Key Takeaways

- Annuities are not designed to rival the potential returns of growth investments such as securities. Some annuities offer higher growth potential than others.

- Annuities provide financial security later in life by generating lifetime income streams.

- While they tend to carry less risk than investments like stocks or bonds, annuities do come with some degree of risk.

When most people think of investing, they conjure images of Wall Street and the high-stakes energy of the New York Stock Exchange trading floor. Maybe you imagine the ticker symbols of Fortune 500 companies or the less exhilarating pie chart on your annual mutual fund report.

There’s a reason annuities don’t spring to mind: Annuities are not technically investments in the world of finance. Annuities are insurance products intended to provide guaranteed income in retirement. However, this doesn’t mean that annuities shouldn’t be part of your investment portfolio.

And it doesn’t mean they should.

The answer to the question of whether or not an annuity is a good investment for you can be found in your personal investment objectives. And your objectives will be largely influenced by your age and time horizon for investing, your risk-tolerance, your lifestyle and a number of other factors.

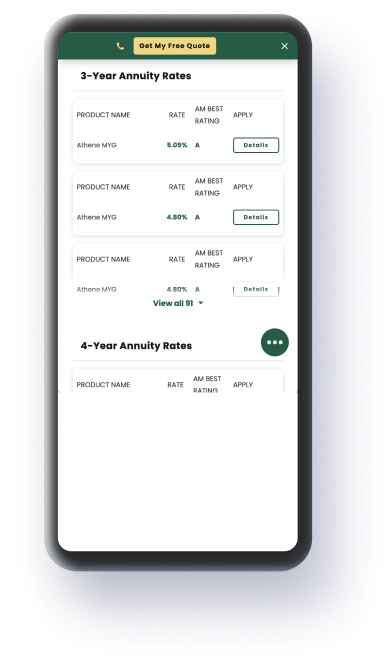

Purchase an Annuity Today

Your Financial Plan

Economists have been researching what they call the “annuity puzzle” for years in an effort to understand why people shy away from these products.

A white paper published by the National Bureau of Economic Research states that “standard economic models of life-cycle spending patterns imply that the portfolio of a risk-averse individual should include a substantial portfolio share in life annuities as a hedge against uncertainty about length of life.”

This statement, when considered alongside the framing of annuities as investments rather than insurance, supports the idea that annuities can be an excellent addition to a balanced portfolio for a particular type of investor.

Depending on your priorities, your portfolio will contain various asset types that strike the appropriate balance to help you achieve your goals.

For example, your portfolio may follow the 60/40 investment strategy that has been popular for decades thanks to its consistent risk-adjusted returns. This strategy invests 60 percent of the investor’s assets in stocks and 40 percent in lower-risk bonds. But if economic conditions negatively affect the rate of return of this mix — as they seem likely to over the next decade — you will want to consider reallocating your assets.

In July 2020, Bloomberg quoted JPMorgan Chase & Co.’s senior adviser of long-term investment strategy, Jan Loeys, who predicted that the 60/40 portfolio returns could drop to 3.5 percent over the next ten years, down from the 10 percent returns they produced from 1983 to 2019.

Loeys suggested a reallocation of assets, creating a portfolio of 40 percent stocks, 20 percent bonds and 40 percent securities “with some characteristics of both.”

But other experts still advise a defensive allocation, underscoring the need for the 40 percent low-risk investments.

In either scenario, buying an annuity to provide the buffer of a low-risk asset could work and offers the bonus features of tax-deferral, lifetime income and a death benefit for your heirs.

Let’s Talk About Your Financial Goals.

When Is an Annuity a Good Idea?

Based on your financial plan and your solid understanding of the key difference between annuities and equity investments — annuities are insurance; equity investments are growth vehicles — you can ascertain whether an annuity is a good addition to your investment portfolio.

First, you need to know that there are several types of annuities on the market. Your specific reason for buying an annuity will determine which type fits your investment strategy.

According to annuity expert Stan Haithcock, annuity benefits can be summarized in a simple, memorable acronym: P.I.L.L.

Note that Haithcock doesn’t include aggressive growth and capital appreciation among the benefits of annuities.

Although annuities are not designed to provide returns that rival securities and other growth investments, some annuities can offer higher growth potential than others. The tradeoff in these cases includes the possibility of losing your premium, which may negate the very benefit that attracted you to an annuity in the first place.

For example, a variable annuity functions somewhat like the securities with characteristics of both stocks and bonds that Loeys recommended, except that variable annuities have characteristics of fixed annuities — including periodic payments, tax deferral and death benefits — as well as a growth potential similar to that of mutual funds.

Remember, in the United States, variable annuities are categorized as securities and regulated by the SEC because their payments vary according to the performance of an underlying investment portfolio.

