Key Takeaways

- The cost of an annuity includes the premium, or initial investment, along with any fees and commissions paid to the annuity provider.

- You can purchase a fixed annuity for as little as $2,500 and an immediate annuity for as little as $25,000.

- An annuity’s rate can affect its cost — purchasing an annuity with the best rate will maximize your return.

How Much Does an Annuity Cost?

The cost of an annuity generally involves the premium, or the initial investment, and any fees and commissions associated with the contract. Combined, these factors can total in the tens or hundreds of thousands of dollars. The more you put into the annuity initially, the more you can expect to receive when the contract annuitizes.

Is There a Minimum Investment for an Annuity?

The amount of money you need to start an annuity depends on the type of annuity you purchase. If you shop around, you should be able to buy an annuity for an initial investment of less than $10,000.

“For your MYGAs, which is a multi-year guaranteed annuity, some are $2,500,” Joe Liekweg, an agent at Insuractive with an extensive annuity background told Annuity.org. “But I’d say for most fixed annuities, you’re looking at anywhere from a minimum of $5,000 to $10,000.”

You can continue investing into a deferred annuity up to one or two million dollars — or even more if you get a special exception from the company that sells you the annuity.

Will You Be Able to Maintain Your Retirement Lifestyle?

Learn how annuities can:

✓ Help protect your savings from market volatility

✓ Guarantee income for life

✓ Safeguard your family

✓ Help you plan for long-term care

Speak with a licensed agent about top providers and how much you need to invest.

Suggested Investment Levels Based on Annuity Type

Different types of annuities require different minimum investment amounts. This is largely because of how they are set up to be purchased, the way they pay out and the type of long-term goals they address.

- Fixed Annuity

- Fixed annuities and MYGAs guarantee a fixed interest rate on their premium for a specified period. It can cost as little as $2,500 to open a fixed annuity. You can keep contributing up to one or $2 million over the life of the annuity.

- Fixed Index Annuity

- A fixed index annuity bases your payout on the performance of a market index — such as the Dow Jones Industrial average or the S&P 500. You can open a fixed index annuity for as little as $5,000 with some companies.

- Flexible-Premium Annuity

- Flexible-premium annuities are deferred annuities purchased through a series of payments over a long period of time. You can open a flexible-premium annuity for an initial payment of $5,000 with some companies.

- Immediate Annuity

- Immediate annuities are typically paid for with a single payment and begin paying out within a year. The minimum investment for an immediate annuity can be as little as $25,000.

- Single-Premium Annuity

- Single-premium annuities are purchased with a single payment. They include immediate annuities that are typically purchased close to retirement as well as single premium deferred annuities, which you can purchase well before you plan to withdraw money, allowing it to accumulate wealth over time. Minimum investments can be as low as $25,000.

Potential Minimum Annuity Investments by Type

Consider how much money you must invest overall and how an annuity fits into your long-term financial plans.

“It’s based on your liquidity and what you need to have accessible to you at all times because an annuity does lock up your money,” Liekweg said.

Fees and Commissions

It’s important to know what annuity fees and commissions you’ll have when buying an annuity.

These can vary from company to company, the type of annuity you choose and how you customize your annuity.

- Administration and Maintenance Fees

- These fees cover the costs of managing your annuity account.

- Add-On Rider Benefits

- Riders are extras you can add to your annuity contract. They can give you flexibility, but they come with a cost. Be aware of how much they are costing you.

- Contingent Deferred Sales Charge

- Also called a CDSC, this is a fee you must pay if you cancel the annuity earlier than specified in the contract.

- M&E Risk Charge

- The mortality and expense risk charge is a fee you pay to guarantee that your cost will not change over time.

- Underlying Subaccount Expenses

- Subaccounts are the separate account funds to which you allocate a variable annuity. You will pay a fee to cover managing the funds which differs for each fund in which you invest.

- Surrender Charges

- If you cancel or cash out the annuity — typically in less than seven years — you will have to pay surrender charges. These can range from 5% to 25% of the amount you withdraw.

- Additional Provisions

- Ask your agent about any miscellaneous fees the company may charge and how much they will be.

Annuity Fees and Costs to Consider

While fees differ widely, variable annuities typically have the highest fees of any type of annuity. These typically run about 2% to 3% of the value of the annuity per year.

Annuity Rates

Annuity rates can also impact the cost of the annuity. The rate of an annuity refers to how much the contract’s value grows over a period of time. Different annuities calculate rates differently; a fixed annuity earns interest at a guaranteed rate that never changes, while the growth of variable and indexed annuities fluctuates based on market performance.

“The interest rates paid on investments in an annuity contract determine how much future income the annuity will provide,” said R.J. Weiss, a Certified Financial Planner™ professional and founder of the personal finance site The Ways to Wealth. “The higher the rate, the more income the annuity will pay.”

Annuity interest rates tend to rise with interest rates on other financial products, making them a better investment during times of rising interest rates. The average payout of an immediate annuity increased by 11% for men and 13% for women from January to May of 2022, according to CANNEX Financial Exchanges Limited. During this period, the Fed issued multiple interest rate hikes to curb inflation, causing rates to surge across the financial system.

