuity Provider Is Legitimate

Purchasing an Annuity

Once you’ve decided to purchase an annuity, you can complete the application and transfer the funds to pay the premium. This completes the purchasing process.

After the contract has officially been issued, the annuity’s free look period begins. This period typically lasts between 10 and 30 days, depending on what your state’s insurance commissioner requires. During the free look period, you can cancel your contract with no penalty and receive a full refund.

The free look period is an opportunity to review your contract in full one last time. Make sure you understand the fees and how interest is credited as well as how any riders or extra provisions will affect your contract.

Questions To Ask When You’re Ready To Buy

When you sit down with an advisor to discuss purchasing an annuity, you might find it helpful to have some questions prepared. Here are some potential questions to ask your advisor to help determine whether an annuity is right for you:

- What is the guaranteed minimum interest rate?

- What is the current interest rate?

- Is there a bonus interest rate? If so, what are the requirements for you to get the bonus interest rate?

- How long is the surrender period and how much are the surrender charges?

- Is there a free withdrawal option? If so, what are the terms?

- Can the annuity lose value?

- Will the annuity pay my beneficiaries after I die?

- What is the maturity or annuitization date?

- What are the fees?

Source: Texas Department of Insurance

Let’s Talk About Your Financial Goals.

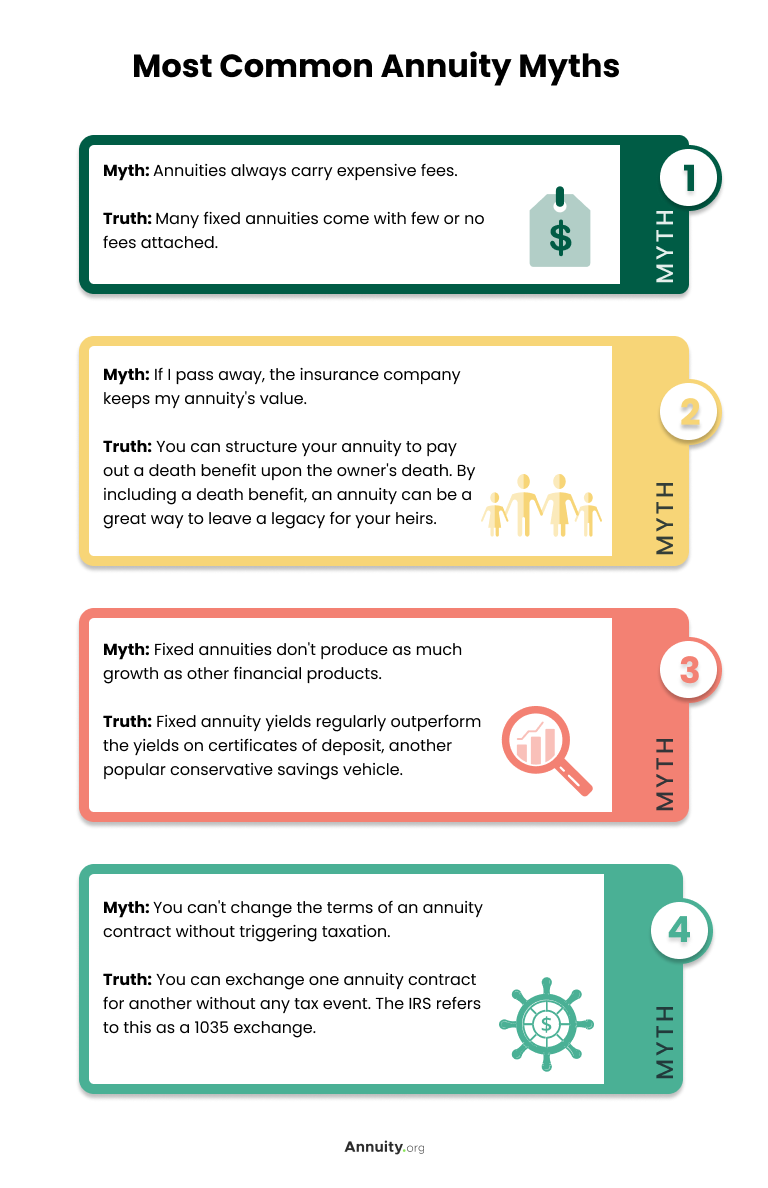

Breaking Down the Biggest Annuity Myths

Annuities can be complicated financial instruments, and many people hold misconceptions about what they are and how they work. Let’s take a look at the truth behind four of the most common myths about annuities.

Featured Experts

Russ is a financial advisor and retirement income planning specialist at The Financial Guys, an independent wealth management firm outside of Buffalo, NY. He earned an MBA from the University of Arizona Eller College of Management. Russ is a Certified Plan Fiduciary Advisor and a Certified Social Security Claiming Strategist. He holds Series 6, 7, 63, 65, and New York State Life, Accident and Health Insurance licenses.

Ralph holds a Certification in Long-Term Care (CLTC) designation from the Corporation for Long-Term Care and specializes in long-term care. He is also a Certified Financial Fiduciary, signifying his commitment to supporting the best interests of his clients. Ralph has spent his entire career educating himself and his clients on what will be needed financially in retirement.