What Is Lifetime Income?

As the phrase implies, lifetime income is a steady stream of income that lasts throughout your life — with no possibility of deterioration. The benefit of such an arrangement is clear: a fiscally carefree retirement, one where you can cover your living expenses and, possibly, fund discretionary travel and passion projects.

This arrangement is ideal for nearly everyone, except for the fortunate few that have multiple millions (or billions) of dollars at their disposal. For those that do not possess such wealth, generating a stream of income that will last through retirement can be highly reassuring — both financially and emotionally.

How Can I Invest for Lifetime Income?

There are many ways investors can generate income, and there are countless investment products designed to fulfill the goal. At the top of the list are bond funds, private credit funds, high-dividend stock funds, real estate investment trusts (REITs) and hybrid vehicles that include some or all of the aforementioned assets.

These types of investments can offer relatively high levels of income in a potentially diversified manner, but they are also exposed to significant marketplace risks which can cause price volatility and uneven income streams. As a result, they do not offer guaranteed income.

There are two main investment structures that offer guaranteed lifetime income — defined benefit plans and fixed annuities. There are also some variable and structured annuities that offer living benefit riders that provide income for life.

- Defined Benefit Plans

- Commonly called pension plans, defined benefit plans are retirement plans sponsored by employers. They provide a lifetime payout to workers based on their years of service and their earnings.

- Fixed Annuities

- Fixed annuities are financial contracts sold by life insurance companies. They provide a guaranteed stream of future income in exchange for an upfront payment, and you can structure your contract to provide the income for life.

You can’t participate in a defined benefit pension plan unless your employer sponsors one. Unfortunately, outside of government sectors, these plans have become extremely rare. As a result, fixed annuities are the only accessible source of lifetime income for most people.

Annuities may not be suitable for your specific goals, but they definitely warrant consideration. Given their unique positioning, anyone looking to establish a sensible plan for retirement would benefit from learning more about fixed annuities.

While the Pension Benefit Guaranty Corporation partially insures pension plans, the guarantees associated with annuities are subject to the financial stability of the issuing insurance companies. If you are looking to buy an annuity, find out whether your state has a guaranty association that will protect you if your insurer becomes insolvent.

Speak to One of Our Reps

Understanding Fixed Annuities

A fixed annuity is a tax-advantaged financial contract between an individual, the contract owner, and an insurance company, the issuer. The contract may be structured in a myriad of ways with a variety of plan features, including single or joint life payments, death benefit payments and inflation protection.

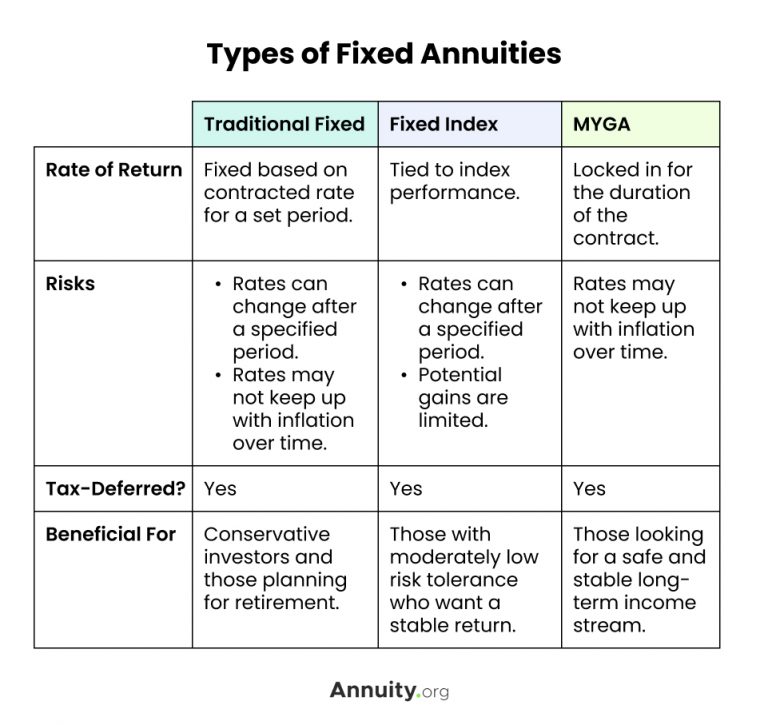

In exchange for an upfront payment, an annuitant receives a series of guaranteed income distributions from the insurance company. Traditional fixed annuity rates are specified according to a contract, but index-linked optionality provides the opportunity to increase future payouts based on the performance of a chosen market index, such as the S&P 500 index. Multi-year guaranteed annuities (MYGAs) are another type of fixed annuity, offering long-term fixed interest rates on the annuity payouts.

Guaranteed income is achieved with no downside volatility, plus the added ability to customize the timing and duration of the income payouts to your preferences. This makes fixed annuities extremely attractive to conservative investors.

It’s important to remember that these financial products are not completely risk-free. They are illiquid, and they can be adversely affected by inflation. Nevertheless, if structured properly, fixed annuities can be a highly beneficial aspect of your retirement plan by providing a guaranteed stream of income in a relatively low-risk, hands-off manner.

Read More: Reasons To Buy An Annuity