Purchasing an annuity with the best rates is the key to getting the most out of your money. With a higher interest rate, you can invest less money to get the same payout you would if interest rates were lower.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

Example of How a Minimum Annuity Would Pay Out

Generally, the more money you put into an annuity, the more you will receive in your payout. Payouts can vary depending on the type of annuity you buy. You can use an annuity calculator to determine what your payout will be.

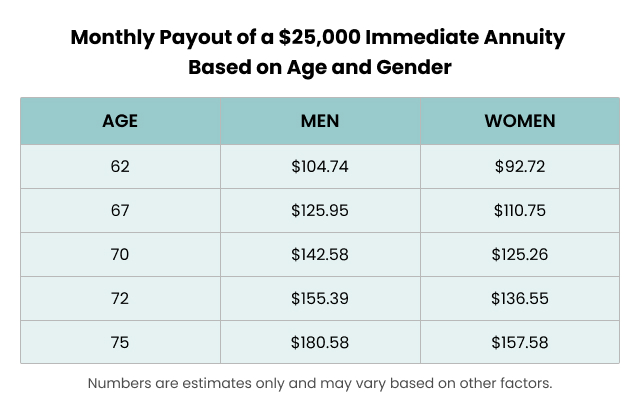

For example, let’s say you are a man who invested the minimum amount of $25,000 in an immediate annuity at age 67 — the retirement age for full Social Security benefits. You’d begin collecting monthly payments of $125.95 immediately every month for the rest of your life.

But if you were to use a portion of your retirement savings to make a larger investment — say $125,000 — your monthly payout would be $629.74.

For immediate annuities, your age, sex and amount of your investment all play a part in your monthly payout.

Life expectancy affects the difference in monthly payout amounts between men and women. Because women tend to live longer, the lifetime payout is spread out over more years.

The things to consider when deciding how much to invest depend on the type of annuity, interest rates or stock indexes, your age when you buy the annuity and your expected retirement age.

Read More: First-Time Annuity Buyers

Questions to Ask Before Buying an Annuity

There are several questions to ask the annuity agent, your financial advisor and yourself before buying an annuity.

- What are your financial goals with an annuity?

- What do you want to accomplish by buying an annuity? Make sure you have a clear idea of why you want to buy an annuity and whether it is the best tool to accomplish your goals.

- What kind of annuity is best suited for your needs?

- Make sure the type of annuity you buy is the best for your situation. Compare the various types of annuities available to find the best fit for your needs, age and financial situation.

- How much are fees, commissions and other costs?

- Hidden costs may eat away at your expected income. Make sure you know these up front and how they will affect your investment and payout.

- How much do you have to invest?

- Ask yourself if you can do without the money you are investing until the annuity begins paying out. And make sure it is the best investment you can make toward your financial future.

- How well does the timing and length of the investment work for you?

- Make sure the time and age at which you will start withdrawing money best fits your needs. Be aware of your potential earnings to make sure it’s enough money.

- How much risk are you willing to take?

- Consider how much of your investment you may lose and whether the return is worth it. The fixed and fixed index annuities are good alternatives for less risk.

- What is the guaranteed minimum interest rate?

- Rates vary between companies and annuities. Make sure you are getting the most bang for your buck.

- How much of your annuity can you withdraw?

- Find out how much you can withdraw from your annuity each year without a penalty. Make sure that’s enough to meet your needs. And talk with your financial advisor or tax professional about any tax issues for withdrawals.

- How will an annuity work with your other income?

- Look at how your annuity income will work with your retirement savings, pensions and Social Security. Examine how it fits into your income mix and whether it’s the best investment for you.

9 Questions to Answer Before You Buy an Annuity

Other Things to Consider

Remember that annuities limit the accessibility options to the money you invest. You will need to weigh your liquidity against the needs a lifetime income from an annuity will deliver.

This is true whether you’re considering converting part of your retirement savings into an annuity right before retirement or if you’re considering how much to invest in annuities versus other investments when you’re in your 30s or 40s.

“It wouldn’t be suitable to take 100% of your money and throw it into an annuity and lock it up. That’s just not a good thing,” Liekweg said.

The bottom line is that you should ask yourself what you want your money to do for you — and then discuss that with your financial advisor or the agent selling the annuity.

“There has to be a conversation between you and the agent that’s helping you about that suitability factor. And that helps break down what allocations of your money you put into an annuity,” Liekweg said.

Join Thousands of Other Personal Finance Enthusiasts

Frequently Asked Questions

The monthly income you can expect from an annuity depends on a few factors. According to Nick Schrader, an insurance agent with Texas General Insurance, payouts can vary based on the premium amount, your age and the annuity’s interest rate.

Schrader gave the following estimates for a $100,000 immediate annuity payout: • Immediate Lifetime Income Annuity with immediate coverage at age 65: $543 monthly income

• Immediate Lifetime Income Annuity with immediate coverage at age 70: $596 monthly income

What age to buy an annuity depends on what type of annuity you’d like to purchase. Purchasing a deferred annuity would be best if you’re between 45 and 70. After 70 is the best age to purchase an income annuity.