Fixed index annuities are also tied to the market but offer a guaranteed minimum return, which makes them less risky than variable annuities but not as safe as fixed annuities.

Pros and Cons of Annuities

It’s always a good idea to weigh the pros and cons of any investment as it pertains to your situation. A generic list of annuity pros and cons would look something like this:

Pros

- Provide financial security later in life

- Generate lifetime income

- Grow on a tax-deferred basis

Cons

- Limit your access to the funds

- Provide modest returns

- Come with fees and surrender penalties

- Can be complicated

A generic list of pros and cons for every other type of investment would cover the same concerns. This is why most experts advise a holistic financial plan and a diverse investment portfolio. What may be considered an advantage for a 52-year-old in a high tax bracket and nearing retirement may be a disadvantage for a 35-year-old with a high risk tolerance and a long-term investment horizon.

Like all investments, annuities are exposed to certain risks. Generally, they are illiquid investments that can be adversely impacted by inflation. That said, if structured properly, they can be a highly beneficial aspect of a retirement plan, providing a guaranteed stream of income in a relatively low-risk, hands-off manner.

Perhaps a better way to determine the suitability of an annuity is to think of the characteristics of different financial instruments as a grid that illustrates their general, but not exact, nature.

| Characteristics | Equity Investment | Annuity *depends on type |

Savings Account |

|---|---|---|---|

| Safe | ✓ | ✓ | |

| Liquid | ✓ | ✓ | |

| Tax-deferred growth | ✓ | ||

| High risk | ✓ | ||

| Modest growth potential | ✓ | ✓ | |

| Death benefits | ✓ | ||

| Pays investor dividends | ✓ | ||

| Pays investor interest | ✓ | ✓ | |

| Guarantees lifetime income | ✓ | ||

| Pays investor capital gains | ✓ | ||

| Focus is on increasing investor’s capital | ✓ | ||

| Performance depends on the market | ✓ | Applies to some types of annuities | |

| Long-term asset | ✓ | ✓ | |

| Have associated management costs | ✓ | ✓ | |

| Appropriate for retirees | ✓ | ✓ |

These are only a few of the features you’ll need to prioritize before deciding whether an annuity is a good investment, and the products themselves aren’t always cut-and-dried in regard to each.

For example, annuities are always intended as vehicles for long-term savings, whereas active investors typically seek short-term profits. However, some investment strategies — such as the passive buy-and-hold strategy — involve the investor holding on to stocks or ETFs for a long period of time.

Rising interest rates, imposed to control inflation following the COVID-19 pandemic, made Annuities a more attractive retirement plan component — a guaranteed income stream in retirement.

According to a 2022 report on CNBC, the average immediate annuity payouts increased 11% for men and 13% for women in the first half of 2022. And sales of fixed-rate deferred annuities were up 44% over the same time, according to the insurance industry group LIMRA.

Variable annuities can adjust to market shifts and provide some hedge against inflation. But you should read the fine print and make sure you understand just how well a particular variable annuity adjusts to inflation.

You can buy inflation protection for annuities — but it comes at a cost. If inflation slows, you may end up paying too much for the protection. If inflation declines, it can take away from future inflation adjustments, according to Morningstar.

And although a common complaint about annuities concerns the fees associated with products, a study from 2008 noted that one reason mutual fund managers were rarely able to consistently beat the market was the “high fees and expenses” they charged for their services.

In 2006, according to the authors, 9.6 percent of mutual fund managers were able to choose stocks that outperformed the market on a pre-expense basis, but once expenses were accounted for, that number dropped to 0.6 percent. Thus, management, administration and marketing fees are as much a consideration for securities as for annuities.

To be sure, there are many investors — and even many retirees — who should not buy an annuity. The disadvantages of annuities greatly outweigh the benefits for people who require immediate access to their money or have adequate sources of retirement income.

And most importantly when it comes to investing, annuities are not right for an investment strategy that targets high rates of growth and capital appreciation. That doesn’t mean, however, that an annuity wouldn’t be the perfect solution for a separate retirement plan if you don’t have a 401(k) plan or an IRA.

Read More: First-Time Annuity Buyers

Frequently Asked Questions About Annuities

Typically, the best age to buy an annuity is between 45 to 70 years old but the reasons for buying one varies depending on age groups. Most annuities are purchased by people nearing retirement age or already retired.

Annuities provide a reliable income stream during retirement. People entering retirement can use part of their retirement savings to buy an annuity, guaranteeing income from the annuity while diversifying their retirement income sources.

An annuity may not be right for you if other retirement income — such as Social Security or pension benefits — already cover your expenses. If you are in poor health or prefer high-risk investment options, you may want to consider alternatives to annuities.